Patience is the key to successful investing - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 28 Jul 2021, 05:38 PM

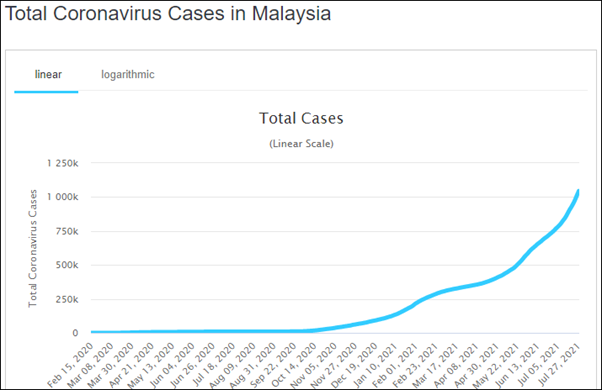

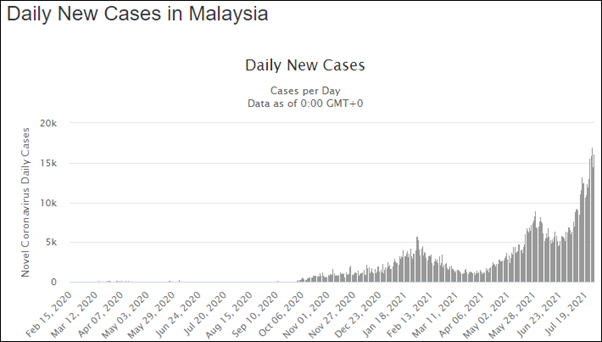

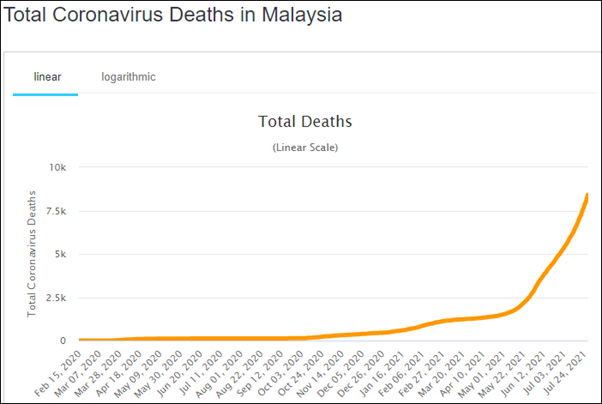

Currently Malaysia has a total of 1,044,071 Covid 19 cases and 8,408 deaths. Unfortunately, these 2 figures are still surging so rapidly as shown on the charts below.

Today we have established a new record of 17,405 new Covid 19 cases.

Our government has already ordered mandatory lockdown of all industries except essential industry in the last 3 months. Due to rapid increase of Covid 19 cases, our government has extended the 3 months lockdown until the number of daily new cases is less than 5,000. If we have 17,405 Covid 19 new cases today, when will the number of new cases be less than 5,000? It is most likely the lockdown extension will be at least another 3 months.

All the steel and construction industries have remained close in the last 3months and will remain close for at least another 3 months.

All the steel and construction companies will soon report losses for the next 1 or more quarters.

Investors should not buy any shares now. It is wiser to wait to see the market reaction when the steel and construction companies report losses.

Patience is the key to successful investing.

I have posted a few similar articles to advise investors to cash out of the stock market. Unfortunately, Mr Ooi Teck Bee disagreed with my opinion. Only time will tell who is right and who is wrong. The truth will prevail eventually. In any case, it is wiser to wait.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

"Be fearful when others are greedy and be greedy when others are fearful" -Warren Buffett

2021-07-29 13:21

Abang Misai, your misai is longer now compare to your last year misai.

I hope you are ok. Money stuck in Bursa kah?

2021-07-29 15:59

Economy 22:00, 29-Jul-2021

China raises export tariffs on steel products for industrial upgrade

CGTN

China will adjust export tariffs on some steel products as part of efforts to push upgrading and transformation of the industry.

Starting August 1, China will raise export tariffs on ferrochrome and high-purity pig iron to 40 percent and 20 percent, respectively, according to a circular issued by the Customs Tariff Commission of the State Council.

Previous rates on the product exports stood at 20 percent and 15 percent, respectively, since May 1.

The decision is aimed at pushing industrial upgrading and high-quality development in the steel sector, the circular said.

Also on Thursday, the Ministry of Finance and the State Taxation Administration jointly announced that China will scrap export tax rebates on 23 types of steel products from August 1.

The specific execution time will depend on the export dates indicated in the declaration form for export goods, according to an online statement by the ministry.

The moves come as China is intensifying efforts to transform the energy-consuming steel industry for greener and high-quality growth. The country plans to cut crude steel output to ensure it falls year on year in 2021.

In 2020, crude steel output rose by 5.2 percent year on year to exceed 1.05 billion tonnes, according to the China Iron and Steel Association.

Making steel and other energy-consuming industries greener is an important part of China's broader efforts to cut pollution and tackle climate change.

China previously announced that it would strive to peak carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060.

2021-07-30 06:45

KYY said above "I have posted a few similar articles to advise investors to cash out of the stock market. Unfortunately, Mr Ooi Teck Bee disagreed with my opinion. Only time will tell who is right and who is wrong. The truth will prevail eventually. In any case, it is wiser to wait."

Very wise Mr Koon, no need to argue. Everyone is entitled to his/her opinion.Today Hiaptek is trading at 50.5 sen. let see what is the price in 31.7.2022.

2021-07-30 10:41

Look like China really determined to control its polution (which is worsen year by year). Few days : controlling coal usage and steel industry, EV, green power etc.

2021-07-30 10:52

kyy is always one step behind everything. The stock market is about the future not the present. His investments in glove stocks at its very peak is an excellent example

2021-07-30 20:34

KYY I THOUGHT HE SAID HE QUIT I3 AND STOCK MARKET? WHY STILL HERE TALK C0ck? Mr Con you win

2021-07-30 22:41

Be steady lah....on bjcorp & bjland lah....go for longer term loh!

Just invest like raider base on fundamental....u can be rich loh!

2021-07-31 08:50

Abidjan

Uncle Koon, I agree with you.... Patience is Key in Investment.

There are just too many species of sharks in the KLSE.

You are mostly right but sometimes can be wrong. Price action dynamics can sometimes misled the share movements vs performance of a company.

Maybe, you can have a look at High Tech or Chips stocks and give me your trending views. Fundamentally, you are quite forward looking ....

2021-07-29 11:06