All Steel and Construction companies will report reduced profit despite steel price increase - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 21 Jul 2021, 04:12 PM

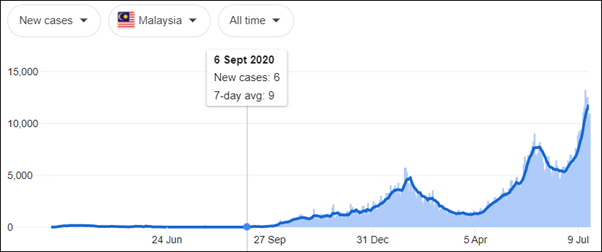

Currently we have a total of 928,000 Covid 19 cases and 7,148 deaths. We have more than 11,000 daily new cases in the last 7 days. The number of Covid 19 new cases in Malaysia is still increasing so rapidly that our government has to impose MCO to restrict workers from going to work in steel and construction companies. As shown on the chart below, about 9 months ago we only had a few cases.

I just I rang Leon Fuat tel. 03-33753333 and Hiap Teck tel. 03-337788888. Both these companies are closed. Last week, I also did the same and found that both these companies were closed. You can ring up to verify what I said. If they are closed for so long, they cannot report increased profit in the next few quarters.

Even if they can produce steel and steel products, construction companies do not need them because all their construction works have stopped. Just open your eyes you can see there are so many construction works are in a stand still.

I just rang Dennis Tan, Secretary General of Master Builders Association, Malaysia to confirm what I just said. You can call tel 6019-3316282 to verify what I just said.

Among all the stock selection criteria such as NTA, cashflow, dividend yield, debts or healthy balance sheet, the most powerful catalyst to push up share price is profit growth prospect.

All the steel companies do not have profit growth prospect.

Investors must not buy any steel stock which does not have profit growth prospect because when it reports reduced profit many smart investors will rush to sell their holdings.

As all investors know that all steel companies have reported increased profit for the last quarter ending March 2021 and they are selling at PE 2. They are undervalued based on their previous profit.

Unfortunately, many less informed investors are buying them based on their previous quarterly profit. They are undervalued and look very cheap but they will remain cheap until they can report increased profit.

Investors should wait to see their next quarter result which will be announced before end of August. Patience is the key for successful investment.

Political Uncertainty

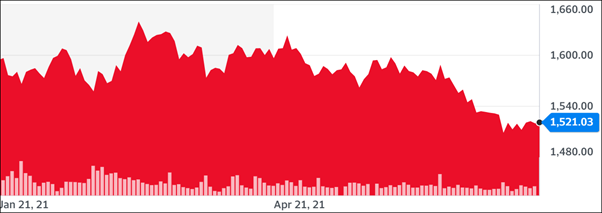

Moreover, we have so much of political uncertainty. No body knows who will be the next Prime Minister. This is important because the PM can make rules and regulations that can affect business operations. That is why so many foreign institutional investors and local institutional invest banks are net sellers every day. That is why the KLCI chart below shows that KLCI has been dropping in the last 6 months.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

U say OTB trying to spite you...while in fact you are the one who keeps trying to hit at him. Just let the market decide. 3 months from now lets see where prices are. No need to write the same stuff over and over again. What u want to achieve? U want everybody cut loss and thank you?

2021-07-21 17:15

Leon Fuat is on fire sale - Koon Yew Yin

Author: Koon Yew Yin | Publish date: Thu, 24 Jun 2021, 11:08 PM

China is the biggest steel producer

China is the biggest steel producer in the world. Since China wants to reduce the use of coal to reduce air pollution, it has reduced steel production and stopped steel export. China requires all the steel for its own property and infrastructure development.

As a result, the price of steel has been going up as shown on the price charAll the steel products makers will benefit because their steel stocks and manufactured goods have also gone up in price. That is why all the steel companies have been reporting increased quarterly profit. Leon Fuat reported the best quarterly profit increase among all the metal stocks. As steel price continues to rise, Leon Fuat will continue to make more and more profit which should be reflected on the share price soon.

Today the closing price is 98.5 sen. Its latest quarter EPS was 11.65 sen. Even if I assumed its next 3 quarter is the same, its annual EPS will be 4 X 11.65 equal 46.6 sen. It is selling at PE 2. That is why I put the title of this article “Leon Fuat is on fire sale”.

Today RHB bought 745,000 Leon Fuat for me. You can call 05-2493279 to confirm my purchase. Today HLIB bought for me 565,000 Leon Fuat for me. You can call 05-2559110 to confirm my purchase. t above. It has gone up about 50% in the last 12 months.

2021-07-21 17:47

Blog Headlines (by Date) Blog Index

All Steel Companies will report better profit - Koon Yew Yin

Author: Koon Yew Yin | Publish date: Sun, 27 Jun 2021, 1:25 PM

Currently China is the 2nd richest nation and very soon China will be the richest nation in the world. China has been using coal to produce steel and it has been the largest steel producer and exporter in the world. China is now taking its social responsibility seriously to improve its air quality and its environment. China has stopped steel export. As a result, steel price has risen about 50% in the last 12 months as shown on the chart below.All the steel companies have reported much better profit in their latest quarter. Since steel price is rising, all the steel companies will continue to report increasing profit in the next few quarters.

A few days ago, Astino reported its EPS jumped from 6.43 sen to 8.46 sen for quarter ending April 2021. As a result, its share price also shot up to close at Rm 1.40 per share.

Based on Astino’s profit growth, all the other steel companies will surely report increased profit for their next quarter ending June 2021.

The table below is a comparison of all the steel stock EPS. Leon Fuat is the best. Even if I assume that Leon Fuat’s EPS for the next 3 quarter is the same as 11.42, its annual EPS will be 4 X 11.42 = 45.68 sen. Last traded price Rm 1.02 divided by 45.68 = 2.2 PE ratio.

Best buying opportunity

Covid 19 pandemic is affecting almost all the listed companies. We also have so much of political uncertainty. Moreover, many investors have lost their employment and money in their businesses. As a result, almost all the listed shares are being depressed and many investors are forced to sell their holdings.

Clever investors should take advantage of this fire sale opportunity to buy steel stocks. My largest holding is Leon Fuat

2021-07-21 17:48

Geezer is a sore loser. He has no friends because he will quarrel with everyone who disagree with him. In fact, he is not worth talking about.

2021-07-22 00:09

narcissistic clown, spamming i3 with mindless drivel.

stop writing lazy garbage using the brief time between your diaper changes.

allocate time or hire someone to do the work properly.

massive fail. no one respects you anymore!

2021-07-22 03:33

Seriously, old crook thinks he still have big influence now ah?

Big laughing stock got lah

2021-07-22 06:18

I wonder whether KYY read the comments on his i3 blog article?

If he had read it and still come out with more rubbish articles than his skin is as thick as our MO1 "Malu Apa Bossku"

2021-07-22 06:49

You know what...should we all rang up Mr. Dennis Tan, Secretary General of Master Builders Association at tel 6019-3316282 to verify? If 100 ppl ring him up a day, it will surely keep him occupied especially in the time of MCO. But must also tell him to give credit to Mr. Koon for sharing his number.

2021-07-22 08:10

why so worry stocks going up ? already sold all and now keep attacking.

2021-07-22 09:57

Another piece of negative posting from our kyy who is trying his utmost to bring down the mkt for him to buy chip chip shares lah.

His coffer is oredi overflooded, like the flooding in China n Germany, with cash after his recent stock dumping !!!

2021-07-22 10:26

kyy is super fit, no need rest or sleep, can esili go battling in the mkt for 15 rounds !

2021-07-22 10:33

kyy keeps himself super fit by eating pineapple.

Eat pineapple n U SHALL got long life like him !

Oredi proven beyond reasonable doubt by him !!!

2021-07-22 10:40

I think an article a day is not enough to bring down the mkt...can try 3 to 5 articles a day

Last time CPTeh shouted mkt crash everyday for many years....finally his wish came true in Mac last year....It really crash

2021-07-22 10:48

I wonder if KYY actually read the articles written by his machai before signing off??

2021-07-22 10:52

We no blame kyy at all. We all try learn n understand the expert kyy's art of war

in the mkt onli.

2021-07-22 12:00

U buy u praised the stock to the sky

U sell off u pijak kuat kuat...Wat investment attitude u become?

2021-07-22 20:10

steel price go up again!

Now Steel index <<5,593.00>> up 72.00 up 1.30% (23/7/2021 11am)

the data cannot lie

2021-07-23 11:00

All mkt players always got difference of opinion lah. Some buy bcos they think the stocks will go up n some sell bcos they think the stocks will go down.

2021-07-23 12:52

I just rang 6019-331628x Dennis Txx, Secretary General of Mastex Builder Association, Malaysia to confirm what U just said.

The number is closed as well.. xD

2021-07-23 13:36

dnt listen to this guy. he buy shares, push it up and put few articles almost like a bull trap and then sell off take profit and talk bad about the counters. I'm surprised bursa and SCC don't take action on him

2021-07-23 14:14

Yes, listen to Kyy with caution.

In case you missed my earlier comment, I repost below.

Another example of his con job is :--

He posted the following asking people to buy Supermax on 28.2.2021. [ By the way he had earlier for days asking people to buy this stock. You can check in i3 yourself ]

https://klse.i3investor.com/blogs/koonyewyinblog/2021-02-28-story-h154...

then on 3.3.2021 he posted the following article tell people he SOLD . He said " Fortunately, I sold all my Supermax about 3 weeks ago instead of buying more at cheaper prices to average down."

https://klse.i3investor.com/blogs/koonyewyinblog/2021-03-03-story-h154...

Just check the dates of the articles and you can see for yourself the kind of person he is !!! Say no more.

2021-07-23 17:24

Did kyy read Vitrox 2nd Q result (30/6/21). Turnover and profit increase substantialy from 1Q even lock down from june. Let see the coming Q from steel co.

2021-07-23 18:12

sherlockman

Why do u keep repeating the same point over and over again?? Got nothing better to write...them dont write la knn

2021-07-21 17:08