Subur Tiasa is selling at lowest PE - Koon Yew Yin

Koon Yew Yin

Publish date: Sat, 09 Apr 2022, 06:23 PM

Subur Tiasa Holdings Bhd is an investment holding company. It engages in the extraction and sale of logs, manufacturing plywood, particleboard and sawn timber. The Timber segment consists of upstream logging, reforestation and downstream manufacturing of timber products. It contributes the majority of the group's total revenue. Logging and a forestation contribute about one-third of the group's revenue. India is a major export market for this segment. The company has further expanded its oil palm plantation and are looking to increase the share of revenues from oil palm operations. Currently the company has already planted 13,000 hectares of oil palms and continues to plant more and more.

If you examine the CPO price chart carefully, you can see that CPO price had been below Rm 2,500 per ton for many years. CPO price has started to go up about 2 years ago and has been going up to historical record high price of Rm 7,000 per ton as shown on the CPO price chart above.

Due to the rising CPO price, all plantation companies have reported increasing profit in the last 2 or more quarters and will continue to reported increasing profit.

Plantation stocks comparison update

The table below shows the names of 11 plantation stocks, last traded prices, latest reported EPS, 4 X EPS and PE ratio based on 4 X EPS, assuming EPS is the same for the next 3 quarters. Of course, all plantation companies will be making increasing profit in the next few quarters.

Subur Tiasa is selling at the lowest PE ratio as shown on the table below.

|

Name |

Price |

EPS |

EPS X 4 |

Price÷EPS |

|

Subur |

Rm 1.98 |

16.15 |

64.60 |

3.1 |

|

Cepat |

Rm 1.08 |

7.74 |

30.96 |

3.5 |

|

SOP |

Rm 5.71 |

36.44 |

Rm1.46 |

3.9 |

|

MHC |

Rm 1.32 |

7.41 |

29.6 |

4.5 |

|

Jaya Tiasa |

Rm 1.01 |

5.28 |

21.1 |

4.8 |

|

Sarawak Pl |

Rm 2.71 |

11.66 |

46.6 |

5.8 |

|

Hap Seng |

Rm 2.84 |

11.79 |

47.2 |

6.0 |

|

Ta Ann |

Rm5.59 |

21.8 |

87.2 |

6.4 |

|

Boustate Pl |

Rm 1.06 |

3.80 |

15.2 |

6.9 |

|

United Pl |

Rm 15.8 |

37.16 |

Rm1.49 |

10.6 |

|

KLK |

Rm26.7 |

55.6 |

Rm2.22 |

12.0 |

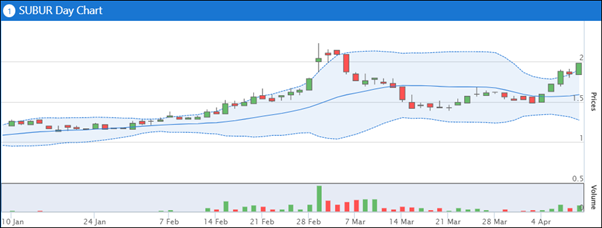

Subur Tiasa price chart below is showing up trend, forming a CUP and a handle.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

Although I don't like Uncle attitude, but I can't deny that Subur is one of the best pick for Plantation counter.

1) The EPS for next 2 quarter will be very good, above 20 sen per quarter (this is based on my own calculation and estimation, if CPO can continue stand at RM4500 and above).

2) Subur's share unit is very little, and there is no much retailer inside (i.e. Compare to TDM, JTIASA, BPLANT..etc). So when someone start to accumulate it, it can go up very fast.

2022-04-10 14:46

daretocutandchange, yup, you spot the hidden point. That is why I am very confidence next 2 quarter result will be above 20sen EPS

2022-04-10 15:52

Here comes another 'hopeless' recommendation! You know i know what the next article will be!

2022-04-10 16:05

Not really advisable to use only the recent qtr result earnings. It can be one off extra ordinary gains. Better used the company past dividend ratio vs management guidance or dividend policy. Last but not the least the company planted acreage and the location of their estates. Plantation land in the right growth area is a golden source of opportunity.

2022-04-10 19:22

dont listen to this ah koon. now he sings prases for subur. as memtioned we know what to expect. he prcce will go up and he will start to sell . thien this itchy backside fella will write something bad and price will fall.many will be trapped

2022-04-10 19:55

itchfied old man who gets his orgasms from making people lose monet

remember dayang, supermax and most recentlt tecguan. there are many others too

2022-04-10 19:58

Because he has some very dumb financial advisors to ask him buy all garbage counters..

2022-04-10 20:18

Oil Palm now price still good,n then those plantation all had good profit....those below 1.00 until 2.00 plantation counter still can buy some or hold......may be they will Replace ...Glove counter....i think in Medium term ( in 3 months or six months ) they will stable........But Advice buy that we can BEAR LOST......

2022-04-11 13:17

i come to a conclusion that this company deforest due to oil palm plantation as what EU claimed..

"Logging and a forestation contribute about one-third of the group's revenue. India is a major export market for this segment. The company has further expanded its oil palm plantation and are looking to increase the share of revenues from oil palm operations."

2022-04-11 17:24

investor77

Subur high quarterly eps could be due to extra ordinary items. Also bear in mind that it has high borrowings. A cheaper alternative can be found in Sin Heng Chan, fell from 50 over cents to 40 cents something. Paid up Capital not very high. In 1993, price up to over RM20 !! Anyway another good choice is IOI Plantation as it has large acreage and PNB selling non stop to get money for 10 k withdrawal. One of the few CPO shares that has not moved up, in fact it fell from a high price, despite high Cpo price.

2022-04-10 14:24