IPO - Critical Holdings Berhad (Part 1)

MQTrader Jesse

Publish date: Thu, 30 Nov 2023, 11:47 AM

Company Background

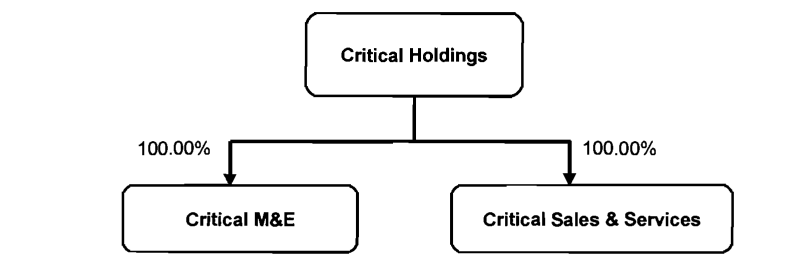

The Company was incorporated in Malaysia under the Act on 26 August 2022 as a private limited company under the name of Critical Holdings Sdn Bhd. The company subsequently converted the status of the Company to a public limited company on 22 September 2022 for its Listing.

The Company is an investment holding company and the principal activities of its Subsidiaries are design and build, project management, supply, installation, testing, commissioning, maintenance and services support of MEP systems and equipment for critical facilities.

The corporate group structure after the Acquisitions and upon Listing is as follows:

Use of proceeds

- Business expansion - 46.50% (within 24 months)

- Acquisition of the new regional office - 23.06% (within 24 months)

- Expansion of sales and technical team - 17.29% (within 24 months)

- Capital expenditure - 6.15% (within 24 months)

- Working capital - 38.13% (within 12 months)

- Estimated listing expenses - 15.37% (Within 3 months)

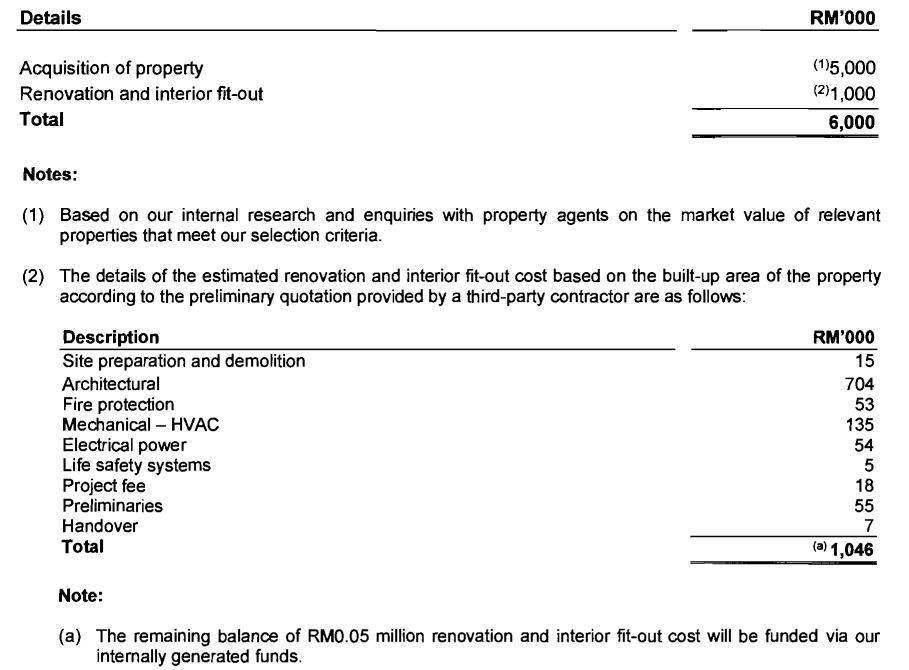

Acquisition of the new regional office - 23.06% (within 24 months)

The company intends to allocate a total of RM6.00 million or 23.06% of its IPO proceeds raised from the Public Issue, for the acquisition and the setting-up of a new regional office in the central region of Peninsular Malaysia, specifically in Klang Valley. The company expects the plan to be implemented within 24 months from the date of Listing. The acquisition of the new regional office is in line with the business plan to expand and tap into the growth opportunities in the central and southern regions of Peninsular Malaysia.

Details of the allocated proceeds for the new regional office are as follows:

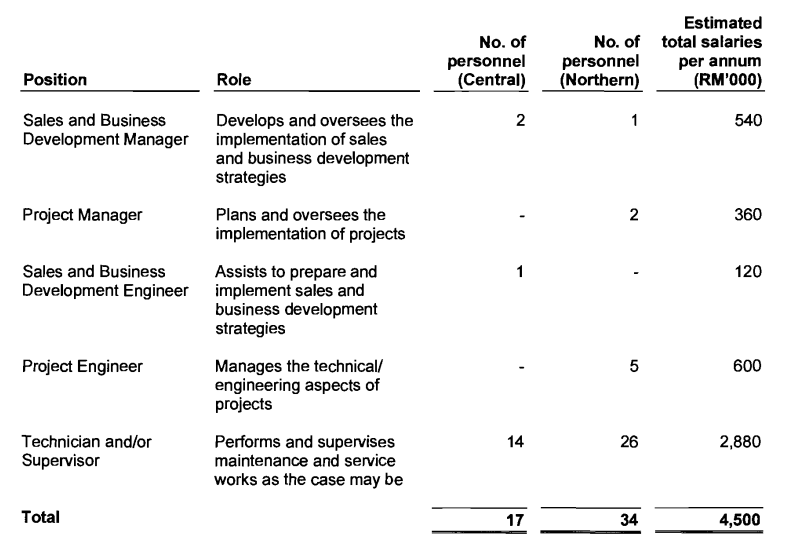

Expansion of sales and technical team - 17.29% (within 24 months)

The company intends to allocate a total of RM4.50 million or 17.29% of the IPO proceeds raised from the Public Issue to expand its sales and technical team by recruiting additional personnel to support the growth of the existing business operations and the expected growth in the business in tandem with its plan to expand into the central and southern regions of Peninsular Malaysia and the company expects the plan to be implemented within 24 months from the date of Listing.

The company plans to recruit a total of 51 new personnel to be stationed in the northern region (i.e. Pulau Pinang) and the central region (i.e. Selangor Service and Support Office as well as the new regional office) of Peninsular Malaysia. Details of the allocation are as follows:

The expansion of the sales and technical team will enhance its in-house capability and capacity which would allow the company to undertake more jobs concurrently and address any issue of manpower shortages. For instance, the company currently engages subcontractors on a project basis to carry out certain maintenance and service works as the majority of its technical personnel has been deployed for the implementation of the MEP Engineering Solutions business segment. Further, the company's capacity to take up any new MEP Engineering Solutions projects also largely depends on the availability of the technical personnel for project deployment.

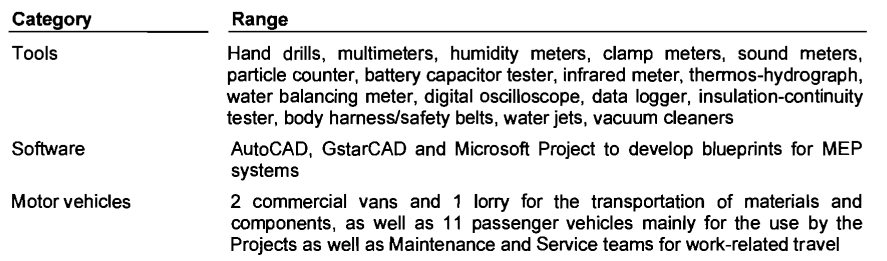

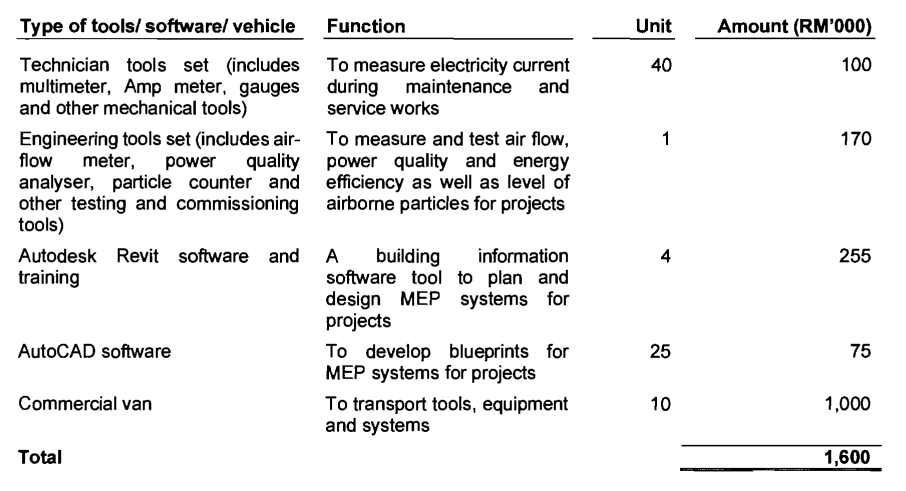

Capital expenditure - 6.15% (within 24 months)

The company owns the following:

The company intends to allocate a total of RM1.60 million or 6.15% of its proceeds raised from the Public Issue for the purchase of new technician tools, engineering tools, motor vehicles and software to support the business expansion and replacement of fully depreciated engineering tools and the company expects the plan to be implemented within 24 months from the date of Listing.

All the following technician tools, engineering tools, motor vehicles and software will be purchased from local suppliers are as follows:

Working capital - 38.13% (within 12 months)

The company intends to allocate RM9.92 million or 38.13% of its proceeds raised from the Public Issue to supplement the working capital requirements. The Group's working capital requirements are expected to increase in line with the growth in the business operations.

The allocation of proceeds raised from the Public Issue for its working capital will improve the liquidity and cash flow position, which would place the company in a better position to expand the MEP Engineering Solutions projects portfolio and allow the company to undertake more MEP Engineering Solutions projects concurrently. The breakdown of the allocation is as follows:

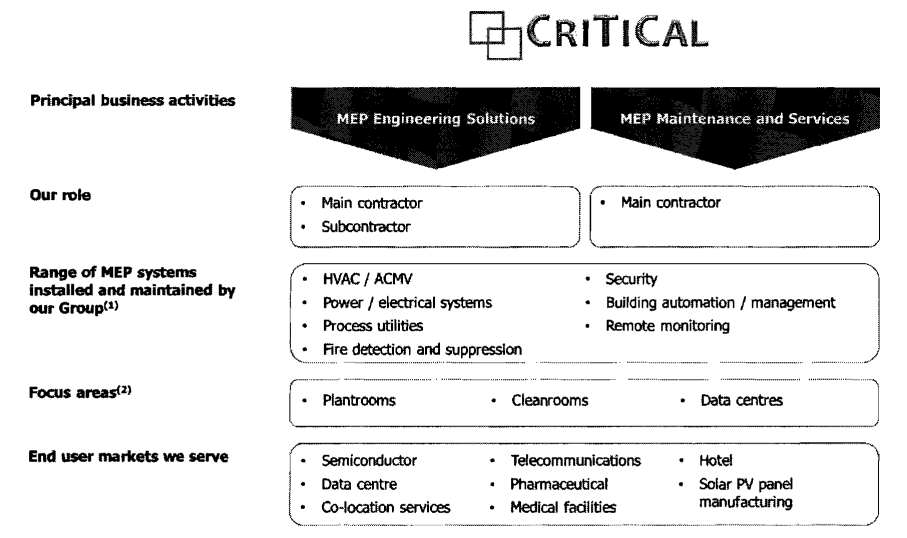

Business model

The Group is a MEP design and engineering solutions firm and the principal business activities relating to MEP for critical facilities comprise:

1. MEP Engineering Solutions

The company undertakes design and build, project management, supply, installation, testing and commissioning of MEP systems for newly built critical facilities and redevelopment, refurbishment and upgrading of existing critical facilities.

2. MEP Maintenance and Services

The company undertakes maintenance and service support, including preventive and scheduled maintenance as well as breakdown service and repair, to ensure proper functioning of the existing MEP equipment and systems.

The company’s MEP Engineering Solutions is an integral component for facilities and buildings with critical functions that require resilient infrastructure to ensure uninterrupted essential services for businesses, operations and systems to function efficiently, effectively and continuously. Critical facilities include data centres, cleanrooms, manufacturing floors, plant rooms, laboratories, hospitals and healthcare facilities as well as selected government buildings.

The company has a track record of delivering MEP Engineering Solutions for data centres, cleanrooms and plant rooms. The end user markets its serve are the semiconductor, pharmaceutical, and solar photovoltaic ("PV") panel manufacturing sectors as well as data centre, co-location services, telecommunications, hotel and medical facilities sectors.

The business model is as follows:

Click here to continue the IPO - Critical Holdings Berhad (Part 2)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)