IPO - Solar District Cooling Group Bhd (Part 2)

MQTrader Jesse

Publish date: Fri, 30 Aug 2024, 03:09 PM

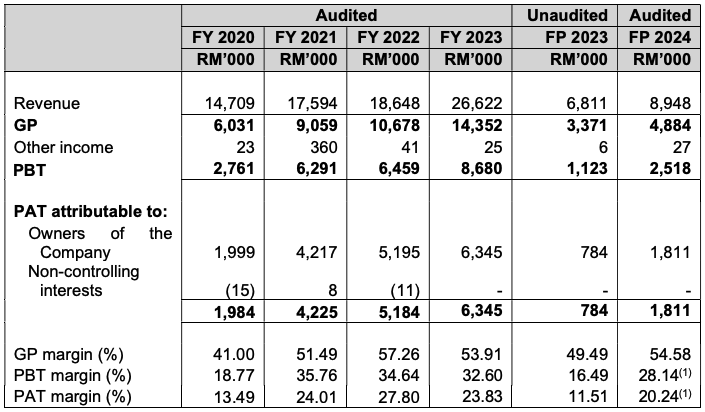

Financial Highlights

The key information of the audited combined financial statements of SDCG Group for the FY Under Review and FP Under Review are set out below:

The revenue increased from RM 14 million in FYE 2020 to RM 26 million in FYE 2023. The company is expanding its market share in this industry.

The GP margin increased from 41.00% in the FYE 2020 to 57.26% in the FYE 2022 but decreased to 53.91% in FYE 2023. This was mainly due to the higher administrative expenses.

The PAT margin increased from 13.49% in FYE 2020 to 27.80% in FYE 2022 and dropped to 23.83% in FYE 2023.

The gearing ratio is 0.04 in FYE2023, which is below the benchmark. This indicates that the company still has room to further increase its debt, indirectly suggesting that in the event of any crisis, the company will not easily face risks due to excessive debt. (A good gearing ratio should be between 0.25 – 0.5).

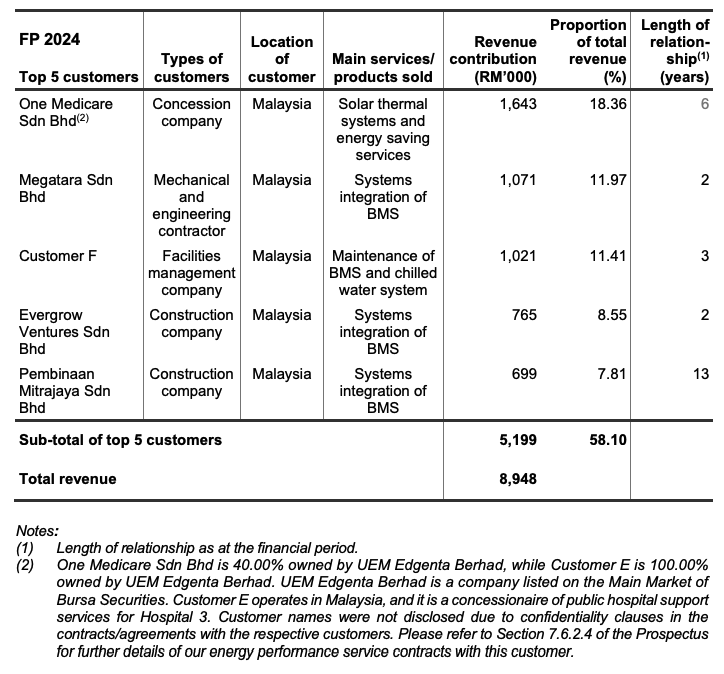

Major customers and suppliers

The top 5 major customers and their revenue contribution for the FY Under Review and FP 2024 are as follows:

The group is dependent on One Medicare Sdn Bhd and Pembinaan Mitrajaya Sdn Bhd as each of these customers accounted for 10.00% or more of the total revenue in at least 3 FY Under Review and FP 2024.

Radicare Group may have accounted for 15.70% of the total revenue for FY 2021, however, they are not dependent on this customer as they accounted for more than 10.00% of the total revenue in only one of the FY Under Review and FP 2024. In addition, the revenue from Radicare Group was for a project based contract which was completed in 2022.

The group is not dependent on the following customers although they accounted for more than 10.00% of the total revenue in FY 2023 and/or FP 2024 for the following reasons:

(i) Customer C accounted for 25.07% of the total revenue only in one FY Under Review namely in FY 2023. The group is not dependent on this customer as the business relationship commenced in 2023 and this was for two project based contracts namely the Conference and Residential Complex Project, and Cyberjaya Data Centre Project.

(ii) Megatara Sdn Bhd accounted for 11.97% of the total revenue only in FP 2024. The group is not dependent on this customer as their business relationship only commenced in 2023, and this was for a project based contract namely the Ampang Office Tower Project.

(iii) Customer F accounted for 11.41% the total revenue only in FP 2024. The group is not dependent on this customer as this was for project based contracts namely the Chilled Water System Maintenance Project.

The company is also not dependent on the remaining top 5 customers for the FY Under Review and FP 2024 as each of them accounted for less than 10.00% of the total revenue in each of the FY Under Review and FP 2024.

Major Suppliers

For FY Under Review and FP 2024, the suppliers that accounted for 10.00% or more of the purchases of materials and services were Noblecom Technology Sdn Bhd, Tridium Asia Pacific Pte Ltd, SPE (former related party), Siemens Pte Ltd and SFM Global Engineering. Generally, the group is not dependent on any of the top 5 suppliers for the FY Under Review and FP 2024 as similar products or services are available from other suppliers in the market.

Industry Overview

According to the research by Vital Factor Consulting, BMS are commonly provided for high-rise commercial, institutional and industrial buildings. As a result, the demand for BMS industry is dependent upon, among others, the performance of the building construction industry, as well as the existing and future supply of buildings as a platform for business sustainability and growth. A growing construction industry will provide opportunities for the implementation of BMS. In 2023, the value of building construction work completed grew by 3.3% compared to 2022. In 2023, the real GDP of the construction industry in Malaysia grew by 6.1% compared to 2022, and is forecasted to grow by 6.8% in 2024 (Source: Ministry of Finance). In H1 2024, the real GDP of construction industry and the value of construction work completed for building construction grew by 14.5% and 9.8% respectively compared to H1 2023 (Source: DOSM).

The existing supply of commercial properties provides an indication of the potential market requiring retrofitting, while future supply indicates the need for the installation of BMS in the construction of new buildings. As of Q1 2024, the existing supply of purpose-built offices and serviced apartments grew by 0.5% and 19.4% respectively compared to Q1 2023. Meanwhile, the future supply of purposebuilt offices declined by 9.0% while serviced apartments grew by 3.8% compared to Q1 2023.

Overall, in 2023, the performance of the BMS industry was supported by the real GDP growth of the Malaysia economy and construction industry, the value of construction work completed for building construction, as well as the increased existing supply of purpose-built offices and serviced apartments. It is noted that there was a decline in the future supply of serviced apartments, nevertheless, opportunities may arise from the existing supply for potential upgrades or retrofitting. As the BMS industry is reliant on the building construction industry, operators in the industry would be subject to the risks inherent in the construction industry which include, among others, general economic conditions, and business and consumer sentiments which may affect the general demand for property investment and construction activities.

The Malaysian government has introduced several policies and incentives to promote renewable energy adoption and energy efficiency, driven by environmental concerns and global commitments to combat climate change. Solar power projects are being developed to harness Malaysia’s natural resources. Energy performance contracting was one of the key initiatives to improve energy efficiency. In 2022, there were 160 public hospitals, including 137 hospitals and 11 special medical institutions under MOH, and 12 army and university hospitals. As of December 2022, MOH has implemented a total of 44 energy projects through energy performance contracting (Source: MOH), providing opportunities to service the remaining public hospitals and special medical institutions with solar thermal and energy performance services. In addition, private hospitals may also serve as potential targets for solar thermal and energy performance services. Overall, in 2023, the performance of the solar thermal industry was supported by government initiatives, real GDP growth of the Malaysia economy, and the increase in the existing supply of hotels and number of public hospitals. It is noted that there was a decline in the future supply of hotels and the number of private hospitals, nevertheless, opportunities may arise from the existing supply for potential retrofitting.

The trend towards environmental sustainability and the drive to reduce the carbon footprint associated with commercial and industrial activities, coupled with potential cost savings, will contribute to the increasing demand for energy saving services and energy-efficient solar thermal systems within buildings. Some of the government policies relating to renewable energy under the National Energy Transition Roadmap include an increase in the target for renewable energy installed capacity from 40% in 2040 to 70% by 2050, scaling up the installation of solar systems in government buildings, and the establishment of electricity exchange systems to allow crossborder renewable energy trade (Source: Ministry of Economy). Between 2021 and 2023, the total number of Green Building Index (GBI) certified buildings in Malaysia grew at a CAGR of 7.1% from 591 projects in 2021 to 678 projects in 2023. As of 30 June 2024, there were 696 GBI-certified buildings and 1,223 registered GBI projects in Malaysia. (Source: Vital Factor analysis)

Market Position

There are no publicly available statistics on the market size for the provision of BMS and solar thermal systems, therefore it is not possible to derive market share for SDCG Group. As the government intends to promote energy efficiency in government buildings, the number of public hospitals indicates the potential market for energy performance services, which includes the use of solar thermal systems.

Future plans and strategies for SOLAR DISTRICT COOLING GROUP BERHAD

The group’s business strategies and plans will continue to focus on the current core competencies in the provision of BMS and solar thermal systems and energy saving services to grow their business. In addition, the group plans to address opportunities in solar PV systems. They intend to implement these business strategies and plans from 2024 to 2027. Their business strategies and plans are as follows:

The group plans to expand the Headquarters.

The group intends to purchasing and subscribing for ICT software and services to improve the business operations.

The group intends to purchase new tools and equipment for the BMS segment and solar thermal systems and energy saving services segment.

MQ Trader View

Opportunities

The group has an established track record of approximately 17 years to serve as a reference site for prospective customers.

The group has two revenue streams namely the BMS segment, and the solar thermal systems and energy saving services segment.

Risk

The group is dependent on certain major customers.

The group is dependent on their ability to continually secure new and sizeable projects to ensure the sustainability and growth of the business.

The group may face early termination or suspension of the contracts which may adversely affect their financial performance.

Click here to continue the IPO - Solar District Cooling Group Bhd (Part 1)

Eager to explore more trading opportunities? Apply margin account now!

https://bit.ly/mqatamargin

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Initial Public Offering (IPO)