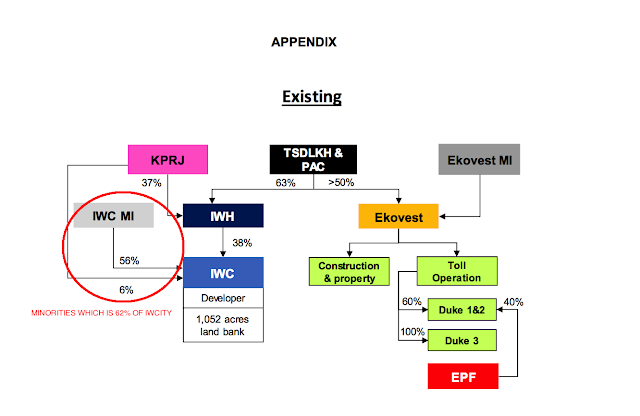

He is not buying his shares of 37% in IWCITY which is held through IWH. He is buying the shares held by the other parties 62% - 63%. There is no injection of cash into IWCITY. He is not desperate to rescue IWCITY. In fact, he is taking OPPORTUNITY. This deal is done at its best so that it does not touch KPRJ which is related to the Sultan of Johor - it seems.

I am of course perplexed when the shares of Ekovest dropped massively.

Having said the above, I can understand the investment communities concerns. IWCITY holds land in Bandar Iskandar which to them cannot be transacted as there is a doldrum in properties especially down south. Moreover, Ekovest will need to fork out RM800 million which it does not have to buy over the minority stake - hence delisting IWCITY.

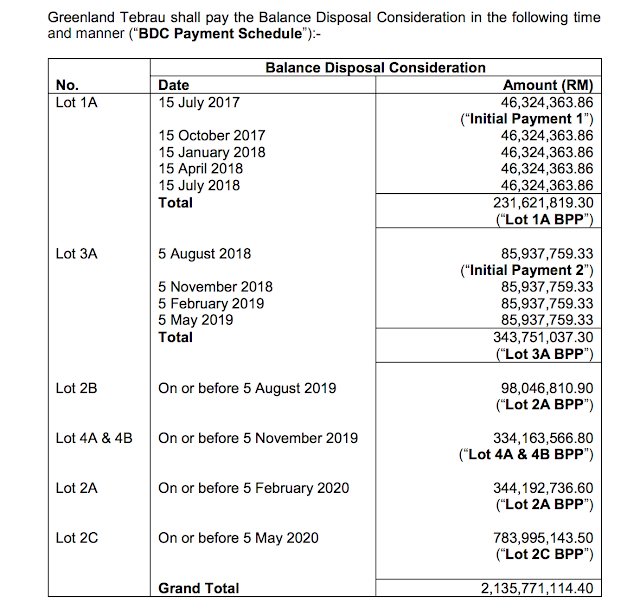

However, that is flawed thinking. IWCITY just did a deal worth around RM2.1 to RM2.3 billion with Greenland group from China and they are paying for 127 acres of land in Bandar Iskandar.

Because even reading yesterday's one pager announcement cannot even be done properly by those who invested into Ekovest, I hence will put down the payment schedule for IWCITY - Greenland deal below. There are obviously a lot of milestones and the sweet side is that IWCITY has collected the first payment of RM46.2 million. I know that's small but it also means the collection will be going to Ekovest in future rather than the listed IWCITY.

As for raising the RM800 million to buy up the IWCITY minorities stake, I have this prophesy. The payment schedule above will help a bit, then the amount paid by EPF of RM147 million just last week AND more importantly, in its announcement yesterday, one can also opt for an Ekovest share equivalent which is valued at RM1.50. Obviously, Ekovest shares is not worth RM1.50 now and the latest as at my writing now - it is priced at RM0.97. No chance to trade in shares?

If the transaction is done now, all IWCITY minorities will be opting for the cash - me too. But obviously again, the deal is not done now. It is many months down the road, if it is ever pulled through.

Now, my question to Tan Sri Lim Kang Hoo (who is many time more brilliant than me) is which option he prefers - cash or shares. If cash, then obviously again Ekovest is worth more than IWCITY at per share price of RM1.50 or more as he does not want to waste the value of Ekovest to be given to minorities. If shares, then IWCITY is more valuable.

Having seen how he does his deals, it is not going to be that smooth and straight forward. There will be challenges and hurdles.

On the strategy with this deal, as mentioned above there will be challenges but strategically it is there. IWCITY is a land owner. Ekovest is a developer, contractor. There are still some 900 acres of land in IWCITY after the sale to Greenland. Moreover, part of the deal will need IWCITY to reclaim (worth RM400 million) the land which Ekovest can obviously do.

To me what was obvious yesterday has now become murky. An analyst said that the deal is bad. He is perhaps not being straight or thinking clearly.

Or could it be I am too slow to have a clear head as I have become too complicated.

brightsmart

yes, writer is getting too complicated.....

point is........300 million shares done this morning...where did the sellers come from?

my money...Ekovest will be 70 sen if deal goes through and $ 1.20 if deal is aborted....place your bets.

on Greenland....even without this deal.....IWC has been traded all these years as if the Greenland deal is not there.

2017-11-01 14:39