Daily technical highlights – (YTL, KHJB)

kiasutrader

Publish date: Tue, 01 Dec 2020, 09:39 AM

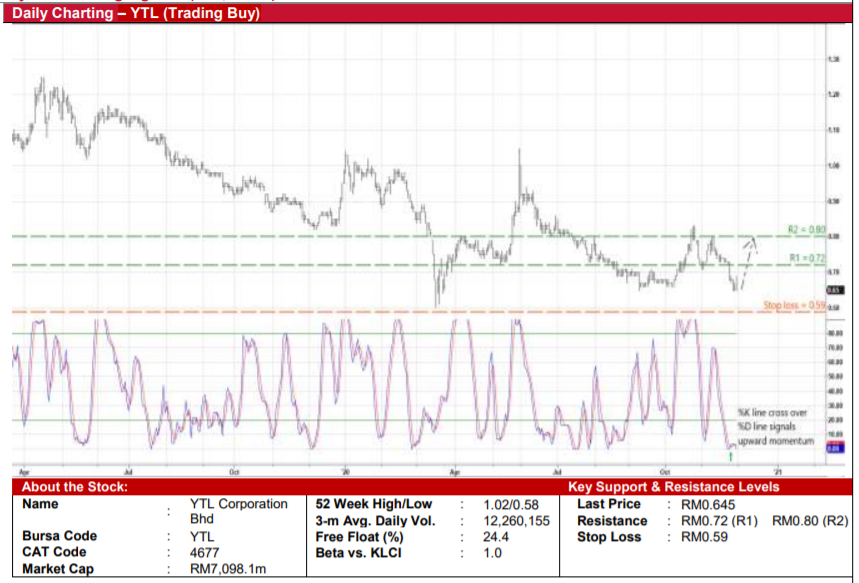

YTL Corporation Bhd (Trading Buy)

• After sliding from RM0.80 on 10 November to close at RM0.645 yesterday (and hovering marginally above its March’s trough of RM0.58), YTL shares – which have been actively traded in recent days possibly due to portfolio rebalancing exercise as the stock was to be deleted from the MSCI Malaysia Index as of the close of yesterday – offers a timely trading opportunity.

• On the chart, its share price will likely stage a technical rebound with the Stochastic indicator showing the %K line crossing above the %D line in the oversold territory.

• Riding on the renewed buying momentum, YTL shares are expected to bounce up towards our resistance thresholds of RM0.72 (R1; 12% upside potential) and RM0.80 (R2; 24% upside potential).

• We have placed our stop loss price at RM0.59 (or 9% downside risk).

• Meanwhile, the Group – a conglomerate that is involved in multiple businesses ranging from utilities, cement manufacturing & trading, construction, property investment & development, hotel operations to information technology & e-commerce – has just released its first quarter results ended September 2020 with net profit coming in at RM1.3m (-92% YoY).

• Still, forward earnings are expected to recover swiftly as consensus is projecting YTL to make net profits of RM121m in FY June 2021 and RM215m in FY June 2022, which implies forward PERs of 59x and 33x, respectively.

Kim Hin Joo (Malaysia) Bhd (Trading Buy)

• Listed in July last year, KHJB – a leading retailer of baby, children and maternity products in Malaysia under the Mothercare brand with a network of approximately 500 distribution points – is a proxy to the increasing number of young families in the country.

• Last Friday, the Group reported a net profit recovery to RM2.6m (+60% YoY; >5-fold QoQ) in 3QFY20, lifting its 9-month earnings to RM4.4m (-33% YoY), which has been hit by the Covid-19 movement restrictions in the preceding quarters.

• The Group is financially stable with a debt-free balance sheet that is backed by cash holdings & short-term investments of RM31.5m (8.3 sen per share or slightly more than one-third of its existing share price) as of end-September this year.

• From a technical perspective, the stock will probably extend its run-up from a recent low of RM0.175 in the beginning of November and ride on the positive momentum following: (i) the appearance of a Dragonfly doji on the chart; and (ii) the share price crossover of its 50-day SMA line.

• That being the case, we have set our resistance levels at RM0.28 (R1) and RM0.32 (R2) for KHJB shares to challenge ahead. This represents upside potentials of 24% and 42%, respectively.

• Our stop loss price is pegged at RM0.17 (or 24% downside risk from yesterday’s closing price of RM0.225).

Source: Kenanga Research - 1 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024