MQ Expresso

What is MSCI Index ?

MQTrader Jesse

Publish date: Fri, 03 Jun 2022, 05:37 PM

What is MSCI?

Morgan Stanley Capital establishes MSCI Index. The MSCI index types include industries, countries, regions, etc which cover the world. It is a critical reference index for fund managers to understand the world stock market.

Typically only companies with strong fundamentals and good performance are included in the MSCI Index.

MSCI Index Market Allocation

The MSCI Index market distribute as follows:

- DEVELOPED MARKETS

- EMERGING MARKETS

- FRONTIER MARKETS

Performance measurement and attribution

The annual market classification review is based on the MSCI Market Classification Framework, which aims to reflect the views and practices of the international investment community by striking a balance between a country’s economic development and the accessibility of its market while preserving index stability.

The framework consists of the following criteria:

- Economic development: According to the sustainability of economic development.

- Size and liquidity requirements: Determines those securities that meet the minimum investability requirements of the MSCI Global Standard Indexes.

-

Market accessibility criteria: Aims to reflect international institutional investors’ experiences of investing in a given market and includes five criteria

- Openness to foreign ownership: Investor qualification requirement, Foreign ownership limit (FOL) level, Foreign room level, and Equal rights to foreign investors.

- Ease of capital inflows/outflows: Capital flow restriction level, and Foreign exchange market liberalization level.

-

The efficiency of the operational framework:

- Market entry: Investor registration & account setup

- Market organization: Market regulations, and information flow

- Market infrastructure: Clearing and Settlement, Custody, Registry/ Depository, Trading, Transferability, Stock lending, Short Selling.

- Availability of Investment Instruments

- Stability of institutional framework

MSCI Quarterly Review

MSCI Index will make an adjustment every 3 months which is in February, May, August, and November. February and August are considered quarterly reviews, therefore the weight adjustment is relatively small. However, May and November are considered half-yearly reviews, therefore the weight adjustment is relatively big.

How does it affect a company’s share price when it enters/exits the MSCI index?

Stocks which are easily traded and have high liquidity will be more likely to be selected by MSCI. For example, the stocks must have active investor participation and be without owner restrictions. The shares must include enough stock to represent the underlying equity market. At the same time, MSIC must balance the accuracy and efficiency of the stocks.

MSCI uses the same methodology to calculate the index by summing up the total value of all stocks’ market capitalization (stock price X total outstanding shares = market capitalization). The market caps of MSCI are calculated in both US dollars and local currency.

The index is updated daily depending on the market day. Furthermore, the index will be reviewed quarterly and rebalanced twice a year. Meanwhile, the fund manager will add or delete stock to make sure the index still accurately reflects the whole equity market.

MSCI indexes have the power to change the market. After the announcement of the latest MSCI report, relevant stocks will fluctuate violently in a short period. MSCI is an international reference index for fund managers to select a stock. Any company included in the MSCI index will be easier to spot by fund managers, therefore most of the fund managers will be able to recognize the company and buy the share under their portfolio.

MSCI Malaysia

MSCI Malaysia Index was also established and announced by Morgan Stanley Capital. MSCI Malaysia Index is mainly to track the performance of the company with Large and Medium Cap. This index covered 85% of Malaysia’s CSV (circulated stock value)

MSCI Malaysia Index (USD) - 35 constituents

MSCI Malaysia Small Cap Index (USD) - 63 constituents

Example of MSCI Malaysia Index (USD) - updated on May 2022

MR D.I.Y

F&N

WPRTS

Conclusion

The MSCI index classifies the market from low-risk market to high-risk market which is Developed Markets > Emerging Markets > Frontier Markets. The country involved in a lower-risk market will easier to attract international investors such as fund managers to enter the country’s market as the MSCI index is international, therefore many investors use it as an investment benchmark. When many investors are entering the country's market, the demand (investors wish to buy the share) will increase; while the supply (total share outstanding in the market) remains the same. As a result, the share price will easily go up according to the basics of the economy’s theory where the demand increases while the supply remains unchanged will cause the price to go up.

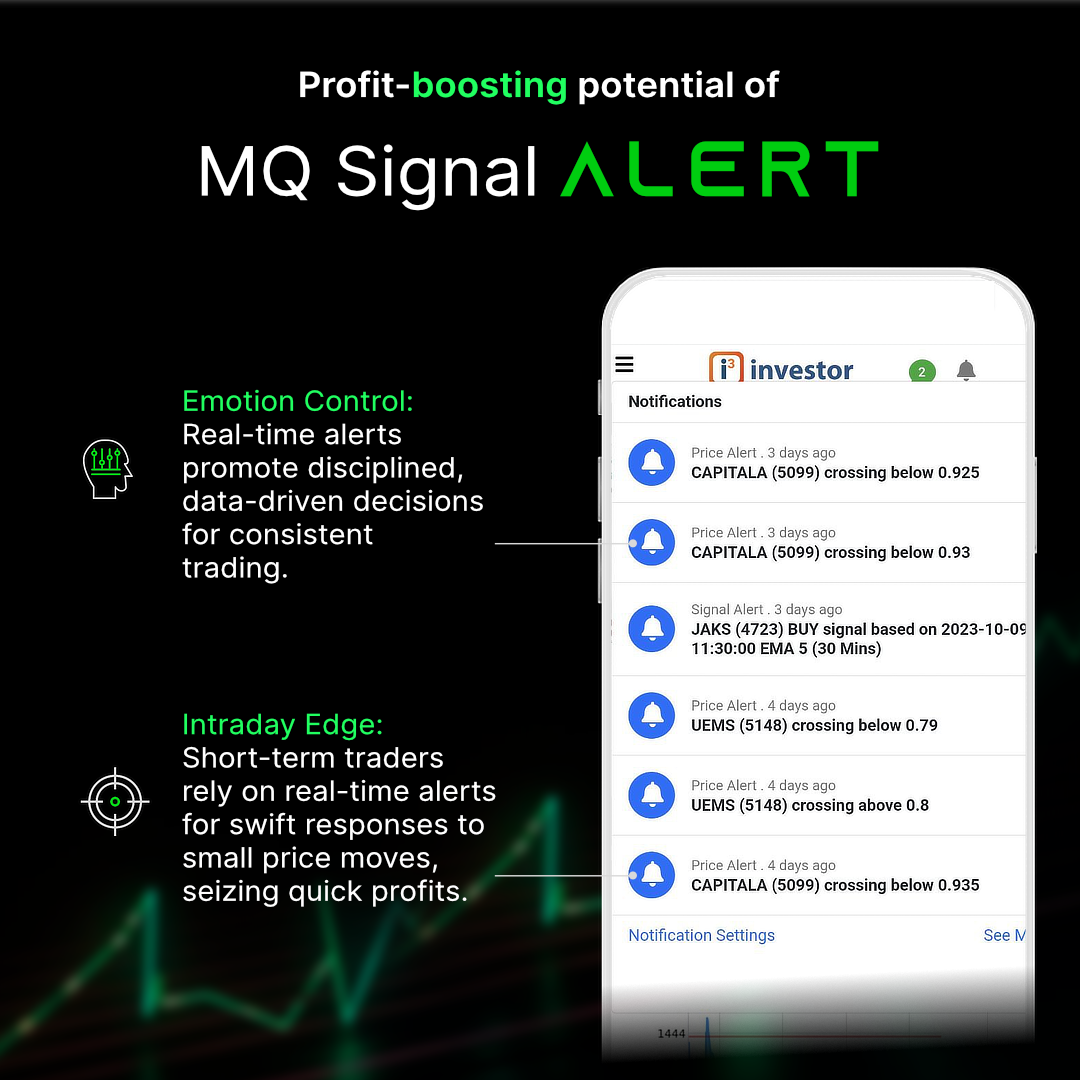

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram: https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on MQ Expresso

Don't let your busy lifestyle be a barrier to successful trading

Created by MQTrader Jesse | Oct 26, 2023

The Revival of Construction and Real Estate: Government Plans to Revitalize the Economy

Created by MQTrader Jesse | Oct 12, 2023

Discussions

Be the first to like this. Showing 0 of 0 comments