weekly update 22/3/15, REITs vs Bonds

investfuture

Publish date: Mon, 23 Mar 2015, 07:51 AM

view this orginal site: http://malaysiareit.com/2015/03/weekly-update-22315-reits-vs-bonds.html

这星期REITs股价的波动相当大,特别是pavreit(5212),axreit(5106), 和AHP(4952)

pavreit的股价从上个礼拜的RM1.49急挫至RM1.40,下挫了6.4%,ahp则突破至RM1.21,距离52weeks 高价RM1.22只欠 1sen,axreit也急挫了8sen至RM3.48。pavreit的股价下滑至相当吸引的价位。

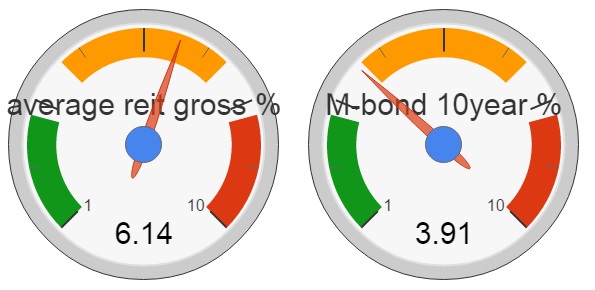

这礼拜整体REITs的股价呈上升趋势,average DY下挫至6.14% 可是同时,大马10years bond yield的利息也走跌至3.906。事实上REITs dividend yield与bond yield呈正比关系,也就是说,bond yield上升,REITs Dy也会上升(有兴趣的朋友可以阅读旧帖,click here to read),而这礼拜REITs DY vs Bond Yield = 2.234% 这是正常的范围,一般上,REITs与bond的yield差别是2-2.5%,而现在REITs的股价处于合理范围。

以下是个别REITs的最新dividend yield table,看看有没有REITs合你的心水吧:

| weekly update | ||||||

| reit | dividend | latest dividend | yearly payout | share price | gross yield | nett yield |

| Arreit (5127) | 0.072 | 0.018 | 4 | 0.91 | 7.91% | 7.12% |

| Ytlreit (5109) | 0.0748 | 0.0187 | 4 | 1.02 | 7.33% | 6.60% |

| Uoareit (5110) | 0.1146 | 0.0573 | 2 | 1.6 | 7.16% | 6.45% |

| Hektar (5121) | 0.108 | 0.027 | 4 | 1.51 | 7.15% | 6.44% |

| Amfirst (5120) | 0.0618 | 0.0309 | 2 | 0.935 | 6.61% | 5.95% |

| Qcapital (5123) | 0.0752 | 0.0188 | 4 | 1.22 | 6.16% | 5.55% |

| Ahp(4952) | 0.074 | 0.037 | 2 | 1.21 | 6.12% | 5.50% |

| Cmmt (5180) | 0.0906 | 0.0453 | 2 | 1.48 | 6.12% | 5.51% |

| Atrium (5130) | 0.072 | 0.018 | 4 | 1.19 | 6.05% | 5.45% |

| Pavreit (5212) | 0.0824 | 0.0412 | 2 | 1.4 | 5.89% | 5.30% |

| Igbreit (5227) | 0.078 | 0.039 | 2 | 1.33 | 5.86% | 5.28% |

| Sunreit (5176) | 0.0908 | 0.0227 | 4 | 1.57 | 5.78% | 5.21% |

| Alaqar (5116) | 0.0758 | 0.0379 | 2 | 1.42 | 5.34% | 4.80% |

| twrreit (5111) | 0.064 | 0.032 | 2 | 1.27 | 5.04% | 4.54% |

| Klcc (5235ss) | 0.35 | 0.0875 | 4 | 7 | 5.00% | 4.50% |

| Axreit (5106) | 0.166 | 0.0415 | 4 | 3.48 | 4.77% | 4.29% |

| average | 6.14% | 5.53% | ||||

谢谢你的浏览,请在网页的右上角给我们一个like或到malaysiareit tracker注册你的资料,让我们update你最新的REITs消息吧。如果你觉得malaysiareit.com不错,请通过社交媒体把我们介绍给你的朋友吧!

More articles on vitamin cash - all about REITs

Created by investfuture | Dec 11, 2020

.png)