IPO - EPB Group Bhd (Part 1)

MQTrader Jesse

Publish date: Wed, 03 Jul 2024, 10:25 AM

Company Background

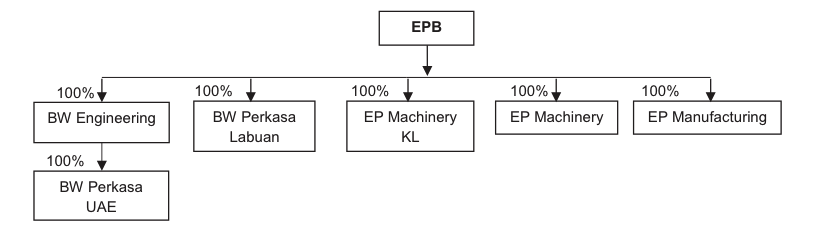

This Company was incorporated in Malaysia under the Act on 28 February 2022 as a private limited company under the name of EPB Group Sdn. Bhd., for the purpose of being an investment holding company and the listing vehicle to facilitate the Listing. Subsequently, this Company was converted to a public limited company on 10 March 2023 and adopted the present name, EPB Group Berhad. The group structure, after our IPO, is as follows:

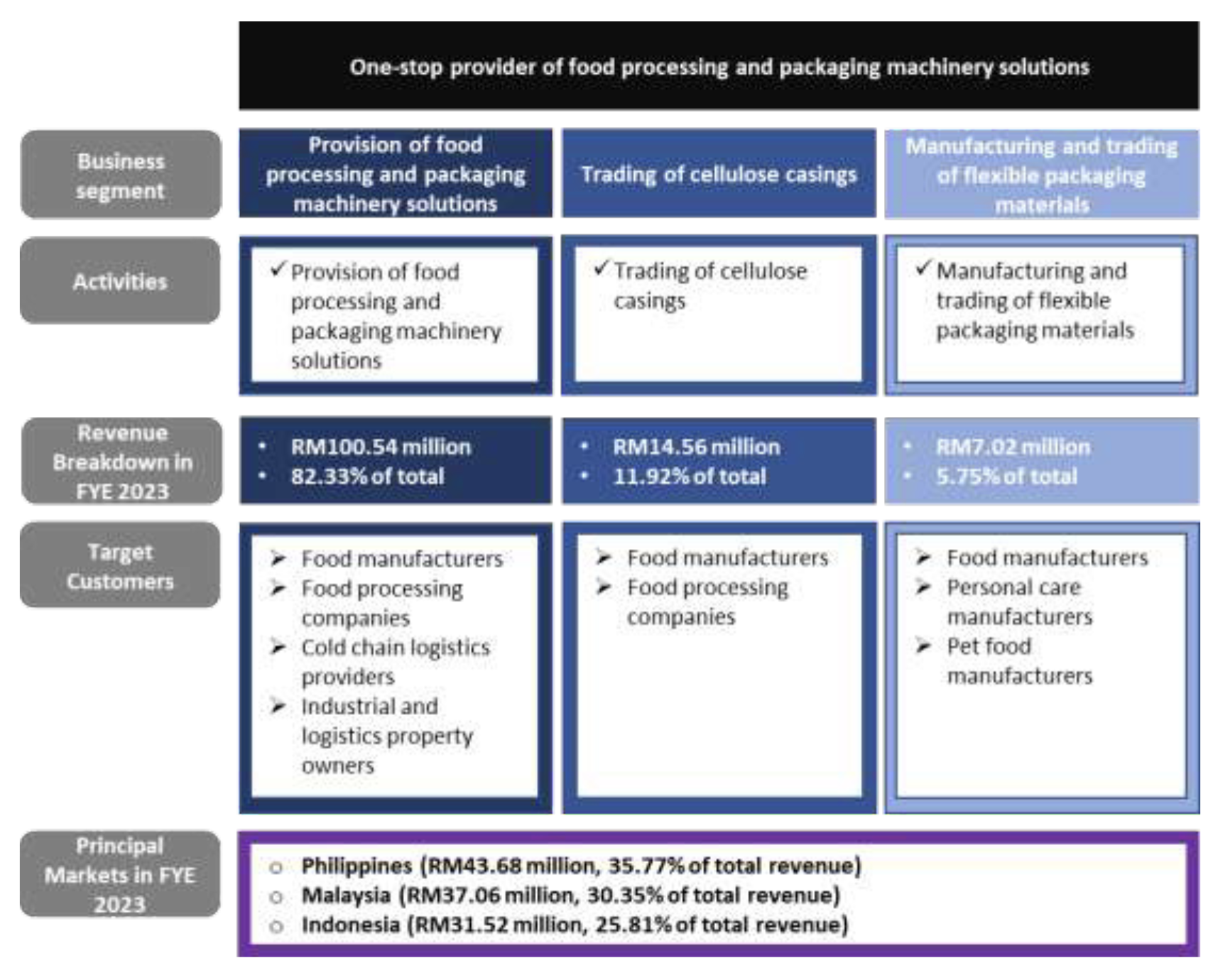

The Group is a one-stop provider of food processing and packaging machinery solutions. They are primarily involved in the design, customisation, fabrication, integration and automation of production lines for food manufacturing and processing companies, based on our customers’ needs. They are also involved in the trading of cellulose casings, as well as manufacturing and trading of flexible packaging materials.

Use of proceeds

Acquisition of land - 32.43% (within 12 months)

Construction of factory - 26.20% (within 36 months)

Purchase of machinery - 2.74% (within 36 months)

Repayment of bank borrowings - 7.49% (Within 6 months)

Working capital - 21.16% (Within 12 months)

Estimated listing expenses - 9.98% (Within 3 months)

Acquisition of land - 32.43% (within 12 months)

As part of the Group’s business strategies, they intend to allocate RM13.00 million representing approximately 32.43% of the gross proceeds from our Public Issue for the acquisition of land to construct a new factory, corporate office, warehouse and showroom to accommodate the growth in their business.

Construction of factory - 26.20% (within 36 months)

As at the LPD, the group has approximately 28,335 sq ft within Plant 1 which is allocated and utilised for their fabrication and assembly activities for their food processing and packaging machinery solutions business segment. They intend to allocate RM10.50 million, representing approximately 26.20% of the gross proceeds from the Public Issue, to fund the construction of a new single-storey factory on the land to be acquired as set out above in (a) with an estimated built-up area of approximately 52,000 sq ft to cater for the production of food processing and packaging machineries, warehouse and showroom, and a three-storey corporate office attached with an estimated built-up area of approximately 18,000 sq ft.

Purchase of machinery - 2.74% (within 36 months)

As at the LPD, the group owns three (3) units of CNC machines and one (1) unit of laser cutting machine that are used for the fabrication of necessary metal and plastic components under our food processing and packaging machinery solutions business segment. They intend to allocate RM1.10 million, representing approximately 2.74% of the gross proceeds from the Public Issue, to purchase additional machineries to cater for increasing orders from both existing and new customers. These additional machineries would enhance the in-house production capabilities and shorten the turnaround time should there be multiple large orders secured at the same time.

Repayment of bank borrowings - 7.49% (Within 6 months)

As at the LPD, the total outstanding bank borrowings (excluding lease liabilities) of the Group amounting to RM2.78 million. Their Board intends to utilise RM3.00 million, representing approximately 7.49% of the gross proceeds from the Public Issue to partially repay the bank borrowings.

The expected annual interest savings from the repayment of the bank borrowings is approximately RM0.13 million based on the effective interest rates ranging from 4.69% to 5.00% per annum for the relevant banking facilities. However, the actual interest savings may vary depending on the then applicable interest rates. Their selection to repay the above financing facilities was determined after taking into consideration the interest cost of such financing facilities and the outstanding loan amounts.

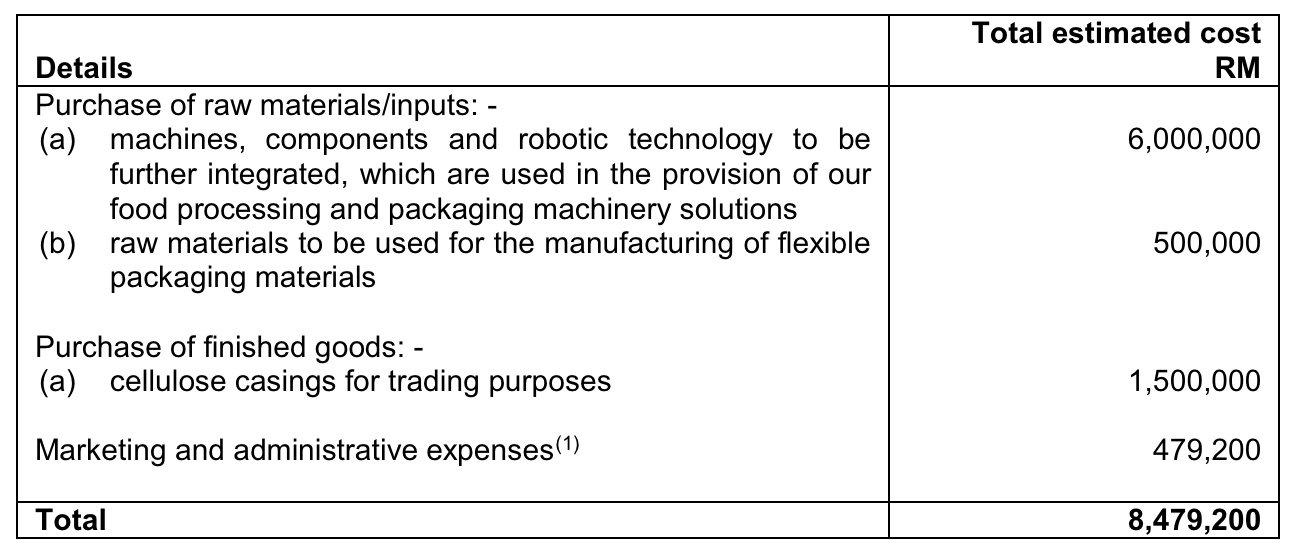

Working capital - 21.16% (Within 12 months)

Their working capital requirement is expected to increase in conjunction with the planned expansion of the existing business operations, through enhancement of the product offerings (where they are predominantly focused on increasing the level of automation and integration of robotics technology in the machinery solutions that they provide to their customers) and extension of their market reach in both the local and overseas markets (particularly the Indonesia and the Philippines markets). They intend to allocate approximately RM8.48 million, representing 21.16% of the gross proceeds from our Public Issue, for working capital purposes to be utilised in the following manner:

Business model

The business model is illustrated as follows:

Click here to continue the IPO - EPB Group Bhd (Part 2)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)