IPO - DayThree Digital Berhad (Part 1)

MQTrader Jesse

Publish date: Fri, 23 Jun 2023, 11:35 AM

Company Background

The Company was incorporated in Malaysia under the Act on 11 August 2022 as a private limited company under the name of Daythree Digital Sdn Bhd. On 28 September 2022, it was converted into a public limited company and changed to its present name.

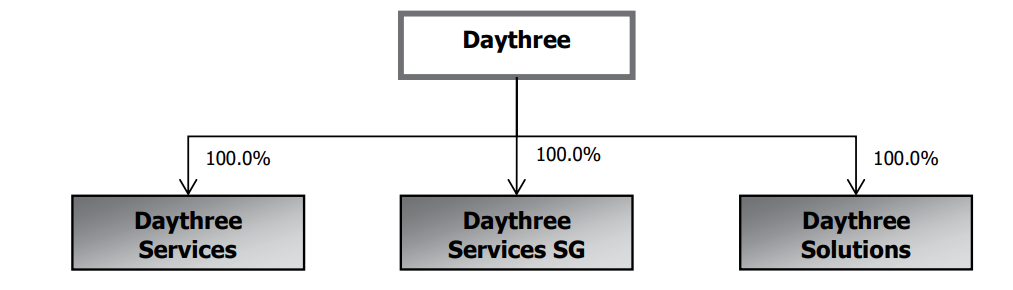

The company is an investment holding company. The Group structure at LPD is as follows:

Through the subsidiaries, namely Daythree Services, Daythere Services SG and Daythree Solutions, the company is a GBS service provider focusing on CX lifecycle management services enabled by its in-house developed digital tools.

Use of proceeds

- Office expansion - 21.40% (within 24 months)

- Recruit industry experts to capture growth opportunities - 9.10% (within 24 months)

- Capital expenditure in networking infrastructure, IT hardware and software - 9.10% (within 12 months)

- Branding, marketing and promotional activities - 4.5% (within 12 months)

- Working capital - 44.40% (within 12 months)

- Estimated listing expenses - 11.50% (within 1 month)

Office expansion - 21.40% (within 24 months)

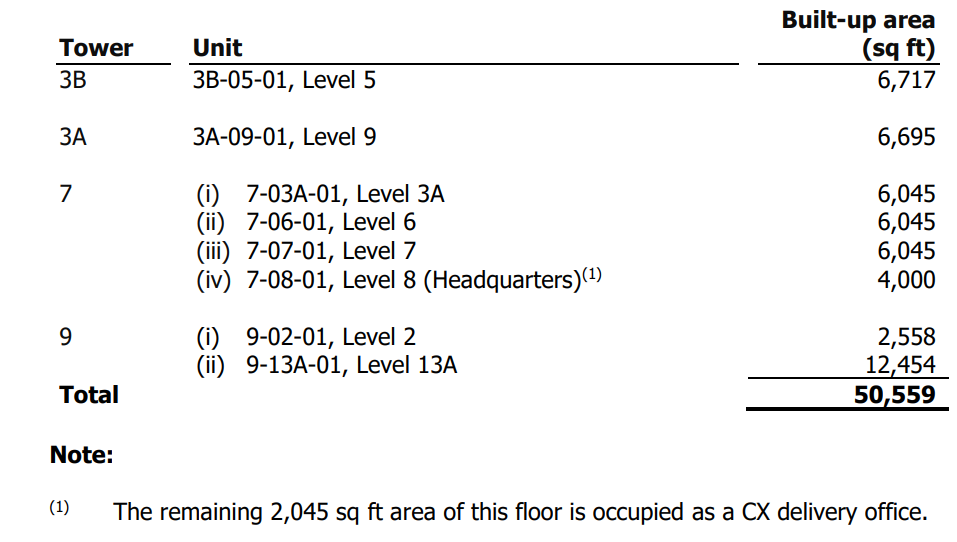

The company occupies the following units in UOA Business Park:

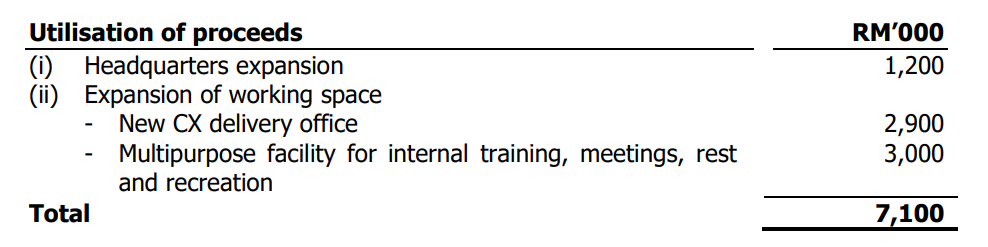

The company intends to allocate RM7.1 million from the proceeds of the Public Issue for the expansion of its headquarters, additional working space in UOA Business Park for internal use as a training ground and for employee wellbeing, and additional CX delivery offices, in the following manner:

Recruit industry experts to capture growth opportunities - 9.10% (within 24 months)

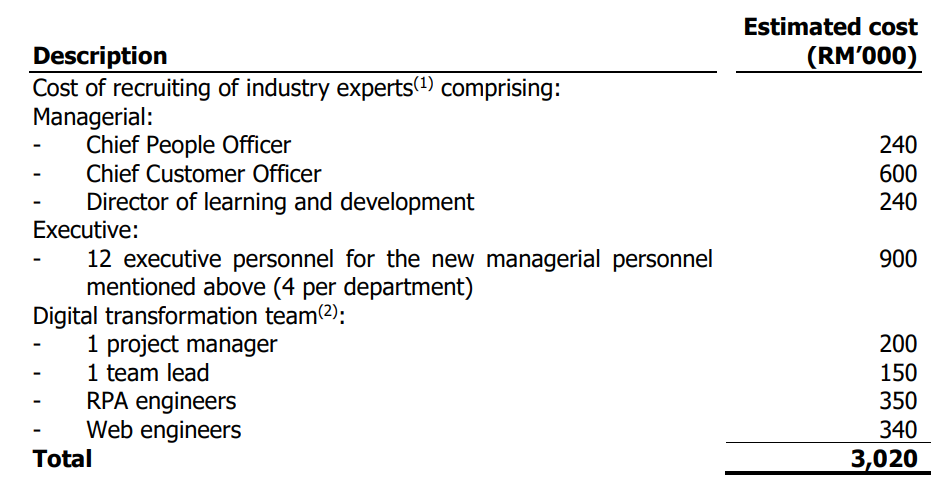

The Group believes that the quality of the employee is a key differentiator in securing and retaining business, as well as in delivering superior CX. Strengthening the workforce is fundamental for continued business growth and as such, the company intends to use RM3.0 million to hire a team of industry experts comprising the expansion of the management team with a Chief People Officer, Director of learning and development, and Chief Customer Officer, together with 12 executive personnel to support this expanded management team.

This is to further develop our company’s talent and corporate culture, as well as better focus on improving CX, in a bid to get ahead of the competition. Additionally, the company intends to establish a digital transformation team whose role is to continuously enhance the in-house developed digital tools of the Group.

The breakdown of the RM3.0 million allocated is set out in the table below:

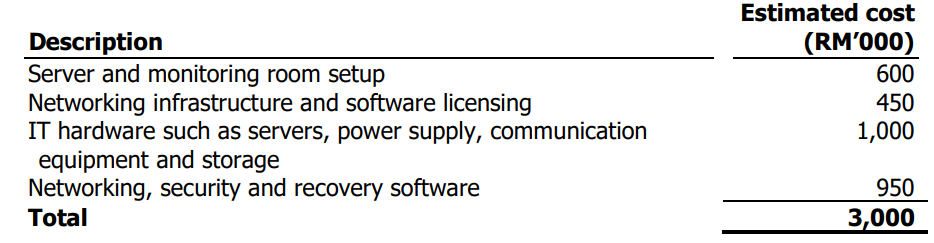

Capital expenditure in networking infrastructure, IT hardware and software - 9.10% (within 12 months)

The capital expenditure on networking infrastructure, IT hardware and software will serve as backup and disaster recovery and for the further development of the Group’s proprietary range of in-house developed digital tools which will involve system build, design and development, integration of hardware and software. The additional equipment for backup and disaster recovery will be installed at the existing offices in UOA Business Park. The Group’s network monitoring is presently conducted at the current offices in UOA Business Park.

The company also intends to build a network monitoring centre to detect network anomalies and address any cyber-attacks and/or network disruptions and thus ensuring operational continuity. There will not be a need for additional renovation works to accommodate this new equipment as the new network monitoring centre is expected to be located in the Group’s current offices. With the growth in business, the new set of servers will better manage the load of the call process and network performance.

The RM3.0 million is allocated in the following manner:

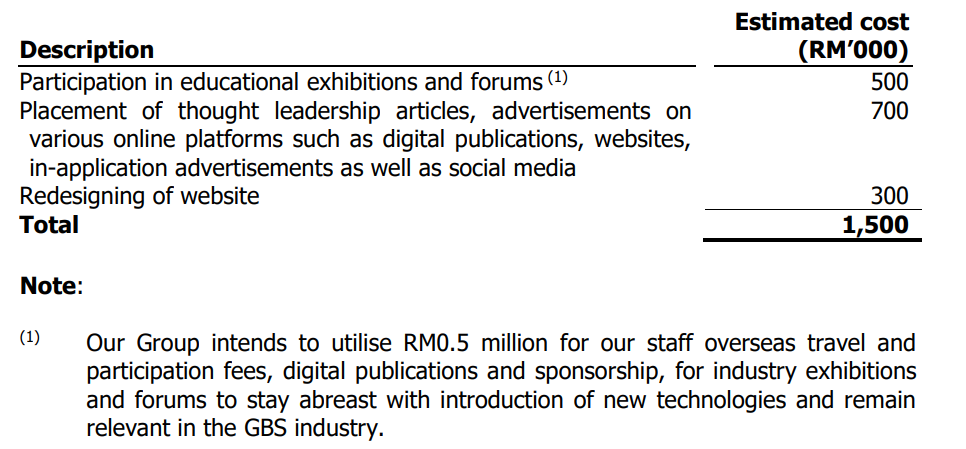

Branding, marketing and promotional activities - 4.5% (within 12 months)

The company aims to increase its market visibility and brand recognition by participating in more educational exhibitions and forums, and placing of thought leadership articles, and advertisements through various platforms such as digital publications, websites, inapplication advertisements and social media platforms as well as redesign the Group’s website. Historically, the company has incurred minimal costs for branding, marketing and promotional activities, mainly for participation at promotional events or activities organised by academic institutions and industry associations such as PIKOM.

To strengthen the marketing and sales activities, the company intends to utilise RM1.5 million of the proceeds from the Public Issue over the next 12 months in the following manner:

Working capital - 44.40% (within 12 months)

The company expect the working capital requirements to increase in tandem with the expected growth in scale of its operations. As such, the company has allocated approximately RM14.7 million from the IPO proceeds towards expanded working capital requirements for 12 months, in the following manner:

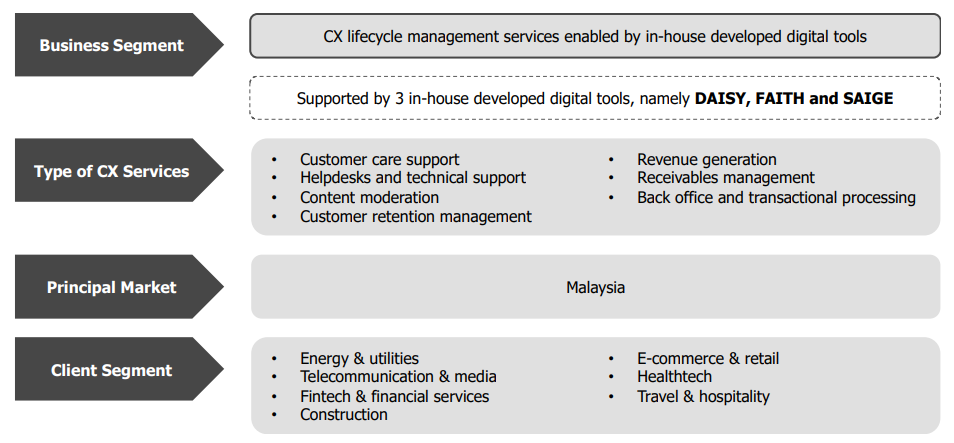

Business model

The company is a GBS service provider focusing on CX lifecycle management services enabled by the in-house developed digital tools. GBS is the evolution of the shared services model and service outsourcing model. The shared services model and service outsourcing model mainly deliver traditional transaction functions (such as payroll and accounting) that focus on process efficiency improvement and cost reduction, whereas GBS provides services beyond traditional transaction functions and has a wider scope and expertise to deliver high-value generating functions such as consulting and business analytics

The CX lifecycle is a series of steps that a Customer completes throughout the process of being a customer. The company depicts it in 4 stages: acquisition, engagement, retention, and feedback. The Group offers a range of services at all stages of the CX lifecycle, as a GBS service provider.

The company provides its CX lifecycle management services to Clients across diverse industries such as energy & utilities, telecommunications & media, fintech & financial services, construction, ecommerce & retail, healthtech and travel & hospitality.

The Group’s business segment is summarised in the following diagram:

CX lifecycle management services

- Customer care support

- Helpdesk and technical support

- Content moderation

- Customer retention management

- Revenue generation

- Receivable management

- Back office and transactional processing

In-house developed digital tools

The company currently own and utilise 3 in-house developed digital tools, namely, DAISY, SAIGE and FAITH to facilitate and support its CX operations.

- DAISY is an AI associate assistant tool with RPA that enables its CX executives to handle Customer interactions more efficiently across all channels of communication.

- SAIGE is an integrated data analytics and reporting platform, embedded with AI digital assistant tool, that gathers data from every Customer’s interactions and captures into one analytics platform for analysis, interpretation and recommendations for improvement

- FAITH is an employee engagement web-based application that streamlines scheduling, payroll, communication, and performance feedback regardless of an employees are working from office or remotely.

Click here to continue the IPO - DayThree Digital Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

i3messanger: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)

Winer21

New digital system will be good

2023-06-30 19:06