AYS is selling at lowest PE among all the steel, chips and CPO counters - Koon Yew Yin

Koon Yew Yin

Publish date: Wed, 03 Nov 2021, 12:33 PM

The last traded price for AYS was 87 sen and its latest EPS was 8.5 sen. It has reported increasing profit in the last few quarters. Steel is always required in any building and infrastructure construction. Currently there is no more MCO; there should be more construction activities. As a result, it should continue to report better profit in the next few quarters.

AYS is the cheapest growth stock among all the steel, chips and popular stocks. Assuming its latest EPS of 8.5 sen remains unchanged, its annual EPS will be 4 X 8.5 sen = 34 sen. Share price 87 sen divided by 34 sen = 2.5 PE ratio.

The tabulation below shows AYS is the cheapest among all the popular counters.

|

Nmae |

price |

Latest EPS |

EPS divided by price |

|

|

AYS |

87 sen |

8.5 sen |

9.8 |

|

|

MPI |

Rm 47.7 |

37.9 sen |

0.8 |

|

|

UNISEM |

Rm 4.28 |

4.95 sen |

1.2 |

|

|

QES |

74 sen |

0.46 sen |

0.6 |

|

|

Freight Manage |

92.5 sen |

1.54 sen |

1.7 |

|

|

May Bulk |

67 sen |

3.21 sen |

4.8 |

|

|

MMC |

Rm 1.98 |

5.7 |

2.9 |

|

|

SOP |

Rm 3.84 |

17.2 |

4.5 |

|

|

Boustead Plant |

72 sen |

2.3 sen |

3.2 |

|

|

KLK |

Rm 21.6 |

72 sen |

3.3 |

|

|

Jaya Tiasa |

71 sen |

1.94 sen |

2.7 |

|

|

Pentamaster |

Rm 5.35 |

2.72 sen |

0.5 |

|

|

EL Soft |

Rm 1.05 |

0.29 sen |

0.3 |

|

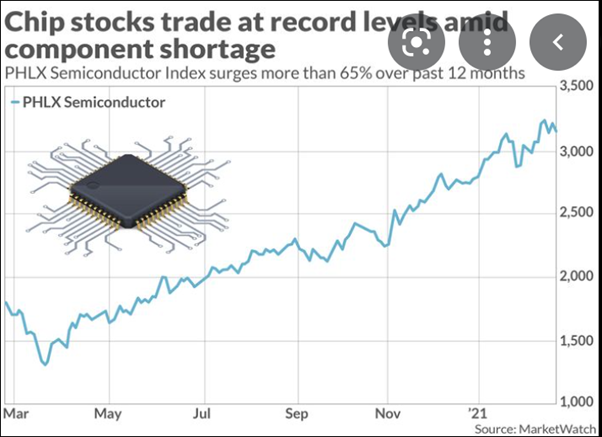

Many investors have asked me to look at computer chip stocks and plantation stocks because the prices of computer chips and CPO crude palm oil are at historical record high as shown on their price charts above. Even with the historical record high prices of computer chip and CPO, these counters are selling at ridiculously high PE ratio. For example, MPI last traded price was Rm 47.7 and its latest EPS was 37.9 sen. Its annual EPS will be 4 X 37.9 sen = Rm 1.52. 47.7 divided by 1.52 = 31 PE ratio. While AYS is selling at PE 2.5

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

lol comparing to MPI and KLK. Just how you and your gang used Heng Yuan to compare with Nestlé. Don't make me laugh..

It seems uncle KYY and his followers know nothing about balance sheet and cash flows statement.

2021-11-03 12:49

CPO counters at historical high level ??

This fellow tell lies with his eyes wide open!

Investors just need to look into each of the plantation’s performance for H1 2021 and some has just reported Q3 EPS vis a vis their share price to know the truth . I am surprised he is willing to go down so low to tell lies .

2021-11-03 12:50

those who lose money because of his unlicensed recommendation should report sc to investigate kyy for a pontential market manipulation.

2021-11-03 14:24

next week he will tell u he sold all his steel stocks because charts not nice already. U watch

2021-11-03 14:46

run run run... the madman is here again!!! Comparing between sectors now!!!

2021-11-03 15:22

KYY keep thinking to sell AYS so the title also spell out to sell.

"AYS is selling at lowest PE among all the steel, chips and CPO counters - Koon Yew Yin"

2021-11-03 18:04

Haha,

KYY once wrote margin call force selling is a vicious cycle so expecting race to the bottom.

2021-11-03 18:43

einvest88

leading death indicator out again...

2021-11-03 12:44