Genting - Are you ready to place your bets?

DrGru

Publish date: Mon, 18 Jul 2016, 08:30 AM

Genting "GENT" (pronounced as https://www.youtube.com/watch?v=gF4sUlYTPh0, definitely not pronounced using the Queen’s English otherwise will sound like you need to use the Gent.) is a household name mainly known for their leisure themeparks, casinos, cruise, plantation, and property. To understand Genting, one would need to take a look at Genting Singapore (GENS), Genting Malaysia (GENM) and Genting Plantation (GENP).

You will find a lot of pictures and charts in this note. They say a picture tells a thousand words. Much easier to understand IMO.

For GENT the following 4 catalysts to drive the share price. Namely. 1) Turnaround in GENS, 2) The launch of Twenty Century Theme Park at Genting Highlands Malaysia, 3) TauRx, the potential blockbuster drug getting FDA approval. 4) GENP's leverage to CPO.

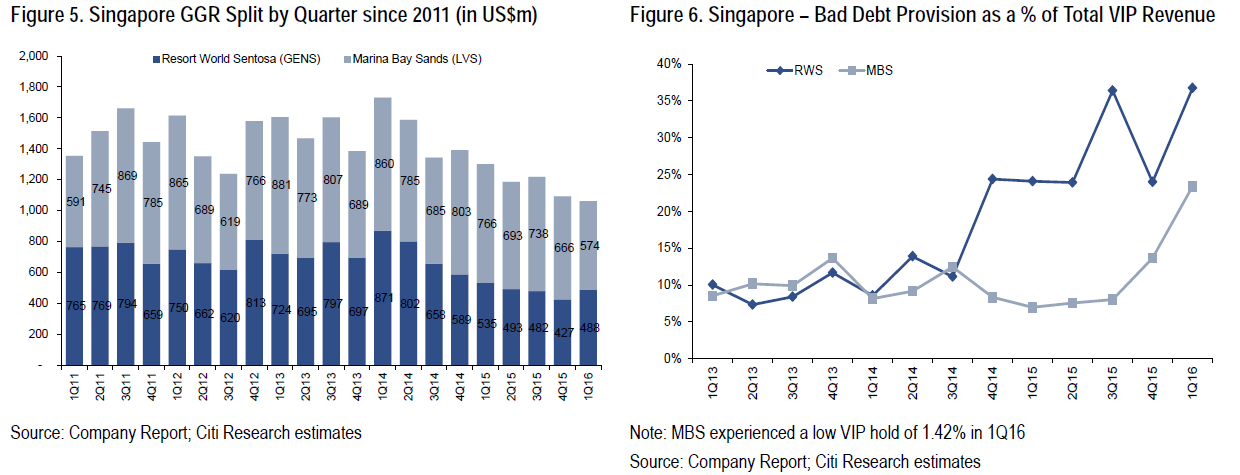

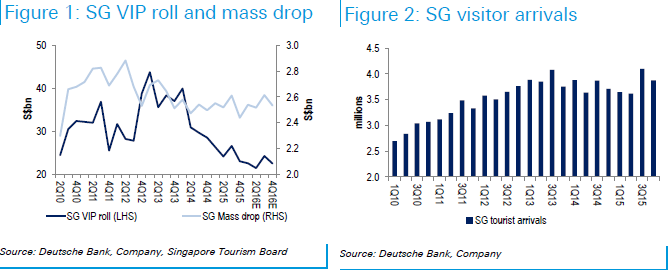

Catalyst 1. We expect GENS to turnaround. This following the recent 1Q results which saw GGR stabilizing as of 1Q16 while bad debt provision has stayed flat at 35%.

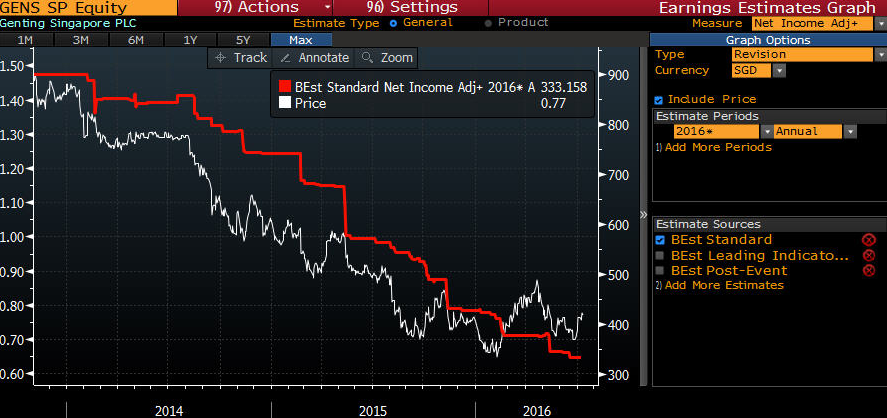

The share price of GENS has started to stabilized too. Earnings expectations already all time low!

If tourist arrival start to improve, the gaming and theme park of GENS will improve.

Catalyst 2. We move on to 52.9% owned GENM which operates the highland theme park. This was what it look like in the good old days of 90s.

Come 2017, the theme park should be ready and look like this...

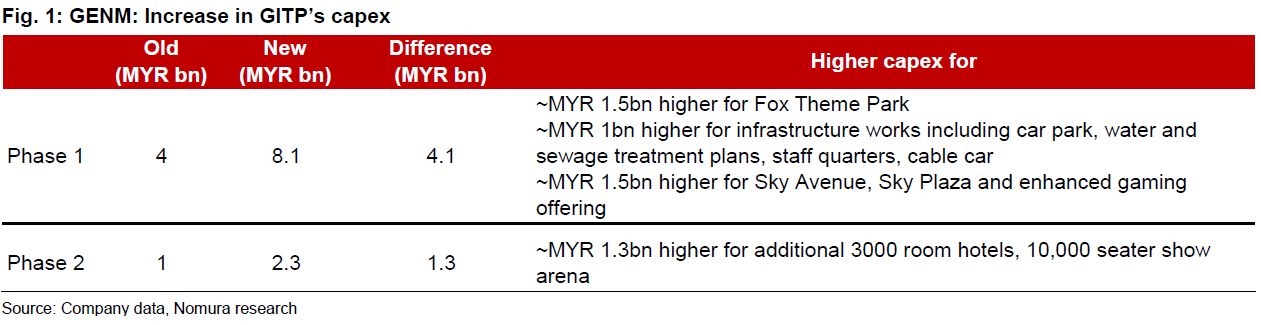

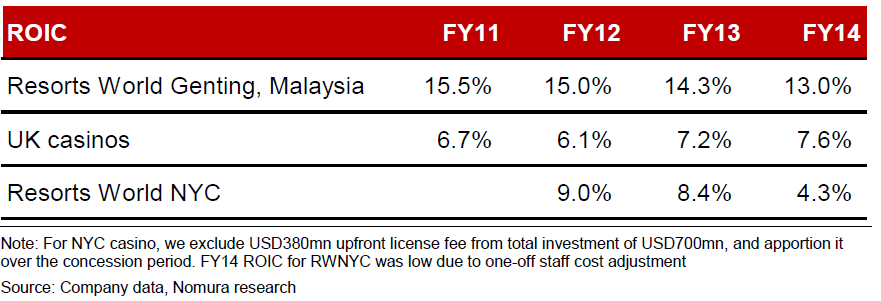

That’s right folks. Twenty Century Fox is opening a theme park in partneship with Genting Highlands. This is part of Genting Integrated Tourism Plan (GITP). For GITP, GENM is spending a total MYR8.1 bn and 2.3bn in capex for phase 1 and 2 respectively. In the past, the local theme park is big ROIC generator.

As someone who hasn’t been to the highland for ages, I can’t hide the excitement. Haha.

The theme park is expected to be ready by end 2017. Management however has hinted July 2017 to the investment community. For the latest photos on their status, please refer to http://www.themeparx.com/20th-century-fox-world-malaysia/

20th Century Fox World Genting Theme Park Rides

• Rio

• Ice Age

• Titanic

• Life of Pi

• Planet of the Apes

• Alien vs. Predator

• Night at the Museum

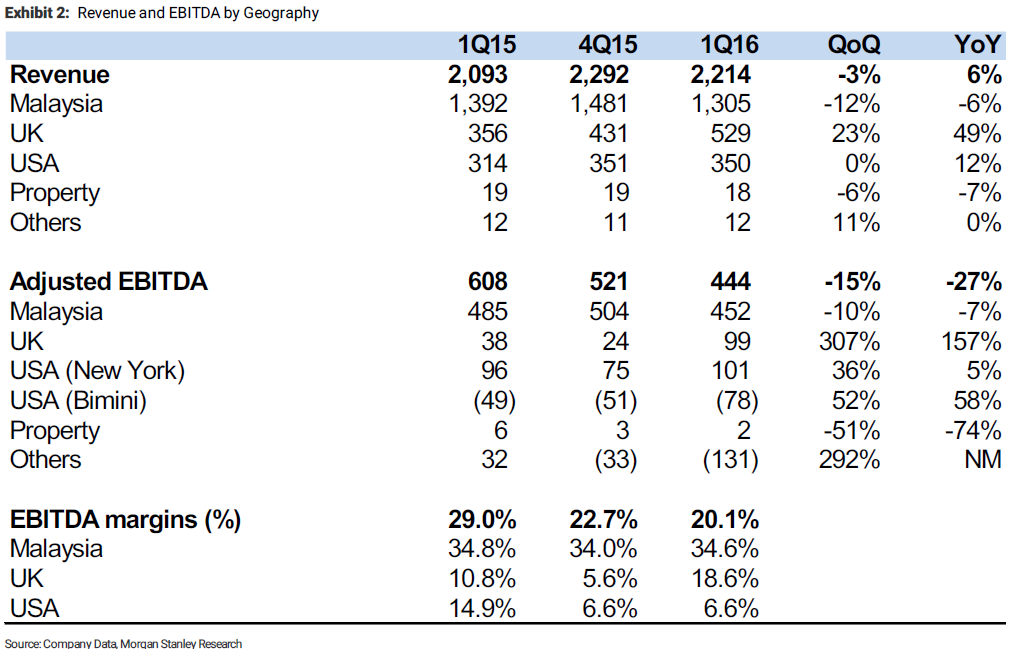

As the theme park is being build as we speak, the financial numbers for GENM is of course not exciting. For 2016, GENM’s revenue will be driven by its UK business. The recent Brexit should not affect much on its UK operation. DB estimated about c1% decline in core profit for every 10% depeciation in the pound. UK assets comprises 19% of GENM of total assets in the form of casino property.

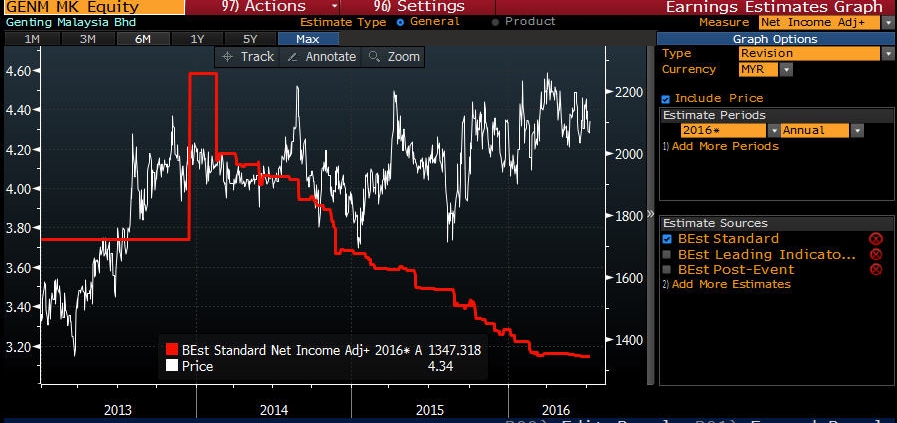

Similar to GENS, GENM’s earnings has already bottomed, how low can it go?

“History doesn't repeat itself but it often rhymes,” Mark Twain

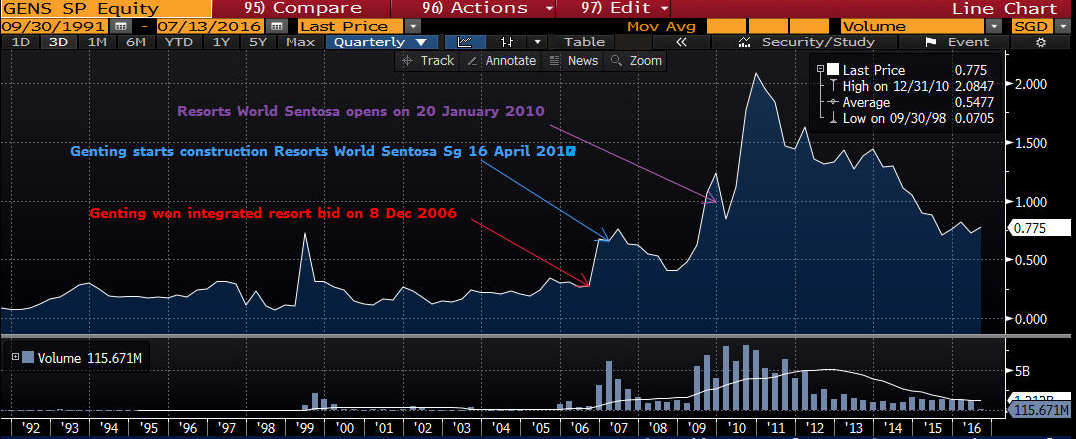

The timeline on GENS from start construction to finish/opening of thempark and share price during the same period. I believe the same could happen for GENM.

Catalyst 3. TauRx may provide a blockbuster boost for Genting’s valuation. Its initial investment of MYR450m or USD150m could be worth RM15b if TauRx goes for IPO listing. This would add RM10.4b or 40% to the sum of parts of Genting.

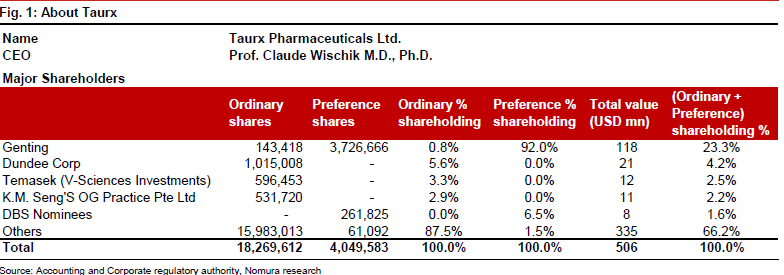

TauRx, founded by Claude Wischik is involved in Alzeheimer research. Its biggest backers include Genting, Singapore Temasek and little known Dundee Corp.

http://www.thestar.com.my/business/business-news/2016/01/07/taurx-boost-for-genting/

When the Star and bloomberg news reported about this drug. The investors reaction was bullish and share price of Genting soared from MYR7.00 to MYR9.90 in 3 months.

To follow TauRx. https://twitter.com/hashtag/TauRx?src=hash

The excitement in TauRx is clearly reflected in the share price of Dundee Corp which has rallied some 58% YTD. http://www.investing.com/equities/dundee-corp

The key date to watch will be around 27 July 2016 where the company will present results from its third phase of human trial on its experiemental Alzheimer’s drug known as LMTX.

Meanwhile, we can see insiders buying Genting.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5135433

DEALINGS IN LISTED SECURITIES (CHAPTER 14 OF LISTING REQUIREMENTS) : DEALINGS OUTSIDE CLOSED PERIOD

|

GENTING BERHAD |

|

Type |

Announcement |

|||||||||||||||

|

Subject |

DEALINGS IN LISTED SECURITIES (CHAPTER 14 OF LISTING REQUIREMENTS) |

|||||||||||||||

|

Description |

Pursuant to Paragraph 14.09(a) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, we set out below details of the dealings in the Company's securities by a Principal Officer. |

|||||||||||||||

|

Name of Principal Officer : Tan Kong Han

Remarks : The percentages are computed based on the total number of issued and paid-up share capital of the Company excluding a total of 26,220,000 shares bought back by the Company and retained as treasury shares as at 24 June 2016 and 27 June 2016 respectively. Mr. Kong Han Tan has been Deputy Chief Executive Officer of Genting Plantations Berhad since December 2010. Mr. Tan served as President and Chief Operating Officer of Genting Berhad. Mr. Tan served as the Group Chief Operating Officer of Tanjong PLC from March 2003 to June 2007. Mr. Tan has more than 13 years of working experience with an Investment Bank in Malaysia. He has been a Director of TauRx Pharmaceuticals Ltd., since November 20, 2012. He was called to the English Bar (Lincoln's Inn) in 1989 and the Malaysian Bar in 1990. He holds Bachelor of Arts degree in Economics and Law from Cambridge in 1988.

|

||||||||||||||||

OMG!, insider buying ahead of clinical phase 3 trials.. a signal of confidence?

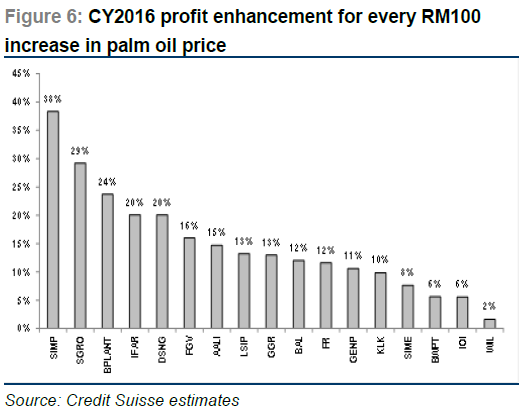

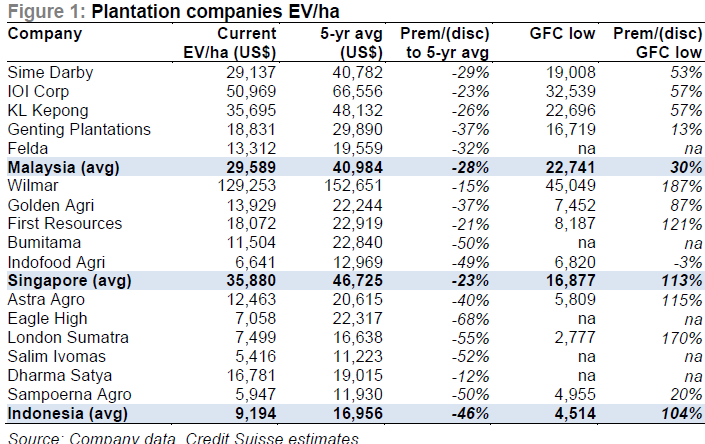

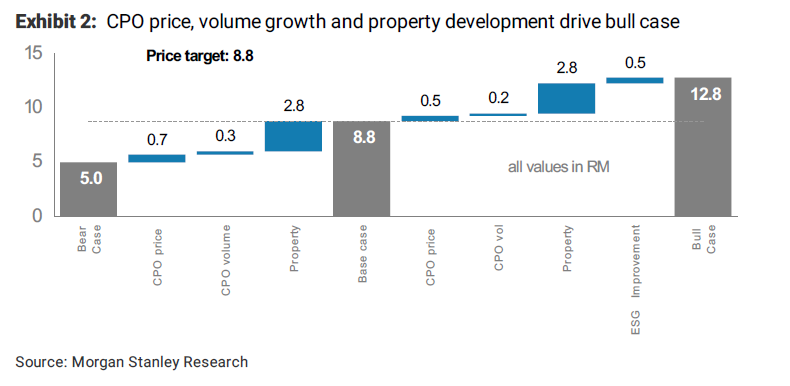

Catalyst 4. GENP is a company involved in crude palm oil (CPO) production. It has fairly young mature estates with good FFB and CPO volume growth. It also has a property development arm. It is leverage to CPO price movement.

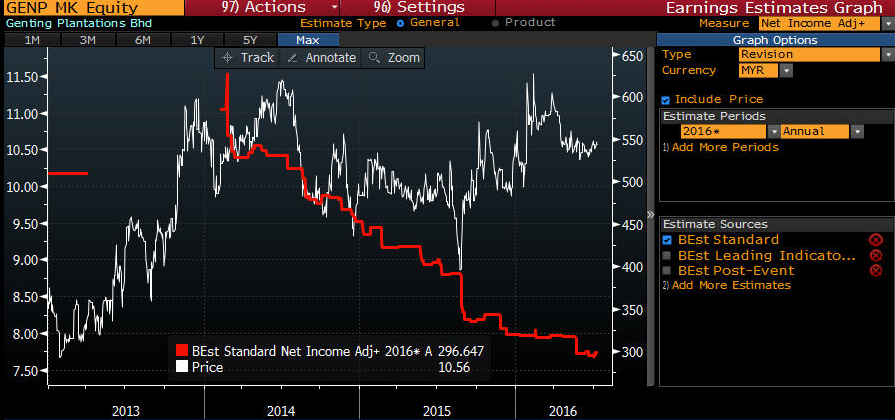

GENP earnings and price has bottomed?

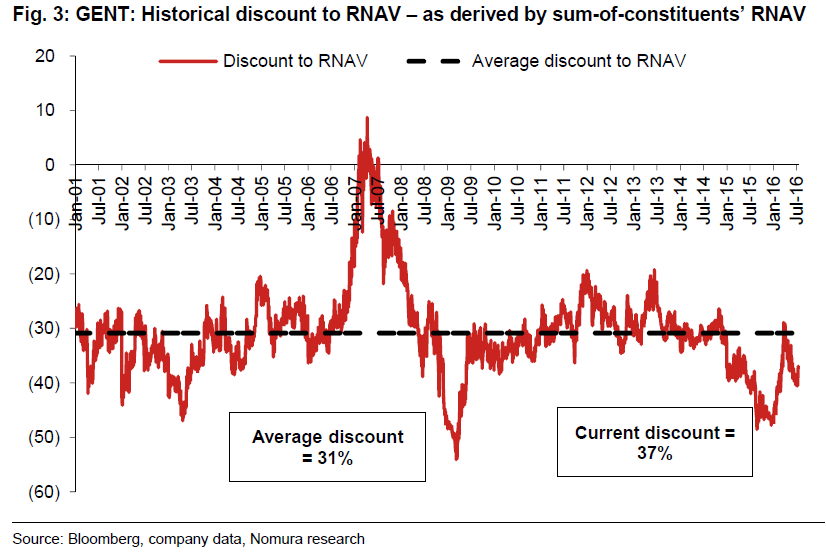

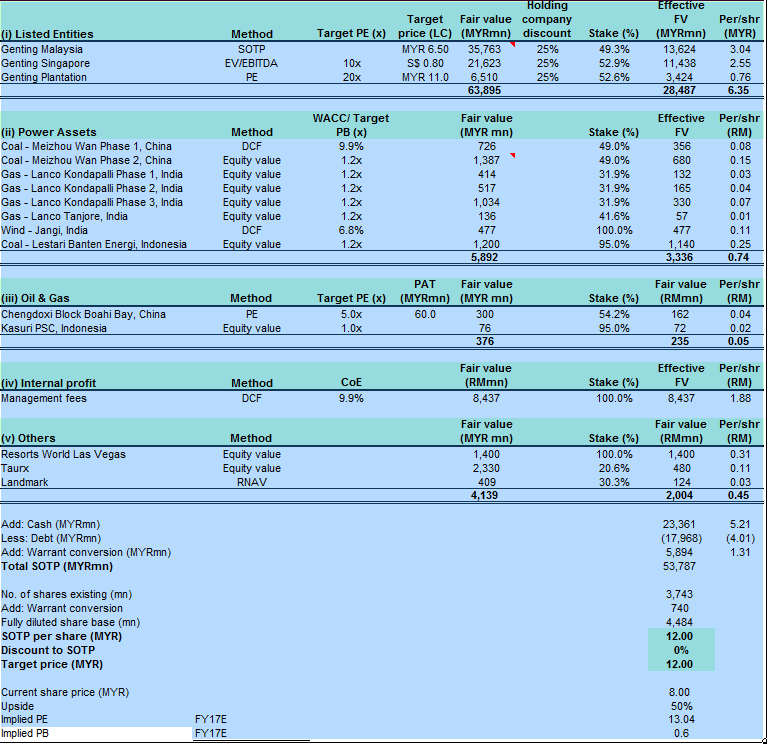

Valuations of GENT

So are you ready to place your bets?

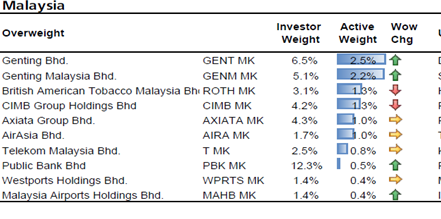

Fyi Investors’ chips are already rolling into Genting.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Does Money Grow on Trees?

Discussions

Wonder why Genting M'sia 's EBITA Margin (34%) is so much higher than in UK (18%) n US (6%). Really got bomoh stationed in Genting Msia ah?

2016-07-18 09:43

The theme park cannot ready by end 2017. only can expect sky avenue, sky plaza and new cable car.

2016-07-18 11:52

Fantastic! Thanks for this detailed insights. Not many will understand what drives Genting'share price due to its many businesses. But this analysis made it much easier to understand.

2016-07-18 19:17

This 27th July. Presentation is only phase 1 and phase 2. Phase 3 will be excluded.

2016-07-18 19:33

Wakakaka. Friend, which planet are you from? 27th announce Phase 3 larr..so sohigh larr you

2016-07-18 19:35

Tom 274, before you ask me which planet I am from, you should do your homework first. At least, I felt obliged to copy and paste the link for you to check it out. Now, find it yourself. This piece of information is available officially.

2016-07-19 01:30

Phase 3 started in 2012...finish trial and collected data 2015..apa lu cerita?

2016-07-19 02:11

Phase 3 clinical trials are currently underway with TauRx’s second-generation tau aggregation inhibitor, LMTX®. The Phase 3 programme comprises two clinical trials in Alzheimer’s disease and a further trial in the neurodegenerative orphan indication behavioural variant frontotemporal dementia.

The trials are fully recruited and results are expected in Q3 2016.

2016-07-19 02:13

Go check their official website. under clinical trial and read until last 2 sentences. then, you know apa wa cerita.

2016-07-19 06:29

This is a binary event and only one of the catalyst for the stock. Investors should take into consideration other catalysts when reviewing the company.

We are also keeping an eye on the upcoming Alzheimer’s Association International Conference in Toronto.

TauRx, which is working on a potential line of treatment to slow the progress

of Alzheimer’s disease. Unlike most previously researched Alzheimer’s

treatments which focussed on Amyloid beta (Aβ) plaques, Dr Claude

Wischik-led TauRx is focussing on Tau-proteins in the brain in his research

for a possible cure. The mid-stage trials for TauRx showed cognitive

benefits to patients taking the drug for 24 and 50 weeks, although with some

dosage-related inconsistencies, which TauRx has tried to fix in the phase-3

trials. TauRx researchers Dr Wischik and Dr Serge Gauthier are registered

to present on the phase 3 trial updates for two separate disease variants –

1) mild to moderate Alzheimers’ disease and 2) behavioural variant

Frontotemporal Dementia (bvFTD) respectively.

2016-07-19 08:33

way too risky to venture into biotech space. then again high risk high reward (if trials are successful).

2016-07-19 08:40

OPR rate cut is good for genting as more ppl now have extra money to gamble.

speakup UPGRADE genting to BUY!

2016-07-19 09:14

Wakakaka. Apa lu cerita friend? Mabuk cow dung ah? In 2 years TauRx already manufacture LMTX for Alzheimer larr...now waiting good news on 27th only

Posted by staind86 > Jul 19, 2016 06:29 AM | Report Abuse

Go check their official website. under clinical trial and read until last 2 sentences. then, you know apa wa cerita.

2016-07-19 10:35

Maybank IB Research 20 July 2016

Worth a bet – up TP to MYR11.10, Upgrade to BUY

21%-owned TauRX will reveal results of two out of its three Phase III trial

studies very soon. We understand that there has been some success,

notably with frontotemporal dementia. We leave our earnings estimates

unchanged but remove the 20% discount to our GENT SOP/sh valuation to

lift our TP to MYR11.10 from MYR8.90 to reflect the potential

monetisation of TauRX. Consequently, we upgrade GENT to BUY from

HOLD. Downside risk also appears limited at current valuations.

TauRX to reveal results of 2 of 3 Phase III studies

Channel checks indicate that 21%-owned TauRX will reveal results of two

out of its three Phase III trial studies during the Alzheimer’s Association

International Conference in Toronto, Canada on 27 Jul 2016. We

understand that TauRX will reveal results of its TRx-237-015 (mild to

moderate Alzheimer’s) and TRx-237-007 (frontotemporal dementia)

studies. Please refer to Fig. 1 for details. We understand that results of

the TRx-237-005 (mild Alzheimer’s) study will only be revealed in 4Q16.

Anecdotes suggest some success in the 2 studies

While we do not know exactly how effective LMTX (the drug subjected to

the Phase III trials) was, in improving the cognitive function of patients,

we understand that TauRX’s participation in the Alzheimer’s Association

International Conference is a positive indication of the results. Our

perusal of online Alzheimer’s forums also indicate that LMTX has had

some success in improving the cognitive function of patients, most

notably with frontotemporal dementia.

One step closer to monetisation?

If TRx-237-005 is successful, the next step is for LMTX to obtain approval

from the US Food & Drug Administration. Despite reports of a potential

listing at USD15b valuation (link), we gather that a trade sale of LMTX is

more likely as a listing requires a profit track record. If LMTX were sold

at USD15b, we estimate that it will add ~MYR2.55/sh to our GENT TP

([USD15b valuation X 20.7% shareholding – USD120m investment – 20%

holding company discount]/3,750m shares X MYR4:USD1 exchange rate).

2016-07-20 09:09

Tan kong han bet is rather small if he knew the result. Nope i dont think he got insider news, his education background doesnt supprt that nor he directly involve in the trial. His position in taurx the most is just attend meeting twice yearly and earn few hundred thousand dollar as director...that all. Every invested company have the rights to place their ppl in the company, what about temasek or dundee ppl? Any action?

2016-07-24 04:47

fangyew

thank you

2016-07-18 08:41