Daily technical highlights – (TSH, MRDIY)

kiasutrader

Publish date: Fri, 08 Jul 2022, 09:34 AM

TSH Resources Bhd (Trading Buy)

• After reaching its peak of RM1.89 in late April 2022 lifted by escalating crude palm oil (CPO) prices, TSH’s share price has subsequently plunged to close at RM0.97 yesterday, near its 52-week low of RM0.96.

• Technically speaking, the stock price is expected to reverse direction after crossing back above the lower Bollinger Band as the RSI indicator climbs out from the oversold area.

• Thus, we expect the stock to trend higher to test our resistance thresholds of RM1.07 (R1; 10% upside potential) and RM1.13 (R2; 16% upside potential).

• Conversely, our stop loss price has been identified at RM0.87 (representing a 10% downside risk).

• TSH is primarily engaged in the cultivating, processing and refining of palm oil. Its other business segments are oil palm plantation and bio-integration, wood product manufacturing & trading, reforestation, cocoa manufacturing & trading, as well as generation & supply of electricity from a biomass plant.

• The group has reported a core net profit of RM64m (+87% YoY, -6% QoQ) in 1QFY22 driven mainly by stronger CPO prices.

• Based on consensus forecasts, TSH’s net earnings is projected to come in at RM197.4m in FY December 2022 and RM151.8m in FY December 2023, which translate to forward PERs of 6.8x this year and 8.8x next year, respectively.

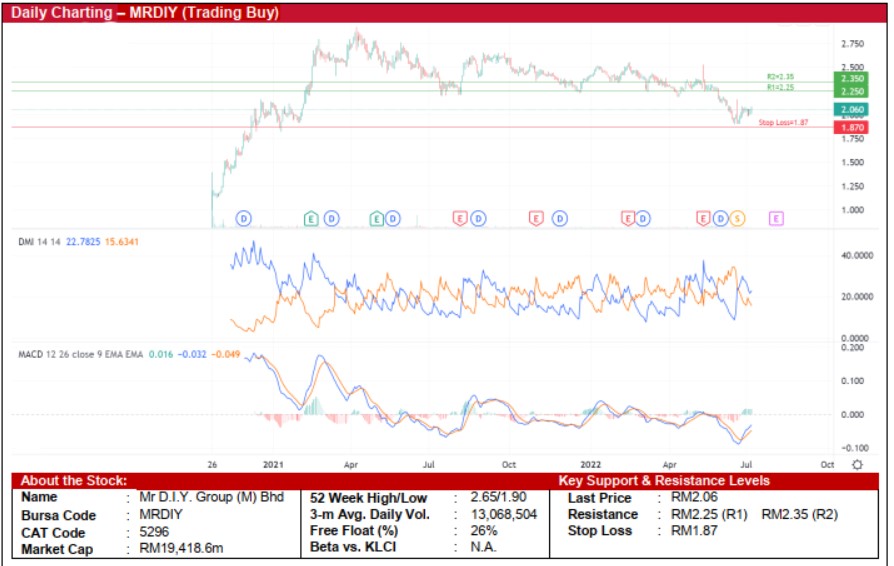

Mr D.I.Y. Group (M) Bhd (Trading Buy)

• MRDIY’s share price has been trending down since early April 2021 from a peak of RM2.92 to its 52-week low of RM1.90.

• Chart-wise, following a recent bounce-up to RM2.06 currently, the stock price is expected to continue its upward bias as the MACD has crossed over the signal line in late June and the DMI Plus remains above the DMI Minus.

• With that, MRDIY shares could rise towards our resistance thresholds of RM2.25 (R1; 9% upside potential) and RM2.35 (R2; 14% upside potential).

• Our stop loss price is set at RM1.87 (representing a 9% downside risk).

• Fundamentally speaking, MRDIY is Malaysia’s largest home improvement retailer which is known for its low prices with its chain of stores mostly located in convenient locations that are accessible to customers.

• The group recently reported a revenue of RM905.2m (+4% YoY, -7.2% QoQ) and net profit of RM100.5m (-19.5% YoY, - 25.3% QoQ) in 1QFY22.

• Based on consensus forecasts, MRDIY’s net earnings is projected to come in at RM554.7m in FY December 2022 and RM669.4m in FY December 2023, which translate to forward PERs of 35x this year and 29x next year, respectively.

Source: Kenanga Research - 8 Jul 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-24

TSH2024-11-22

MRDIY2024-11-22

MRDIY2024-11-22

TSH2024-11-22

TSH2024-11-22

TSH2024-11-22

TSH2024-11-21

MRDIY2024-11-21

TSH2024-11-20

MRDIY2024-11-19

MRDIY2024-11-19

MRDIY2024-11-18

MRDIY2024-11-16

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-15

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-14

MRDIY2024-11-13

MRDIY2024-11-13

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIY2024-11-12

MRDIYMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024