IPO -Critical Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Thu, 30 Nov 2023, 11:47 AM

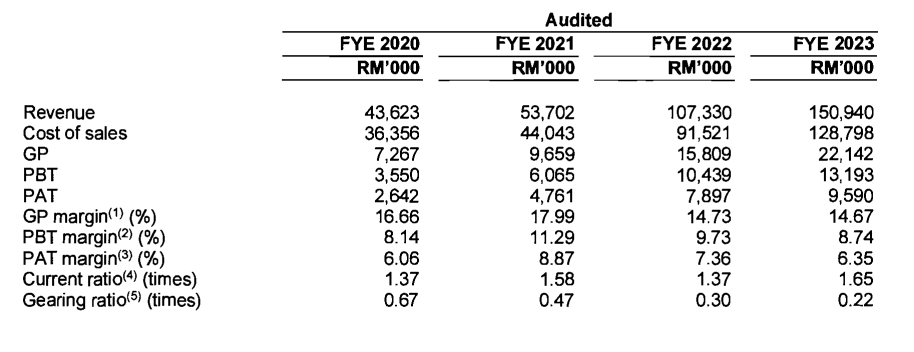

Financial Highlights

The key financial highlights of the historical audited combined statements of comprehensive income for the FYE Under Review are set out below:

- The revenue increased from RM 43 million (FYE 2020) to RM 150 million (FYE 2023), indicating that the company's market share in its sector is continuing to grow.

- The gross profit margin declined from 16.66% in FYE 2020 to 14.67% in FYE 2023. Despite the company's ongoing expansion, its profitability has not improved. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin reached its highest point at 8.87% in FYE 2021 and its lowest at 6.06% in FYE 2020. Over the span of 4 years, the average PAT margin has been around 7.16%.

- The current gearing ratio stands at 0.22. Looking at historical records, the company's gearing ratio has been decreasing year by year. This indicates that the company strives to enhance its liquidity and mitigate potential financial risks. (A good gearing ratio should be between 0.25 – 0.5).

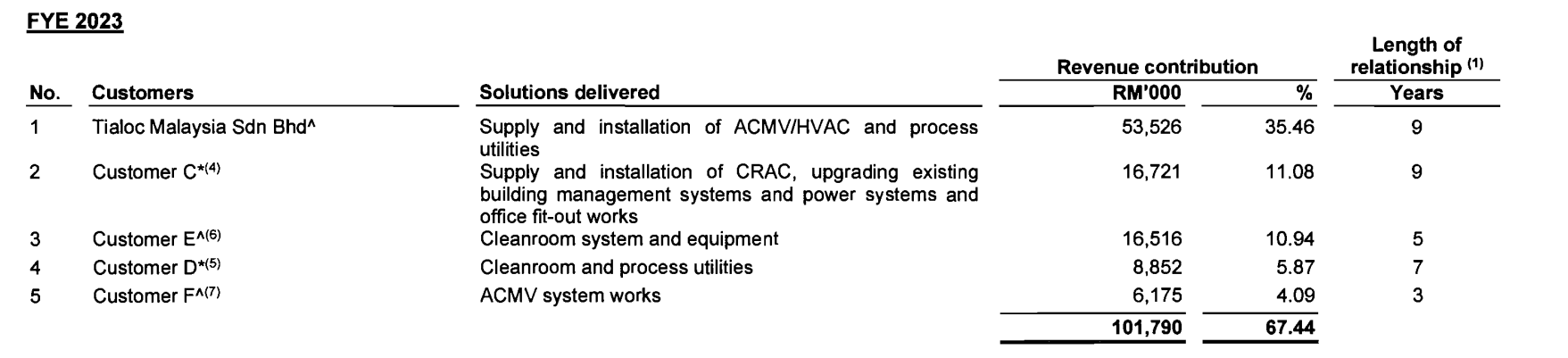

Major customers and supplier

Major Clients

The top 5 major customers for the Period Under Review are as stated in the table below.

According to the table, the top 5 customers contribute 67.44% of the company's revenue, with the top 1 contributing over 1/3 of the total revenue. This shows that the company is heavily reliant on its major client and is exposed to high-concentration customer risk.

Major Suppliers

The top 5 major suppliers for the Period Under Review are as stated in the table below.

The total purchases from the top 5 suppliers account for 36.27%. Despite this, the management has mentioned that they are not dependent on these specific suppliers. They've pointed out the presence of other suppliers and subcontractors in the market offering similar quality products and services at comparable prices.

Industry Overview

According to the research report from Providence Strategic Partners, MEP engineering in Malaysia, measured in terms of the value of MEP engineering works done, increased from RM3.8 billion in 2018 to RM6.6 billion in 2022 at a compound annual growth rate ("CAGR") of 14.8%.

MEP engineering is specialised construction work that is performed during the erection, reconstruction, renovation, retrofit, or upgrade of buildings or structures, and entails the design, installation, commissioning and maintenance of MEP systems such as heating, ventilation and air conditioning systems; water supply and sanitation; fire protection systems; escalators and lifts, electrical systems such as electricity transmission and distribution systems; communications and information technology networks; lighting systems; security and alarm systems; and process utilities such as steam, industrial gasses and corresponding infrastructure.

PROVIDENCE projects the value of MEP engineering to rise from RM6.6 billion in 2022 to RM10.1 billion in 2025 at a CAGR of 15.2%. The growth in MEP engineering will be supported by the:

- growth of end-user industries which drives demand for MEP engineering;

- foreign investment and domestic investment growth which support investments in MEP engineering;

- increased outsourcing and relocation of electrical and electronics ("E&E") manufacturing activities to Southeast Asia;

- growth prospects of the semiconductor and electronics ecosystem in Pulau Pinang; and

- economic and property growth that creates demand for MEP engineering.

Key Growth Drivers

- Growth in end-user industries drives demand for MEP engineering

- Semiconductor and electronics industry

- Telecommunications industry

- Data centre industry

- The solar power industry

- Foreign investment and domestic investment growth support investments in MEP engineering.

- Increased outsourcing and relocation of E&E manufacturing activities to Southeast Asia.

- Growth prospects of the semiconductor and electronics ecosystem in Pulau Pinang support the demand for MEP engineering.

- Economic and property growth creates demand for MEP engineering

Industry Challenges

MEP engineering activities are exposed to risks such as project delays, poor quality of work and on-site accidents that have consequences on the industry and its stakeholders. These risks lead to customer and public complaints and loss of reputation and revenue. Project delays typically lead to increased overheads and cost overruns. Increased overheads affect the ability of industry players to complete projects on time due to financial shortages or budget overruns, and loss of opportunity if resources have been committed to a delayed project. In 2020, the construction industry faced the COVID-19 pandemic which resulted in a reduced work capacity to comply with containment measures, labour shortages due to international border closures, supply chain disruptions and site shutdowns. This resulted in many industry players experiencing cash flow issues, as well as being exposed to liquidated damages and termination.

Source: Providence Strategic Partners

Future plans and strategies for CRITICAL HOLDINGS BERHAD.

- The company intends to expand the scale of operations and undertake more MEP Engineering Solutions projects in Malaysia.

- The company plans to expand its workforce by recruiting additional skilled professionals and labour, as well as acquiring engineering tools, software and motor vehicles to support the business expansion.

MQ Trader View

Opportunities

- The management has planned to expand the company. From financial data, it's evident that the company's revenue has been increasing year by year, indicating its ongoing growth potential. To further expand its market share, the management is actively implementing an expansion plan, which includes acquiring new offices, increasing team size, and purchasing new equipment, among other initiatives.

- The company's gearing ratio demonstrates improvement. From the report, we can see that the primary reason for the decrease in the Gearing Ratio is the increase in total equity. Despite the increase in total equity, the company hasn't blindly borrowed excessively. Instead, it has maintained debt at a healthy level before planning expansion.

Risk

- The company is exposed to high customer concentration risk. The company's revenue overly relies on a single major client, which would directly impact the company's financial data if this client terminates the partnership.

- The company's profitability is limited. Despite continuous revenue growth, the rise in costs has led to a decline in the GP margin, indicating that the management has not been able to effectively control expenses.

Click here to refer the IPO - Critical Holdings Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)