IPO - SkyWorld Development Berhad (Part 2)

MQTrader Jesse

Publish date: Thu, 22 Jun 2023, 02:56 PM

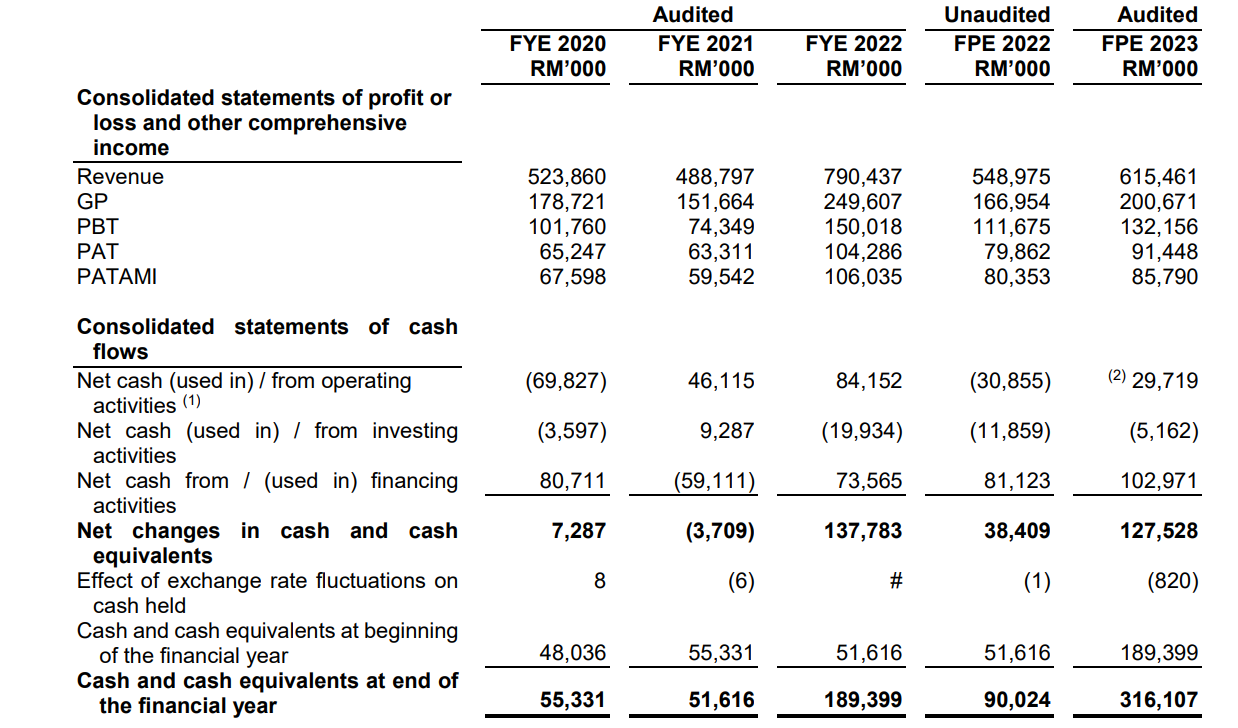

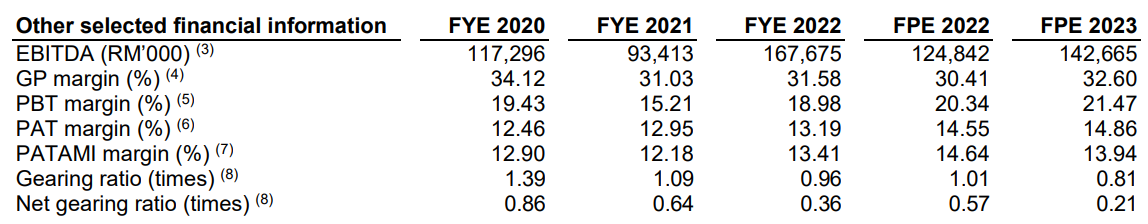

Financial Highlights

The following table sets out a summary of the consolidated financial information of the Group for the Financial Years Under Review.

- The revenue increased from RM 523 mil (FYE 2020) to RM 790 mil (FYE 2022), this shows that the company is expanding its market.

- The gross profit margin decreased from 34.12% (FYE 2020) to 31.58% (FYE 2022). Although the company's market share is expanding, the increase in costs is greater than the increase in revenue. (Generally, a GP margin of 20% is considered high/ good).

- PAT margin increased from 12.46% (FYE 2020) to 13.19% (FYE 2022).

- The gearing ratio is 0.61 times (after IPO). Although a construction company typically requires significant capital to acquire land and expand its business, we still need to investigate its cash flow, current ratio, and available cash on a quarterly basis. (A good gearing ratio should be between 0.25 – 0.5).

Major customer and Supplier

Major Customers

The company’s business is not dependent on any single major customer as each of the top 5 customers accounted for less than 10.00% of its total revenue for the Financial Years Under Review and FPE 2023. The customers are primarily individuals or companies who generally purchase one or a number of units of the property developments, this is due to the nature of the business in property development. The customers also include financial institution, Maybank Islamic Berhad for the sales of properties under the RTO financing scheme.

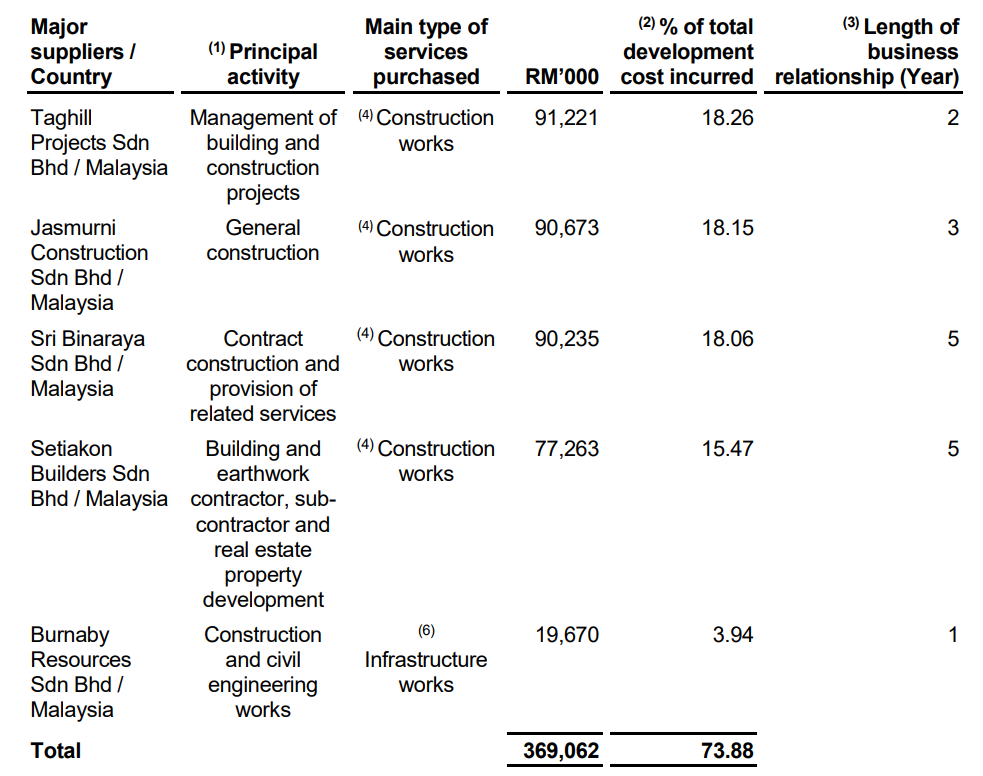

Major Suppliers

The top 5 major suppliers for FYE 2022 are as follows:

According to the details, the top 5 suppliers account for 73.88% of the company's total suppliers. However, the company has disclosed that they have not entered into any long-term agreements with these contractors. Instead, each contract is based on a specific project or development. The company maintains back-to-back arrangements with the contractors, which include provisions for the completion date and rectification of defects during the defect liability period stipulated in the contract. As a result, the company is not reliant on any of its major suppliers.

Industry Overview

Performance of the Economy and property development industry

- In 2023, the property development industry in Malaysia is expected to grow due to a stronger housing market and increased rental activities, supported by government initiatives like the Malaysia Premium Visa Programme and the Keluarga Malaysia Home Ownership Initiative (i-MILIKI).

- However, in Q1 2023, there was a decline in both volume and value of residential property transactions in FT KL compared to Q1 2022, attributed to weakening consumer sentiment.

- In 2022, there was an overall increase in the volume of residential property transactions, with high-rise and landed properties experiencing growth. The commercial property sector in FT KL saw an increase in transaction volume in 2022, mainly driven by serviced apartments.

- In Q1 2023, there was a further increase in commercial property transaction volume, but a decline in transaction value. Properties above RM500,000 represented a significant portion of commercial property transactions in both 2022 and Q1 2023.

- The volume of high-rise and landed commercial property transactions in FT KL grew in 2022, attributed to the gradual recovery from the COVID-19 pandemic.

- However, in Q1 2023, the volume of high-rise commercial property transactions increased, while landed commercial property transactions declined.

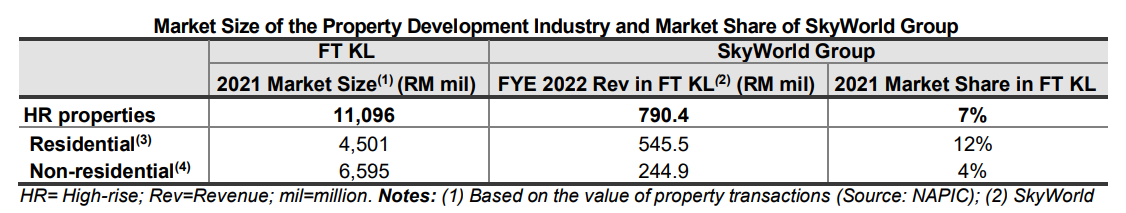

Market Size and Share

Industry Consideration Factors

The property development industry in Malaysia is influenced by various factors such as the country's economic growth, socio-economic conditions, interest rates, lending policies, and government initiatives. The increase in the Overnight Policy Rate (OPR) by Bank Negara Malaysia (BNM) can have an impact on the industry. The Malaysian government has introduced economic stimulus packages and allocated significant funds to drive economic recovery, including measures to promote home ownership.

The real GDP of Malaysia and the property development industry experienced growth in 2022 and Q1 2023 compared to previous years. The government's Budget 2022 included initiatives to enhance home affordability, such as tax waivers, housing projects for low-income groups, and housing credit guarantees. Affordable housing programs like Residensi Wilayah and Residensi Prihatin continue to provide opportunities for the property development industry.

The Ministry of Housing and Local Government introduced programs like HOPE, i-Biaya, and i-MILIKI to further promote homeownership. Stamp duty exemptions and increased allocations for housing projects and housing credit guarantees are part of the Budget 2023 initiatives. However, the overhang of high-rise residential properties in FT KL may temporarily impact the demand for similar new properties.

Overall, the property development industry in Malaysia is influenced by economic factors, government initiatives, affordability concerns, and ongoing efforts to address housing needs for different income groups.

Source: Vital Factor Consulting

Business strategies and future plans for SKYWORLD DEVELOPMENT BERHAD.

The overall strategy is to leverage its strengths as an urban property developer with a view to expanding the business. A summary of the strategies and plans are set out below:

- The company plans to replenish the land bank to seek potential land for the acquisition in Klang Valley including FT Kuala Lumpur and Selangor.

- The company plans to launch 10 new developments with a total GDV of RM 4.08 billion.

- The company plans to develop Build-to-Rent properties including commercial square and co-living space in FT Kuala Lumpur.

- The company plans to expand the urban property development business model into Ho Chi Minh City, Vietnam.

MQ Trader View

Opportunities

- The company has experience in the sector with a proven track record, supported by the completion of 7 developments in FT Kuala Lumpur. Since the commencement of the business in 2014, the company has a proven track record of 9 years in property development and this is supported by the completion of 7 property developments including residential, commercial and affordable properties with a total GDV of RM3.05 billion.

- The company has a sizeable land bank of 55.66 acres to sustain its property development business. The company has developed 43.20 acres of land (comprising land used for completed and ongoing developments). As at the LPD, they have a total land bank of approximately 55.66 acres in various locations including Setapak, Setiawangsa, Bukit Jalil, Taman Desa and Cheras which are reserved for future developments.

Risk

- The company may be exposed to liquidity risk and interest rate risk. The company may be exposed to liquidity risk that arises principally from its borrowings and timing of cost incurred and collections from the purchasers of the properties.

- The company's financial performance may be adversely affected by adverse land issues. As an urban property developer, the company may be exposed to the risk of acquiring land with adverse topography, encumbrances or land that may not be feasible for development.

Click here to refer the IPO - SkyWorld Development Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)