Daily technical highlights – (HPPHB, YTLPOWR)

kiasutrader

Publish date: Mon, 28 Aug 2023, 11:06 AM

HPP Holdings Berhad (Technical Buy)

• Hitting a low of RM0.28 in April 2023, HPPHB’s share price has been riding on an uptrend ever since and reached a high ofRM0.425, showing an increment of 52% and closed at RM0.40 last Friday. HPPHB’s earnings are projected to increase inconjunction with its launch of paper pulp products.

• In light of the favourable technical indicators, there is a potential for a technical uptrend ahead, indicated by the risingParabolic SAR as well as the 12-day moving average still hovering above the 26-day moving average.

• The stock will likely climb towards our resistance thresholds of RM0.44 (R1: 10% upside potential) and RM0.475 (R2: 19%upside potential).

• Our stop-loss level is pegged at RM0.36 (representing a 10% downside risk).

• HPPHB’s primary operations revolve around its comprehensive printing and production services for paper-based packaging,encompassing both corrugated and non-corrugated options. HPPHB is also involved in the printing of brochures, leaflet,labels as well as paper bags.

• Earnings-wise, the group reported a profit of RM3.2m in 4QFY23 compared with a profit of RM3.5m in 4QFY22 primarily dueto fall in orders from the E&E segment for corrugated packaging segment and rigid box segment, but this was partially offsetby the higher contribution from the non-corrugated packaging segment, especially from the pharmaceutical industry.

• Based on consensus forecasts, HPPHB’s net earnings are projected to come in at RM14.1m in FY May 2024 and RM16.7min FY May 2025, which translate to forward PERs of 11.0x and 9.3x, respectively.

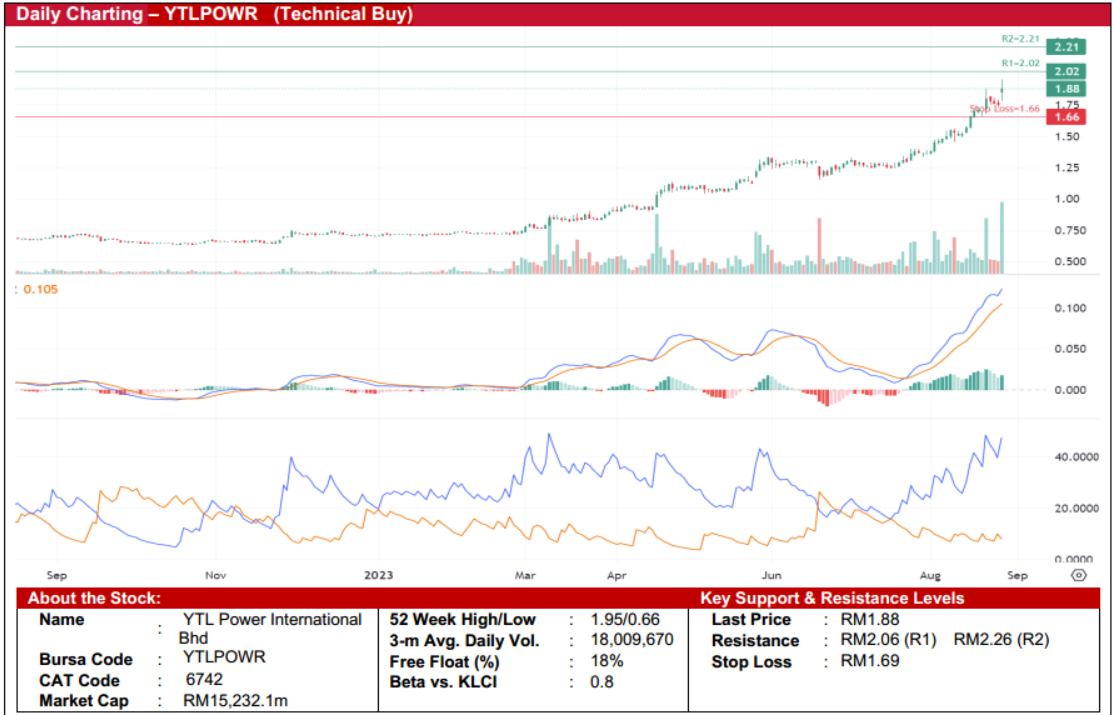

YTL Power International Berhad (Technical Buy)

• The share price of YTLPOWR reached a low of RM0.39 in March 2020. Since then, the share price has ride along an uptrendin tandem with its progressive earnings growth on higher retail prices for its power generation business in Singapore. It closedat RM1.88 last Friday.

• A continuation of the uptrend is supported technically by the 12 day moving average positioning above the 26 day movingaverage along with DMI Plus hovering above the DMI Minus.

• The stock will likely head towards our resistance thresholds of RM2.06 (R1; 110% upside potential) and RM2.26 (R2: 20%upside potential).

• Our stop-loss level is pegged at RM1.66 (representing a 9% downside risk).

• Fundamentally speaking, YLTPOWR is involved in electricity generation, transmission, and distribution; water supply andsanitation services; as well as telecommunications.

• YoY, the group reported a profit of RM1,130.2m in 4QFY23 compared with a profit of RM412.3m in 4QFY22 mainly attributedto favourable exchange rate and interest rate gain from investment holdings activities as well as its Singapore powergeneration revenue which was due to higher retail prices.

• Based on consensus forecasts, YTLPOWR’s net earnings are projected to come in at RM2,157m in FY June 2024 andRM2,143m in FY June 2025, which translate to forward PERs of 7.1x and 7.1x, respectively.

Source: Kenanga Research - 28 Aug 2023

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024