IPO - Keyfield International Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 02 Apr 2024, 10:36 AM

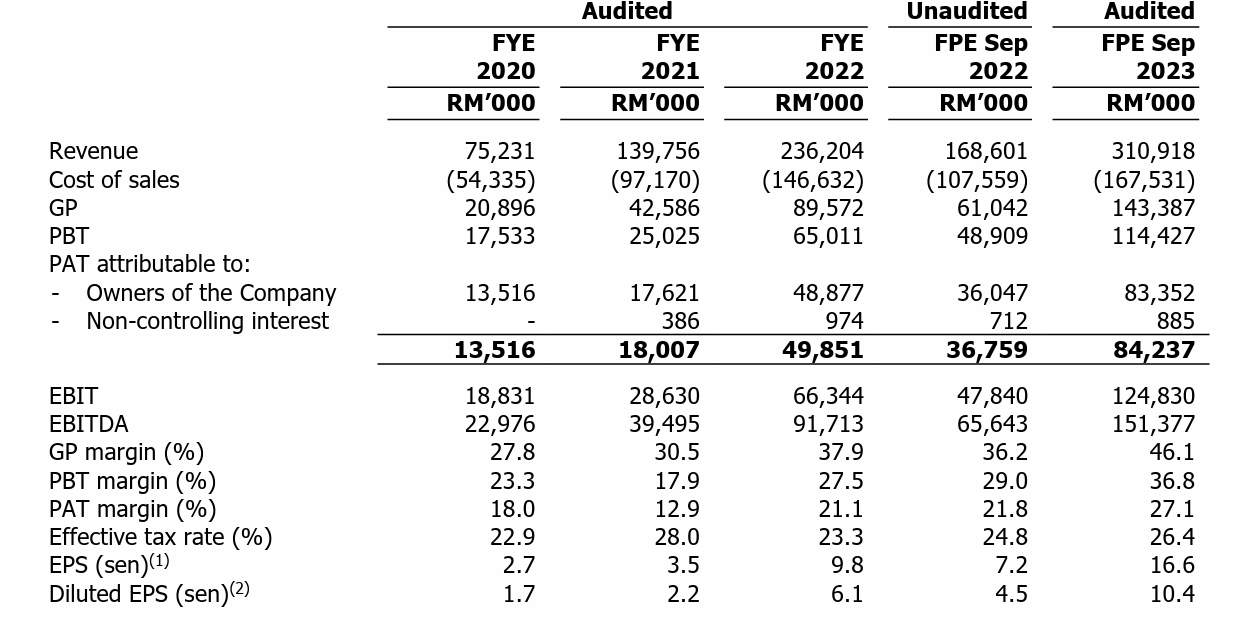

Financial Highlights

The following table sets out the financial highlights of the historical consolidated statements of profit or loss and other comprehensive income for the FYEs 2020 to 2022 as well as FPE Sep 2022 and FPE Sep 2023:

- The revenue grew from RM 75 million in FYE 2020 to RM 236 million in FYE 2022. This shows that the company is expanding its market share in this industry.

- The gross profit margin increased from 27.8% in FYE 2020 to 37.9% in FYE 2022. The increase in the GP margin is mainly due to better Daily Charter Rates (DCR) and longer charter times, which provide better revenue to the company. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin decreased from 18.0% in FYE 2020 to 12.9% in FYE 2021 and increased to 21.1% in FYE 2022.

- The gearing ratio was 1.3 in FYE 2022. Due to the nature of the business, the company's gearing ratio is above the benchmark. This also means that the company is more prone to liquidity risk. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and supplier

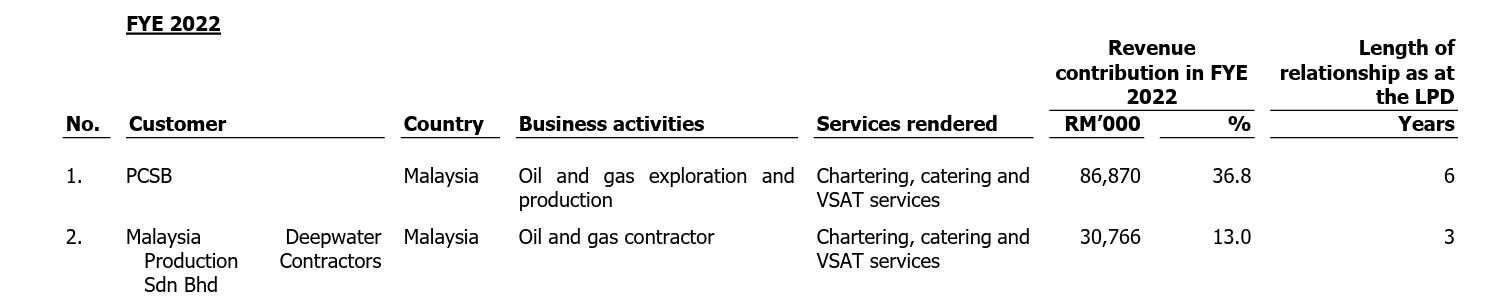

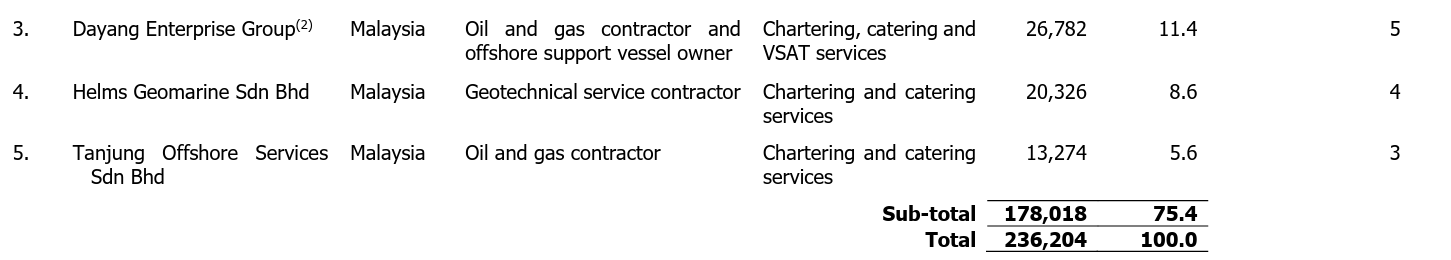

Major Customers

The customers comprise PCSB, PACs, oil and gas contractors and offshore support vessel owners. These customers fall under the upstream oil and gas industry. The top 5 major customers for the past FYE 2022 are as follows:

The top 5 customers contribute 75.4% of the company's revenue, with the leading customer accounting for 36.8%, approximately 1/3 of the total revenue. The company is involved in high-concentration customer risk, as the management mentioned that the company is dependent on PCSB. If the group loses PCSB as its customer, they will have to secure chartering contracts from other customers to replace the revenue loss.

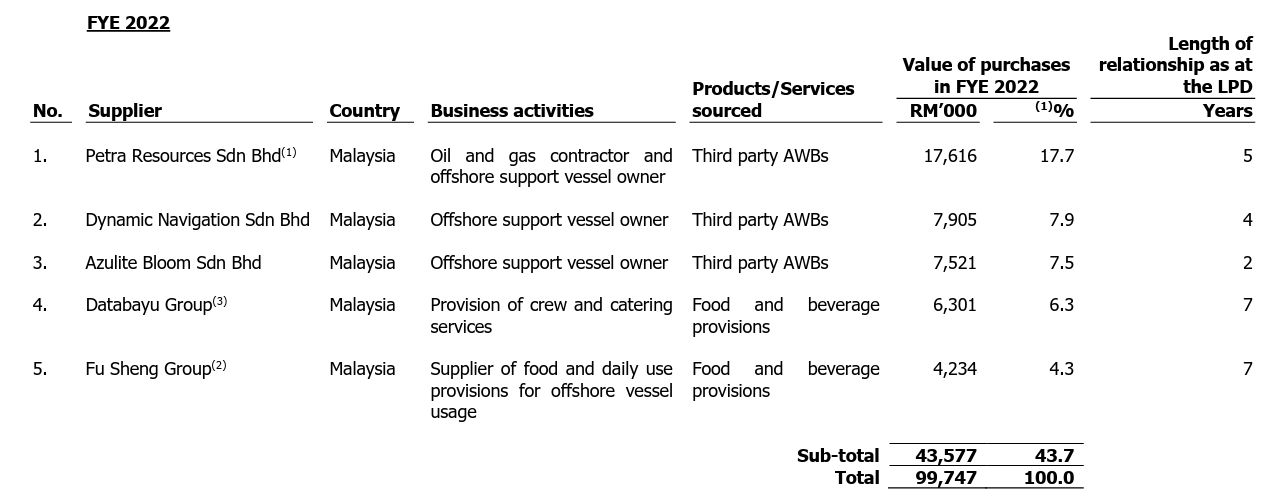

Major Suppliers

The suppliers comprise third party offshore support vessel owners as well as suppliers of equipment, spare parts, food and beverage provisions and manpower, among others. The top 5 suppliers for the past FYE2022 are as follows:

The top 5 suppliers are 43.7% of the purchases. The company does not have any long-term arrangements with its major suppliers. They are not dependent on any single supplier due to the following:

- Over the last few years, the growth trajectory has been driven by the expansion of the fleet of its own vessels which allows us to reduce the reliance on third party AWBs;

- The company has established a network of vessel owners which allows them to be able to access and secure available vessels that meet customers’ requirements within the timeframe required; and

- Aside from Sea Steel Sdn Bhd, the company do not have any long-term arrangements or contracts with any of its other major suppliers.

Industry Overview

The AWB chartering market in Malaysia has been growing at a CAGR of 6.4% between 2017 and 2023. Although the AWB chartering market in Malaysia has been growing at a CAGR of 20.7% between 2017 and 2019, the local AWB chartering market experienced a fall in market size due to the COVID-19 pandemic between 2020 and 2021. Nevertheless, the AWB chartering market size in Malaysia recovered and grew by 43.7% between 2021 and 2022. Moving forward, PROVIDENCE forecasts the AWB chartering market size in Malaysia to register a CAGR of 6.0% between 2024 and 2026. This is in line with the anticipated growth in the local upstream oil and gas industry, wherein PETRONAS estimates an increase in capital investment allocation from 2023 to 2027 years of 43% as compared to the last 5 years, i.e. 2018 to 2022.

As a key industry player in the AWB chartering market in Malaysia, Keyfield Group stands to benefit from the positive outlook of the AWB chartering market in Malaysia, which will be driven by the local upstream oil and gas industry. In this respect, the Group stands to benefit from the expansion of its fleet of vessels, as it will be able to capture the continuous demand from the local upstream oil and gas industry. In addition, the Group’s plans to enhance its vessels’ features and capabilities to reduce greenhouse gas emissions and/or be more environmentally sustainable are expected to further strengthen its position in securing new chartering contracts. This is because PETRONAS and PACs are increasingly making conscientious efforts to reduce carbon emissions and be more environmentally sustainable. In particular, PETRONAS has announced its intention to achieve net zero carbon emissions by 2050 and has been implementing initiatives to reduce greenhouse gas emissions and embark on new growth opportunities that are sustainable including renewable energy (such as solar and wind energy), hydrogen and biofuels. Keyfield Group also stands to benefit from the growing accommodation work barge chartering market in Malaysia as it has 1 accommodation work barge, as well as the continuous demand for AHTS and PSV chartering in Malaysia as the Group intends to expand into these markets.

Source: Providence Strategic

Future plans and strategies for KEYFIELD INTERNATIONAL BERHAD.

The future plans and strategies of the Group are as follows:-

- The company intends to strengthen its market position through fleet expansion via acquisitions(s) of accommodation vessels.

- Acquiring completed accommodation vessels that are put up for sale

- Entering into a shipbuilding contract with suitable shipbuilder(s) to build new accommodation vessel(s)

- The company intends to broaden its service offering to PCSB and PACs

- The company plans to continuously enhance its own vessels’ capabilities in alignment with industry trends and its sustainability agenda.

- Installing food composting systems onboard its vessels

- Installing solar panels onboard its vessels

- Installing a DP2 system onboard LS2

MQ Trader View

Opportunities

- The company is performing well according to historical financial statements. The company's revenue has improved rapidly, indicating aggressive expansion of its market share. Moreover, the management has been able to improve the gross profit margin as well while the revenue is growing, which also indicates the capability of the management.

Risk

- The company had been involved in high-concentration customer risk. The company depends on PCSB as it constitutes a large proportion of its revenue, and the loss of PCSB could adversely impact the financial and business performance.

- The financial performance and position may be affected due to the financial commitment of payment for the bareboat DCR if they are unable to charter out Daya Indah Satu and Daya Ceria.

Click here to refer the IPO - Keyfield International Berhad (Part 1)

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)