IPO - EPB Group Bhd (Part 2)

MQTrader Jesse

Publish date: Wed, 03 Jul 2024, 10:25 AM

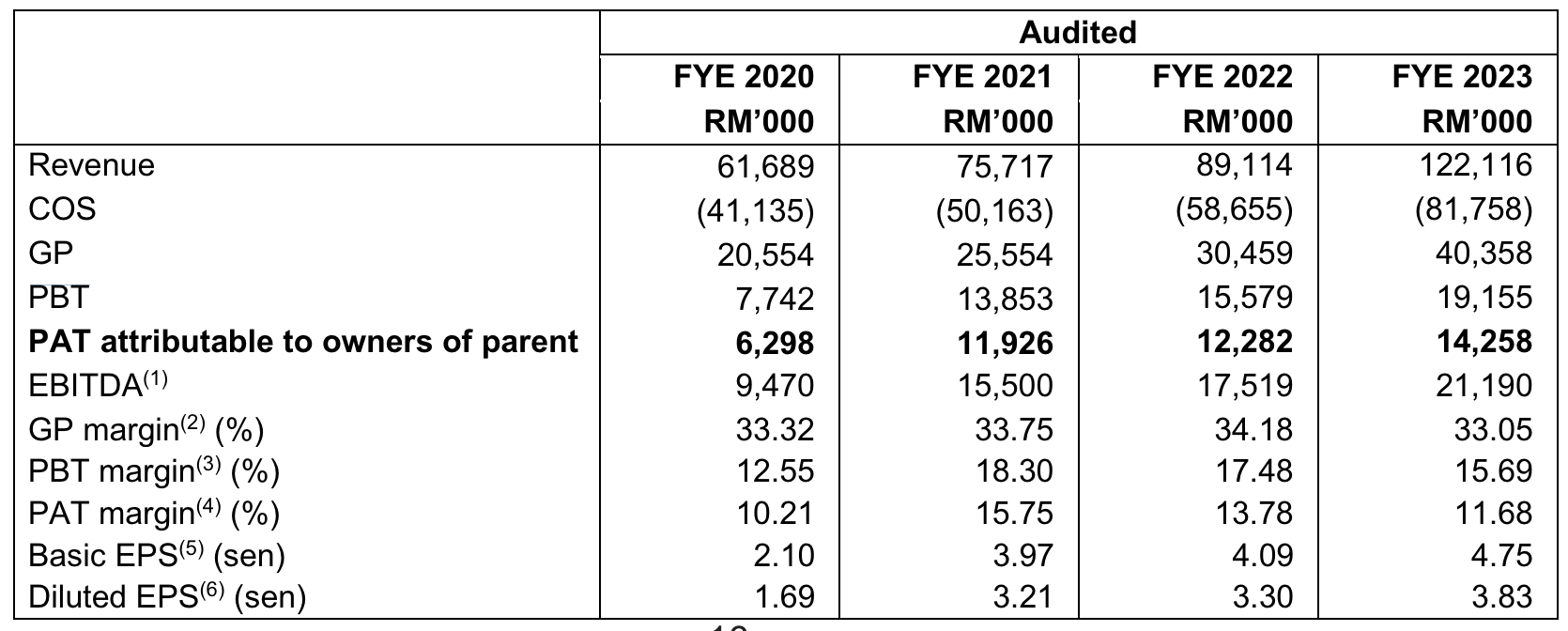

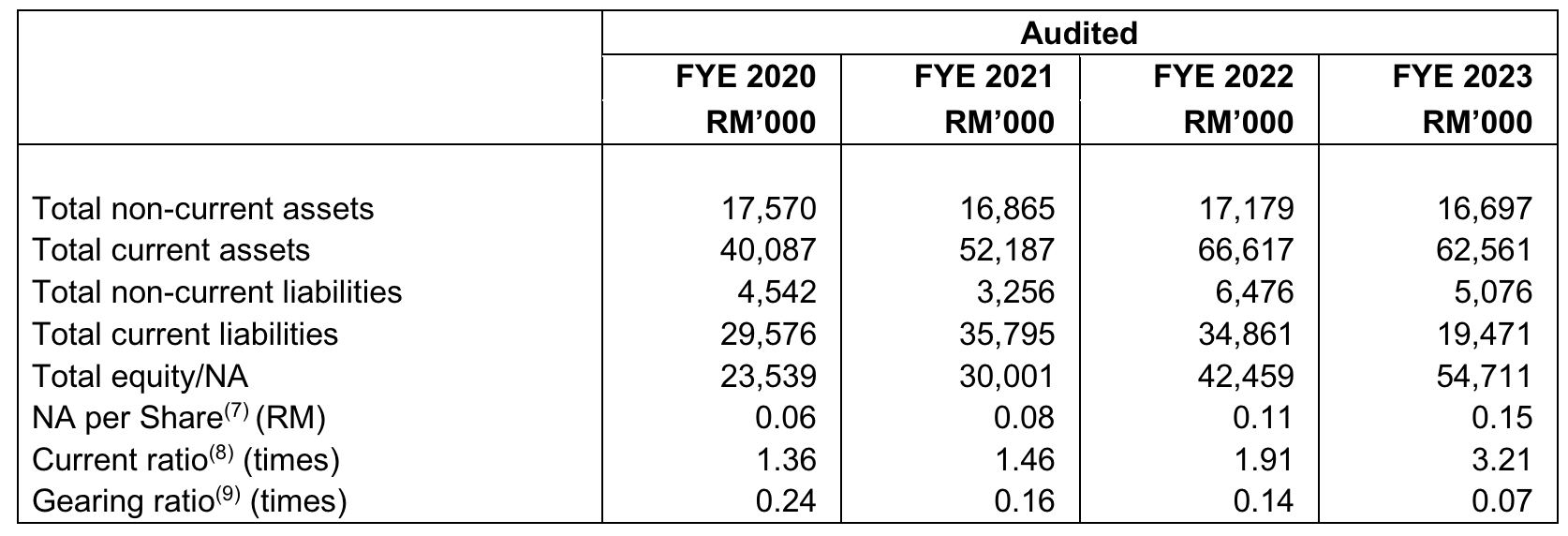

Financial Highlights

The table below sets out financial highlights based on the audited combined financial statements for the Period Under Review:

- The revenue grew from RM 61 million in FYE 2020 to RM 122 million in FYE 2023. The company is expanding its market share in this industry.

The gross profit margin increased from 33.32% in FYE 2020 to 34.18% in FYE 2022, but it declined to 33.05% in FYE 2023. The decline in the PBT margin was mainly due to the increase in the cost of sales which might be caused by the price hike of raw materials.

The PAT margin grew from 10.21% in FYE 2020 to 15.75% in FYE 2021, but it declined to 11.68% in FYE 2023.

The gearing ratio is 0.07, which is below the benchmark. This indicates that the company still has room to further increase its debt, indirectly suggesting that in the event of any crisis, the company will not easily face risks due to excessive debt. (A good gearing ratio should be between 0.25 – 0.5).

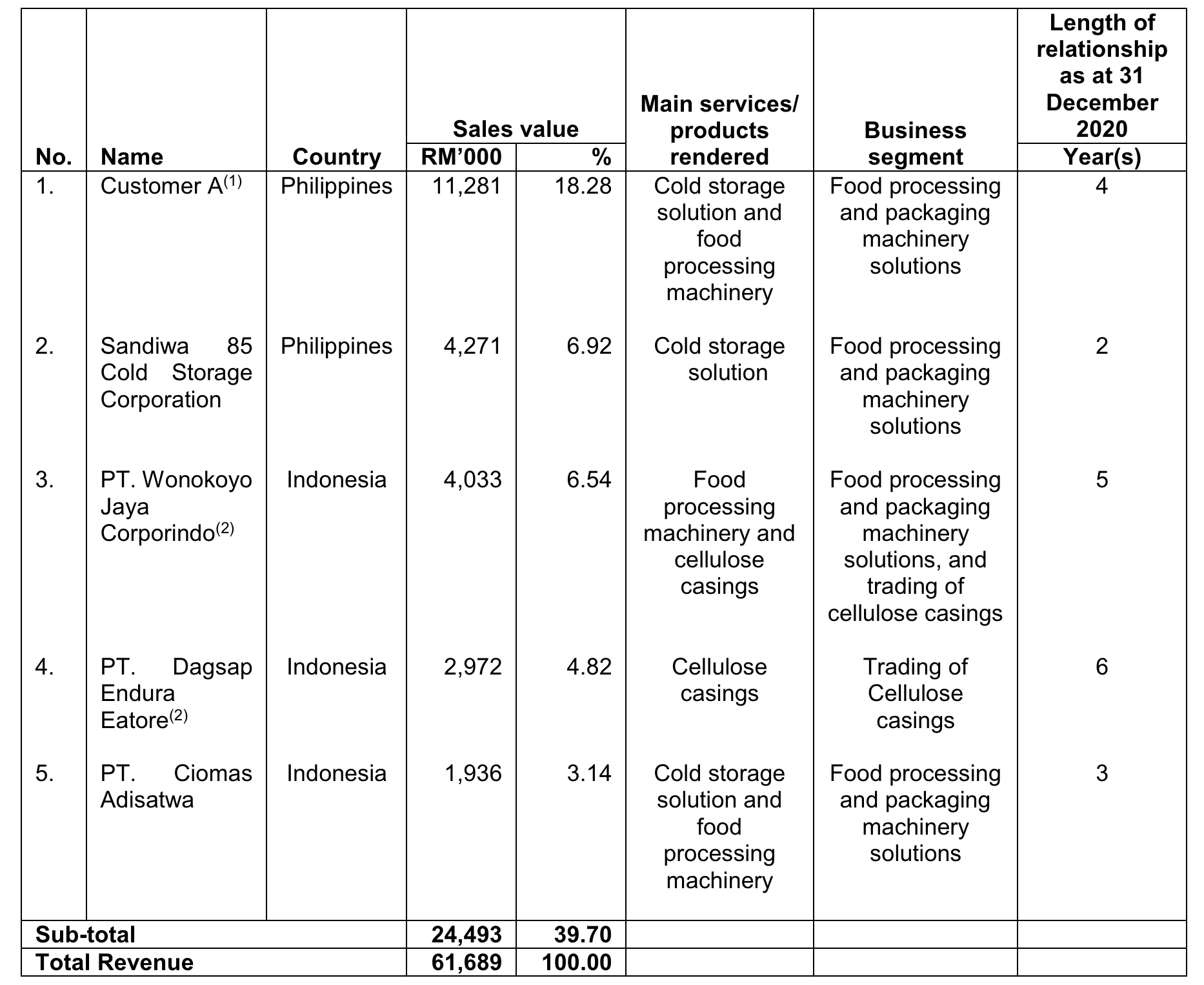

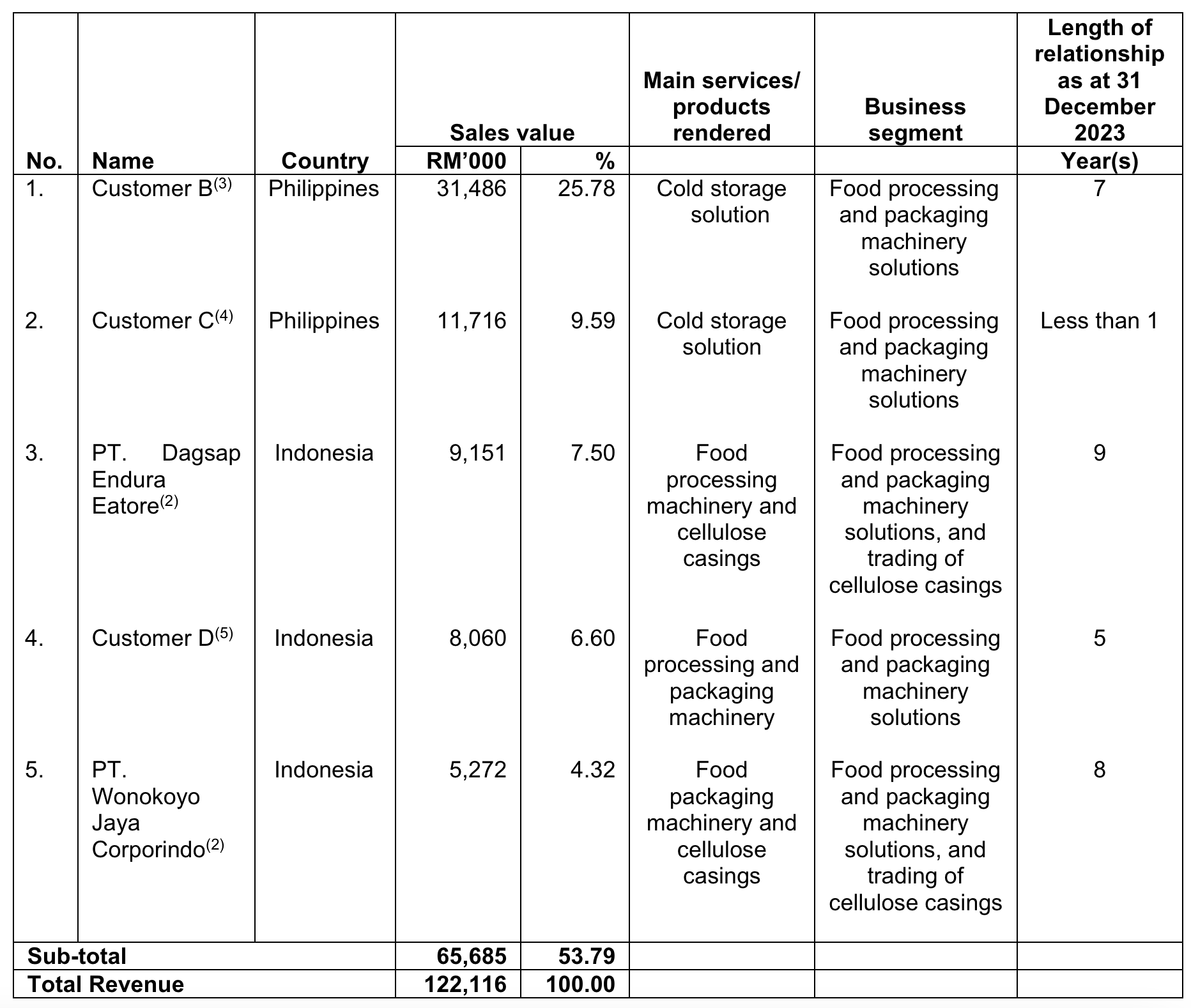

Major customers and suppliers

The top five (5) major customers of our Group in the Financial Years Under Review are as follows:

The top five (5) major customers contributed approximately 39.70%, 35.95%, 36.38% and 53.79% to the Group’s total revenue for the Financial Years Under Review respectively. For the FYE 2023, the Group has over 630 transacted customers for food processing and packaging machinery solutions business segment, 3 transacted customers for trading of cellulose casings business segment, and over 80 transacted customers for manufacturing and trading of flexible packaging materials business segment. As such, the Group is not dependent on the major customers as they have built a large customer base throughout the years. They did not have any material dispute with the major customers in the past and they expect the major customers to continue contributing to the Group’s revenue moving forward.

Major Suppliers

The top five (5) major suppliers of our Group in the Financial Years Under Review are as follows:

For the Financial Years Under Review, the group was dependent on Shandong Vicel of China for the supply of cellulose casings. Purchases from Shandong Vicel accounted for 12.99%, 16.30%, 17.84% and 12.85% of our total purchase value respectively for the Financial Years Under Review. Shandong Vicel is the sole supplier for cellulose casings to the Group for the Financial Years Under Review, save for a one-off repurchase of cellulose casings amounting to RM0.07 million from one of the Group’s customers to cater for an urgent need of another customer in the FYE 2020 (as disclosed under Section 7.18, Note (2) of this Prospectus).

In the event of shortage of supplies from Shandong Vicel, the group would be able to access other similar suppliers of cellulose casing to ensure no disruption to their operations. In 2024, they renewed the distribution agreement with Shandong Vicel with some changes to the terms of agreement, to continue as distributor of its Vicel Speedy Peel Cellulose Casings in Indonesia for another two (2) years commencing from 1 January 2024. The notable changes in the terms of agreement include the reduction of annual sales target and the increase in the number of companies in Indonesia from (1) company to five (5) companies that the supplier may approach directly and sell to them for their own use or on-sell to an identified company for its own use only where Shandong Vicel shall ensure that these companies do not transfer or resale the products.

Industry Overview

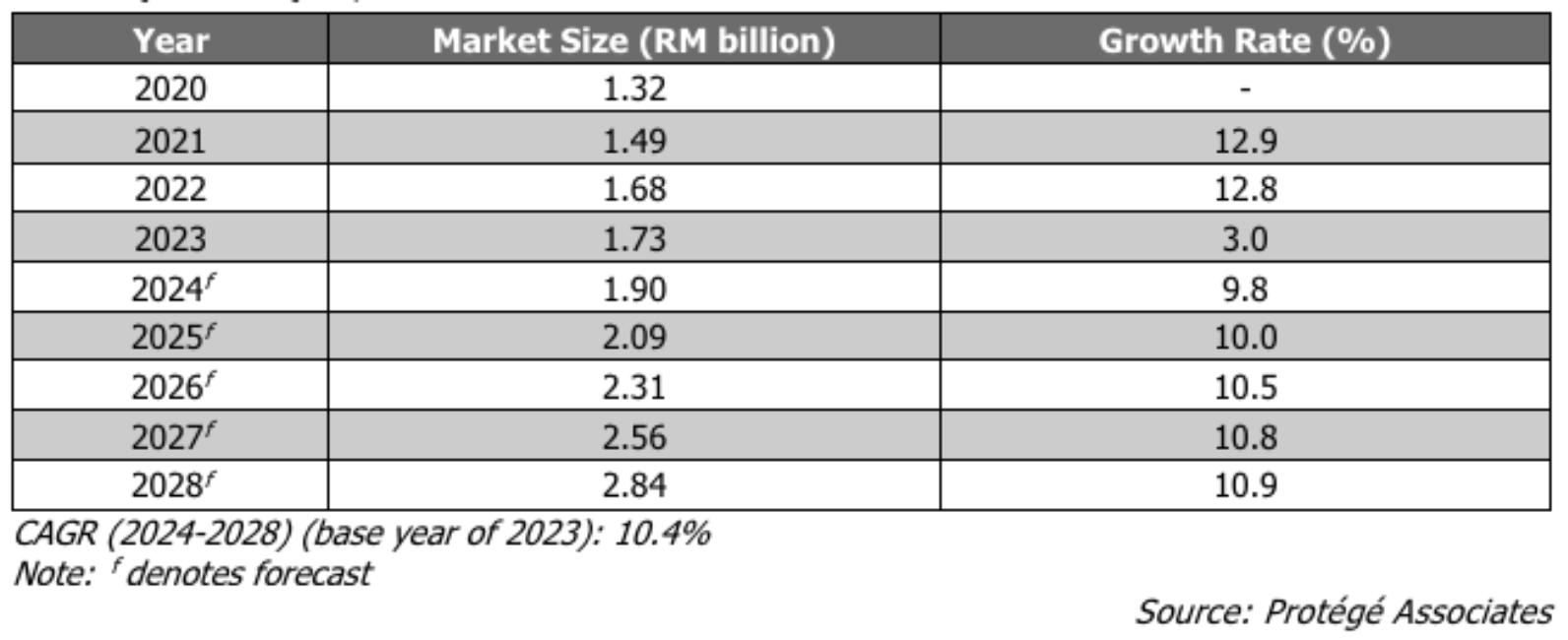

Addording to Protégé Associates’s research, the historical performance and growth forecast of the F&B processing machinery industry in Malaysia is based on a combination of resources, including data from the Department of Statistics Malaysia ("DOSM”), the Malaysian Investment Development Authority and Bank Negara Malaysia. Data is also gathered from further secondary and primary research works conducted such as searches on private F&B processing machinery manufacturers and traders with the Companies Commission of Malaysia (“CCM”) to gather more disclosure on their business performance. Primary research works are conducted with stakeholders in the local industry such as industry players, suppliers, and customers to gather their insights on the industry. All the findings are collated, analysed and/or computed to ascertain the outlook of the F&B processing machinery industry in Malaysia.

The size of the local F&B processing machinery industry was valued at RM1.73 billion in 2023, which was an increase of 3.0% from the previous year. Growth in the industry is supported by factors including labour shortage issues spurring adoption of industrial automation, a wide range of F&B products requiring processing as well as growing consumer preference for convenient processed food products. In particular, while the sales value of F&B products in Malaysia was lower at RM305.50 billion in 2023 as compared to RM316.81 billion in 2022, it was still higher than the RM280.98 billion recorded in 2021. At the same time, while sales value of plastic articles for the packaging of goods decreased slightly from RM21.47 billion in 2022 to RM21.07 billion in 2023, this was still higher than the RM16.60 billion recorded in 2021. The decrease in sales value can be attributable to lower demand for F&B products stemming from slower growth in global economic activities coupled with high inflationary environment weakening purchasing power and affecting consumer sentiments. This is expected to lead to a scaling down of expansion plans by F&B companies which in turn, will reduce demand for F&B processing machineries. Nonetheless, the growth in the Malaysian economy is expected to gather pace from 2024 onwards, with world trade likely to improve in tandem with stronger trade activities – providing the impetus for the gradual pick-up in the pace of growth in the local F&B processing machinery industry. The industry is forecast to expand at a compound annual growth rate (“CAGR”) of 10.4% from RM1.90 billion in 2024 and reach RM2.84 billion in 2028. Growth in the industry is expected to be driven by favourable demand conditions which include labour shortage spurring the adoption of more industrial automation, a wide range of F&B products requiring processing, the preference for convenient processed food products, positive policy support from the Malaysian Government to develop the local food-related industries and a steady population growth.

Market Size And Share

For the FYE 31 December 2023, EPB Group generated revenue of RM100.54 million from its food processing and packaging machinery solutions business segment, which was equivalent to 5.8% share of the RM1.73 billion market size of the Malaysian F&B processing machinery industry in 2023.

Key Industry Drivers

Labour Shortage Spurs Adoption of More Industrial Automation

A Wide Range of F&B Products Requiring Processing

Preference for Convenient Processed Food Products

Positive Policy Support from the Malaysian Government to Develop the Local Food-Related

Steady Population Growth

High Inflationary Pressure Weakening Purchasing Power and Affecting Consumer Sentiment

Technological Advancement

Future plans and strategies for EPB GROUP BERHAD

The group’s business objectives are to maintain a sustainable growth rate in the business and to create long-term shareholder value. To achieve the business objectives, they will implement the following business strategies and future plans over the period of thirty-six (36) months from the date of our Listing:

Expanding Business Footprint in Penang

Increasing Robotic Footprint in Food Processing and Packaging Machinery Solutions

MQ Trader View

Opportunities

The company has accumulated more than thirty (30) years of operating track record since the formation of the sole proprietorship business, New Tech Machinery.

The company provides a one-stop provider of food processing and packaging machinery solutions with Inhouse manufacturing capabilities.

Risk

The company is dependent on one of the major suppliers. In the event of sudden cessation or disruption to the supply of cellulose casings from Shandong Vicel and the group is unable to deliver to their customers within their required timeframe, revenue from trading of cellulose casings will be affected which in turn, may adversely affect their operations and financial performance.

The company’s financial performance is dependent on the ability to continually secure new orders from existing and new customers in relation to the three (3) business segments namely, food processing and packaging machinery solutions, trading of cellulose casings, and manufacturing and trading of flexible packaging materials.

The company is exposed to risk relating to fluctuations in raw material prices. Any price hikes in raw materials caused by their shortages, which are beyond their control could result in increased costs and hinder the Group’s business profitability particularly given that the Group cannot immediately or fully pass-on these costs to their recurring customers.

Click here to continue the IPO - EPB Group Bhd (Part 1)

Eager to explore more trading opportunities? Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)