The Advantage Of MARGIN CALL - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 18 Feb 2016, 11:35 AM

I know many readers would say that I am just joking. In fact, during the recent market down turn, I have margin call and I expect many readers are laughing at me. Let me explain in details with examples so that you can learn how to make more money using margin to its limit, provided you know how to select really good shares to buy.

I have trading accounts with all the financial institutions in Malaysia and my loan limit exceeds Rm 100 million. I have always been using the loan to nearly the approved limits. As a result, I have margin call in the recent market down turn.

At first I thought I should not use the margin loan so much to avoid margin call and forced selling. After I have a closer look at the prices of the shares that I am forced to sell, I am convinced that it is not so bad as I thought. Actually I have been forced to sell some of my good shares to realise profit which I would not sell normally. In other words, I am forced to make more money.

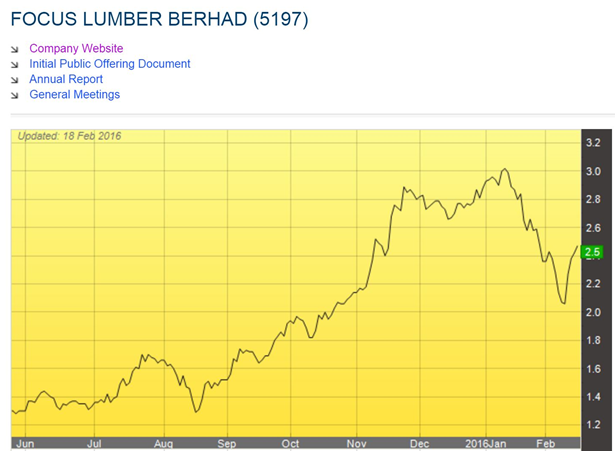

For example: I started buying Focus Lumber in 22nd Aug. last year after I saw its 2nd quarter announcement of 7.80 sen per share. Its first quarter EPS was 3.22 sen. It was trading between Rm 1.40 –Rm 1.60 per share. I continue to buy aggressively and as the price went up higher, I could borrow more to continue buying because my collateral value has increased.

It went up to peak above Rm 3.00 in mid-January about one month ago. When the market started to crash I had margin call and I was given 3 days to normalize my position. I sold some between Rm 2.80 – Rm 2.40, averaging about Rm 2.60 to meet margin call. I still manage to make more profit than if I did not use margin loan to its limit.

The 1st quarter EPS was 3.22 sen, 2nd quarter EPS was 7.8sen and 3rd quarter was 9.35sen. I foresee its annual EPS to be above 30 sen which will be announced in the next few trading days. Basing on P/E of 10, its price should be above Rm 3.00. The share price had dropped drastically from above RM3 to low of RM2.01. It has dropped too rapidly and as I said before it should rebound rapidly. I have been bottom fishing in the last few days.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

Many tycoon cut loss on crude oil counter their reason is very simple to minimize their potential loss in the near future, they can expect crude oil crisis may last for how many years ahead and their bank is very urgent in need of the cash for their business and their other clients.

2016-02-19 11:14

O&G tycoons are in bad shape, very bad shape. No light at the end of the tunnel for them.

2016-02-19 11:20

Market will be bad for how many years ahead since many tycoon decide to cut loss

A lot of unrealized profit vaporize into the financial system.

There is one way to save this system

It is reboot it again from zero

2016-02-19 11:35

Leverage and alcohol are the 2 things that can send you into bankruptcy.

Avoid them.

2016-02-19 13:39

Ooi !!! where are my shoes ? Small man Desa stop fooling around with your RM20k Mickey mouse portfolio. Shine my shoes !!!

2016-02-19 14:21

Market drop sikit sikit , Icon lost his mind already.

Die lo if market drop more.

2016-02-20 09:38

Soros, Why you worry so much one.?

This is called overly worries after the chicken left the barn.

Good undervalued shares will always come back

You better worried for half bankrupt companies in your portfolio.

2016-02-20 09:55

If oil goes up, looks like share market also go up.....

So what is your worry?

2016-02-20 09:58

Soros.....

Business tycoons are by their nature more optimistic and feet more firmly planted on the ground than young stock traders such as your self.

That is why they succeed , you fail.

2016-02-20 10:03

I told u I'm long out for all the penny stocks.

Currently in only good fundamental counters.

I notice u over confident.

Just gentle reminder to u.

2016-02-20 10:04

Good fundamentals counters.....what do think KYY have been doing all these while?

They are all leaders in their industry with a bright future.

Some times, share over stretched, they correct, goes up and down.....do your own timing la.

2016-02-20 10:14

Well said Duit.

Never look down on people.

I'm just giving Desa gentle reminder , because he seems over confident recently in i3.

If fall then will be very painful lo.

2016-02-20 10:29

A margin owner need to bear in mind potential margin call....whenever share market drop or banks change their policy, capping and valuation of the security loh.....!!

Using margin is not itself bad, it is the skill and how use it, that determine whether u are competent to use it mah.....!!

Margin is just bank borrowings.....for shares, why should we avoid not plague....learn how to use it, master it..this will offer u monies making opportunity loh.....!!

Just like business loan.....why business man borrow ??

This applies to housing loan too....why should u borrow to buy a house, what happen u lose your job....u may not able to service your housing loan....in case u cannot get back another good job....!!

All loan has risk loh.....not only margin loan mah...!!

2016-02-20 10:33

dont judge the book by its cover, you will get into trouble in certain circumstances.

2016-02-20 10:35

margin is a good tool for trader. But the rule is you must be an intelligence and smart trader. otherwise, it will bring u jump from building. So newbies dont just read then goto apply margin. u will die very fast.

2016-02-20 10:38

Raider says....margin could be a better tools for good investor too...!!

Especially in low interest environment....!!

2016-02-20 10:48

Put it this way.....never seen a successful business man without borrowings.

Have anyone?

In the low interest rate environment, you are supposed to borrow if you are smart.

2016-02-20 10:54

He was forced to take some profits from earlier purchases instead of more profit if he had sold before margin call. That's all to it.

2016-02-20 11:10

Margin is two edge sword, it cut both ways when market drop, and you go bankrupt very fast, it is advisable not to borrow money to buy shares...

2016-02-20 11:13

His deposited shares that was brought way earlier that he sold for cash in return to meet his margin call. I got it.

2016-02-20 11:19

Margin only for experienced traders . Misused will make u suffer financially in the end.

2016-02-20 11:25

Mr Koon, do you need assistance? I need to learn from you please?

email leng5796@yahoo.com

2016-02-20 20:22

If KYY is so England, then why is his name still using communist 3 ply, Koon Yew Yin? Why not change it to Cow Koon or Porky Koon?

2016-02-20 20:51

How good yr england may be,the white man wouldn't recognised u.The late premier Mr.LKW had the experience.

2016-02-20 21:02

Global Polyurethane Foam Market is expected to bring new players into the market. Multipurpose and versatile physical properties enabled polyurethane foam market to grow fast

http://www.briskinsights.com/report/global-polyurethane-foam-market-forecast-2015-2022

2016-02-25 00:11

99% Koon Koon received margin again these few days..and I doubt he will be as happy as when he wrote this article (The advantage of margin call)....

2016-03-01 10:32

StockQueen

margin call seems like good chances for those can buy low.. wait durian drop

2016-02-19 11:00