When governments keep throwing money at the problem, some succeed while others are restricted by their fiscal constraints and prudent financial management. There's only so much budget deficit you can stomach. Not the US and Eurozone, they can literally print their way out of the problems at hand, with no need for any asset backing, particularly from the USA. The rest of the world, we can't do that. Our printing capacity has to correlate with our foreign reserves, government debt to domestic and international bodies, our GDP, etc...

What that does is that at every major financial crisis, involving the big guns, its the smaller guys that get whacked. The big guys has printed more monopoly money, get the money circulated, pay down debt, give people money to spend, and spend trip way out of the issues. The smaller nations just have to tighten our belts and compete ever harder to maintain status quo. Its colonialism in the financial age.

Just when you think colonialism is over, in financial markets, the masters still get 10x, 20x, 30x more than the slaves earnings per day. Even when the master make mistakes, its still the saves that kena.

The Horny Black Swans That Keep On Reproducing

That rant aside, have a look at the video. You will begin to appreciate why swiftness, preparedness and commitment to curtail were so important. Just look at China, South Korea, Singapore and HK. Compare that to the top 4 European countries, plus UK, Iran and USA.

Looking at the trajectory alone, the latter countries have not even peak yet, although Italy has shown positive signs of peaking. USA at near 277,000 confirmed cases, and the equity markets there seemed to have rallied. All markets are forward discounting machines. I want to know how many cases has the US markets discounted thus far, taking into account the substantive trillions of dollars worth of stimulus: 300,000 ... 500,000 .... one million or 2 million? Mind you, China and South Korea seem to have peaked at 80,000 and 11,000 respectively.

How can you discount something that has not peaked? You cannot take the statistical distribution for China or South Korea and extrapolate because: the level of preparedness were different; the "more authoritative governments" have better deployment and effectiveness in curtailment strategies; the level of resources and testing are different ... hence it is likely the trajectory will be pushed out higher and further than the former group.

Look at the above statement from US White House (reported in CNBC)... 93,000 deaths, at 1% mortality rate = 9.3 million cases. OK let's take a 5% mortality rate (which is very worrying for the public) = 1.86 million cases. Look at those figures for a while and compare China's 80,000 and South Korea's 11,000. Even if you double both those figures: 160,000 and 22,000 ... compare that to 1.86 million.

OK, let's not even look at those figures, let's halve that further from 1.86 million to 930,000 cases to deal with say over 2-4 month period. There is no way the US system can take it. There are only 924,107 hospital beds. Other illnesses may require at least 50%-70% of those beds.

So, you still think the US equity markets have discounted the fallout from the virus? If its 1 million cases over 4 weeks .. I think US cities will descend into a state of anarchy ... making handguns very handy indeed.

The Latecomers

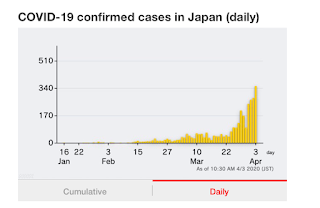

Has anyone looked at Japan? Its about to boil over. Last Thursday the prime minister's plan was no lockdown and everyone gets 2 cloth masks. Look at the table above. On 2nd April Tokyo had 97 new cases, still hunky dory. That's just Tokyo, in Japan the total has surged past 340 cases. Ueno Park was only closed on 24th March to the public.

Has anyone looked at Japan? Its about to boil over. Last Thursday the prime minister's plan was no lockdown and everyone gets 2 cloth masks. Look at the table above. On 2nd April Tokyo had 97 new cases, still hunky dory. That's just Tokyo, in Japan the total has surged past 340 cases. Ueno Park was only closed on 24th March to the public.Well, everyday in March 2020 till they closed the park, the scene was like this everyday:

Now imagine the scene below being played out 20 hours a day in every major city in Japan with no lockdown:

... at schools, Disneyland, malls, cinemas, etc...

Japan is a time bomb.

There are other latecomers as well, places where "proper testing" had been insufficient, masking the real numbers. Consider Indonesia and Pakistan to start with.

The Bigger Time Bomb For Us

Unfortunately, Ramadan is just around the corner. Will Malaysia allow the 1 million legal and 1 million illegal Indonesians and other foreign workers to go back for Ramadan. Do we have the resources to check, test/quarantine them when they come back. What about illegal channels of entry? Will we have another wave after Ramadan?

http://malaysiafinance.blogspot.com/2020/04/why-i-think-markets-are-too-optimistic.html

.png)

.png)

chinaman

great article, last statement is spot on, carry highest weight-quote:-

Unfortunately, Ramadan is just around the corner. Will Malaysia allow the 1 million legal and 1 million illegal Indonesians and other foreign workers to go back for Ramadan. Do we have the resources to check, test/quarantine them when they come back. What about illegal channels of entry? Will we have another wave after Ramadan?

2020-04-05 10:49