Kenanga Research & Investment

Daily technical highlights – (TALIWRK, YTL)

kiasutrader

Publish date: Wed, 03 Feb 2021, 02:04 PM

Taliworks Corporation Bhd (Trading Buy)

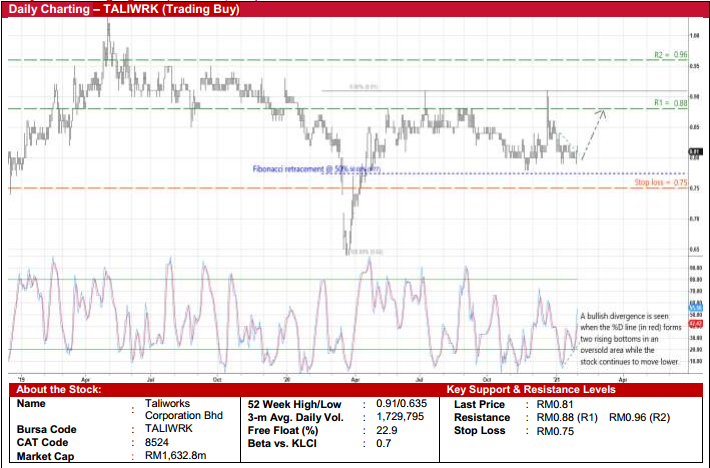

- After slipping from a recent high of RM0.91 around mid-December last year to close at RM0.81 yesterday, TALIWRK’s current share price weakness offers investors an opportunity to accumulate the stock.

- Its further downside risk will likely be cushioned by the 50% Fibonacci retracement line, which has provided steady support during the price correction in November last year.

- On the chart, the sighting of a bullish divergence – with the %D line forming two rising bottoms in the oversold area while the stock continues to move lower – indicates that a share price rebound could be on the cards.

- Riding on the positive momentum, TALIWRK shares will probably climb towards our resistance thresholds of RM0.88 (R1; 9% upside potential) and RM0.96 (R2; 19% upside potential).

- We have set our stop loss price at RM0.75 (or 7% downside risk).

- In terms of recent corporate development, TALIWRK – an infrastructure group engaged in operation & maintenance of water treatment plant, highway & toll management, waste management and construction & engineering – has ventured into the renewable energy market via the acquisition of majority economic interest in four solar projects with an aggregate capacity of 19MW peak for RM144m.

- Backed by net cash holdings & investments of RM106.6m (or 5.3 sen per share) as of end-September 2020, the stock is also appealing offering an attractive dividend yield of 8.1% based on consensus FY21 DPS of 6.6 sen. For FY20, the Company has so far declared cumulative DPS of 4.95 sen (comprising three quarterly payments of 1.65 sen each) after paying out annual DPS of 4.8 sen in the preceding four years.

YTL Corporation Bhd (Trading Buy)

- YTL’s share price is looking technically interesting following a pullback of 22% from its recent high of RM0.83 in midDecember last year. At the last traded price of RM0.65, the stock is not far away from its March 2020’s trough level of RM0.58 with further downside risk supported by a horizontal line that stretches back to September last year.

- As the shares approach the RSI oversold zone, a technical rebound is anticipated when the stock climbs above the oversold threshold going forward.

- That being the case, the share price will probably bounce up to reach our resistance targets of RM0.72 (R1; 11% upside potential) and RM0.80 (R2; 23% upside potential).

- We have pegged our stop loss price at RM0.59 (which represents 9% downside risk).

- Fundamentally speaking, YTL – a conglomerate that is involved in multiple businesses ranging from utilities, cement manufacturing & trading, construction, property investment & development, hotel operations to information technology & ecommerce – is forecasted to register net profit of RM108m in FY June 2021 and RM193m in FY June 2022 based on consensus numbers. This translates to forward PERs of 66x and 37x, respectively.

Source: Kenanga Research - 3 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments