WTK 黄传宽控股:木材、油气和铝箔能够擦出什么火花?(附年报跟进)

kakashit

Publish date: Sat, 21 May 2016, 06:54 PM

答案是各自精彩。

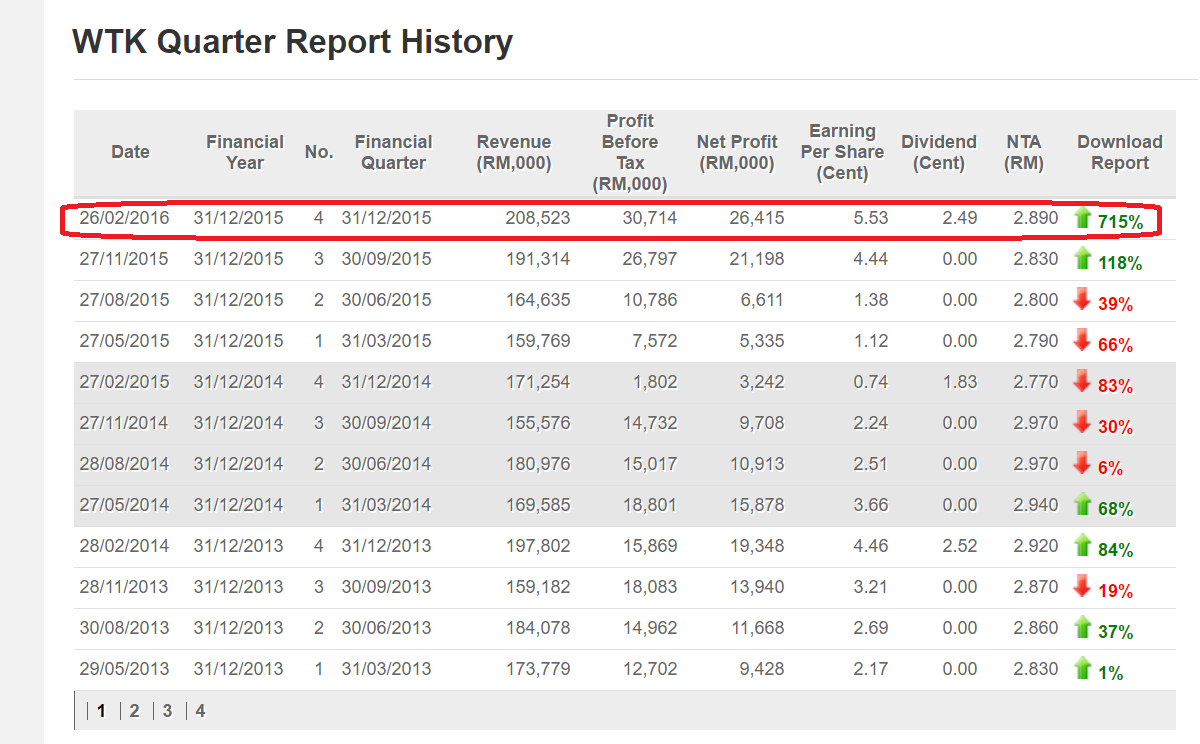

2015年12月第四季,WTK营业额和净利都创新高,可是股价并没有受到鼓舞。

"The Group achieved total revenue of RM724.7 million and net profits of RM58.6 million.While revenue growth was marginal, net profits increased almost 50% as compared to theyear before. The improved financial performance were attributed to turnover growth in thetimber division, sale of investment properties and dividend income received from the oil and gas division. As a result of the better performance, the Group’s earnings per share (EPS) rose 37% to 12.5 sen from last year’s EPS of 9.1 sen."

2015年按年相比,公司的净利增长50%,每股净利增长37%,增长贡献源自伐木业务、油气业务的利息收入以及脱售投资资产所得。

伐木业

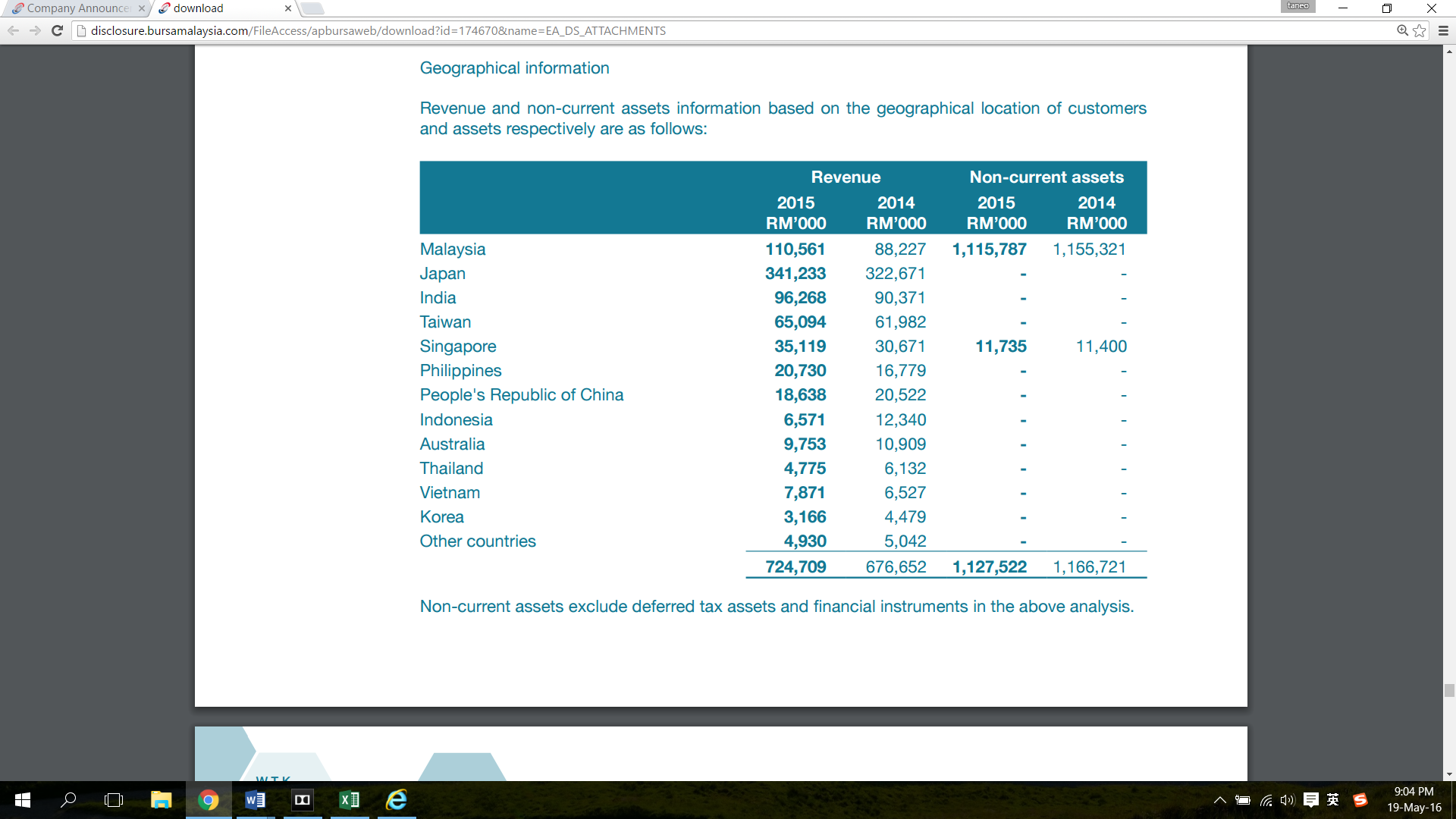

伐木是WTK的核心业务。出口去印度的原木占了产量的80%,出口去日本的板木占了产量的75%。

“For the timber division, the major markets were Japan and India, which accounted for 75% and 80% respectively of the Group’s plywood and round logs.”

而整体的伐木业务就占了WTK盈利的八成,所以WTK是吃饭或吃粥,就要看日本和印度了。

目前,印度为了经济成长大力推动基础建设,也提高了对原木的需求。单单是印度市场,就占了整个砂拉越原木产量的六成。

日本2020奥运太遥远了,不可能造成需求吃紧。而近期的熊本大地震确实迫在眉睫,许多家园必须重建。

只要没有什么经济风暴,日本和印度这两个大国对木材的需求永远殷切。

另外一个对大家不好可是对WTK好的消息就是加拿大Alberta省森林大火狂烧一个月,导致所有居民必须潜力家园,焚毁面积足足有两个香港,相信这也会造成全球的木材供需吃紧。

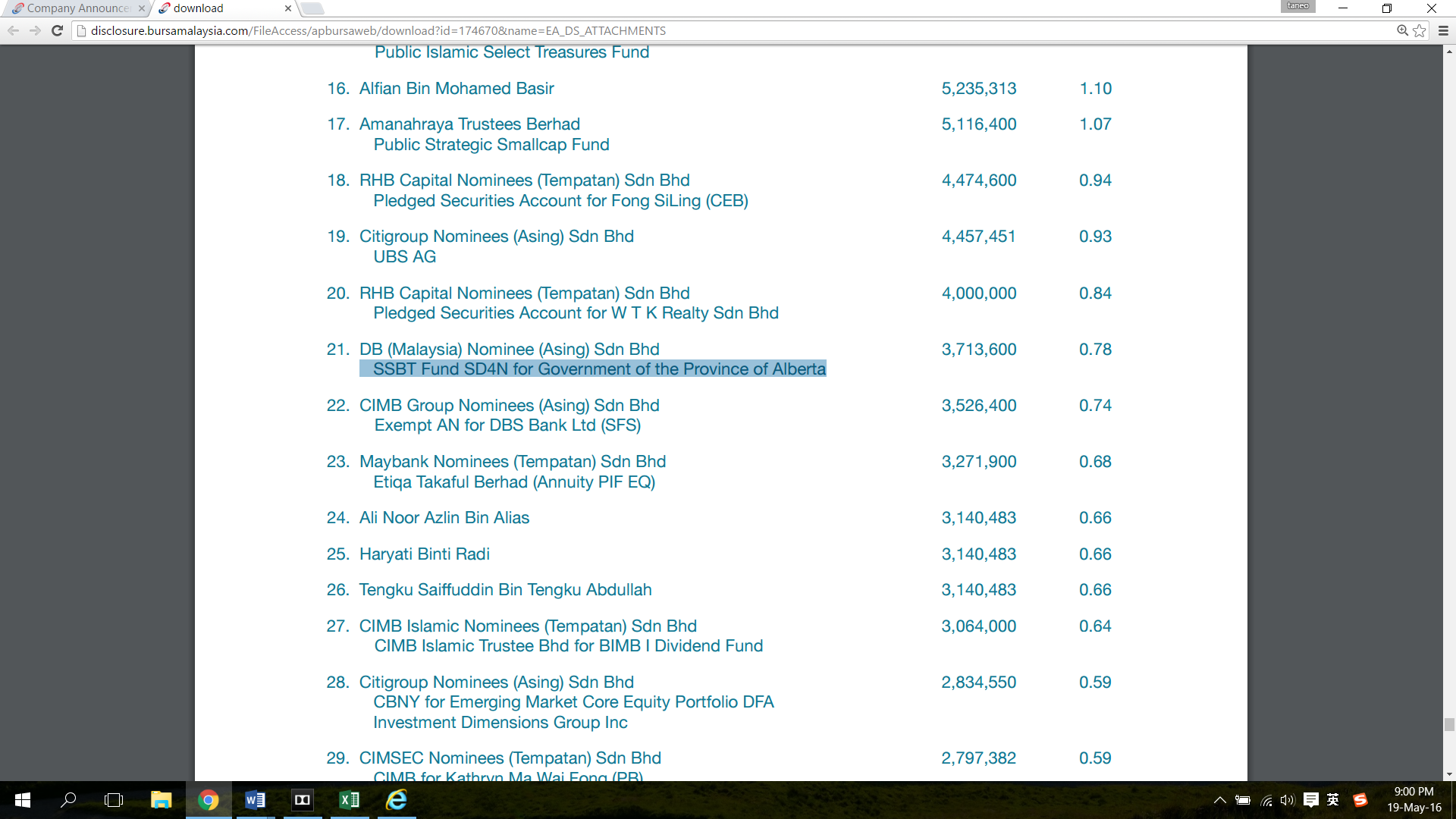

刚好我看到Alberta省政府基金有股份在Wtk,难道这就是所谓的识木材,重木材?

随着IOI集团因为保护环境不力而导致RSPO准证被吊销,显示先进国越来越重视环保,而WTK绝无这方面的风险。

"WTK Group is proud to be the pioneer in using helicopter-harvesting in Sarawak since 1993. Helicopter harvesting is recognized as the most environmental-friendly method of timber harvesting where freshly-cut logs are lifted vertically from the forest to a landing zone, thereby eliminating the need for skid trails that would further damage the forest floor."

用直升机调上去,成本是很高,但是讲究环保的先进国喜欢,会跟你埋单。

犹记,刚上任的砂州行政首长阿德南大力打击砂州的非法伐木活动,冻结了许多伐木公司的银行户口,导致2015年上半年整个砂州的伐木量大减。

WTK也不例外,产量大减,过后Wtk被证实是干净的。历年以来,Wtk的伐木量都是持稳的,证明Wtk没有过度开发森林。除了尽量不采用破坏环境的,WTK也有重植树木。

既然伐木量量是固定的,所以有公司必要多元化业务才能够成长。

种植业

凡是可以耕种的农作物,都可以被归类为种植业。Wtk有两种农作物,油棕和森林重植。

森林重植的好处是一来可以保护森林,确保树木永续生长。二来是为以后公司的木材供应做准备。不过要等一个十年以后才能贡献盈利。

Wtk目前拥有总值372m的生物资产,其中290m是属于棕油资产,其余82m属于重植林资产。

目前Wtk的种植业务还是无法达到收支平衡,2015年一共亏了近15m,没办法,种油棕头那七年是注定要亏钱的。

“The Group’s plantation division’s FFB production increased by 173% as compared to the previous corresponding year. With the Group’s oil palm maturing into higher yields cycle, this division is expected to derive significant contributions to Group earnings in future. The first half of 2016 is expected to see a stabilization of CPO prices.”

“During the year, approximately 3,300 hectares of oil palm plantations have matured and this raised the Group’s total matured area to 4,600 hectares. ”

Waoh,鲜果串产量按年增长173%,算是很厉害吧。通常以这种增长速度来看,Wtk的油棕园应该是由young mature 进入 prime mature,就是要进入盛产期了。

包装业

主要是制造和贸易铝箔和胶贴相关的包装产品。

由于原料全部是进口的,长期面对各种成本上涨的压力,最低薪金,消费税,原料等。

包装业务占了WTK一成的净利,规模虽然不大,但还是有利可图,长期为公司提供固定的现金流。未来公司会朝烟草和食品这两块市场来发展。

油气船业

两年前Wtk宣布进军油气船业,一共投资了70m。

住宿船,为在岸外油井作业的员工提供住宿。从造买船到把船移动至油井涉及庞大的费用。前两年的整体业绩主要是受到这个业务的拖累。另外,市场一听到Wtk有涉及油气就怕怕了,导致股价长期低迷,而我也一直犹豫要不要进场。经过两年的阵痛,如今已经看到回报。

2015年的第三季(2m),该油气业务达到收支平衡并开始有了盈余,第四季(5m)就很赚钱了,我才敢大举买入WTK。

“The demand for the Group’s DP2 AWBs remains steady and all four (4) vessels are being deployed to support PETRONAS and its PSCs.”

WTK的四艘住宿船已全部安置于国油的油井,而且需求稳定。

Wtk在这方面占有主场的优势,容易调动人手,而且一海之隔,西马的竞争对手也很难移师到东马。

看来WTK没有因为国油大砍资本开销而止步,还会继续竞标,向国油拿多一点工程,以后更要扩充至油气管的维修和保养业务。

以此看来纳吉怪不得那么看重砂州州选,森林资源自然不在话下,更令人垂涎的是岸外的黑金。

不动产

大家可能不知道这个消息,Wtk在第四季已经把位于吉隆坡金三角地带的Wisma Central给卖掉了,总值51m。WTK很神秘,只是在季报的一个段落略过,并没有向马交所报告。

“This was due to that parcel’s original strata title deed has been damaged at the Land Office and the replacement strata title deed is still pending from the Land Office. Under the circumstances, until the disposal of this parcel is completed, the carrying amount of its value is presented in the Statements of Financial Position as “Assets classified as held for sale”. Once the disposal of this parcel is completed, the Group would then recognise the gain on disposal of approximately RM6,000,000.”

可是只卖了一半,第四季一共录得9.9m的脱售盈利。这不是WTK的错误,而是土地局的疏忽,不知为何原版的地契在土地局遭到破损。相信很快就能发出新的地契,还有6m的脱售盈利有待入账。

*以上的英文段落都是取自WTK 2015年年报和季报

如果你看到公司的营运现金流是净利的一倍,那么就代表该公司write off了很多不涉及现金的资产。

这两年来Wtk注销了很多油气和种植业务的资产,这是作风保守的公司的作法,也叫做先甜后苦。

能够分散投资永远是好事。

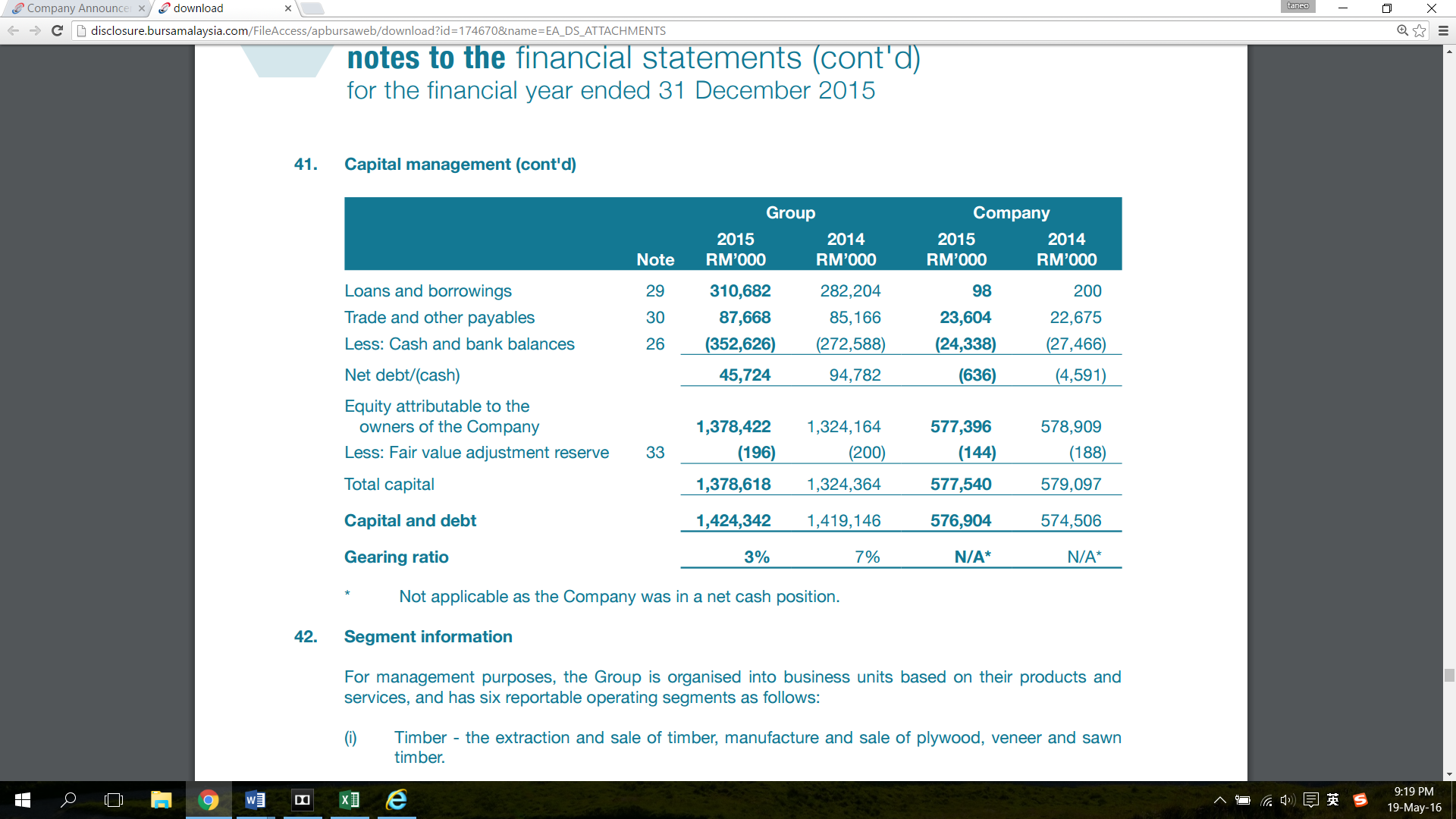

很健全吧,风暴来也不用怕。

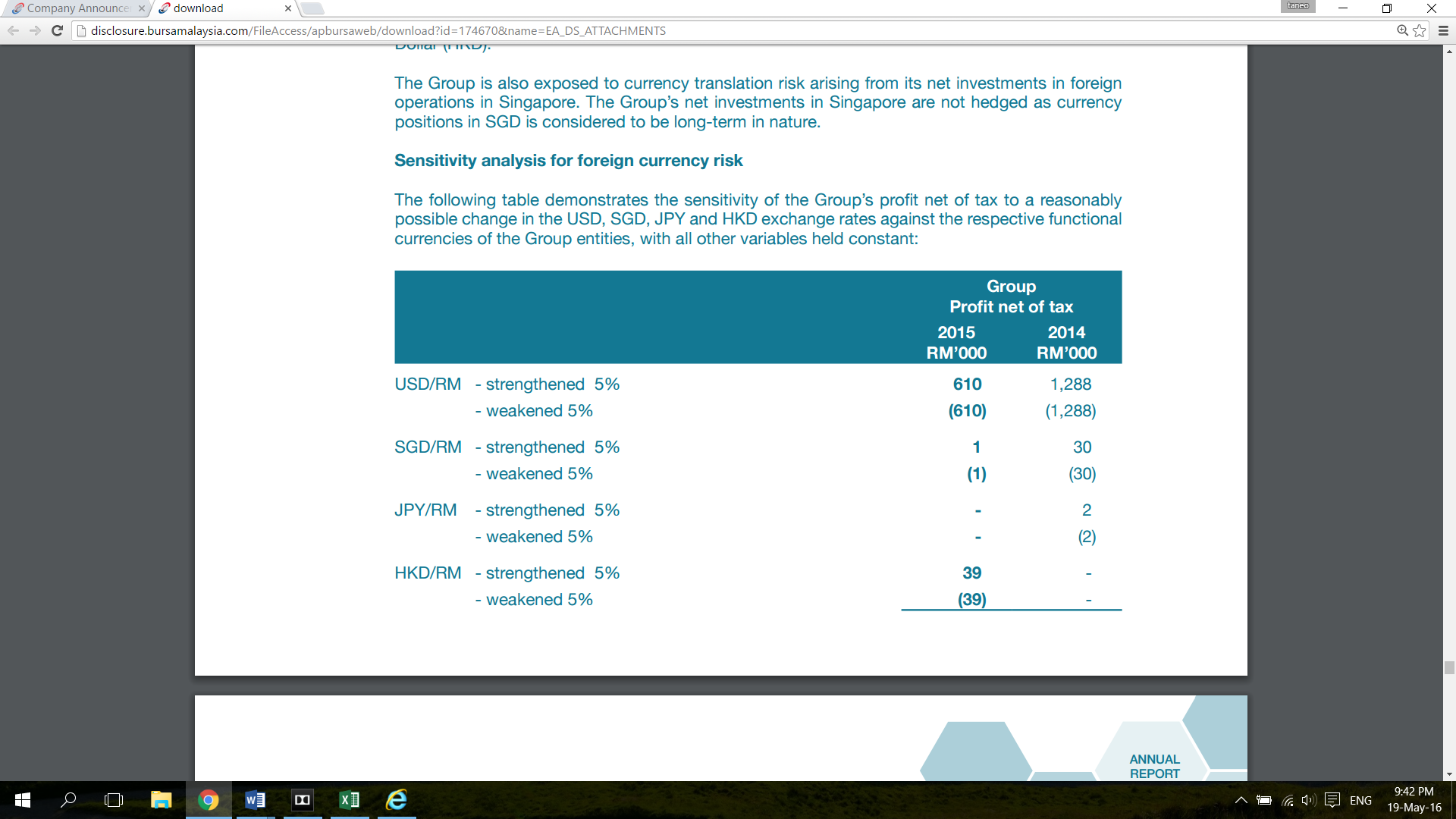

其实令吉升贬影响不太大。

总结

Wtk的伐木业是个现金牛,因为木材只会越来越少,不像油气可以开发新的科技,所以不用担心供应过剩的问题。

油气船业现在已经是丰收期了,而且不会再有一次性的费用或勾销。

至于棕油要等多一年就能达到收支平衡。另外产业脱售能为短期带来惊喜。

以现在1.15令吉的股价来说,周息率仅有1.6%,但是派息额按年也增长了36%。

WTK的净资产为2.90令吉,现在只需要以净资产约三分之一的价钱就能买到该公司的股份,加上源源不绝的的现金流,可谓是物超所值。

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Bursa Hunter-net-Hunter

Created by kakashit | May 08, 2017

Created by kakashit | Feb 10, 2017

Discussions

Taann good, Wtk better, coz the former I comment only, the latter I wrote on it.

买股要懂得权衡轻重。

2016-05-21 23:41

Yistock, I only compare it on a yoy basis. Coz the palm trees can only grow larger, cannot grow smaller

2016-05-21 23:42

All things good, but why stock price keep going down?? This is something we need to understand deeply.

2016-05-22 01:30

paperplane, seem like you know everything whenever someone said something, why not you show us what you know or understand deeply?

Don't give all kinds of rubbish excuses like "you know but you don't want to let us know lah" this or that.

2016-05-22 01:52

Most of the timber related counters announced below expectation results such as TAAN & FLB.

What make this one extraordinary?

2016-05-22 10:11

One more.

All Sarawak or Sarawakian related counters plunging,no matter good or bad results.

What make this one spare??

2016-05-22 10:14

We can have all kinds of calculation and expectation.

But Mr market is telling us another side of story. Pay more attention to Mr Market when he go against with yours.

2016-05-22 10:20

A very sincere warning on all Swk counters, seems all such counters really controlled by crocodiles who work on insider news, a live and undeniable case is Taan, Share price of Taan dropped by >15% before results announced on last Thursday, the fucking crocodiles kept on throwing! Very clearly, these blood sucking, damned to death crocodile insiders know the the fuckingly poor results of deadly Taan which were announced last Thursday! Damned, all these blood sucking crocodiles who earned by insider news will

All be condemned to early and premature deaths via the most horrible means!! KARMA!!

2016-05-22 10:48

Seems my sifu and fong silkng buRn their hands here! Kena conned by sabahan and Sarawak ian with no dignitiy

2016-05-22 10:59

Consider everything held constant, but only share price drops, it will be a big bargain right?

This is not a rocket science

2016-05-22 11:42

Just bought some wtk net cash company n wait for this coming results. Foresee upcoming result to be satisfactory since the production logs are increased since December 2015.

2016-05-22 23:08

Kakashit thumbs up for your good research in line with my expectation on wtk as well.

2016-05-22 23:10

The show will be from poultry integration, not the removal subsidy of flour.

2016-07-26 11:54

YiStock

Kakashit, can you keep track and share with us the monthly production of wtk so that can can see the trend. Thank you very much and appreciate that.

2016-05-21 19:45