Cement shortage will benefit CMSB - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 02 Feb 2023, 04:55 PM

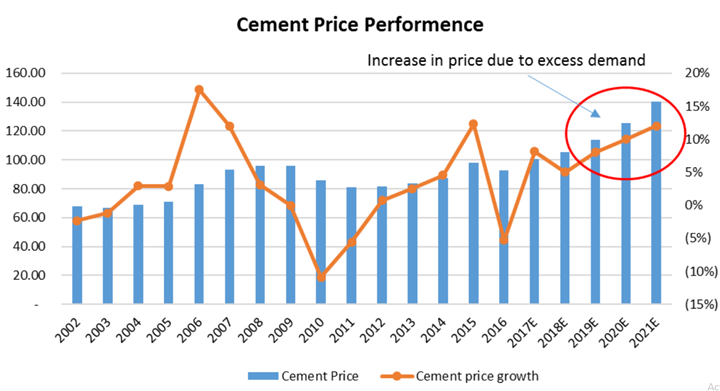

After the Covid 19 pandemic lockdown, all the people can go out to work freely to earn more money and many of them want to use their saving to buy houses. As a result, there are more construction activities and demand for cement has increased. Currently there is cement shortage in Sarawak and cement price has gone up. Sarawak Government will import cement from Thailand to ease the situation.

BANGKOK: A Sarawak delegation to Thailand led by the Sarawak Economic Development Corporation (SEDC) and the Bintulu Development Authority (BDA) visited the Siam Cement Group (SCG) headquarters here for a study visit.

The study visit on Dec 19 led by SEDC chairman Tan Sri Datuk Amar Dr Abdul Aziz Husain and BDA general manager Datuk Muhammad Yaakup Kari was to explore the possibility of SEDC and BDA forming a joint venture company to import cement from SCG to address cement shortage and price hike currently faced by the Sarawak construction industry.

“The envisaged benefits of the effort will entail an increase in supply of cement for Sarawak to fulfil the immediate need of the construction industry. This will also help to alleviate the shortage and price increase of cement in Sarawak.

“The scarcity of cement supply in Sarawak has also affected cement prices. Sarawak’s average cement unit price is 15 per cent more than in Peninsular Malaysia and 4 per cent higher than in Sabah.

“Problems with supply and pricing have hampered and delayed key development projects in Sarawak,” said a joint press release here today.

Furthermore, cement imports are subject to certificates of approval issued by the Construction Industry and Development Board (CIDB).

Sarawak imported RM206.6 million in lime, cement, and fabricated construction supplies in 2021, primarily from Peninsular Malaysia (RM112.8 million), Indonesia (RM56.3 million), and China (RM13.6 million).

“To address these issues, the SEDC-BDA joint venture company is eyeing the prospect of importing 500,000 to 1 million metric tonnes of cement per year from SCG for Sarawak beginning in 2023,” added the statement.

On 15 June 2022, Cahya Mata Sarawak sold Entire Stakes in Sarawak Alloy Smelter and OM Samalaju to OM Holdings for RM526.52 Million.

CMSB is cash rich. The last traded price is Rm 1.24 and Rm 3.08 Net tangible asset.

Latest Net profit Rm 154.4 million and EPS 14.37 sen. In the previous quarter, Net profit Rm 39.6 million and EPS 3.69 sen. Profit shot up 400%.

Malaysia has 3 listed cement manufacturers, namely CMSB, YTL and Malayan Cement. CMSB is in Sarawak. YTL and Malayan Cement are in Peninsula Malaysia.

CMSB price Rm 1.24, latest quarter EPS 14.37 sen and previous quarter EPS 3.69 sen

Malayan Cement price Rm 2.14, latest quarter EPS 0.07 sen and previous quarter EPS 2.61 sen

YTL price 56 sen, latest quarter EPS 0.33 sen and previous quarter EPS 0.08 sen

CMSB is the best stock to buy. I am obliged to inform you that CMSB is one of my major investment.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

For someone who claimed he was in the construction industry, he knew very little about CMSB. Everyone in Sarawak knows what CM stands for and who actually owns it. This is a typical stock SSlee would buy because high NTA and low stock price. I am inclined to think that KYY is not as naive as SSlee and speakup has summarised KYY's motive.

2023-02-04 12:56

When at 80c it was ignored. Only now is promoted after it shot up to 1.27. Need to think carefully before enter.

2023-02-04 13:26

https://says.com/my/news/malaysian-mum-boy-ate-mouldy-hotdog-coffee-joint-kl-mall

AVOID ZUS COFFEE!

2023-02-04 22:40

This content is written very well. Your use of formatting when making your points makes your observations very clear and easy to understand. Thank you. https://www.chardhamtour.in/

2023-02-09 17:23

speakup

Koon say buy = time to sell?

2023-02-03 07:47