Hengyuan's support is broken - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 12 Sep 2022, 09:24 AM

My sole purpose for writing this piece is to prevent my readers from losing their hard earned money or life time savings. Currently there are a few irresponsible promoters to encourage readers to buy Hengyuan.

A few days ago, I posted my article namely “Investors ignored Hengyuan’s fantastic profit” which you can read on the Hengyuan’s forum.

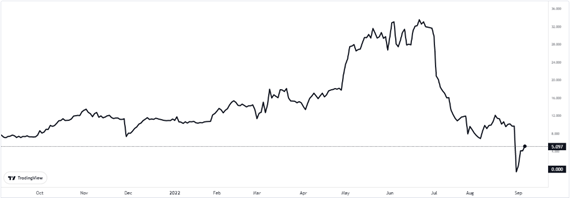

The blue line is the 50 day moving average price and the red line is the 20 day moving average price. When the red line crosses over the blue line and the share price is below the 2 lines, it is a strong signal of down trend as shown on the chart below.

Hengyuan Refinery buys crude oil to refine to various kind of products for sale. An oil refinery or petroleum refinery is an industrial process plant where petroleum (crude oil) is transformed and refined into useful products such as gasoline (petrol), diesel fuel, asphalt base, fuel oils, heating oil, kerosene, liquefied petroleum gas and petroleum naphtha.

Hengyuan’s profit or loss solely depends on the buying price of crude oil and the selling prices of the refined products which is shown by the Brent Crack Spread margin is chart below:

Crude oil price chart below:

Due to the high crude oil price and the low Brent Crack Spread margin as shown on the 2 charts above, Hengyuan will report a reduced profit or a loss in the next quarter ending September.

Price chart cannot lie. It is a record of the daily closing price. Currently there are more sellers than buyers every day. As a result, it is dropping continuously. Even financial institutions and syndicates cannot stop it from dropping because the daily volume traded is several million shares.

Price chart takes preference over financial analysis. Price chart is more important than its profit growth prospect which is wishful thinking.

Hope is not a strategy

Hope is only a wishful thinking. It is only a dream. Despite the chart showing down trend, many investors refused to sell to cut loss because they still hope for Hengyuan to report better profit in the next quarter ending June which will be announced before the end of August. At the meantime, it continues to drop. Hope is not a strategy because your hope might not materialise.

Why investors refused to cut loss?

Investors hate to lose and hate to admit they are wrong.

But in life, losing is inevitable. Warren Buffet is wealthy not because he never loses money, it’s because he’s better at minimizing his losses and capitalizing on his wins.

Most investors refuse to sell a losing stock because of loss aversion, a term used very often in behavioral finance and economics. When we sell a losing stock, we not only lose money we also lose our pride and ego.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 25, 2024

The group is expected to deliver better profits and revenue from its pipe coating, engineering, and bioenergy segments.

Created by Koon Yew Yin | Oct 14, 2024

Today I read the article by Murray Hunter titled “A Visit to the Malaysian Communist Party tunnels in Betong, Thailand”, which is an important part of Malaysia’s history.

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Oct 04, 2024

KSL is still the cheapest based on a 4.4 PE ratio, which means its share price should continue to go up. Unfortunately, there are a few small investors who always queue to sell at cheaper prices...

Created by Koon Yew Yin | Sep 06, 2024

Water pollution is a huge challenge for freshwater in the UK, impacting our rivers, streams, and lakes and the wildlife that call them home.

Discussions

DEAR KOON,

DOES THIS MEAN THAT YOU ARE SHORTING AND PUBLISHING ARTICLES TO ATTACK THE STOCK SO YOU CAN BUY CHEAP, OR ARE YOU ACTUALY BUYING NOW

2022-09-12 10:14

Haiyoh Uncle Koon macam dont want to be HengYuanese leh. Cham lor. Still jadi penkritik macam Raider and qqq333 leh. Look like want to achieve 2017 high price is getting more fae away leh. Haiyoh. Correct?

Uncle Koon cakap one leh. Many sifu sifu pun cakap ini macam leh. Dunno why HengYuanese very clever one leh. Dont believe Uncle Koon one leh. Haiyoh. Correct?

Why investors refused to cut loss?

Investors hate to lose and hate to admit they are wrong.

But in life, losing is inevitable. Warren Buffet is wealthy not because he never loses money, it’s because he’s better at minimizing his losses and capitalizing on his wins.

Most investors refuse to sell a losing stock because of loss aversion, a term used very often in behavioral finance and economics. When we sell a losing stock, we not only lose money we also lose our pride and ego.

2022-09-12 10:14

Uncle Koon horsim you cakap he is shorting. Uncle Koon exited and tulis blog to warned ppl dont fall into promoters trap leh. So far he is correct mah. Why you kenot give Uncle Koon a clap to show he is correct meh. When he is salah you all kutuk Uncle Koon. When he is betul pun kena kutuk lagi. So kesian Uncle Koon leh. Haiyoh. Correct?

emsvsi

DEAR KOON,

DOES THIS MEAN THAT YOU ARE SHORTING AND PUBLISHING ARTICLES TO ATTACK THE STOCK SO YOU CAN BUY CHEAP, OR ARE YOU ACTUALY BUYING NOW

28 seconds ago

2022-09-12 10:17

Ular pun ada TP like many TP HY until next QR mah. You buta meh. Only promoters dare not to TP lah. Kira kira panlai tapi TP dare not to show like the penkritik leh. You should ask those promoters why dare not to TP baru betul leh. Haiyoh. Correct?

mikesieew

I don't know why you are all out against this stock, tell us then what is the fair value of this stock and basis of valuation

20 minutes ago

2022-09-12 10:22

SOME paid over RM10,000 for Stock Trading course to listen to Sifo Trainer to tell them

"Price chart cannot lie."

"Price chart takes preference over financial analysis. Price chart is more important than its profit growth prospect which is wishful thinking."

"Hope is not a strategy"

"Why investors refused to cut loss?

Investors hate to lose and hate to admit they are wrong."

"Most investors refuse to sell a losing stock because of loss aversion, a term used very often in behavioral finance and economics. When we sell a losing stock, we not only lose money we also lose our pride and ego."

KYY give it to YOU for FREE and SAVE RM 10000

2022-09-12 10:27

Idoit there is not such thing as Brent Crack Spread margin don't invent it.

In the market refining margin refer selling price of refining products[

gasoline (petrol), diesel fuel, asphalt base, fuel oils, heating oil, kerosene, liquefied petroleum gas and petroleum naphtha] minus Brent crude price.

And please go check HRC financial report what are HRC refining products:

HRC 2021 annual report Page22 :

CRUDE PROCESSING FY2021

Finished Products

Liquified Petroleum Gas 7.8%

Propylene 3.8%

Light Naphtha 0.1%

Petrol 24.5%

Jet Fuel 7.1%

Diesel 35.1%

Fuel Oil Component 2.7%

Additional

Catalytic Cracked Gasoline (CCG) 16.3%

Combined Cycle Oil (CCO) 2.6%

SOURCES OF CRUDE

Malaysian: 52%

Far East: 7.2%

Russian :14.7%

Middle East: 9.6%

Others 16.5%

HRC CRUDE PROCESSING FY2020

Finished Products

Liquified Petroleum Gas 7.0%

Propylene 3.0%

Light Naphtha 0.5%

Petrol 22.0%

Jet Fuel 4.0%

Diesel 46.0%

Fuel Oil Component 1.5%

Additional

Catalytic Cracked Gasoline (CCG) 11.0%

Combined Cycle Oil (CCO) 5.0%

SOURCES OF CRUDE

54.8% Malaysian

14.9%Far East (Non Malaysian)

10.9% Russian

14.4% Middle East

5.0%Others

2022-09-12 10:37

ITS CLEAR THIS FAT PYTHON HHAS BOUGHT HENGYUAN

Posted by UlarSawa > Sep 12, 2022 10:17 AM | Report Abuse

Uncle Koon horsim you cakap he is shorting. Uncle Koon exited and tulis blog to warned ppl dont fall into promoters trap leh. So far he is correct mah. Why you kenot give Uncle Koon a clap to show he is correct meh. When he is salah you all kutuk Uncle Koon. When he is betul pun kena kutuk lagi. So kesian Uncle Koon leh. Haiyoh. Correct?

emsvsi

DEAR KOON,

DOES THIS MEAN THAT YOU ARE SHORTING AND PUBLISHING ARTICLES TO ATTACK THE STOCK SO YOU CAN BUY CHEAP, OR ARE YOU ACTUALY BUYING NOW

28 seconds ago

2022-09-12 10:39

Haiyah calmdown lah!

What uncle Koon mean is Mogas crack margin mah!

Btw....no need to call Uncle koon idioot for that loh!

Posted by Sslee > 30 minutes ago | Report Abuse

Idooit there is not such thing as Brent Crack Spread margin don't invent it.

In the market refining margin refer selling price of refining products[

gasoline (petrol), diesel fuel, asphalt base, fuel oils, heating oil, kerosene, liquefied petroleum gas and petroleum naphtha] minus Brent crude price.

And please go check HRC financial report what are HRC refining products:

HRC 2021 annual report Page22 :

CRUDE PROCESSING FY2021

Finished Products

Liquified Petroleum Gas 7.8%

Propylene 3.8%

Light Naphtha 0.1%

Petrol 24.5%

Jet Fuel 7.1%

Diesel 35.1%

Fuel Oil Component 2.7%

Additional

Catalytic Cracked Gasoline (CCG) 16.3%

Combined Cycle Oil (CCO) 2.6%

SOURCES OF CRUDE

Malaysian: 52%

Far East: 7.2%

Russian :14.7%

Middle East: 9.6%

Others 16.5%

HRC CRUDE PROCESSING FY2020

Finished Products

Liquified Petroleum Gas 7.0%

Propylene 3.0%

Light Naphtha 0.5%

Petrol 22.0%

Jet Fuel 4.0%

Diesel 46.0%

Fuel Oil Component 1.5%

Additional

Catalytic Cracked Gasoline (CCG) 11.0%

Combined Cycle Oil (CCO) 5.0%

SOURCES OF CRUDE

54.8% Malaysian

14.9%Far East (Non Malaysian)

10.9% Russian

14.4% Middle East

5.0%Others

2022-09-12 11:14

Uncle,when crack is high, you mentioned high crack spread will cause deviviaitivess loss.

Now, why you no mention low crack spread will make derivative gains?

2022-09-12 11:16

No worry.

A good investor will make money quietly.

This old man already lost > 500 million in last few years.

Basically, this old man also lost until not much money left behind.

He sold his bungalow lot and land in last few years.

Very sad to hear that.

2022-09-12 11:26

Simple mah!

If U take all derivative valuation mark to mkt in June & flow thru P&L....base on the same high standard as Petron...then Hengyuan will make Q2 losses of Rm 412m or EPS loss of Rm 1.37 per share & Half year losses of Rm 475m or EPS loss of Rm 1.58 per share mah!

No need to bluff mah!

It is all back up by facts & figure mah!

2022-09-12 11:53

Actually uncle attack Hengyuan because uncle want to prove that he is better than otb. Because Hengyuan is recommended by otb. Either that or uncle is buying so want people to buy it cheap cheap

2022-09-12 12:23

Value destruction happening in hengyuan summarise below

31-12-2020.....Nta per share Rm 7.22

31-3-2021.................................. Rm Rm 7.14

30-6-2021................................ Rm 6.75

30-9-2021............................ Rm 6.07

31-12-2021......................... Rm 6.83

31-3-2022..........................Rm 6.62

30-6-2022......................... Rm 5.25

Actually 30-6-2022 is the highest value of wealth destruction in Hengyuan despite reporting record operating qtrly profit eps of Rm 2.22 loh!

Why leh ??

Something is not right mah!

2022-09-12 12:40

The unrealised derivatives gain/loss although did not pass thro' the P&L as it was kept as other comprehensive income:

Items that will be reclassified to profit or loss:

But in Balance sheet the unrealised drivatives gain/loss was captured as derivatives assets and derivatives liabilities.

2022-09-12 12:47

That means now u realized there is value destruction in hengyuan loh!

Value destruction happening in hengyuan summarise below

31-12-2020.....Nta per share Rm 7.22

31-3-2021.................................. Rm Rm 7.14

30-6-2021................................ Rm 6.75

30-9-2021............................ Rm 6.07

31-12-2021......................... Rm 6.83

31-3-2022..........................Rm 6.62

30-6-2022......................... Rm 5.25

Actually 30-6-2022 is the highest value of wealth destruction in Hengyuan despite reporting record operating qtrly profit eps of Rm 2.22 loh!

Why leh ??

Something is not right mah!

Posted by Sslee > 1 minute ago | Report Abuse

The unrealised derivatives gain/loss although did not pass thro' the P&L as it was kept as other comprehensive income:

Items that will be reclassified to profit or loss:

But in Balance sheet the unrealised drivatives gain/loss was captured as derivatives assets and derivatives liabilities thus reflected into NTA.

2022-09-12 13:00

U need to be honest by calling a spade a spade mah!

If U take all derivative valuation mark to mkt in June & flow thru P&L....base on the same high standard as Petron...then Hengyuan will make Q2 losses of Rm 412m or EPS loss of Rm 1.37 per share & Half year losses of Rm 475m or EPS loss of Rm 1.58 per share mah!

No need to bluff mah!

Lu tau boh ??

Hengyuan is having a losses of Rm 475m as per comprehensive income disclosure mah!

Stop kidding yourself mah!

If Hengyuan going....to make money after june 2022....due to hedging....that is another story mah!

But since the Crack spread has fallen to USD 1 to 5 from USD 20 to 25....i doubt hengyuan operating profit will be good....u will be lucky hengyuan just break even loh!

As for hedging profit if it come after june, it will need to offset agst the culmulative hedging losses of more than Rm 1 billion as at june 2022 loh!

2022-09-12 13:04

Very important Question if u can answer then u will solve the mystery loh!

Btw...it is not an exchange....it is an individual counter party....having a private deal with Hengyuan mah!

Who is the sooohaaiiii counter party dare to bet one to one... with a refinery like HRC, on Refining margin on one to one bet leh ??

What is there for them, what is counter party their competitive edge over hengyuan leh ?

The huge sum of money, that Hengyuan is betting...to tune of Rm 1.3 billion losses, is just ridiculous mah!

2022-09-12 13:13

I do not need the advice from stockraider after a long bad mouth from him on Hengyuan.

What do you expect from an office boy standard in investing ?

He said, Hengyuan is a con stock, Chinaman siphoned money from Malaysia to China.

I had made a report on him to Hengyuan management, I hope a legal action is taken against him.

FYI, stockraider is the one losing his money in 2017.

I made million from Hengyuan in 2017.

No reason that I take his advice.

If he is so good, he should make more money than me in 2017.

I am very disappointed with him.

Hence I report his name to the management of Hengyuan and suggest to the management to take a legal action against him.

I mean business.

2022-09-12 13:17

Uncle KYY only telling half truth. His crack spread is only for MoGas 92,95, of which comprise only 30% of HY production. 46% is Diesel, of which Crack Spread is high, more than USD 40. HY already hedged 18 mil boe at USD 12.70 as a hedge for this MoGas Crack Spread, so at low spread, there will be a gain. KYY has been known to do what is contrary to what he is posting. Would not be surprised if he is buying HY instead since price is undervalued for a high Eps share. Already we can read Iraq, Vietnam, Indonesia all wants to build Refineries as there is shortage of Refining capacity. Still believe SsLee, Probability and Zhuge s explanation that H2/22 will be better than H1/22, and thus not surprising Net Eps around RM 5 for the year. In Europe public clamouring for Windfall tax on Energy shares as these companies made huge profit as a result of the Ukriane Russia war causing higher Refining Spread due to limited supply of Gas, Oil. Q3/22 result will show who is right. July, August already shown high Diesel Crack Spread, except for MoGas 92,95 due to overproduction by Europe s refiners which is mostly Simple Refinery, and not Complex as in the case of HY that can produce Diesel and Jet Fuel.

2022-09-12 15:48

as usual, follow the proven rule : when uncle Kyy said sell, then is the time to buy.

2022-09-12 16:36

Hengyuan with 2 consecutive quarter of earnings growth should comply with Koon Golden Rule. But seems uncle no longer follow his Koon golden rule.

https://klse.i3investor.com/web/blog/detail/kcchongnz/2022-06-26-story-h1625208343-_Golden_Rule_or_Chart_won_t_lie_kcchongnz

2022-09-12 16:37

Posted by tehka > 14 minutes ago | Report Abuse

Hengyuan with 2 consecutive quarter of earnings growth should comply with Koon Golden Rule. But seems uncle no longer follow his Koon golden rule.

--------------

He did not follow rules now.

He becomes a speculator instead of an investor.

There is the real reason he lost > 500 million in the last few years.

His 2 important generals left him, hence his empire collapsed.

No material in him.

2022-09-12 16:59

more like uncle brain is broken. talking about 50 and 20 day moving average, cheat primary school kid then can la

2022-09-12 17:13

Why today Petron goes up but hengyuan do not leh ??

1. Petron with its refinery & petrol stations has better value than hengyuan loh! Just Petron Petrol station alone already worth Rm 6.50 per share & its refinery worth Rm 4.50 mah!.

2. Petron had paid higher & consistent dividend than hengyuan at 20 sen per share mah!.

3. Petron Qtr2 31-6-2022 result still reported a commendable net profit of 68 sen per share despite netting of hedging losses whrereas HRC reported a loss of eps Rm 1.37 per share after netting off hedging losses loh!

4. Petron are more well manage & less complicated compare to hengyuan, thus easy to understand & investor is more confident on Petron loh!

5. On hedging Petron adopt a more acceptable universal standard of forward exchange contract & commodity swaps route thru the banks base on over the counter arrangement (OTC} whereas Hengyuan has also Forward exchange contract & commodity swap route thru OTC with banks but it has this dubious Refinery Profit Margin swap done as private arrangement individual counter party loh! This Refinery Profit Margin Swap has generated a staggering more than Rm 1 billion losses at hengyuan loh!

2022-09-12 17:37

@stockraider uncle Koon is the indication for HY. Time to collect, don’t let him collect your ticket. I need to thanks him to allow me to collect more.

By the way, pls study and understand what is derivation gain/loss before your comments further.

2022-09-12 19:46

kebling98

Haiyohe if hengheng is over hedging, bank will not give her 5blah.

If hengheng loss 1000m in hedging, bank nampak hengheng pun run loh.

Bank wont lend money to gamblers lah

This MTN proved hengheng business very healthy.

O&G company is very difficult to get MTN.

Only very good company can get MTN.

Sunway has established 3b MTN in March. Sunway good or bad company?

If the statements about unrealize derivatives loss is true ,means bank is doing charityloh

------------------

Do not know whether it is a coincident or not, every time KYY talks bad about Hengyuan, a good news will appear to help the share price of Hengyuan to move up north.

When KYY said Hengyuan is a sell, it means you must buy.

2022-09-12 21:12

y miracle_trader > 16 minutes ago | Report Abuse

hengyuan will indeed fly soon. experience trader can see that, seller have exhausted.

2022-09-12 21:15

Posted by Sslee > 3 hours ago | Report Abuse

Hengyuan establishes RM5 bil MTN programme, accepts RM1.3 bil in revolving credit facilities

By Izzul Ikram | theedgemarkets.com | 2022-09-12 19:00:00

KUALA LUMPUR (Sept 12): Hengyuan Refining Co Bhd has established an unrated medium-term notes (MTN) programme of up to RM5 billion in nominal value, and accepted RM1.31 billion in multi-currency revolving credit (RC) facilities.

In a Bursa Malaysia filing, the crude oil refiner said the purpose of the MTN programme and RC facilities is to refinance its existing loans, fund the medium-term growth and working capital of the company, as well as allow Hengyuan to proceed with its planned upgrade and maintenance projects for its refinery.

Hengyuan said tranches of the RM5 bil MTN programme will be issued over a tenure of 30 years via bought deal or private placement.

The company said it made an initial lodgement for the establishment of the MTN programme to the Securities Commission Malaysia on June 30, and subsequently relodged last Thursday (Sept 8) following certain revisions to the principal terms and conditions of the programme.

AmInvestment Bank Bhd and Maybank Investment Bhd are the joint principal advisers, joint lead arrangers, and joint lead managers of the MTN programme, while Malaysian Trustees Bhd is the trustee.

Meanwhile, on the RC facilities, Hengyuan said they comprise a US dollar facility of up to US$235 million (RM1.06 billion) and a ringgit facility of up to RM250 million offered by AmBank (M) Bhd, China Construction Bank Corp, Labuan Branch and Malayan Banking Bhd.

"The RC facilities are subject to the approval of Bank Negara Malaysia and this was received by Hengyuan on Aug 3," it added.

Shares in Hengyuan finished three sen or 0.65% lower at RM4.57 on Monday (Sept 12), giving the company a market capitalisation of RM1.37 billion.

Edited by S Kanagaraju

----------------------

If Hengyuan will suffer billions of unrealised losses on refined derivatives, which bank will lend money to Hengyuan ?

If Hengyuan is over hedging and suffers heavy hedging losses on refined derivatives, banks will not approve this medium-term notes (MTN) programme of up to RM5 billion in nominal value, and accept RM1.31 billion in multi-currency revolving credit (RC) facilities.

Banks will lend money to a solid stock like Hengyuan means bankers have already scrutinised their Accounts under the microscope. All rumours about unrealised refined derivative losses are not a concern to the banks now.

The worst is over, the share price will perform well after this announcement.

Will it be a limit up tomorrow after this good announcement ?

Mr Market will tell you tomorrow after 9.00 am.

Good luck and may god bless you always.

2022-09-12 23:11

uncle KYY golden rule proven again : When uncle called sell, price will go up. You bought yesterday when uncle call sell, you make money today...

2022-09-13 09:53

Very important Question if u can answer then u will solve the mystery loh!

Btw...it is not an exchange....it is an individual counter party....having a private deal with Hengyuan mah!

Who is the sooohaaiiii counter party dare to bet one to one... with a refinery like HRC, on Refining margin swap on one to one bet leh ??

What is there for them, what is counter party their competitive edge over hengyuan leh ?

The huge sum of money, that Hengyuan is betting...to tune of Rm 1.3 billion losses, is just ridiculous mah!

WHY GENERAL RAIDER ASK THIS VERY IMPORTANT QUESTION LEH ?

"Who is the sooohaaiiii counter party dare to bet one to one massively of more than billions... with a refinery like HRC, on Refining margin swap on one to one bet leh" ?

AS U ALL KNOW, THERE ARE REALLY NO COMMODITIES MKT for 'REFINERY MARGIN SWAP' TRADED....IF U WANT TO BET...U NEED TO FIND A COUNTER PARTY LOH!

THATS LEAD TO RAIDER VIRTUAL REFINERY EXPLAINATIONS EARLIER LOH! SUPPOSE BASE ON SSLEE PAPER CALCULATION, U CAN ACTUALLY MAKE USD 35 PER BARREL MARGIN ON PETROL & DIESEL WHEN U HEDGE FWD LOH! BUT AS RAIDER EXPLAIN THIS PAPER SUCCESS , NEED TO FACE THE CHALLENGE OF MKT VOLATILITY & ACTUAL EXECUTION LOH...THUS TRANSLATE TO A PROBABILITY SUCCESS RATE OF SAY 75% LOH!

THIS SHOULD BE POSITIVE FOR HENGYUAN IF THEY GO BUY CRUDE BRENT & SELL DIESEL & PETROL future IN ORDER TO HEDGE AND LOCK IN A POTENTIAL PROFIT DUE TO THE HIGHER PROBABLE SUCCESS LOH!

BUT INSTEAD OF HENGYUAN DOING THAT....THEY LOOK FOR A FRIENDLY VIRTUAL REFINERY..TO BE THE COUNTER PARTY OFFERING THEM A "REFINERY MARGIN SWAP" WITH USD 10 MARGIN.....AND THE VIRTUAL REFINERY WILL DO THE HEDGE WITH A GROSS PAPER PROFIT MARGIN OF USD 35....N THEY OFFER HENGYUAN REFINERY MARGIN OF USD 10....THUS THE VIRTUAL REFINERY APPEAR SAFELY HEDGE AT USD 25 LOH!

THUS HENGYUAN WILL BEAR THE BRUNT OF VOLATILITY & EXECUTION risk WITH INADEQUATE MARGIN OF SAFETY OF USD 10 LOH! THAT COULD BE THE EXPLAINATION, WHY HENGYUAN MAKE LOSSES OF MORE THAN RM 1 BILLION ON A REFINING MARGIN SWAP LOH!

THE ABOVE SUSPICIOUS ARRANGEMENT IS "BUSINESS LIKE & IT APPEAR LEGAL" BUT IT WILL BE THE DETRIMENTAL TO HENGYUAN SHAREHOLDERS IN THE LONG RUN LOH!

"A quick check on Petron....there is no Refining Margin swap hedge done loh"!

2022-09-13 12:28

@Zhuge_Liang "Those unrealised losses are none of my concern, they will eventually become zero."

You estimated your EPS of RM7 for FY 2022. Perhaps you can show your forecasted proforma P&L for QTR 30.9.2022 to highlight what are the figures in your "other Comprehensive Income / (Expense) section.

It will be interesting to see what is your 'Cash Flow hedge" and " Cost of hedging " figure. TQ

2022-09-13 17:10

Duh,recession and up in interest to cool down hyper price increase.anwar say neutral.then if price increase whose fault.remember during ph ruling(2018-early 2020) in lge reduce interest rates 3 times.cause ringgit depreciation to average 4.20-rm 4.30.the policy are one of the cause of price increase of 20 percents.

2022-09-13 20:57

If low interest continue even more price increase will happen,at the end many disposable income for citizen will dwindle many will without proper food for 3-4 years.The income gap will even wider where rich even more richer.

2022-09-13 22:29

opinion contradicts with own statement , "more sellers than buyers " vs "retailers refuse to cut loss"

2022-09-22 20:50

mikesieew

I don't know why you are all out against this stock, tell us then what is the fair value of this stock and basis of valuation

2022-09-12 09:57