Property developers share prices comparison based on latest EPS - Koon Yew Yin

Koon Yew Yin

Publish date: Thu, 29 Feb 2024, 10:25 AM

KSL share price Rm 1.53, EPS for 4 quarters is 40.76 sen, selling at PE 3.8.

IJM share price Rm 2.17, EPS for 4 quarters is 9 sen, selling PE 24.

Gamuda share price Rm 5.09, EPS for 4Q 24.5, selling PE 21.

Mah Seng price 0.97, EPS for 4Q 8.9 sen, selling PE 11.

ECO World price Rm 1.31 4 Q EPS 6.4 sen, selling PE 20.5.

KSL is the cheapest in terms of PE ratio.

KSL Holdings Bhd is a holding company.

It is engaged in real estate services. The company has four reportable segments Property development; Property investment; Investment holding and Car park operation.

Property development includes the development of residential and commercial properties; Property investment includes an investment of real properties and hotel; Investment holding includes the provision of management services to the subsidiaries, and Car park operation includes car park management services. KSL derives most of its revenue from Property development.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Jul 23, 2024

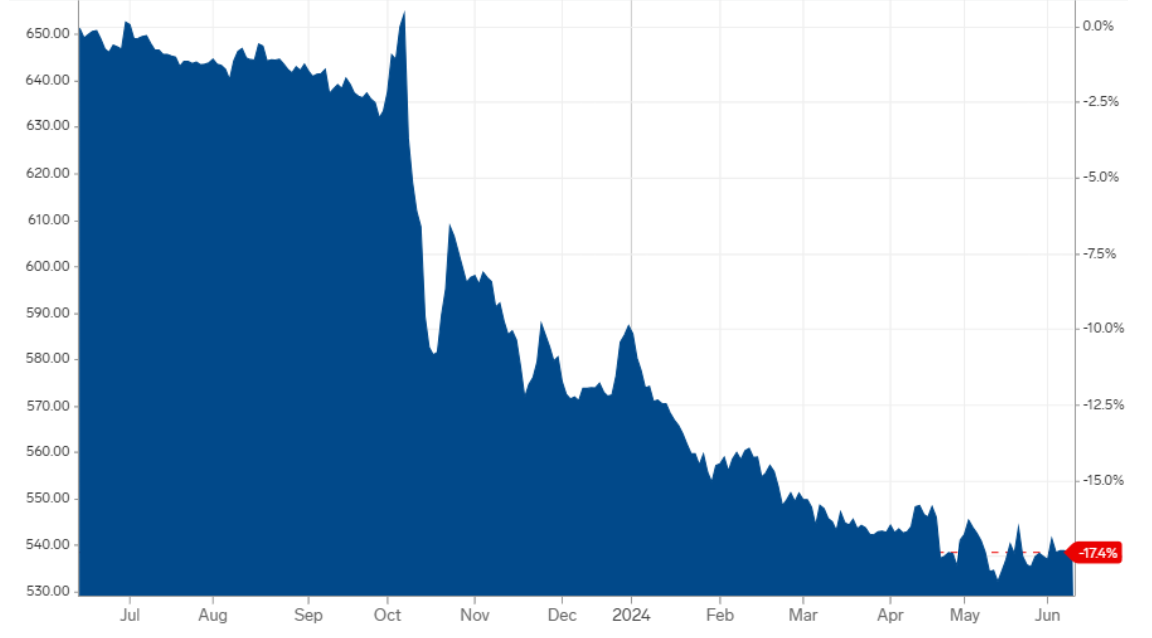

The most important criteria for share selection are technical analysis and financial analysis. The price chart below shows that KSL's share price has been going up from 88 sen to above RM 2.13...

Created by Koon Yew Yin | Jul 22, 2024

Recently one smart accountant pointed out to me that KP Property has millions of Redeemable Convertible Preference Shares (RCPS). This will affect its share price. I sold all my KPP shares to buy KSL.

Created by Koon Yew Yin | Jul 15, 2024

Currently Bahasa Melayu is taught in all Government sponsored schools. Bahasa Melayu is only good within Malaysia. All our overseas customers do not know Bahasa Melayu. I hope all our politicians...

Created by Koon Yew Yin | Jul 09, 2024

Created by Koon Yew Yin | Jun 28, 2024

Discussions

The only problem with KSL is that all the retain earning is reinvested into land purchase and no dividend for shareholders.

It will help if KYY can persuade the BOD to allocated 20-40% of profit as dividend.

2024-02-29 11:36

A share is valuable only if it is willing to share its profit with minority shareholders. Care to check how much is the directors' fees?

2024-02-29 11:41

CRESENDO in a sweet spot to capitalise on DC Mania In Johor due to its massive land bank.

Johor is a rising star in the data center landscape, and CRESCENDO is well-positioned to capitalise on this growth. Coupled with the company's undervalued landholdings, partial recurring incomes, and decent dividend history.

These factors make CRESCENDO an attractive stock for investors seeking exposure to growing data center industry in Johor and RTS Link, the potential game-changer for property market in Johor Bahru.

Net assets per share of Rm 9.0 upon revaluation.

As majority of the lands have not been revalued for years, and if we assume a net gain of RM600m from the remaining 202 acres of industrial land in Nusa Cemerlang Industrial Park and a RM1b revaluation surplus for its remaining landbank and properties, this will bump up its net asset per share to RM9, versus its current share price of RM2.56 per share.

2024-02-29 11:50

Crescendo - Profit jumps 270% in third quarter. Launching a further RM500 million land for sale after clinching RM543 million sales in just 10 days. Best deal for 2024?

Jan 21, 2024 5:26 PM | Report Abuse

Intrinsic value per share for Crescendo is not less than 9 ringgit, taking into consideration quality and credibility of its Directors, steady earning potential for next few years, healthy financial status and strong cash flow, very solid background of its major shareholders (no pledged securities/ nominee holders), recently land disposal, intended further land disposal, development lands were purchased more than 20 years and the location of these land bank.

Looking forward to rm 6 in near future.

22/01/2024 12:17 PM

2024-02-29 12:01

edcheong

Thanks KYY. Your analyses is very much appreciated. Please help write about the oil and gas sector. Your experience is valuable.

2024-02-29 11:27