Profit Growth Prospect of Hiap Teck and Leon Fuat - Koon Yew Yin

Koon Yew Yin

Publish date: Tue, 10 Aug 2021, 10:22 AM

When my critics see this article, they will comment that I had posted many articles to promote Leon Fuat before and why should I promote Hiap Teck now? Many stupid critics will comment that when old man KYY encourages you to buy Hiap Teck, you should sell. Please sell quickly!!!

On 24 June I posted my article to promote Leon Fuat because its EPS for the quarter ending March was 11.56 sen when its share price was below Rm 1.00. Among all the steel listed companies Leon Fuat has the best profit growth rate. Leon Fuat buys steel to make steel products, mostly for the building industry.

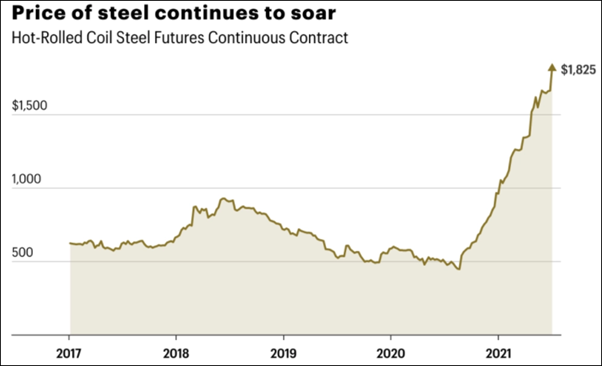

The above steel price chart shows the steel price has shot up more than 300% from $500 to $1,825 in the last 1 year. Since the steel price has gone up more than 300% in the last 1 year as shown on the steel price chart below, Leon Fuat has to buy steel at higher price and has to sell its finished products at much higher prices.

Shougang Group of China has joint venture with Hiap Teck to produce steel.

Hiap Teck is different from Leon Fuat. Hiap Teck is producing steel and steel products. Its latest quarter ending April EPS was 4.79 sen.

It should report faster profit growth rate than leon Fuat in the next few quarters due to the rapid steel price increase.

Conditions have changed: China is the biggest steel producer in the world. Since China wants to reduce the use of coal to reduce air pollution, it has reduced steel production and has stopped steel export. China requires all the steel for its own property and infrastructure development. As a result, steel price has shot up from $ 500 to $ 1,825 as shown on the chart.

Shougang Group of China has joint venture with Hiap Teck to produce steel.

All investors must know what is Eastern Steel Sdn Bhd.

BACKGROUND:

Eastern Steel Sdn Bhd (ESSB) is an Integrated Iron and Steel Mill under the joint venture of Hiap Teck Venture Berhad (HTVB) with Shougang Group of China. HTVB is one of the leading steel companies in Malaysia and listed on the main board of Bursa Malaysia Securities Berhad in 2003. Eastern Steel’s foreign partner – Shougang Group of China was established in the year 1919. Shougang is a well-diversified group in the iron and steel making, mining, machinery, electronics, architecture, real estate, service, overseas engineering contracting and trading.

The change in ownership structure of Eastern Steel Sdn. Bhd. (“ESSB”), started in March 2018, was completed in the FY 2019. Following this, the shareholders of ESSB are now Shanxi Jianlong Industry Company Ltd. (“Jianlong”), HTVB and Chinaco Investment Pte. Ltd. (“Chinaco”) with shareholdings of 60%, 35% and 5%, respectively.

ESSB, now a 35%-owned (from 55% previously) joint-venture of HTVB, operates a fully integrated blast furnace steel plant with a rated annual production capacity of 700,000 MT. With the strong support and technical assistance from our new partner, Jianlong, ESSB has successfully re-ignited its blast furnace and resumed production on 16 July 2018. Production has been smooth since and the plant is now running at above rated capacity. In FY 2019, ESSB has also successfully added a billet caster and commenced construction of a 55MW power plant and will complete in October 2019. The addition of billets to our offering of slabs will afford ESSB the flexibility to optimize its revenue mix, while the completion of the power plant will further help reduce production cost.

ESSB manufactures steel slabs for the steel re-rolling industries. Its manufacturing complex occupies 1200 acres of land and located at Teluk Kalung, Kemaman, Terengganu. The plant comprises of:-

* Raw Material Yard

* Ironmaking Plant:

* Sinter Plant

* Blast Furnace Plant

* Pig Iron Caster

* Steelmaking Plant:

* Converter with Ladle Refining Furnace

* Slab Continuous Casting Machine

* Oxygen Plant

* Billet Caster Plant

* 55MV Power Plant

Its production capacity is 700,000 metric tons per annum and aims to achieve an annual production of 3 million metric tons in the near future.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

"Leon Fuat has to buy steel at higher price and has to sell its finished products at much higher prices."

Can Leon Fuat buy steel at higher price and able to sell its finished products at much higher prices to who????

2021-08-10 11:07

Whatever fuat and Teck is just a tiny dot to China giant steel mill .

Talk 3 & talk 4 like perwaja kaput

2021-08-10 13:29

uncle KYY no need to boast and tell us how much u bot, but if you are sincere with a philantrophic heart, tell us especially all the newbies, uncles and auntie aunties how much hiap tek and leonfb you have oledi sold lah behind their backs, You are just another trader lah. No need to be so "cheong hey" and write all your so called FA reports as if you are a sovereign fund mgr lah.

2021-08-10 13:39

Uncle KYY, the price of Leon Fuat was around 85 to 95 sen and Hiap Teck was around 50 sen for the past 6 weeks? you have been screaming sell during that period.The price held steady when you scream sell.Now you change your mind.

I think you are at least one month behind OTB. looks like now you totally agree with all that is said by OTB. Why ? You go from one extreme to another. its classic comedy.

its ok you made a mistake.We all do.just admit it and move on.

2021-08-10 14:05

Posted by Sslee > Aug 10, 2021 11:07 AM | Report Abuse

"Leon Fuat has to buy steel at higher price and has to sell its finished products at much higher prices."

Can Leon Fuat buy steel at higher price and able to sell its finished products at much higher prices to who????

SSLEE

YOU BETTER STICK WITH YOUR BPLANT

Only masteel won't see higher feedcost of high iron ore or high steel price like Leonfuat because MASTEEL use the cheaper Scrap iron as feed stock

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/2021-08-08-story-h1569650081-WHY_DIRECTORS_INSIDERS_OF_PALM_OIL_COMPANIES_ARE_BUYING_THEIR_PALM_OIL_.jsp

2021-08-10 16:40

The 2 counters that benefited the most from increase in steel price are Ann Joo and Hiaptek. Both are cost leaders due to their more advanced steel making technology using modern Blast Furnace.

Ann Joo currently current annual rated capacity is 820,000 MT and three Rolling Mills with a total annual rated capacity of 650,000MT. Some 10 years ago Ann Joo has invested over RM 1 billion to upgrade its first and only modern Blast Furnace in Malaysia, which is also the first and only hybrid combination of Blast Furnace and Electric Arc.

Hiaptek's Eastern Steel currently operates at 700MT capacity and will soon increase to 1,500,000 MT next year.

2021-08-10 16:40

Iron ore dropping from USD220 to USD167, steel bar price also dropping, plus FMCO & MCO. Does it affect the next quarter result?

2021-08-10 18:17

To uncle, he already makes 10% in just a few weeks. Drop o not, he dun care. Of course 10% is nothing to him la. Minimum must be 30 to 50% ma. Your choice to join this gravy train o not loh. I of course wun loh. At the end uncle still win. Oni more or less oni but others might get burnt le. If the stock can short ah....i will buy short le.

2021-08-11 08:24

agree

his standards had dropped to Gambler Day Trader level

Posted by KingKong_Doll > Aug 11, 2021 8:24 AM | Report Abuse

To uncle, he already makes 10% in just a few weeks. Drop o not, he dun care. Of course 10% is nothing to him la. Minimum must be 30 to 50% ma. Your choice to join this gravy train o not loh. I of course wun loh. At the end uncle still win. Oni more or less oni but others might get burnt le. If the stock can short ah....i will buy short le.

2021-08-11 08:30

He is nothing as compared to Otb who writes with facts and figures. What happened to his golden rule. Totally discarded.

2021-08-11 12:36

thanks uncle koon for the tip. time to short sell Hiap Teck and Leon Fuat!!

2021-08-12 00:29

Golden Rule Number 1: Sell when 'flip flop flip flop con yy' starts promoting.

I got conned on Teoseng 1st. Didn't learn from my mistake and got conned again in Tomei.

2021-08-13 00:21

brian3381

Watever la. Choobee is the best. Hahaha

2021-08-10 10:33