IPO - Life Water Berhad (Part 2)

MQTrader Jesse

Publish date: Tue, 29 Oct 2024, 02:48 PM

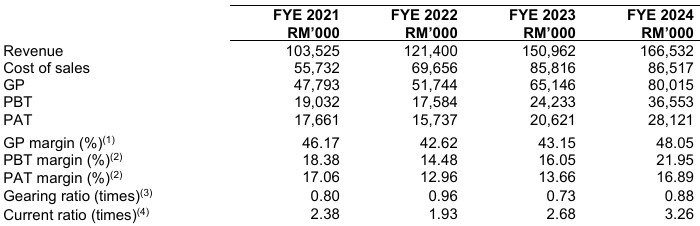

Financial Highlights

The following table sets out a summary of the combined financial information of the company Group for the Financial Years Under Review:

The revenue consistently increased from RM 103 million in FYE 2021 to RM 166 million in FYE 2024, indicating that the company is expanding its market share.

The gross profit margin dropped from 46.17% in FYE 2021 to 42.62% in FYE 2022, primarily due to the increase in the input material costs for plastic bottles and containers. However, it subsequently rose to 48.05% in FYE 2024.

The PAT margin decreased from 17.06% in FYE 2021 to 12.96% in FYE 2022, it then increased to 16.89% in FYE 2024.

The gearing ratio is 0.88, which is above the healthy range. Therefore, the company could easily face a crisis if liquidity issues arise. (A good gearing ratio should be between 0.25 - 0.5).

Major customers and suppliers

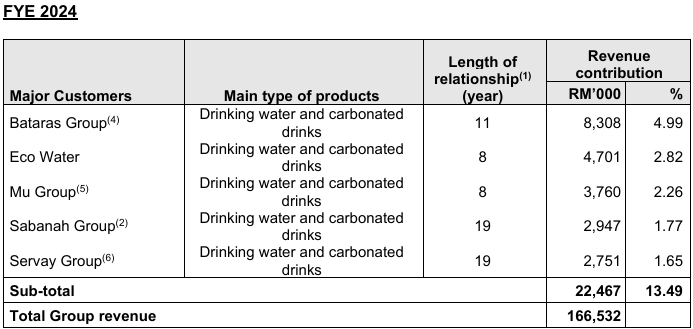

Major Customers

The table below lists the company top 5 major customers for FYE 2024:

The company is not dependent on any individual major customers as their largest customer contributed less than 10% of the company total revenue.

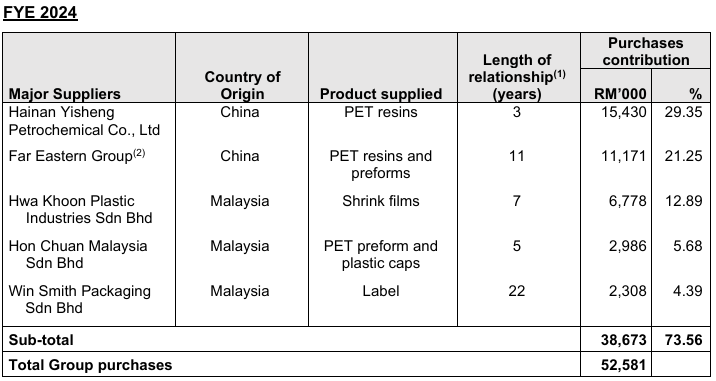

Major Suppliers

The table below lists the company top 5 major suppliers for FYE 2024:

The company is not dependent on any of the major suppliers.

Industry Overview

Life Water Berhad together with its subsidiaries (herein referred to as Life Water Group) is mainly involved in the manufacture of drinking water and carbonated drinks including flavoured carbonated drinks and a small proportion of isotonic drinks and fruit-based drinks in Sabah, Malaysia.

The key process in the manufacture of bottled water is to obtain water and treat the water to ensure it is safe for consumption before packaging it for wholesale or retail to consumers. Natural mineral water is sourced directly from underground water resources (at the point when water flows out to the surface of the earth) through a spring, well, or other natural exits to the surface. It must be collected as close as possible to the point of natural emergence to preserve its original bacteriological purity, and cannot be transported in bulk for further processing or packaging. These water sources must contain natural minerals such as magnesium, calcium, fluoride, sodium and sulphate, and cannot be artificially fortified or enriched with added minerals or vitamins. Meanwhile, drinking water can be sourced from any potable water that is suitable for human consumption including public water supply, surface water or underground water, other than natural mineral water.

Water taken from any sources must be processed and treated to ensure that the end product is safe to drink directly from the container without further preparation. According to the Food Regulations 1985, bottled water needs to comply with the prescribed chemical, bacteriological and radioactivity standards. As such, it may undergo one or more treatment processes to remove or reduce contaminants such as pesticides, mineral oil, manganese, arsenic and coliform organisms to comply with the said standards.

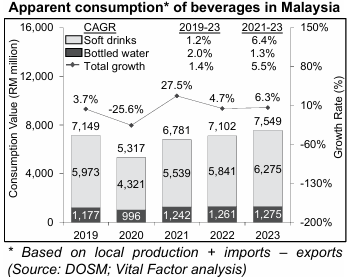

In Malaysia, potable water is widely accessible, so packaged and branded beverages are considered discretionary items, with demand influenced by factors like population size, tourist arrivals, consumer sentiment, and household spending. Between 2021 and 2023, apparent consumption of beverages in Malaysia grew at a CAGR of 5.5%. In 2023, apparent consumption of beverages in terms of value increased by 6.3%, driven by 7.4% and 1.1% growth in soft drinks and bottled water respectively.

The key risk and challenges in this industry:

Market trends and consumer preferences are essential as bottled and carbonated water are discretionary consumer products.

Competition from existing industry players and potential new market entrants

The business operations and financial performance subject to political, social, economic and regulatory risks in Malaysia as well as the occurrence of force majeure events such as global pandemic risks

Source: Vital Factor analysis

Future plans and strategies for LIFE WATER BERHAD

A summary of the company business strategies and plans is as follows:

Expansion of manufacturing facilities

Expansion of warehousing facilities

Expansion of geographical markets

Expansion of beverage products

MQ Trader View

Opportunities

The company has a wide distribution network in place to provide customer convenience and accessibility

The company has an established manufacturer of drinking water in Sabah and have an estimated 11% share of the bottled water market in Malaysia

The company has a proven track record of approximately 22 years as a manufacturer of beverages with a portfolio of established brands of beverages in the Sabah market

Risk

Fluctuations in raw material prices and shortages of raw materials

Disruption in water supply at the manufacturing plants

Click here to continue the IPO - Life Water Berhad (Part 1)

Looking for 3x cash & 2x shares trading limit? Get started now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)