Gabriel Gan: Early Signs Of Asian Bull Markets Returning?

Tan KW

Publish date: Fri, 11 Jan 2019, 10:59 AM

It could be too soon to call for a bull market and even more unbelievable for anyone to actually think that a bull market may return to Asia quite soon. Not with all the bad news about the trade war and the weak economic data coming out from China.

But I am somehow starting to be more confident that a bull market may return sooner rather than later despite the weak US stock market simply because the China and Hong Kong markets have fallen deep into bear market territories almost a year ago! Do remember that fortunes are made in bear markets; money is lost during a bull market. Fortunes are made during a bear market because discerning investors start buying while money is lost in bull markets as a result of investors chasing the bull and refusing to cut losses.

Yes, the Shanghai Composite Index (SSE) and the Hang Seng Index (HSI) have both been in the doldrums for almost a year ever since both indices fell 20% from its closing peaks on 29 January 2018!

Now let us examine the charts of the SSE, HSI, and the STI to see how long each bear market had lasted for the past 12 years. This will more or less help us determine if we are already at the tail end of the bear market from a technical point of view.

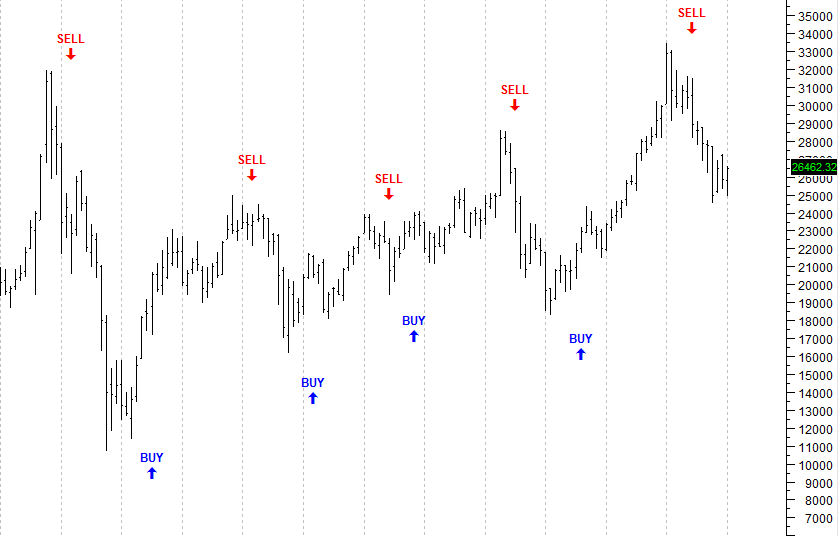

SSE 10-Year Chart

From the first red arrow that appeared in late 2007, which was when the global financial crisis took place, the “Buy Signal” was triggered in early 2009. From sell to buy, the entire bear market lasted no more than 1.5 years and bearing in mind that the 2008 crisis was no small matter, the signal asking investors to buy took a rather short period of time.

Subsequently in 2010, 2011, 2013, and 2015, time taken from triggering of sells signal to buy signals all took no more than 1.5-2 years. Since the last sell signal was triggered on 29 January 2018, the bear market is already one-year-old meaning we are at least halfway through the bearish phase if we were to look at the bearish phases of the SSE over the last decade.

The definition of a bear market, or a bull market, is for the value to fall or rise by 20% or more. These signals, however, appear much earlier than the 20%-prescribed fall in value. If you had waited for the 20% fall or rise to appear before you took action, it would have been too late!

Now, let us look into Hang Seng’s charts over the last decade.

HSI 10-year chart

From its closing peak of 32,966 on 29 January 2018, which incidentally was the day when the SSE peaked, to the sell signal of 28,545 that was triggered on 3 July 2018, the process took about 6 months be confirm. If an investor had waited for the 20%-fall to occur before cutting losses, the investor would have had to wait till the HSI to reach 26,372 before he or she would take action. It would have been in September 2018 before the HSI reached this level. Late, isn’t it?

Similarly, from peak to trough, or from sell to buy, the HSI took an average of one year with the exception of 2008 which took slightly less than 1.5 years.

What about our very own STI?

STI 10-Year Chart

Great news for local investors! The good news is that the STI typically takes just slightly more than a year to turn from sell to buy! Does it mean that we should start buying now?

The newsflow is negative; the sentiment is horrible; and we are in the midst of a tightening cycle whereby interest rate hikes and a bear market almost go hand-in-hand. In the short-term, I am looking at 2,950 for support while, if this support is broken, the index may go as low as 2,550.

Factors That Can Bring Back The Bulls

While these factors may or may not come true in the short term, it is still worthwhile to take note if we want to buy cheap instead of being pessimistic and doubtful during bear markets and chase after buying frenzies during bull markets only to end up getting hurt.

- As shown in the three charts (SSE, HSI and STI), the cyclical bear/bull years for the past decade have ranged from as little as one year to two years at the most. We are already halfway through for some, if not all, of the markets hence it is good for us to remain optimistic so that we can ride on opportunities when they come.

- China government may inject liquidity. As they have shown as recent as the first week of 2019, the Chinee government is becoming concerned that the weakness in the economy and the stock market may worsen hence it injected some Rmb1.5 trillion into the economy by loosening lending requirements and the reserve requirement of the banks. While this move may not be entirely meaningful as the sum is considered small, this expresses the cautious mood of the government for fear of sparking off another round of unwanted inflation. It is likely that more will be done sooner rather than later by investing heavily in infrastructure developments.

- While certain US indices like the S&P 500 and the Nasdaq Composite fell into bear market territory only to get out of it after a recent rally, a breach is still a breach. Although the US indices had just started its bearish phase, Asian markets may return to the bulls much sooner than US since it started becoming bearish much earlier.

- No structural issues except for higher borrowings and slowing economy in China. We have heard the West talking about these issues for a long time. We have to be cautious but crying wolf without the wolf coming is fast becoming a cliché that we are all starting to hate. The threat is, of course, real but for this issue to blow in our faces may take a lot more for it to materialize.

I am trying to inject some optimism as I am seeing the possibility of the bulls coming home to Asia. As long as there is some evidence to be optimistic, we should not disregard the possibility. Having said that, however, things may drag on for a while longer so do not jump in with your eyes closed and homework not done.

For a start, the Sino-US trade war should end before investors can feel some optimism in the air.

http://aspire.sharesinv.com/59447/riel-gan-early-signs-of-asian-bull-markets-returning/

More articles on Good Articles to Share

Created by Tan KW | Jul 26, 2024

Created by Tan KW | Jul 26, 2024

Created by Tan KW | Jul 26, 2024

Created by Tan KW | Jul 26, 2024

speakup

yes. it's time to go all-in (sai-lang).

just whack any counter, and see buta profits come!

2019-01-11 11:05