Kenanga Research & Investment

Daily Technical Highlights - (MMCCORP, YTL)

kiasutrader

Publish date: Thu, 30 Jul 2020, 10:33 AM

MMC Corporation Bhd (Trading Buy)

- MMCCORP shares could stage a technical rebound soon. The stock has been consolidating after pulling back from a recent high of RM0.91 at the end of May.

- Technically speaking, its share price (which closed at RM0.73 yesterday) is now hovering near the lower boundary of the Bollinger Band, indicating that an upward movement may be forthcoming. At the same time, the stock is on the verge of breaking out from a short-term triangle pattern.

- Based on the positive technical signals, the stock could bounce up to our resistance target of RM0.85 (R1) (16% upside potential). Beyond R1, it must penetrate the medium-term negative sloping trendline first before challenging our next resistance barrier of RM0.95 (R2) (30% upside potential).

- We have set our stop loss level at RM0.67 (or an 8% downside risk).

- On the fundamental front, MMCCORP - which is involved in the ports & logistics, energy & utilities (including listed entities namely 38%-owned Malakoff and 31%-owned Gas Malaysia), engineering and industrial development businesses – reported a net profit of RM57.9m (+8% YoY) in 1QFY20.

- Using consensus net profit expectations of RM212m for FY Dec 2020 and RM253m for FY Dec 2021, the stock is currently trading at forward PERs of 10.5x this year and 8.8x next year.

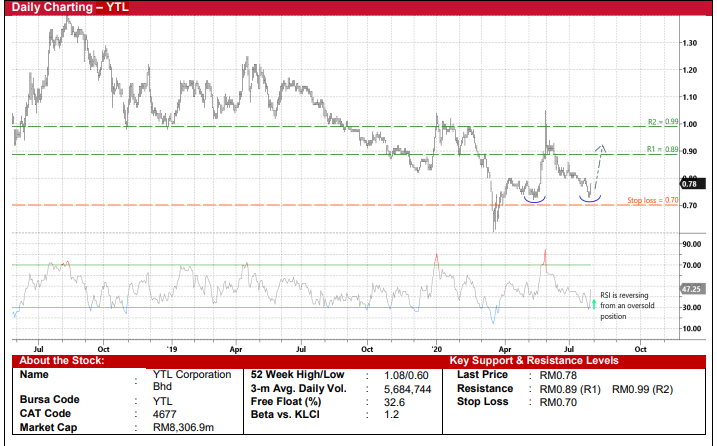

YTL Corporation Bhd (Trading Buy)

- YTL’s share price could have bottomed after sliding from a recent high of RM1.05 end-May to as low as RM0.73 at the beginning of this week.

- In addition, the RSI indicator has reversed from an oversold territory as the stock rose 6% on high volume to close at RM0.78 yesterday.

- On the back of the renewed buying momentum, YTL shares could climb further to test our resistance thresholds of RM0.89 (R1) and RM0.99 (R2). This translates to upside potentials of 14% and 27%, respectively.

- Our stop loss level is pegged at RM0.70 (which represents a 10% downside risk).

- Meanwhile, YTL – a conglomerate that is involved in multiple businesses ranging from utilities, cement manufacturing & trading, construction, property investment & development, hotel operations to information technology & e-commerce – recently announced a net profit of RM29.5m (-66% YoY) in 3QFY20, taking the Group’s 9-month earnings to RM62.4m (-76% YoY).

- Consensus is forecasting YTL to make a net profit of RM79m in FY Jun 2020 before increasing to RM243m in FY Jun 2021, hence valuing the stock at forward PERs of 105.2x this year and 34.2x next year.

Source: Kenanga Research - 30 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments