IPO - TSA Group Berhad (Part 2)

MQTrader Jesse

Publish date: Wed, 03 Jan 2024, 09:45 AM

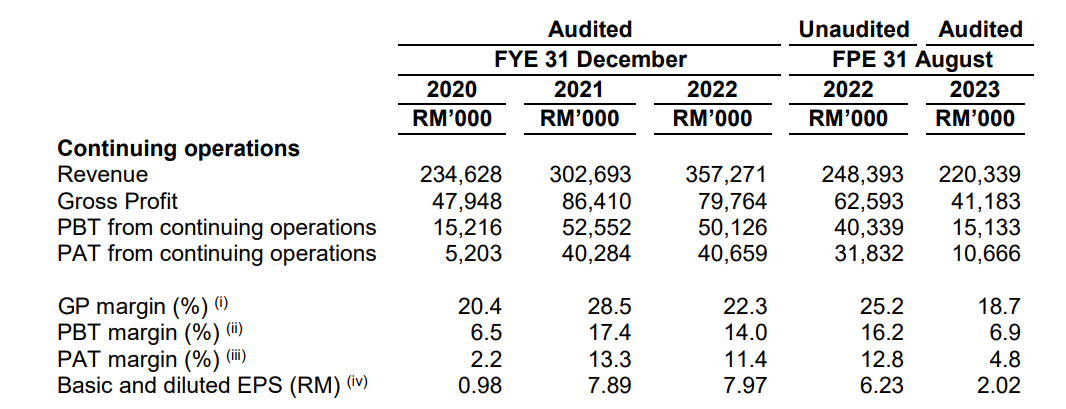

Financial Highlights

The following table sets out a summary of our combined and consolidated statements of profit or loss and other comprehensive income for the Financial Years and Period Under Review which have been extracted from the Accountant’s Report:

- The revenue increased from RM 234 million in FYE 2020 to RM 357 million in FYE 2022. This shows that the company is still growing due to an increase in market share.

- The gross profit margin increased from 20.4% in FYE 2020 to 28.5% in FYE 2021, but it declined to 22.3% in FYE 2022. Although the GP margin has varied considerably, it has consistently remained above 20%. The decrease in the GP margin in FYE 2022 is mainly due to the increasing cost of stainless steel materials. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin reached its highest point at 13.3% in FYE 2021 and its lowest at 2.2% in FYE 2020.

- The current gearing ratio stands at 0.63 (Before IPO), which exceeds the healthy range. Consequently, the company plans to utilize approximately 38% of the funds from the IPO to settle the bank borrowing and reduce the gearing ratio to 0.38. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

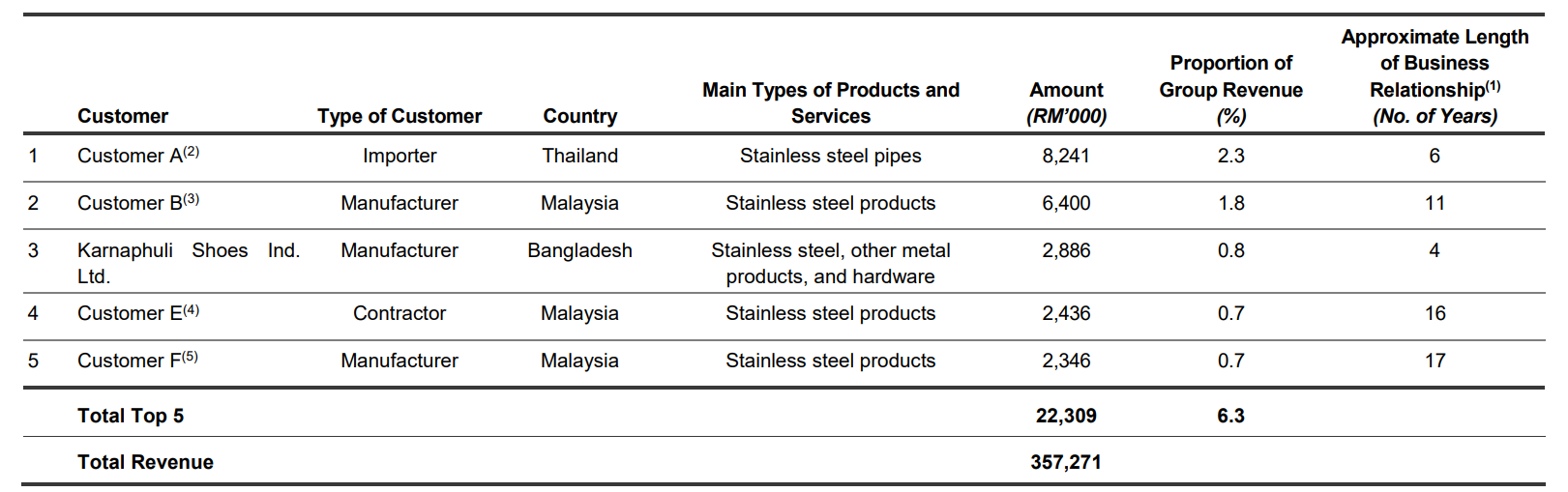

Major Customers

The company's top 5 customers for FYE 2022 are listed in the following table:

According to the table, the top 5 customers contribute 6.3% of the company's revenue. The company is not dependent on any single customer because it has a large customer base, with over 3,000 active customers.

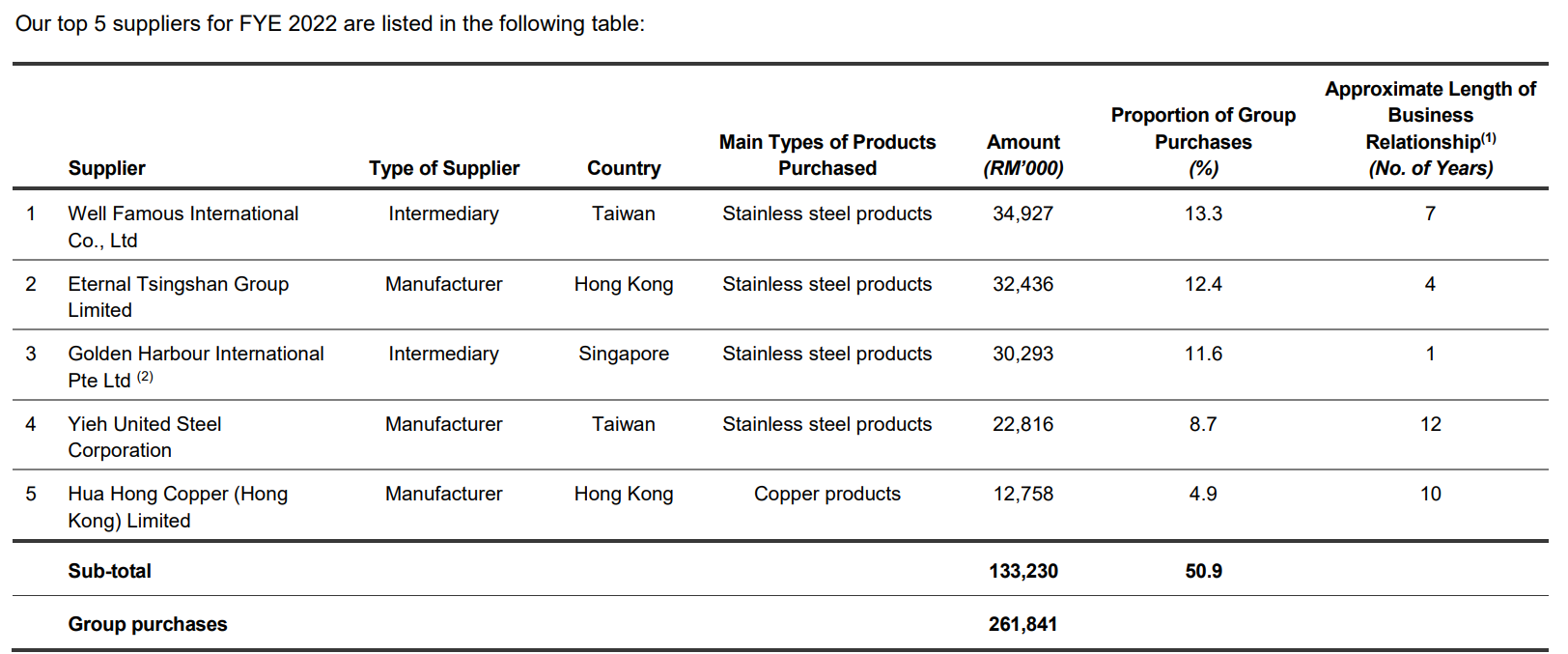

Major Suppliers

The top 5 suppliers for FYE 2022 are listed in the following table:

The total purchases from the top 5 suppliers account for 55%. However, the management has mentioned that they are not dependent on the top 4 suppliers. They can source similar stainless steel products from alternative suppliers. Currently, they work with 18 other suppliers who provide similar types of stainless steel products.

Industry Overview

According to the research report from Vital Factor Consulting, In 2022, the import value of rolled products comprised 82.6% and 17.4% of flat and long products respectively, while the export value of rolled products comprised 95.4% and 4.6% of flat and long products respectively. The large majority of the imported and exported flat rolled products are for a width of more than 600mm, comprising mostly plates, sheets and coils of various thicknesses. These products are commonly the key input materials for the manufacture of flat-finished products such as pipes, food processing equipment, machinery, equipment and automotive parts.

In 2022, the import value of rolled products grew by 10.2% to RM4.9 billion, contributed by the growth of 10.5% and 8.7% from flat and long products respectively. The top three importing countries were Indonesia, China and Taiwan, accounting for 47.0%, 16.7% and 12.6% of the import value of rolled products respectively in 2022. For the first 9 months of 2023, the import value of rolled products declined by 28.5% to RM2.9 billion compared to RM4.0 billion for the first 9 months of 2022, mainly attributed to the falling global stainless steel prices since the second quarter of 2023.

In 2022, import volume declined by 17.1% to 383,400 tonnes, contributed by the decline of 17.6% and 13.5% from flat and long products respectively. The import volume of flat products remained low in 2021 and 2022 compared to pre-COVID-19 pandemic levels, partly due to reduced demand resulting from a slowdown of Malaysia’s production of stainless steel products amid high global stainless steel prices and sea freight rates in 2021.

In 2022, the export value of rolled products grew by 32.5%, contributed by a growth of 38.3% and a decline of 29.1% from flat and long products respectively. The top three destination countries were India, Spain and Italy which accounted for 17.3%, 10.2% and 9.4% of the export value of rolled products respectively in 2022. For the first 9 months of 2023, the export value of rolled products declined by 47.0% to RM1.2 billion compared to RM2.3 billion for the first 9 months of 2022, mainly attributed to weak global demand amid the uncertain outlook coupled with the falling global stainless steel prices

In 2022, the export volume of rolled products declined by 9.4% to 214,600 tonnes, contributed by the decline of 6.2% and 36.2% from flat and long products respectively. In 2022, export value increased mainly due to the increase in stainless steel prices, despite the decline in export volume.

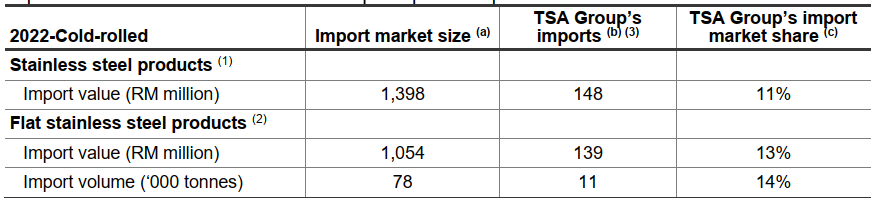

Market Size and Share

TSA Group’s revenue is primarily contributed by stainless steel products mainly of cold-rolled stainless steel. As there are no production figures available for cold-rolled stainless steel products in Malaysia, import market size and share of TSA Group’s imports are provided below instead.

Source: Vital Factor Consulting

Future plans and strategies for TSA GROUP BERHAD.

The company's business strategies and plans will continue to focus on the core competencies in the trading of metal and other products, manufacturing of stainless steel pipes and processing of stainless steel products. In addition, the company intends to grow the business by establishing a stainless steel cold rolling line, as summarised in the following diagram:

The company intends to implement the aforementioned business strategies and plans between 2023 and 2026, as further detailed below.

- Establish manufacturing premises (Semenyih Manufacturing Premises)

- Establish a stainless steel cold rolling line

- Indicative timeline and estimated costs

MQ Trader View

Opportunities

- The company has a large customer base to sustain and grow the business, and they are not dependent on any individual customer. The company has cultivated a large and diverse customer base since commenced business in 1993. The company had approximately 3,600 active customers during FYE 2022 and 3,300 active customers during FPE 2023 (for 8 months) who made purchases of at least RM2,000 in the respective financial year or financial period. Approximately 85% of the customers in FYE 2022 were recurring customers who purchased goods from the company in both FYE 2021 and FYE 2022.

- The company offers a wide range of products to the customer. The company offers a wide range of purchased and manufactured products to meet the diverse needs of the customer base. For FYE 2022, the product range consisted of approximately 18,500 SKU and increased to approximately 18,700 SKU for FPE 2023. The extensive range of products provides customers with the convenience of a one-stop solution for stainless steel and other metal products, hardware and other products, as well as stainless steel pipes.

Risk

- The company is exposed to fluctuations in the price of stainless steel, which can impact product demand and profit margins. The decrease in the gross profit margin in FYE 2022 indicates that it was mainly caused by the increase in the average cost of sales for stainless steel. This demonstrates that raw material prices significantly affect the company’s profitability.

- The company used nearly half of the funds raised from the IPO to repay bank debts. This shows that the management believes choosing to repay bank debts, rather than expanding the business to increase revenue, can save interest costs and thus hold more value. This also implies that even if the company continues to expand, it might face market demand bottlenecks, leading to a stagnation in profit growth.

Click here to refer the IPO - TSA Group Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)