Holistic View of KESM with Fundamental Analysis & iVolume Spread Analysis (iVSAChart)

Joe Cool

Publish date: Mon, 17 Oct 2016, 11:10 AM

Background and Core Business

KESM Industries Bhd. (KESM) was listed on the KLSE since 1994. It commands a market capitalisation of about RM383 million. This Sungei Way based company is associated with the Sunlight Group from Singapore and has the following subsidiaries: KESM Industries Berhad (KESM), KESM Test (M) Sdn Bhd (KTM) and KESP Sdn Bhd (KESP). KESM is categorised in Bursa Malaysia under both the Technology and Fledgling indices. They belong to the Electronic Components industry.

Principally, KESM is involved in specialised electronic manufacturing activities. In particular, it is in the business of providing "burn-in" services, electrical testing of semiconductor ICs and Tape and Reel Assembly. Burn-in is a process of stressing semiconductors to weed out potentially weak circuits.

KESM has business dealings with almost all American semiconductor manufacturers. Their financial year FY2016 concluded on 31st July 2016 with key financial figures as summarised below.

Financial Brief and Ratios

|

KESM (9334.KL) |

FY 2016 |

|

Revenue (RM’000) |

285,734 |

|

Net Earnings (RM’000) |

30,683 |

|

Net Profit Margin (%) |

10.74 |

|

EPS (Sen) |

71.30 |

|

PE Ratio (PER) |

12.51 |

|

Dividend Yield (%) |

0.67 |

|

ROE |

10.70 |

|

Cash Ratio |

1.49 |

|

Current Ratio |

2.68 |

|

Total Debt to Equity Ratio |

0.126 |

Based on figures from the past 5 years, KESM achieved its highest turnover in FY2016, which represents an 8% y-o-y growth. The CAGR of its EPS for the past 5 years on the other hand is almost 20%. Net profit margin has also increased tremendously from about 2% three years ago to nearly 11% for FY2016.

In terms of its valuation, PE ratio is about 12.51, which is neither expensive nor cheap. The efficiency of its management has also been improving, as reflected in its increasing ROE of 10.70%. Management has also been able to maintain a positive gearing, with Total Debt to Equity ratio of 0.126. KESM has no liquidity issues, as its Current and Cash ratios are satisfactory.

In terms of its balance sheet, no new shares were issued for the past 5 years, and the company has managed to reduce its long term liabilities by nearly 71% y-o-y. Book Value per share is approximately RM6.67.

Given the nature of KESM’s business which is capital intensive, FY2016 saw its CAPEX at nearly RM30 million, a sharp drop from RM78 million in FY2015. With that, the company is seeing positive free cash flow again this year. 5 year CAGR of cash flow from operations is about 19%.

KESM paid its shareholders a dividend of 6 sen in FY2015; highest yet for the past 10 years. For FY2016, KESM has paid off a special dividend of 4.5 sen so far. Their dividend payout ratio is about 0.1. Since KESM is still a growing company, we would like to see management use its profits to expand their business.

Next quarterly results announcement should be on the month of Nov 2016 for Q1 results.

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – KESM

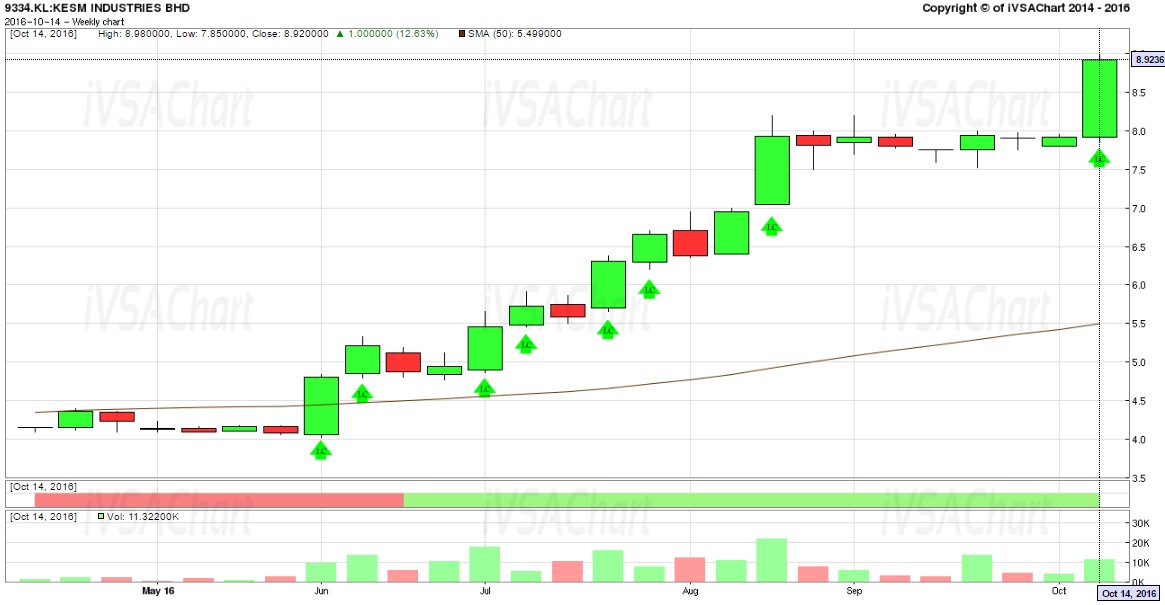

Based on KESM 6-month weekly iVSAChart it is observed that prices have been rallying since Jun 2016 with Signs Of Strength (green arrows) being detected after a period of low volume accumulation. This rally took a pause in Aug 2016 when prices hit RM8.00. Another period of accumulation followed, as seen by low trading volumes and prices well supported by smart money in a tight trading range.

For the week ending 14th Oct 2016, we see another breakout of prices from this trading range. Based on iVSA principles, investors should take note that the breakout for week ending 14th Oct 2016 is not accompanied by sufficient bullish volume. This along with the stock reaching its all time high, should alert short-term traders and even long term investors about the risk to reward ratio of buying the stock now. For the stock to continue its upward move, we would like to see strong closing prices with bullish volume in the weeks to come.

Interested to learn more?

- Free eBook available now! Click this URL to get your free eBook of “Get Rich with Dividends by Bill Wermine and Martin Wong”: http://ebook.ivsachart.com/

- Find out more about iVSAChart events via: https://www.ivsachart.com/events.php

- Follow & Like us on Facebook via: https://www.facebook.com/priceandvolumeinklse/

- Contact us via: email at sales@ivsachart.com or Call/WhatsApp at +6011 2125 8389/ +6018 286 9809/ +6019 645 3376

This article only serves as reference information and does not constitute a buy or sell call. Conduct your own research and assessment before deciding to buy or sell any stock. If you decide to buy or sell any stock, you are responsible for your own decision and associated risks.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on iVSA Stock Review

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Nov 14, 2016

Created by Joe Cool | Nov 03, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 24, 2016