IPO - Vetece Holdings Bhd (Part 1)

MQTrader Jesse

Publish date: Mon, 12 Aug 2024, 03:06 PM

Company Background

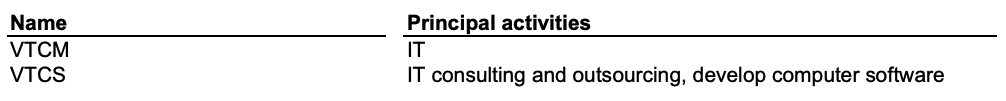

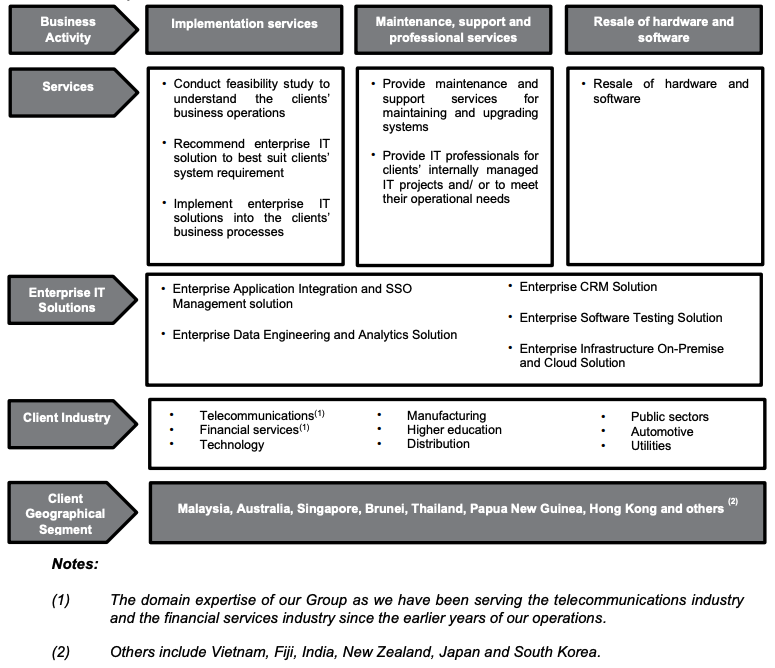

The Company was incorporated in Malaysia on 22 November 2023 under the Act as a private limited company under the name of VETECE Holdings Sdn Bhd and was subsequently converted to a public limited company and assumed its current name on 8 December 2023 to facilitate the Listing. They are an investment holding company and through their Subsidiaries, they are principally involved in the following:

Further details of the Group structure and the Subsidiaries are set out in Section 6.3 and 6.4 of this Prospectus.

The business operations are principally based in Malaysia and they are principally involved as an enterprise IT solutions provider where they provide implementation services, as well as maintenance, support and professional services and the resale of hardware and software. Please refer to Section 7.2 of this Prospectus for further details.

Use of proceeds

Roll out of new core products and services - 8.95% (within 24 months)

Strengthening of Singapore operations - 13.44% (within 24 months)

Establishment of a COE for software solutions - 15.49% (within 36 months)

Hardware and software licensing fees - 26.61% (within 24 months)

Loan repayments - 16.34% (within 6 months)

Estimated listing expenses - 19.17% (Within 1 months)

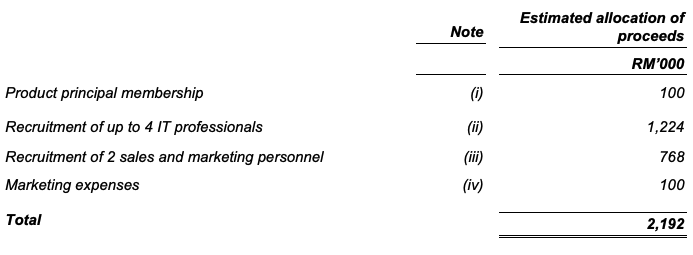

Roll out of new core products and services - 8.95% (within 24 months)

Given the impact of AI bringing improvements in efficiency, decision making and innovation across various industries, the Group intends to introduce AI-driven data handling and analytic solutions to complement their existing enterprise application integration and data engineering solutions. They intend to allocate approximately RM2.19 million or 8.95% for the expansion of new core products and services in relation to the new AI-driven data handling and analytic solutions within 24 months from the date of Listing. Further details are set out in the following manner:

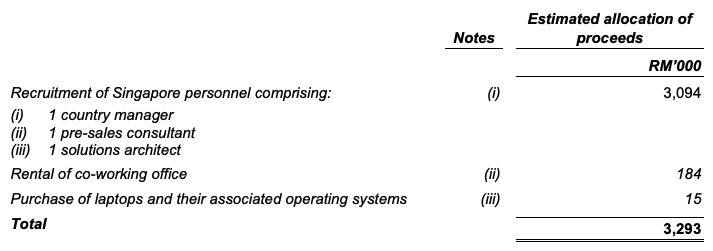

Strengthening of Singapore operations - 13.44% (within 24 months)

The Group has a Singapore presence via their subsidiary, VTCS that was incorporated in 2005. Nevertheless, their Singapore operations were supported by their Malaysia based IT professionals that travels to Singapore whenever there are implementation, maintenance and support, and professional services required in Singapore. As such, they intend to strengthen their Singapore operations through talent acquisition and establishing a Singapore base of operation. They intend to allocate approximately RM3.29 million or 13.44% of the total Public Issue proceeds for the strengthening of their Singapore operations within 24 months from the date of Listing, with details as follows:

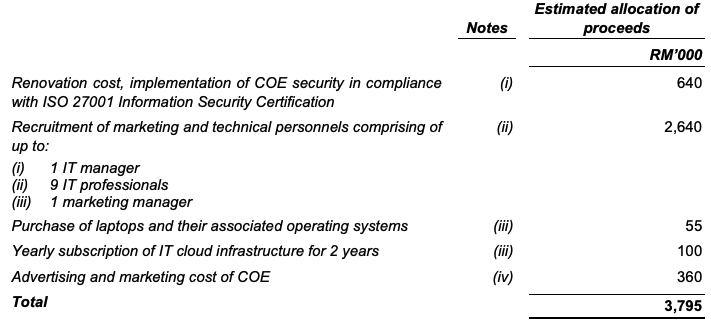

Establishment of a COE for software solutions - 15.49% (within 36 months)

The Group intends to establish a COE for software solutions which allows us to undertake projects for overseas clients remotely from their base of operation in Malaysia. By establishing a COE that adhere to international IT security standard, this is expected to address the requirement of their overseas clients who are seeking for cost-effective IT solution, as well as for these overseas clients that do have their internal IT offices in Malaysia to accommodate their IT professionals to work in their premises. In terms of function and operational focus, the head office will continue to serve as the central administrative hub, managing various functions including administration, finance and human resources, strategic planning and corporate communication to support the Group’s overall functions. Meanwhile, as described above, the COE will serve as a centre to undertake projects for overseas clients remotely and acts as a demonstration centre to showcase their enterprise IT solutions tailored to the specific needs of the clients.

The group intends to allocate approximately RM3.80 million representing 15.49% of the Public Issue proceeds for the establishment of a COE in Malaysia within 36 months from the date of the Listing, with details as follows:

Hardware and software licensing fees - 26.61% (within 24 months)

The group resellsl hardware and software as part of the business activity on top of their implementation and support and maintenance services. Hardware and software licenses are purchased by us and resold to their clients packaged with their services as value-added reseller given their technical expertise to assist in implementing and configuring these hardware and software. This positions us as a one-stop centre for implementation and maintenance support and professional services, allowing us to further drive their revenue from the core businesses. As at the LPD, the Group resells hardware and software licenses from certain of their technology partners being Oracle, WSO2 and Technology Partner B.

They intend to allocate RM6.52 million representing 26.61% of the Public Issue proceeds for the new purchase and renewal of the hardware and software licensing fees of Oracle and WSO2 as well as new licenses from other technology partners depending on the requirements of their clients and contracts. The cost of hardware and software licenses may vary based on types of licenses and technology partners and are depending on the requirements of their clients and the type of software licenses used (i.e. whether onpremises or cloud infrastructure software). On-premises software licenses, being software that are installed directly into their clients’ IT infrastructure on their premises, are typically calculated on the basis of cost per license per software while cloud infrastructure licensing costs are determined based on, amongst others, the type of software, amount of data, time of usage and other factors which may affect how the cloud infrastructure is used. While the group is not able to determine the number of licenses to be purchased at this point in time, the allocated amount of RM6.52 million is expected to be used within 24 months from the Listing for the purpose.

Loan repayments - 16.34% (within 6 months)

The group plans to utilise RM4.00 million representing 16.34% of the Public Issue proceeds for the repayment of the loans taken out to finance the purchase of properties. They have taken bank borrowings of approximately RM4.47 million to fund the purchase of 4 properties, 2 of which are currently used by us as the main offices. As at the LPD, the outstanding sum of bank borrowings for the purchase of their owned properties stands at RM4.00 million, which is the total amount of bank borrowings of the Group.

The group expects to utilise the proceeds to fully repay the entire amount outstanding under the letter of offer within 6 months from the date of the Listing. The intended repayment of bank borrowing will result in an estimated annual interest savings of approximately RM0.18 million based on the effective interest rate of approximately 4.35% per annum. However, the actual interest savings may vary depending on the then applicable interest rates.

Business model

The following diagram illustrates their business model:

Click here to continue the IPO - Vetece Holdings Bhd (Part 2)

Interested to start trading? Send your inquiry now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)