JAKS - We Sold to Meet Margin Call - Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 24 Aug 2018, 07:29 AM

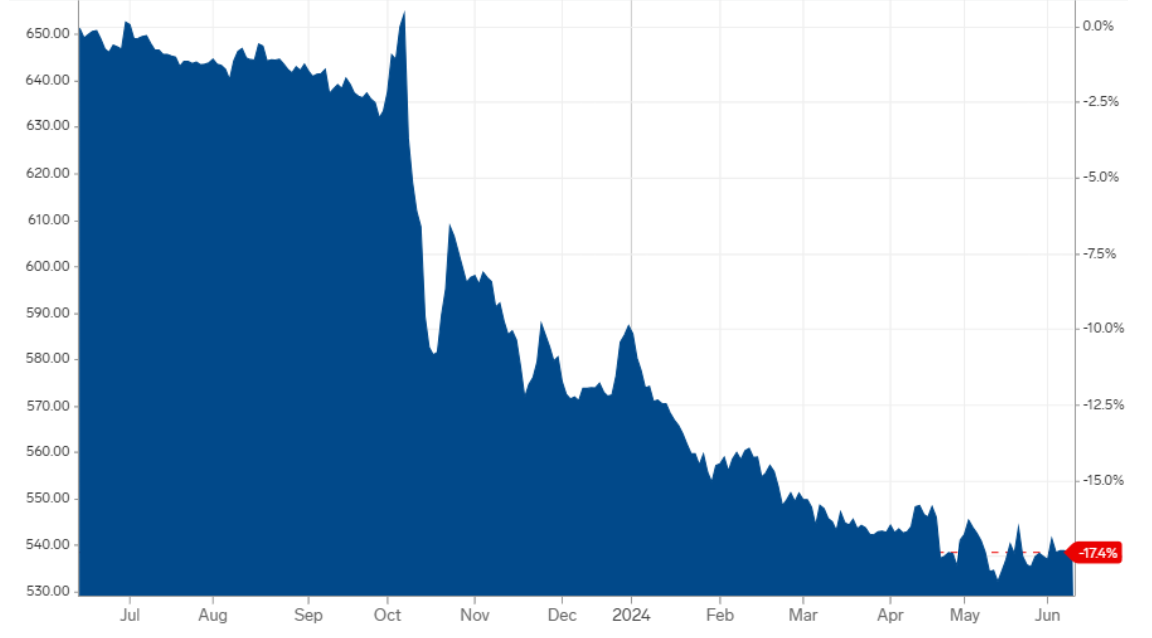

As you can see from the company’s announcement, my wife Tan Kit Pheng and I have bought more than 150 million shares with margin finance. When the share price dropped, we have to sell some shares to meet margin call. We have sold a total of about 45 million shares quite rapidly, causing the price to plunge from Rm 1.54 to 97 sen within the last 3 months.

It went up one sen yesterday, which is a good sign of price trend reversal. As I said many a time before, no share can continuously go up or come down without changing its trend. Smart and observant investors would buy at the pivoting point of changing trend.

I believe if we stop selling the price will continue to go higher.

Our main reason for buying Jaks has not changed at all.

Our main reason for buying Jaks:

The three Chinese banks accepted the power purchase agreement (PPA) duly signed by the Vietnamese Government as collateral to finance the project. The banks will provide 75% of the funding for the project cost totaling of RM7.76 bil with the balance (25%) to be borne by JAKS and China Power Electricity Consulting Company (CPECC).

To protect the banks’ interest, the financiers must make sure that the PPA is water-tight and that JAKS and its JV partner must be able to complete the project on time. Both JAKS and CPECC must also be financially sound, otherwise they will not be capable of paying up the remaining 25% of the project cost of RM7.76 bil which amounts to RM1.94 bil.

To ensure that the whole project can be completed satisfactorily, the Chinese JV partner undertakes the full responsibility to complete the construction and operate the power plant for 25 years. JAKS will receive US454.5 mil (RM1.89 bil) during the construction period and 30% share of the independent power producer (IPP) business. The profit of about RM400 mil for JAKS will flow back into the JV company to fund JAKS’ equity portion. In other words, JAKS only needs to fork out RM203mil to own a 30% stake in the power plant. JAKS is also given an option to buy up another 10% of the JV company.

In essence, JAKS is sure to make RM400 mil during the construction period. Upon completion of the power plant project, both JAKS and its partner will enjoy profit every year for 25 years from the sale of electricity to the Vietnamese government.

As we have sold about 45 million shares, we don’t have any more margin call. Let us see whether the price will go up today if I do not sell.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

.png)