Daily Technical Highlights – (LAGENDA, DRB)

kiasutrader

Publish date: Thu, 20 May 2021, 09:20 AM

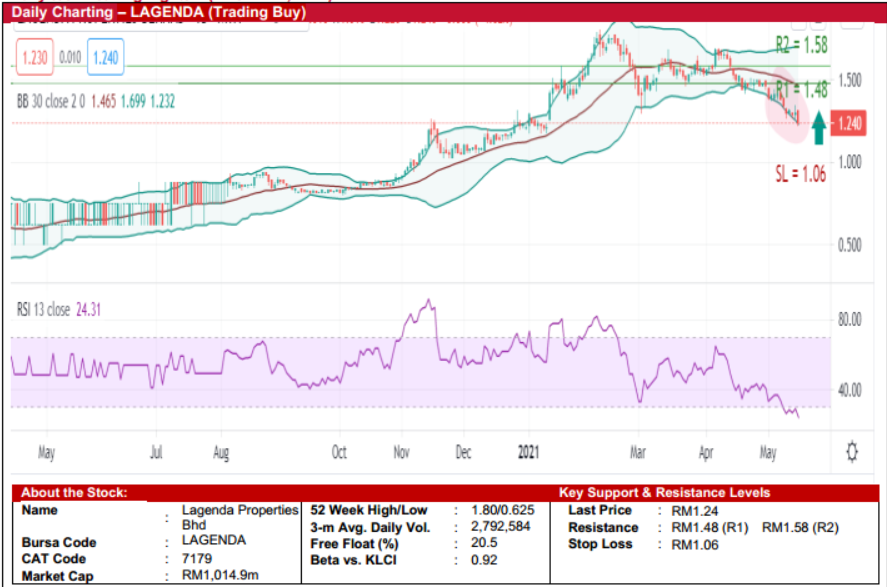

Lagenda Properties Bhd (Trading Buy)

• LAGENDA is a Perak-based affordable housing developer with products priced between RM150-200k per unit. While other developers are struggling with inventory overhangs, LAGENDA is thriving in the current challenging market landscape as they are catering to the needs of homebuyers that fall into the B40 and M40 income groups.

• The group is able to attractively price their properties due to their ability to acquire land bank at low costs while leveraging on their strength in in-sourcing of construction and building materials at affordable rates.

• The group’s 4QFY20 revenue has increased to RM272.5m (+1,026% QoQ) while its net income rose in tandem to RM55.6m (+2,124% QoQ). This took the full-year net profit to RM151.7m (+1,895% YoY) in FY Dec 2020.

• On the chart, the stock has pulled back from a price of RM1.69 at the beginning of April before closing at RM1.24 yesterday.

• Following the pullback, we expect the stock to bounce up ahead as it is about to climb back above the bottom Bollinger Band while reversing from the RSI oversold area.

• With that, the stock could advance to challenge our resistance targets of RM1.48 (R1; 19% upside potential) and RM1.58 (R2; 27% upside potential).

• Our stop loss price is set at RM1.06 (or 15% downside risk from yesterday’s close of RM1.24).

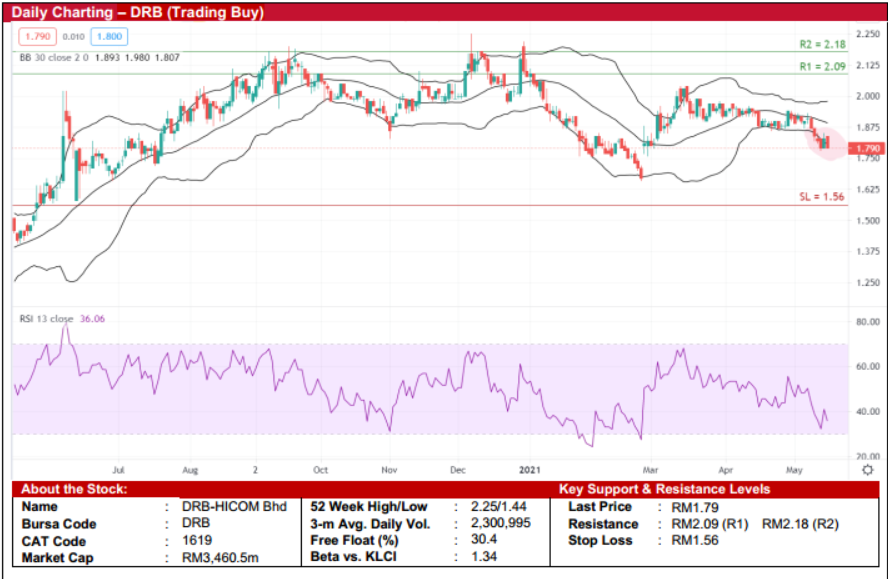

DRB-HICOM Bhd (Trading Buy)

• DRB is one of the largest conglomerates in Malaysia, with key businesses in the Automotive, Services and Properties sectors, including owning Malaysia’s PROTON national car brand.

• The group’s revenue has increased to RM13.2b (+33% YoY) in FY20. The automotive sector was the main contributor to the group’s revenue as it generated approximately RM8.0b (or 60%) due to strong sales of Proton vehicles (X70 & X50) amid the sales tax holiday incentive.

• At the bottom line, DRB posted net profit of RM554.0m (+26% YoY) in FY Dec 2020.

• Chart-wise, the stock has declined from RM2.04 in the middle of March before closing at RM1.79 yesterday.

• With the RSI currently showing the shares are oversold, we expect the stock to bounce up from the bottom Bollinger Band soon.

• On the back of a likely technical rebound, we believe that the stock could advance to our resistance levels of RM2.09 (R1; 17% upside potential) and RM2.18 (R2; 22% potential upside).

• On the other hand, our stop loss price is set at RM1.56 (or 13% downside risk from yesterday’s close of RM1.79).

Source: Kenanga Research - 20 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-28

DRBHCOM2024-11-28

DRBHCOM2024-11-28

LAGENDA2024-11-27

DRBHCOM2024-11-27

DRBHCOM2024-11-26

DRBHCOM2024-11-26

DRBHCOM2024-11-26

LAGENDA2024-11-25

DRBHCOM2024-11-25

LAGENDA2024-11-25

LAGENDA2024-11-25

LAGENDA2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-22

DRBHCOM2024-11-21

DRBHCOM2024-11-19

DRBHCOM2024-11-19

LAGENDA2024-11-19

LAGENDA2024-11-19

LAGENDA2024-11-19

LAGENDAMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024