IPO - Smart Asia Chemical Bhd (Part 2)

MQTrader Jesse

Publish date: Fri, 10 May 2024, 11:44 AM

Financial Highlights

The following table sets out the financial highlights of the historical audited combined statements of comprehensive income of our Group for the Financial Years Under Review:

- The revenue grew from RM 71 million in FYE 2020 to RM 91 million in FYE 2023. The decrease in revenue in FYE 2022 was due to reduced sales of disinfecting products, as the company decided to cease production of these items in April 2022 following a slowdown in demand. However, revenue rebounded and reached a new high in FYE 2023.

- The gross profit margin was maintained at around 30%. The highest gross profit margin was 33.50% in FYE 2021, while the latest gross profit margin stood at 32.92% in FYE 2023. Fluctuations in the gross profit margin are primarily attributed to fluctuations in raw material purchase prices. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin grew from 10.39% in FYE 2020 to 13.40% in FYE 2021. After that, the PAT margin continuously declined to 10.87% in FYE 2022 and 9.67% in FYE 2023.

- The gearing ratio was 0.6 times in FYE 2023, which is above the benchmark. However, the gearing ratio is just slightly above the benchmark; therefore, we believe it is still manageable. In this case, we will have to investigate the company's debt status in the future. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

Major Customers

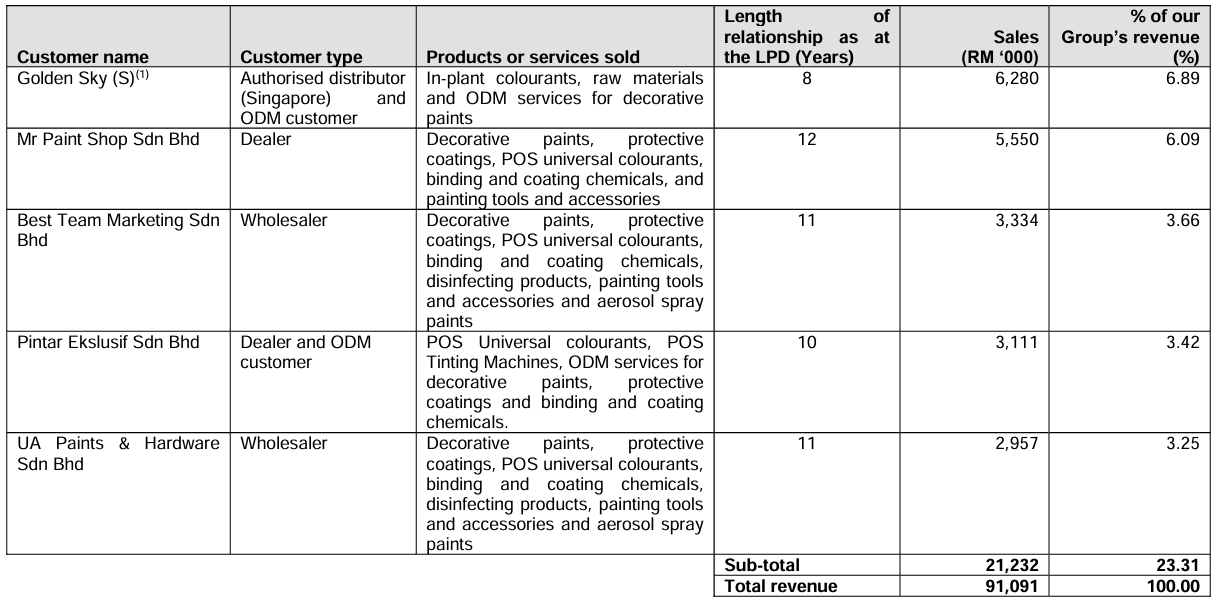

The top 5 major customers for FYE 2023 are as follows:

The top 5 customers contribute 23.31% of the company's revenue. The company is not dependent on any of its customers because the group has a network of 9 wholesalers and 937 dealers in Malaysia, and 14 authorized distributors overseas. The management mentioned that in the event any of its 5 customers cease to purchase from them, they believe they will be able to secure additional sales from other existing or new wholesalers, dealers, and authorized distributors to compensate for any loss in sales.

Major Suppliers

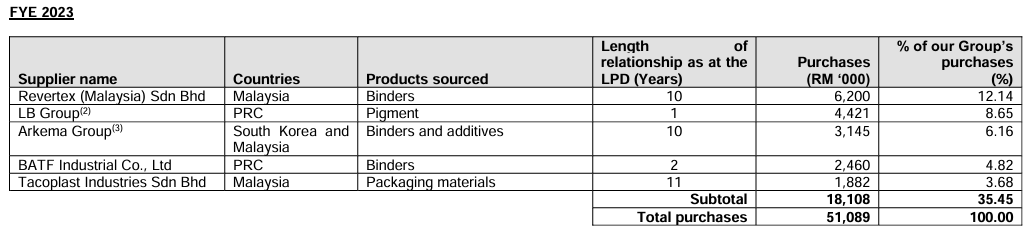

The top 5 major suppliers for FYE 2023 as follows:

The top 5 suppliers account for 35.45% of the purchases. The management mentioned that although there is a supplier continuously contributing more than 10% of the group’s total purchase, they are not dependent on the suppliers because the supply of binders is readily available and can be easily sourced from other suppliers in the market. The company has a sourcing network comprising over 223 suppliers locally and 35 suppliers overseas.

Industry Overview

According to Smith Zander's research, the growth of the paints and coatings industry in Malaysia is driven by the growth recovery in the construction industry in Malaysia. Construction activities are largely economic-driven, whereby economic growth contributes to increased disposable income among the population arising from higher employment, and increased earnings for businesses and companies due to greater operating scale and wider market reach. Consequently, this leads to increased demand for residential, commercial and industrial properties as well as supporting infrastructure, which in turn leads to higher demand for paints and coatings.

Further, industrial coatings are widely used and applied in the manufacturing sector on various manufactured products such as machinery and equipment, as well as furniture, which helps to provide the manufactured product an aesthetic look, as well as protect and strengthen the product’s durability and resistance against chemical and environmental effects to extend the product’s overall lifetime. Therefore, an increase in demand for manufactured products will drive the growth of the overall manufacturing sector which will in turn spur the growth of the paints and coatings industry.

Additionally, increasing GNI per capita may lead to increased investments in residential, commercial and industrial properties. As consumers’ disposable income increases, this will encourage more consumer spending and thus increase the demand for property investment in residential, commercial and industrial properties. As newly purchased residential, commercial and industrial properties generally require renovation and refurbishment works including painting works, this will in turn boost the demand for paints and coatings and therefore drive the paints and coatings industry in Malaysia.

In view of the above-mentioned factors which drive the growth of the paints and coatings industry in Malaysia, SMITH ZANDER forecasts the manufacturing sales value of paints, varnishes and similar coatings ink and mastics in Malaysia to increase from RM13.72 billion in 2023 to RM14.48 billion in 2024 and RM15.28 billion in 2025, recording a CAGR of 5.53% from year 2023 to 2025. Further, SMITH ZANDER forecasts the exports of paints and varnishes from Malaysia to the Selected Countries in SEA to increase from RM 781.51 million in 2023 to RM 807.21 million in 2024 and RM 833.75 million in 2025, recording a CAGR of 3.29% from year 2023 to 2025.

Source: Smith Zander

Future plans and strategies for FEYTECH HOLDINGS BERHAD.

A summary of the business strategies and future plans is set out below:

- Construction of Perak Plant

- Acquisition of land and indicative timeline

- Source of funding

- Expansion of manufacturing capacity

- Reallocation or recruitment of employees

- Purchase and commissioning of an industrial tinting system and automated pain production system in the Perak Plant

- Industrial tinting system

- Automated paint production system

- Purchase 250 sets of Smart Colour POS Tinting Machine to be distributed to the wholesalers and dealers to continue driving the sales

- Sales and marketing strategies

MQ Trader View

Opportunities

- The company has a wide range of products sold under its house brands. Spanning approximately 12 years since the commencement of its business in 2012, they have successfully grown their product offerings to include a wide range of decorative paints and protective coatings for household and industrial applications, as well as colorants, binding and coating chemicals, painting tools and accessories, and aerosol spray paints. This enables the Group to build its reputation on the quality of its products, thus enhancing brand recognition among retail end-users.

- The company adopts a multi-channel distribution network to distribute its products. The Group employs a multi-channel distribution network comprising wholesalers, dealers, and authorized distributors, as well as its own sales and marketing team, to reach out to a wide customer base and achieve economies of scale to grow market share. The Group has a total of 9 wholesalers and 937 dealers across Malaysia, and 14 authorized distributors overseas.

Risk

- The company relies on wholesalers, dealers, and authorized distributors to distribute and sell the products to retail end-users. The Group is dependent on these intermediaries to represent them at the point of sales with retail end-users. Due to reliance on intermediaries, the company is unable to directly obtain feedback from end customers, nor can it ensure the quality of service provided by intermediaries to customers. This may lead to a negative impact on the company's image among customers, thereby affecting the company's brand.

- The company's gearing ratio is above a standard benchmark. This will cause the company to be involved in liquidity risk if any financial issues occur. As investors, we will need to consider the status of debt in the future.

Click here to refer the IPO - Smart Asia Chemical Berhad (Part 1)

Interested to start trading? Send your inquiry now! https://bit.ly/mqtatrade

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)