Taann, pls cut more trees

kakashit

Publish date: Mon, 30 Nov 2015, 09:01 PM

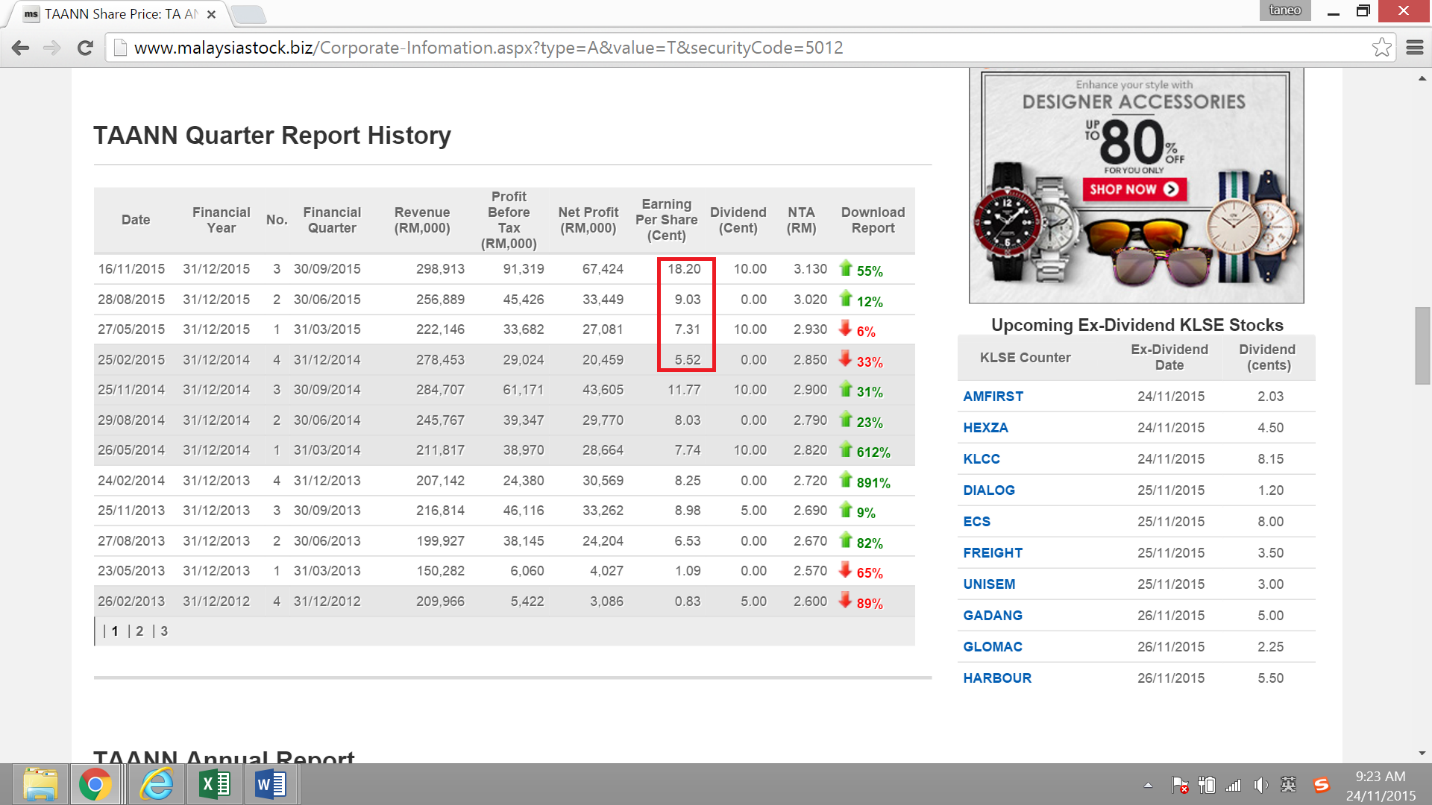

As shown in the table, Taann has improving profit in the consequence last four quarters, and the last quarter has shown a jumping growth due to enormous forex gain and higher log average price.

Taann’s business consist of plantation, plywood and logging. In FY 2014 (ended December), each contributed revenue of 42%, 40% and 18% respectively; each contributed profit before tax of 49%, 13%, 39% respectively.

Oversea revenue contribution is up to 50%, mainly contributed from Japan market then follow up with India market.

Unlike most of the plantation counters, Taann is still profitable despite of the depressed cpo price situation.

This is due to Taann has got 80% of mature palm tree profile and yet to reach its peak production. In the mature phase, there is minimum cost incur to maintain the trees.

Taann has projected 15% to 20% increase in FFB production volumes in 2015. If the cpo price keeps dropping, Taann is able to offset the lost in average selling price with the increasing production volume.

On a macro basis, dropping crude oil has discounted the incentive of turning palm oil into biodiesel, but don’t forget palm oil is still the main source of edible oil in the world especially when the world population keeps booming. That’s mean there is a bottom line to support cpo price and I am certainly believe our government would not let palm oil die like steel industry.

Previously Sarawak government had been investigating many timber companies in conducting of illegal logging activities including Taann.

“According to Further to our announcement on 28 August 2015 on the uplifting of freeze by Malaysian Anti-Corruption Commission (“MACC”) on bank accounts of Ta Ann Holdings Berhad and group of companies (“the Companies”), we wish to advise that MACC has confirmed their checking found no evidence to show that the Companies were involved in any offence under the Malaysia Anti-Corruption Act (MACC) 2009.

This announcement is dated 17th day of November 2015”

Now, Taann is clear of illegal logging probe, with legal license which gives more assurance to the investors.

Now all the furniture stocks are running high, but do you know what is the raw material in making furniture and plywood?

Yes, it is log, it is timber, it is wood, it is tree.

High demand is pushing up the price of logs.

Taann’s plywood manufacturing business mainly export to Japan. Taann has its owned supply of raw material from its logging segment, unlike other plywood companies have to pay more for the raw material cost.

According to the latest quarter report ended September, Tasmania plywood mill started commencing operation to cater the demand of Australian property boom and it is generating profit immediately.

Basically, Taann could earn more from the increases of average log price and weak Ringgit for doing nothing.

Taann’s business is not complicated and Templeton fund who represents EPF is acquiring shares. Analyst reports from five major investment banks give more than RM5 target price.

Taann’s borrowing is in Ringgit and has no foreign borrowings. Therefore it has no burden to face the weakening Ringgit

At the current share price of RM4.30, Taann is trading at undemanding PE valuation of nearly 11.

Dividend yield is 4.5%, better than putting into the bank or into blue chips.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Hunter-net-Hunter

Created by kakashit | May 08, 2017

Created by kakashit | Feb 10, 2017

Discussions

Price will consolidate.Looking fwd to Q4 result in Q1 2016 n status of the el nino come Feb 2016.

2015-11-30 21:37

ha ha ha, icon888, too many wife/girlfriend may not good for old man health. i only choose Ta Ann, very good dividend Pay.

2015-11-30 23:36

Good company. Big potential ahead. Definitely can grow by leaps and bounds to be a huge conglomerate one day.

2015-12-01 08:36

As long as u dun touch the shitty triangles--property development, oil and gas, steel, u can sleep soundly

2015-12-01 18:13

Icon8888

bought some today

2015-11-30 21:14