Daily technical highlights – (YTLPOWR, SIMEPROP)

kiasutrader

Publish date: Wed, 16 Mar 2022, 09:04 AM

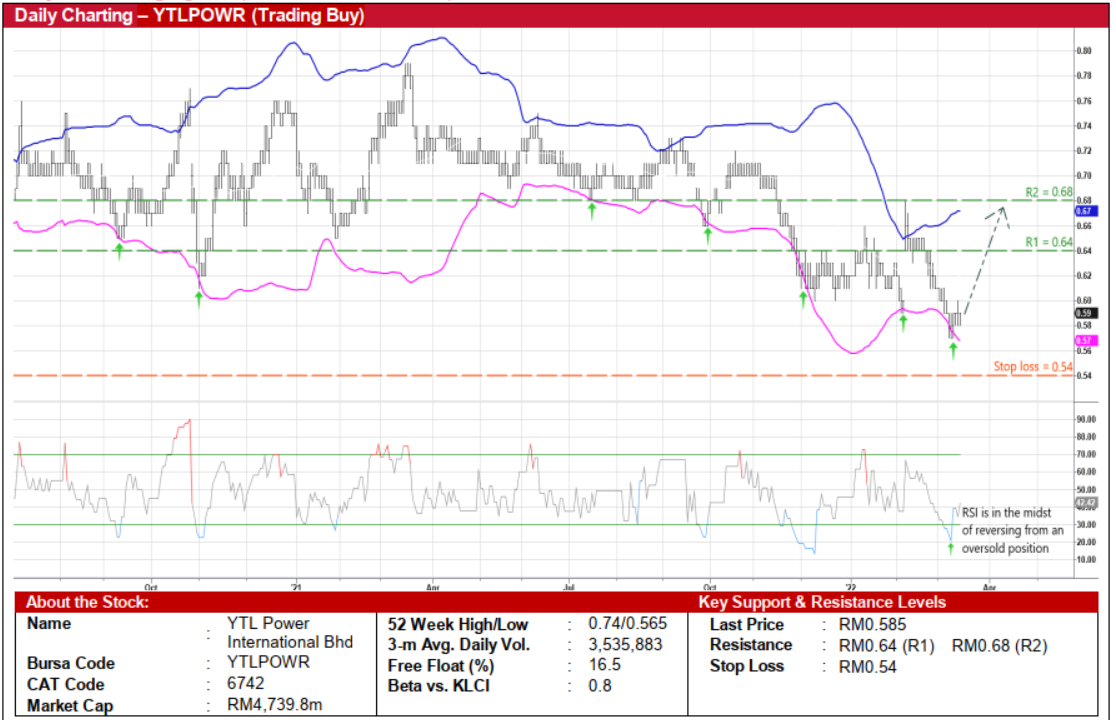

YTL Power International Bhd (Trading Buy)

• A technical rebound could be on the horizon for YTLPOWR shares after falling from last month’s high of RM0.68 to a trough of RM0.565 last Wednesday, back to where it was in mid-April 2020. The stock ended at RM0.585 yesterday.

• With the share price recently crossing back above the lower Bollinger Band and the RSI indicator in the midst of climbing out from an oversold territory, the stock will likely shift higher ahead.

• On the chart, the shares could rise towards our resistance thresholds of RM0.64 (R1; 9% upside potential) and RM0.68 (R2; 16% upside potential).

• We have placed our stop loss price level at RM0.54 (or an 8% downside risk).

• An international multi-utility group with diversified businesses in power generation, water & sewerage and telecommunications spread across Malaysia, Singapore, the United Kingdom, Indonesia, Australia and Jordan, YTLPOWR posted net profit of RM54.2m (-77% YoY) in 1HFY22.

• Going forward, according to consensus estimates, the group is expected to make net earnings of RM243.7m for FY June 2022 and RM376.3m for FY June 2023, which translate to forward PERs of 19.4x and 12.6x, respectively.

• At the current share price, YTLPOWR – which has yet to declare any dividends thus far for FY22 – offers attractive prospective dividend yields of 6.0% - 6.7% based on consensus DPS forecasts of 3.5 sen in FY22 and 3.9 sen in FY23, respectively.

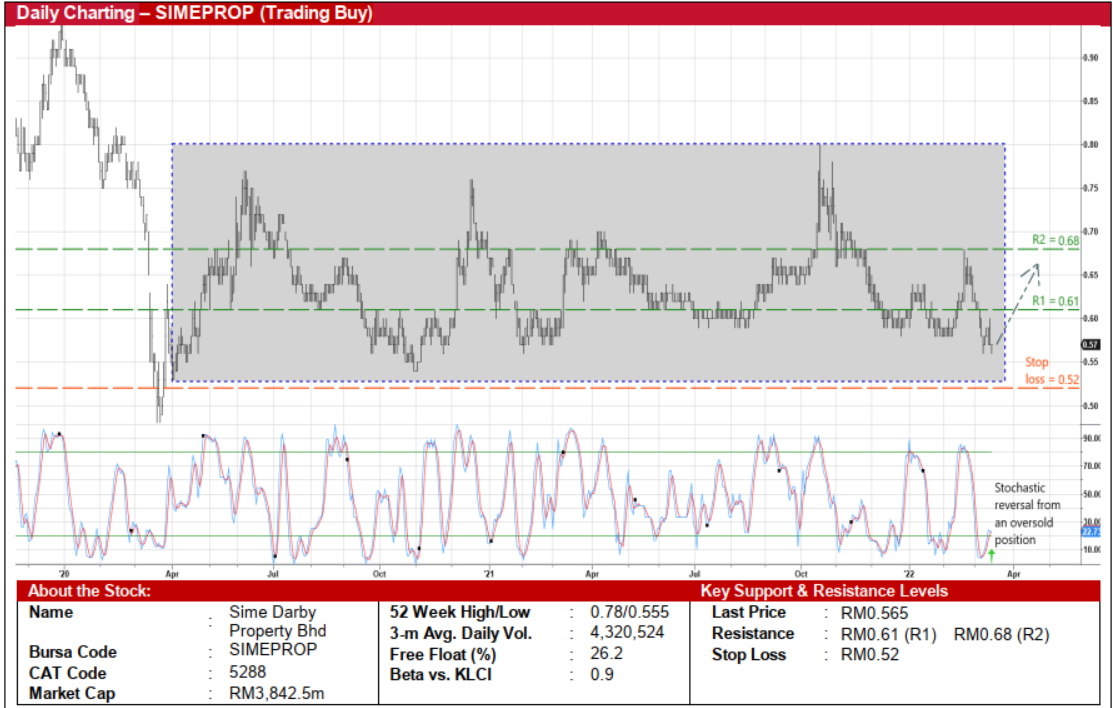

Sime Darby Property Bhd (Trading Buy)

• A trading buy opportunity exists in SIMEPROP shares following a price retracement from a high of RM0.78 in end-October last year to close at RM0.565 yesterday, which is near its 52-week low.

• With the share price approaching the bottom of a rectangle pattern and the stochastic indicator’s %K line crossing over the %D line in an oversold area, a technical rebound may be forthcoming.

• On the way up, the stock could climb towards our resistance thresholds of RM0.61 (R1; 8% upside potential) and RM0.68 (R2; 20% upside potential).

• Our stop loss price level is set at RM0.52 (which represents an 8% downside risk).

• As a property developer with 24 active townships / development strategically located across the country, SIMEPROP is in an advantageous position to mix-and-match its launches according to changing market demand.

• With unbilled property sales of RM2.4b (as of end-December 2021) and a fresh property sales target of RM2.6b for 2022, the group – which reported net profit of RM136.9m in FY21 (a turnaround from FY20’s net loss of RM501.6m) – is forecasted to show net earnings of RM244.8m for FY December 2022 and RM286.8m for FY December 2023 according to consensus expectations.

• Valuation-wise, SIMEPROP is presently trading at a Price/Book multiple of 0.42x (or at 1 SD below its historical mean) based on its book value per share of RM1.34 as at end-December last year.

Source: Kenanga Research - 16 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

YTLPOWR2024-11-22

SIMEPROP2024-11-22

SIMEPROP2024-11-22

YTLPOWR2024-11-22

YTLPOWR2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-21

SIMEPROP2024-11-20

SIMEPROP2024-11-20

SIMEPROP2024-11-20

SIMEPROP2024-11-19

SIMEPROP2024-11-19

SIMEPROP2024-11-19

SIMEPROP2024-11-18

SIMEPROP2024-11-18

SIMEPROP2024-11-18

SIMEPROP2024-11-15

SIMEPROP2024-11-15

YTLPOWR2024-11-15

YTLPOWR2024-11-15

YTLPOWR2024-11-15

YTLPOWR2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

YTLPOWR2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROPMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024