Daily technical highlights – (BAUTO, AWC)

kiasutrader

Publish date: Wed, 06 Jan 2021, 10:11 AM

Bermaz Auto Bhd (Trading Buy)

• BAUTO is set to benefit from the double effects of the government’s extension of sales tax exemptions for motor vehicles (until end-June 2021) and the strengthening of the Ringgit and the Philippine Peso (both have appreciated against the Japanese Yen by 5.3% and 5.4%, respectively since the financial meltdown in March last year).

• With earnings on the recovery, consensus is projecting BAUTO – which is principally a distributor of Mazda vehicles in Malaysia and the Philippines – to make net profit of RM101m in FY April 2021 and RM150m in FY April 2022.

• The stock also offers attractive dividend yields of 3.4% for FY21 and 5.2% for FY22 based on consensus DPS of 5.0 sen and 7.6 sen, respectively.

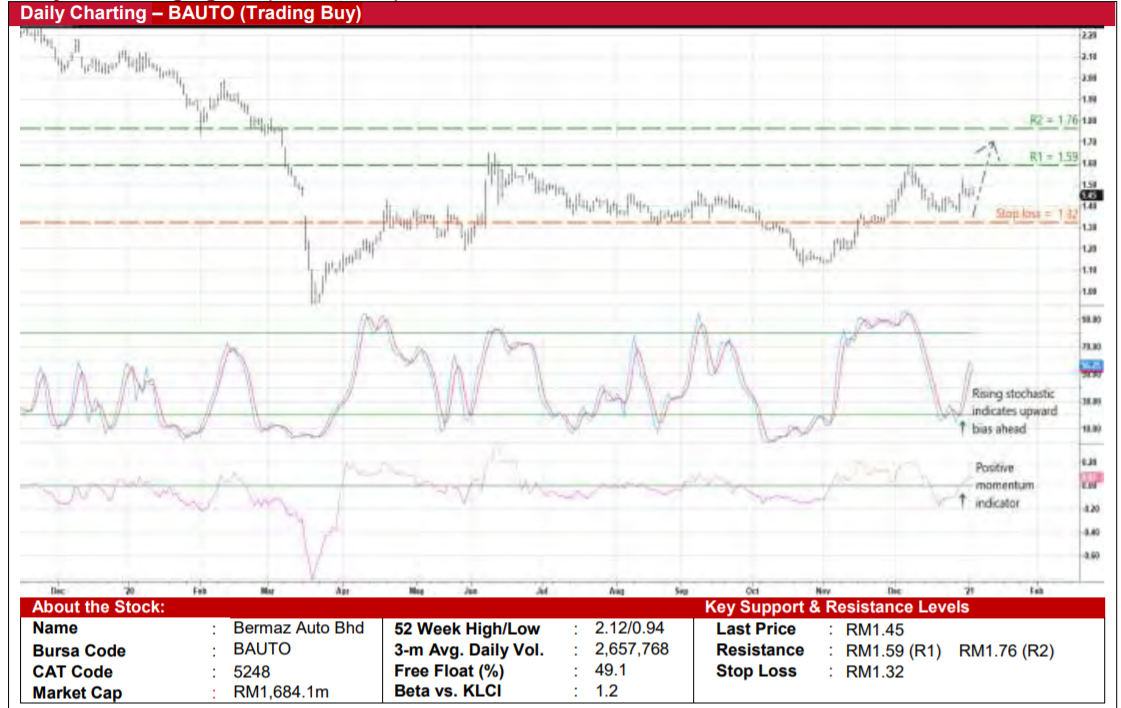

• From a technical perspective, BAUTO’s share price – after correcting from a high of RM1.59 one month ago to settle at RM1.45 yesterday – could be resuming its ascending trajectory (which started in March last year).

• A breakout from the existing consolidation pattern appears likely as the stochastic indicator rises from the oversold zone while the momentum indicator cuts above the zero line.

• Riding on the upward strength, BAUTO shares will probably climb towards our resistance thresholds of RM1.59 (R1; 10% upside potential) and RM1.76 (R2; 21% upside potential).

• Our stop loss price is pegged at RM1.32 (or 9% downside risk).

AWC Bhd (Trading Buy)

• AWC is principally involved in the: (a) provision of integrated facilities management (IFM) services for buildings and facilities; (b) environment sector via the design, supply, installation, testing & commissioning and operations & maintenance of automated pneumatic waste collection systems; (c) engineering business as a contractor for the implementation of full air conditioning systems and mechanical & electrical engineering works for buildings and facilities; and (d) the provision of railway construction and maintenance solutions by supplying and providing specialized services in the areas of railway track, depot and rolling stock.

• The Group has recently clinched a slew of contracts valued at: (a) RM21m for sub-contract works for a water treatment plant in Malacca on 2 December; (b) RM5m for an IFM contract for a building in Sarawak on 3 December; (c) RM108m to provide hospital support services for a hospital in Shah Alam on 9 December; and (d) RM4m for the supply of rail grinding service for the MRT2 project on 5 January 2021.

• These contract wins are expected to contribute positively to future earnings as the Group is set to turn around after registering a net loss of RM18.8m in FY June 2020 (when its bottomline was hit by impairment losses).

• For 1QFY21, AWC reported a net profit of RM5.6m (versus 1QFY20’s net profit of RM6.7m and 4QFY20’s net loss of RM29.9m). The Group is also in a financially strong position with net cash holdings & short-term investments of RM68.8m (21.8 sen per share or almost half of its existing share price) as of end-September 2020.

• On the chart, the stock could see a trend reversal after overcoming a multi-year downward sloping trendline. The positive technical outlook is backed by its share price crossing over the 50-day SMA line and the recent appearance of bullish Dragonfly Doji candlesticks.

• On the way up, AWC shares will probably rebound to reach our resistance thresholds of RM0.52 (R1; 13% upside potential) and RM0.59 (R2; 28% upside potential).

• We have placed our stop loss price at RM0.40 (or 13% downside risk from yesterday’s closing price of RM0.46).

Source: Kenanga Research - 6 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024