IJM Corp accepts KLK's offer for its plantation - Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 12 Jun 2021, 11:18 PM

Many people asked me about the KLK’s offer to buy up all the IJM Plantation shares owned by IJM Corporation since I was a co-founder of IJM Corp. Let me tell you how IJM Plantation Bhd began.

In the early 1980s, I had a road construction contract from the Sabah government. The road past through a neglected Felda Oil Palm estate. All the palm trees were half dead. The Sabah government offered to sell the whole estate at Rm 700 per acre with all the workers living quarters free of charge. We bought the whole estate and we also bought additional land at Rm 700 per acre from the government to plant more oil palms. We employed Velayuthan Tan to take charge of the estate. He is the younger brother of Tan Sri Krishnan Tan who is currently the Chairman of IJM Corporation Bhd. Eventually IJM Corp listed IJM Plantation Bhd.

Currently it has a total of 880 million issued shares and the parent company owns 56.2% of the total issued shares which is 595 million shares. Based on KLK’s offer at Rm 3.10 per share, the total transaction is valued at Rm 1.53 billion.

The latest news:

IJM Corporation Bhd has accepted Kuala Lumpur Kepong Bhd’s (KLK) 1.53-billion-ringgit cash offer for its entire stake in its palm oil plantation business, a stock exchange filing on Friday showed.

Plantation giant KLK proposed acquiring IJM Corp’s 56.2% stake in IJM Plantations Bhd in a letter on Wednesday.

IJM Corp said it has decided to enter into a definitive share sale and purchase agreement with KLK.

It said the disposal enables it to immediately realise the value of its investment, considering the illiquidity of IJM Plantations shares.

It said it expects to record a pro forma gain of approximately Rm 699.89 million.

The disposal is in line with its strategic objective of streamlining its businesses to focus on construction, property development, infrastructure concessions as well as manufacturing of building materials, it said.

“The recent strong (crude palm oil) price environment and good showing by plantation companies have presented an opportune window of divestment,” it said.

Palm oil prices have been rising steadily over the past year and hit a record high last month.

Upon execution of the agreement, KLK is obliged to extend a mandatory general offer to acquire the remaining IJM Plantations shares it does not already own.

IJM Plantation has a total issued shares of 880 million and 56.2 % of the total issued shares is about 495 million shares X Rm 3.10 = Rm 1.53 billion.

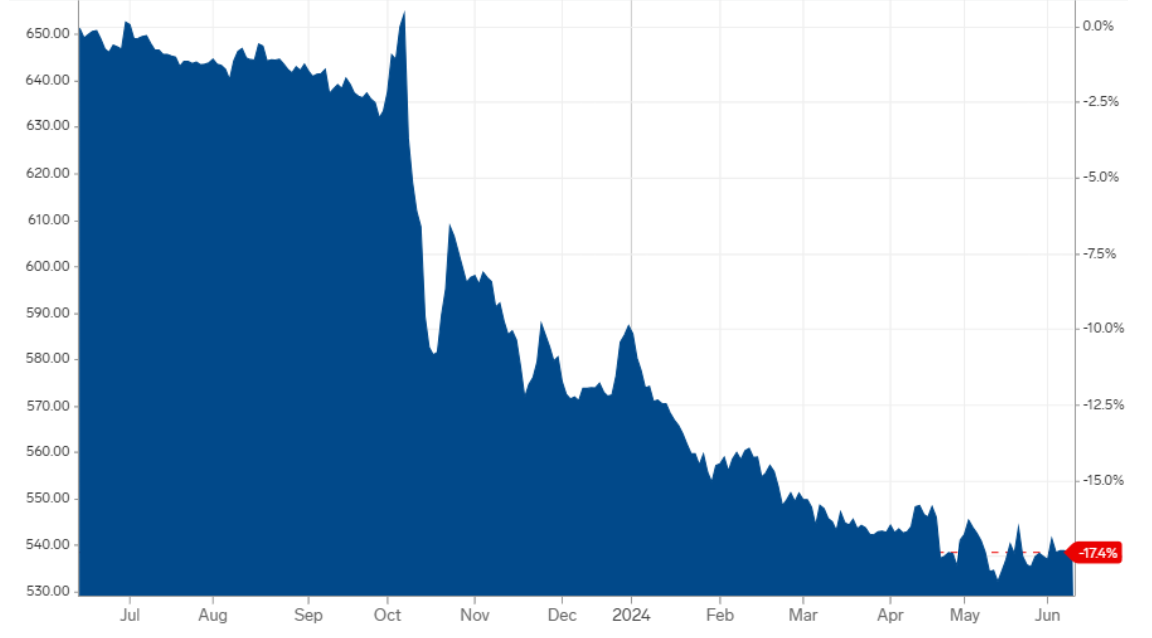

IJM Plantation shares were trading below Rm 2.00 before KLK’s offer of Rm 3.10 per share.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-22

IJM2024-07-22

IJM2024-07-22

IJM2024-07-22

IJM2024-07-22

IJM2024-07-22

IJM2024-07-22

IJM2024-07-22

KLK2024-07-22

KLK2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

IJM2024-07-19

KLK2024-07-18

IJM2024-07-18

KLK2024-07-17

IJM2024-07-17

IJM2024-07-17

IJM2024-07-17

IJM2024-07-17

IJM2024-07-17

IJM2024-07-17

KLK2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

IJM2024-07-16

KLK2024-07-16

KLK2024-07-15

IJM2024-07-15

IJM2024-07-15

IJM2024-07-15

KLK2024-07-12

IJM2024-07-12

IJM2024-07-12

IJM2024-07-12

IJM2024-07-12

IJM2024-07-12

KLK2024-07-12

KLK2024-07-12

KLK2024-07-11

IJM2024-07-11

KLK2024-07-10

IJM2024-07-09

IJM2024-07-09

KLKMore articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

REMEMBER THE IMPORTANT STRATEGY BELOW LOH!

1.If KLK intend to maintained the listing status of IJMplant after takeover, it will be very bullish mah!

It may shoot passed Rm 3.20 takeover price mah, bcos u r actually a business partner of KLK at IJMPLANT with the same cost of Rm 3.20 OR Lesser than KLK mah!

2. If KLK do not want to maintain the listing status of IJMplant...it will be bullish too, bcos KLK would need to fork out more than Rm 3.20 to entice enough minority shareholders to qualify for privatizations, i think an offer price above rm 3.60 to Rm 4.00 is required if want complete privatization mah!

Thus it is bullish for IJMPLANT, no matter how U assess mah!

THE POINT IS SAVVY INVESTORS ARE LOOKING AT, A RETURN & EXCEEDING & BEYOND THE GO PRICE OF RM 3.20 FOR IJMPLANT MAH!

If u r Looking the Price KLK Offer for IJMPLANT, it is so so & not that really attractive at Rm 3.20 mah...hence to be really attractive the offer price or Ijmplant share price need to go above rm 4.00 higher than previous historical high of rm 4.03 mah!

That means the IJMPLANT Share price will be rerate higher above Rm 3.60 closer to the completion of GO mah!

2021-06-13 16:52

Callmejholow

haha i like how u like to take credit for everything.

2021-06-13 16:10