IPO - Wentel Engineering Holdings Berhad (Part 2)

MQTrader Jesse

Publish date: Fri, 19 Jan 2024, 09:06 AM

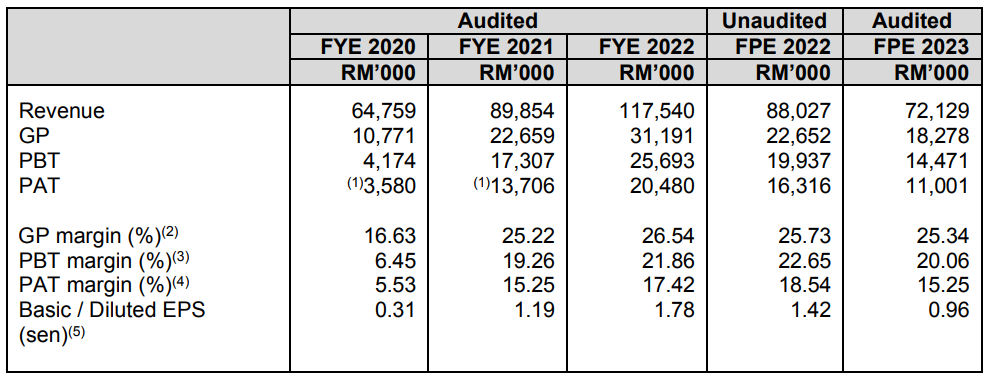

Financial Highlights

The following table sets out the key financial and operational highlights of the Group for the Period Under Review:

- The revenue increased from RM 64 million in FYE 2020 to RM 117 million in FYE 2022. This indicates that the company is expanding its market share within the industry.

- The gross profit margin increased from 16.63% in FYE 2020 to 26.54% in FYE 2022. The increase in the GP margin was mainly contributed by the higher contribution of gross profit from the fabrication of semi-finished metal products and the fabrication of the metal parts segment, which generally yields a higher gross profit margin. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin increased from 16.63% in FYE 2020 to 21.86% in FYE 2022

- The gearing ratio was 0.05 in FYE 2022, which is close to 0. This indicates that the company still has room to increase its debt to maximize its leverage for business expansion. (A good gearing ratio should be between 0.25 – 0.5).

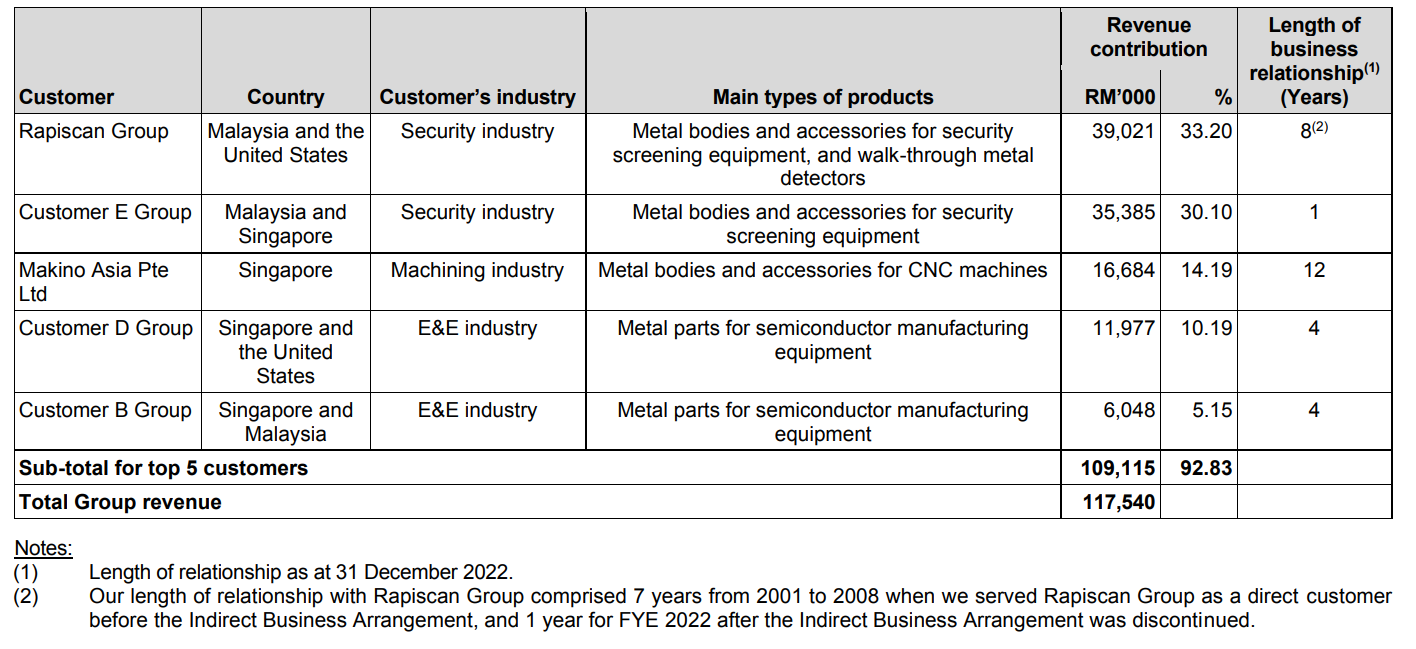

Major customers and supplier

Major Customers

The top 5 major customers for FYE 2022 are listed in the following table:

The top 5 customers contribute 92.83% of the company's revenue. The management mentioned that they are dependent on customers who contribute more than 10% of their total annual revenue. Based on the customer concentration, the company faces high customer risk, which could directly impact its revenue if any customer contributing over 10% of its total revenue chooses to terminate the service.

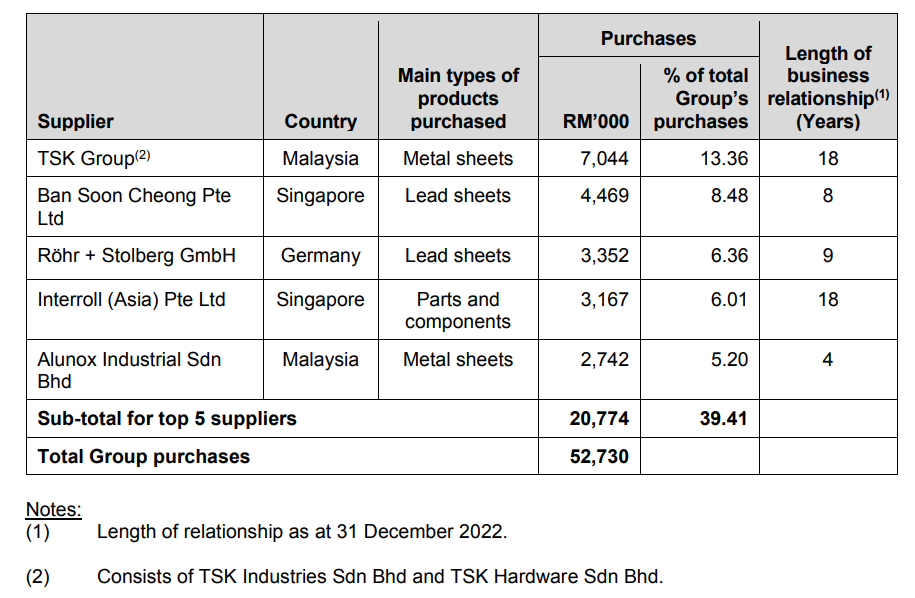

Major suppliers

The top 5 major suppliers for FYE 2022 are listed in the following table:

The total purchases from the top 5 suppliers account for 39.41%. The management mentioned that the company is not dependent on any suppliers because (i) most of the suppliers do not exceed 10% of the total purchases, and (ii) the metal sheet materials are commonly available from manufacturers and hardware suppliers in Malaysia, so the company can easily source them from other suppliers.

Industry Overview

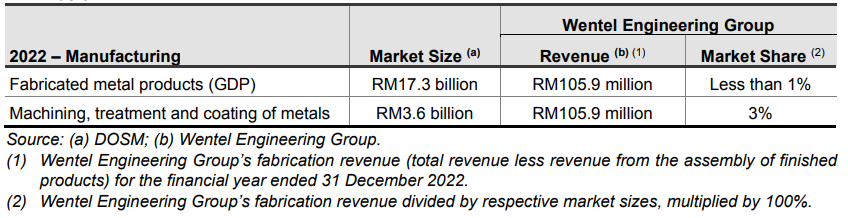

Wentel Engineering Group operates within the fabricated metal product industry. In 2022, the GDP of the fabricated metal product industry grew by 13.1% to RM17.3 billion. The growth in 2022 continues from the growth in 2021 after the dip in 2020 arising from the impact of the COVID-19 pandemic. For 9M 2023, the GDP of the fabricated metal product industry grew by 8.1% to RM13.9 billion compared to 9M 2022.

Fabricated metal products are manufactured through metalworking service activities, which include machining activities such as cutting, boring, turning, milling, grinding, polishing and welding of metal workpieces. It also includes metal treatment such as annealing (heat treatment), surface treatment such as cleaning, blasting and polishing, and coating including plating, painting and powder coating which is under the machining, and treatment and coating of metals, a subset of the overall fabricated metal product industry. Most of the above activities are also carried out by Wentel Engineering Group.

In 2021 and 2022, sales value from the machining, and treatment and coating of metals grew by 35.6% and 21.8% respectively, attributed to the recovery of demand from the supply disruption resulting from the COVID-19 pandemic. For 9M 2023, sales value from the machining, and treatment and coating of metals grew by 15.3% compared to 9M 2022.

Demand dependencies

This section will assess the performance of the key user industries of Wentel Engineering Group, as demand for fabricated metal products is dependent on the user industries

- Machinery and equipment industry

- Security scanning equipment

- Semiconductor manufacturing equipment

- CNC machines

- Medical devices

Supply dependencies

- Global steel, lead and aluminium prices

- Labour supply and cost

Market Size and Share

The market size in Malaysia and market share of Wentel Engineering Group are estimated below:

Source: Vital Factor Consulting

Future plans and strategies for WENTEL ENGINEERING HOLDINGS BERHAD.

The business strategies and plans are focused on leveraging its core competencies and strengths in the fabrication of semifinished metal products, fabrication of metal parts and assembly of finished products, which the company will continue moving forward.

The business strategies and plans are as follows:

- Expansion of production facilities.

- Purchase machinery and equipment for the New Manufacturing Plant.

MQ Trader View

Opportunities

- The company has a range of production facilities to meet the needs of customers for fabricated semifinished metal products and metal parts. The business operations are supported by its in-house facilities for the fabrication of semifinished metal products and metal parts. The range of machinery and equipment as well as surface coating facilities enable the company to address opportunities in multiple industries that require metal bodies, accessories and parts for their manufactured products.

- The company has shown good financial performance. Both the GP margin and PAT margin have grown following the revenue, indicating the management's profitability. In addition, the company maintains a low gearing ratio, enhancing its ability to face risks.

Risk

- The company is exposed to high-concentration customer risk. It depends on certain major customers that contribute significantly to its total revenue, and the loss of one or more of these customers may affect its financial performance.

- The company may be exposed to unfavourable foreign currency exchange rate fluctuations. The company is exposed to the risk of foreign exchange fluctuations as part of its revenue and purchases are transacted in foreign currencies.

- The company's financial performance may be affected by the fluctuation in market prices of metal input materials. The company is exposed to fluctuations in the market prices of metals, particularly steel, lead, and aluminum, through the purchases of these metals as input materials.

Click here to refer the IPO - Wentel Engineering Holdings Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

More articles on Initial Public Offering (IPO)