IPO - SkyWorld Development Berhad (Part 1)

MQTrader Jesse

Publish date: Thu, 22 Jun 2023, 02:56 PM

Company Background

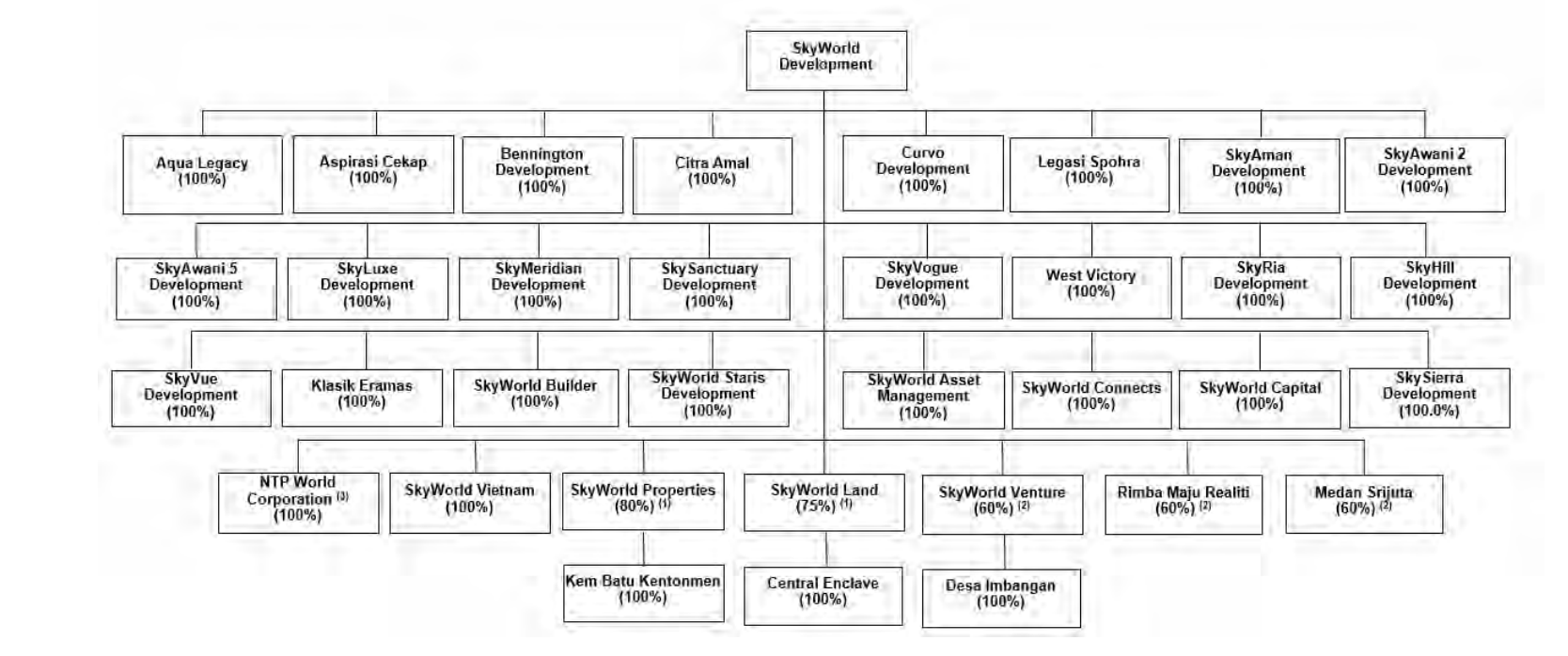

The Company was incorporated in Malaysia under the CA 1965 as a private limited company on 22 November 2006 and is deemed registered under the Act, under the name of Varsity Networks Sdn Bhd. In February 2008, the company changed its name to NTP World Development Sdn Bhd, and on 5 December 2014, the company changed the name to SkyWorld Development Sdn Bhd. The company subsequently converted to a public limited company on 20 September 2022 and assumed the present name of SkyWorld Development Berhad to facilitate the Listing.

The company's principal activity is in investment holding, provision of management services to the Subsidiaries, and property development.

Use of proceeds

- Acquisition of land for development - 60.10% (within 36 months)

- Working capital for project development - 21.15% (within 24 months)

- Repayment of bank borrowings - 12.02% (within 12 months)

- Estimated listing expenses - 6.73% (Immediate)

Acquisition of land for development - 60.10% (within 36 months)

The company has allocated RM100.00 million representing 60.10% of the gross proceeds from the Public Issue for the acquisition of a landbank within the vicinity of the existing landbank in the Klang Valley including FT Kuala Lumpur and the state of Selangor for its future development. As they are an urban property developer, they continuously lookout for suitable landbanks to acquire. This is in line with its future plans of replenishing the landbank for future development to maintain sustainable growth in its business.

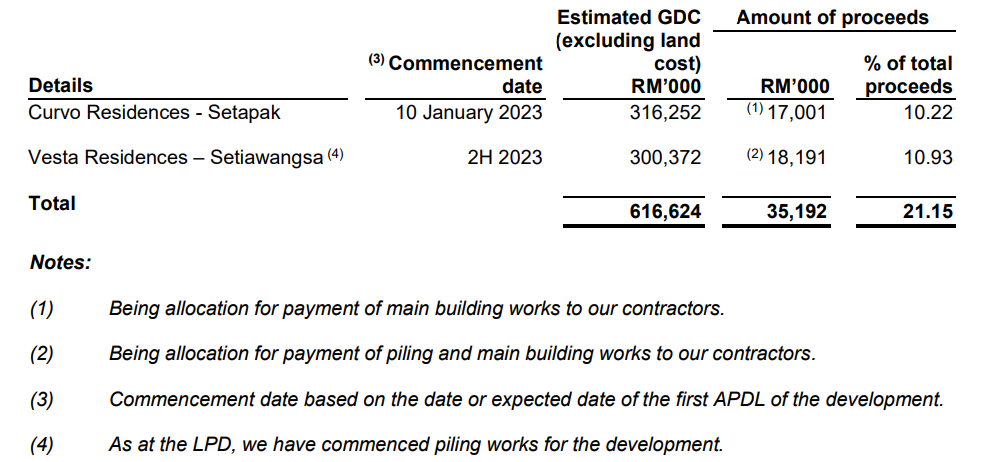

Working capital for project development - 21.15% (within 24 months)

The company has allocated RM35.19 million representing 21.15% of the gross proceeds from the Public Issue to meet the working capital requirements, which include payment of piling and main building works to the contractors for the ongoing project development, namely Curvo Residences – Setapak and planned project development Vesta Residences – Setiawangsa. The proposed allocation of the proceeds for the said projects are set out below:

Repayment of bank borrowings - 12.02% (within 12 months)

The company has allocated RM20.00 million representing 12.02% of the gross proceeds from the Public Issue to partially repay its structure commodity financing-i facility of up to RM50.00 million from Al Rajhi Banking & Investment Corporation (Malaysia) Bhd which was drawn down to finance its working capital requirements on the respective maturity dates. As at the LPD, the outstanding amount for this facility amounts to RM50.00 million (to be payable with maturity dates between 23 May 2023 to 18 November 2023).

The allocated RM20.0 million gross proceeds from the Public Issue will be utilised to partially repay the aforementioned facility on the respective maturity dates. The company has decided to partially repay the aforementioned facility as it allows them to continue drawing down further financing to support its working capital requirements.

The estimated annual interest savings from the repayment of the bank borrowings is

approximately RM1.12 million based on the interest rate of 5.58% per annum as at the LPD. However, the actual interest savings may vary depending on the prevailing interest rates. This repayment is expected to improve our Group’s current ratio, pare down the Group’s current liabilities and maintain the cash flow for working capital.

The repayment of the bank borrowings will reduce the pro forma gearing level from 0.63 times (after the Public Issue and Offer for Sale but prior to utilisation of proceeds) to 0.61 times (after the utilisation of proceeds)

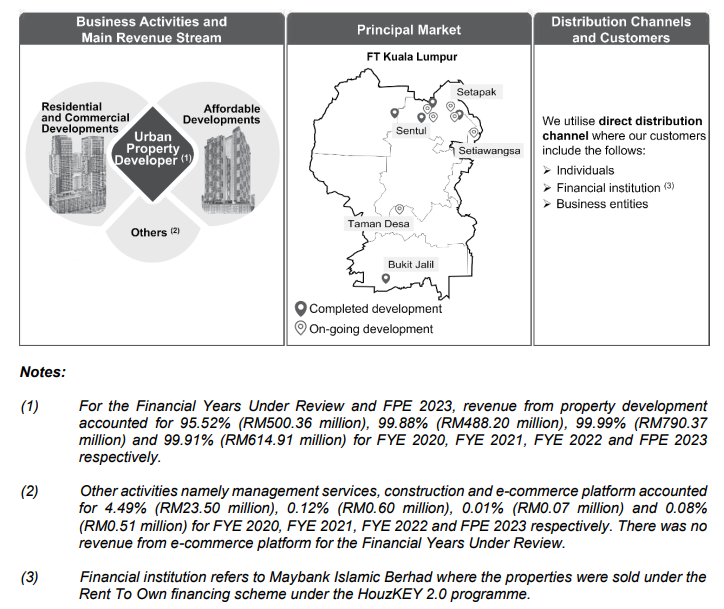

Business model

The business mode is as follows

Property development

The company is an urban property developer focusing on the development of high-rise residential and commercial as well as affordable properties.

Others

(I) Management service

A small proportion of the revenue is derived from management services which the company undertakes for its own completed developments for a maximum of 2 years. The responsibilities under management services involve the supervision of third-party property management companies during their course of managing the properties.

(II) Construction

The Group is not principally involved in the construction business. In FYE 2020, the company recorded revenue from the design and build of SkyArena Sports Complex in Setapak pursuant to the Land Swap Agreement.

(III) E-commerce platform

In March 2022, the company launched an additional module, Solution Plus (Solution+) within its SW Connects mobile application. Solution+ is an e-commerce platform that connects SkyWorld homeowners with third-party product and service providers such as interior design, renovations, furniture, home appliances, telecommunications subscription services, home movers, and other services. The Solution+ platform is designed with a payment gateway where SkyWorld homeowners can purchase products and services and make payment on the Solution+ platform.

Click here to continue the IPO - SkyWorld Development Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)