Why is Brent Crack Spread margin dropping? Koon Yew Yin

Koon Yew Yin

Publish date: Fri, 08 Jul 2022, 12:19 PM

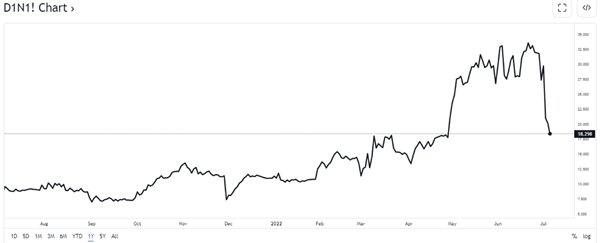

The Brent Crack Spread margin chart is showing that it is dropping sharply from 32% to 18% in the last few days.

What is Crack Spread?

Crack spread refers to the pricing difference between a barrel of crude oil and its by-products such as gasoline, heating oil, kerosene, and fuel oil. The business of refining crude oil into various components requires careful attention to market prices for the various by-products. The spread estimates the profit margin that a refinery can expect to generate from cracking the long-chain hydrocarbons of crude oil into useful petroleum by-products. Depending on various factors such as weather seasonality, global supplies, and time of year, the demand and supply equation for different petroleum components changes. This affects the profit margins for refiners.

The spreads are used by refiners to hedge their Profit and Loss (P&L), while speculators use cracks spreads in futures trading. For example, if a refiner relies on selling gasoline and the price of gasoline drops below the price of crude oil, this is likely to result in a loss to the refiner. Speculators aim to profit from the price difference between crude oil and its by-product components.

Factors Affecting Crack Spread

One of the factors that affect the spread is geopolitical issues. Generally, during periods of political uncertainty and instability, there will be a reduction in oil supply. The result is a rise in crude oil prices relative to refined products. This weakens, or narrows, the crack spread initially. However, as refineries respond to the reduced crude oil supply and by-product output reduction, the crack spread widens. Foreign policy changes also affect crude oil producers and the prices of crude by-products.

Prevailing weather conditions, mainly summer and winter seasonality, affect the spreads as well. During the summer season, there is a higher demand for specific by-products such as gasoline and diesel, which significantly strengthens the crack spread. The winter season increases the demand for distillates like diesel fuel and motor gasoline and also results in a wider crack spread.

There exists an inverse relationship between crude oil and currency strength, and any changes in the strength of a currency may affect crude oil prices and ultimately the crack spread. When the value of a currency declines, crude oil prices increase, and this weakens the crack spread. An increase in the value of crude oil means that the profit margins from crude oil components are reduced. For refiners to get a strong positive crack spread, the price of crude oil must be significantly lower than the price of refined products.

The above Hengyuan price chart shows that it has started to drop from Rm 7.50 to the current price of Rm 4.30 in the last 2 months. Due to rapid dropping of Brent Crack Spread margin, Hengyuan share price will continue to drop. Investors must follow the price chart which cannot lie.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Aug 19, 2024

On 14th Aug 2024, I posted my article “Why people are rioting across UK”. Now I want to tell you why do people riot?

Created by Koon Yew Yin | Aug 19, 2024

If I knew politicians are so well paid, I should have been a politician. A few days ago, one old friend who migrated to Australia about 40 years ago, visited me. He told me that he was a Member of P..

Created by Koon Yew Yin | Aug 14, 2024

Riots have spread across numerous cities and towns in England, and in Belfast in Northern Ireland, over the last week in the worst outbreak of civil disorder in Britain for 13 years. Police have ma...

Created by Koon Yew Yin | Jul 30, 2024

The new poll, conducted between July 22-24 and released Sunday, found that Harris’s approval rating had surpassed Trump’s in Wisconsin, Pennsylvania, Minnesota, and Michigan. In Michigan, Harris was..

Created by Koon Yew Yin | Jul 30, 2024

As you can see below, a few people are using my name to promote sale of Initial Public Offer (IPO) shares before and after listing on Bursa Malaysia. You should not buy IPO shares because statistics..

Created by Koon Yew Yin | Jul 23, 2024

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Discussions

With diesel crack spread of USD 45.573 per barrel HRC and Petronm will make ton of money in Q3 2022.

GOC1!

LOW SULPHUR GASOIL CRACK SPREAD (1000MT) FINANCIAL FUTURES (CONTINUOUS: CURRENT CONTRACT IN FRONT)NYMEX

45.573

D

USD

−0.398

(−0.87%)

2022-09-27 16:30

D1N1!

SINGAPORE MOGAS 92 UNLEADED (PLATTS) BRENT CRACK SPREAD FUTURES (CONTINUOUS: CURRENT CONTRACT IN FRONT)NYMEX

3.595

D

USD

+0.423

(+13.34%)

With Mogas92 at this level, HRC refining margin swap contracts on Mogas will make ton of money in derivatives gain.

2022-09-27 16:35

If KYY cannot differential mogas, gasoil and jet fuel crack spread and just simply label mogas92 crack spread as Brent Crack Spread then I have nothing more to say.

But for an engineering graduate from MU to agree with KYY writting that mogas92 creack spread is Brent crack spread then I can only say god bless Malaysia.

2022-09-27 16:43

Uncle pun know crack spread mogas 92 is for hedging purpose only mah. Q3 average selling price is 130. Brent average is 100. Do your maths lah uncle. Low mogas 92 crack and high selling price is double engine mah. One month later uncle please look into the quarter report. Diesel , jet fuel banyak untung. Mogas 97&95 untung sikit. Only weak currency not favour hengheng. Tapi Hedge untung very very fat. All pending hedge loss will become untung. q3 result will shock many people.

2022-10-12 08:49

.png)

ks55

To cut story short, HYR is declared dead.

2022-07-08 13:11