MQ Trader – How to quantify signal quality with MQ Backtesting? [HENGYUAN] (Part 1)

MQTrader Jesse

Publish date: Wed, 17 Oct 2018, 12:26 PM

Introduction

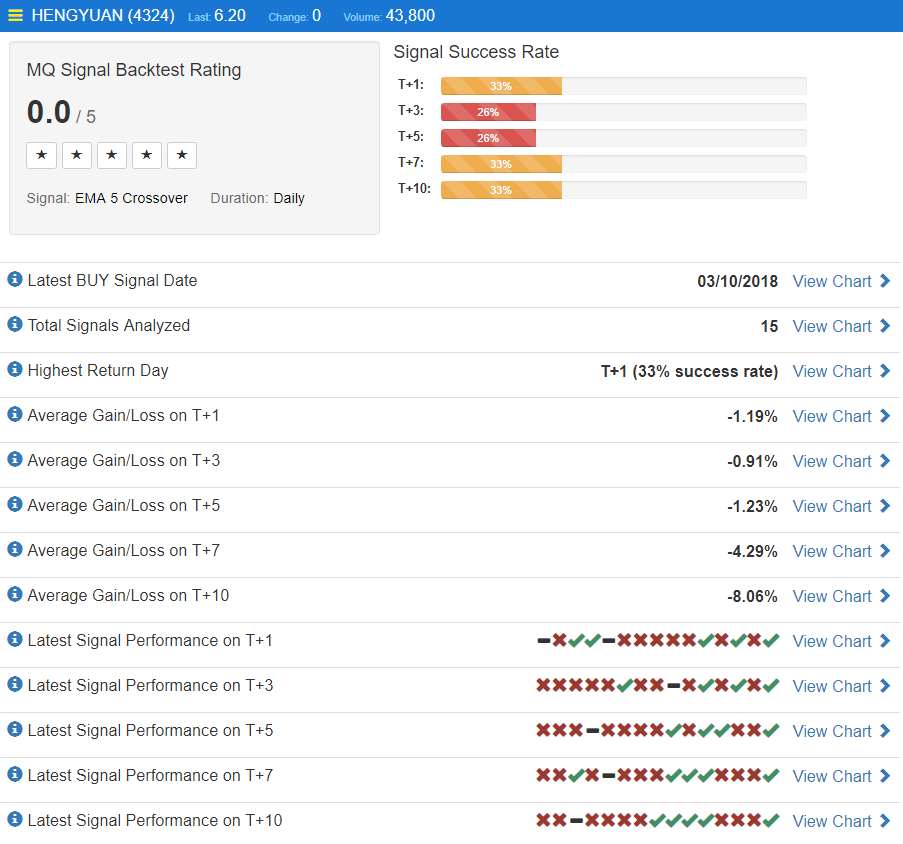

MQ Trading strategies are the key feature of MQ Trader, as they are able to detect the buy and sell signals based on the quantitative data of the stock. However, each trading strategy has their weaknesses leading to false signals might be produced due to the weak sell or buy momentum and the low trading volume. In this topic, we will be discussing on how to identity signals with high quality and accuracy by using HENGYUAN as our case study.

How to identify signals with MQ Trading Strategies

EMA 5 Crossover and ADX Crossover are the most commonly used trading strategies in MQ Trader system, so we will be using both strategies to study technical charts of HENGYUAN in this topic. To know more about EMA 5 Crossover and ADX Crossover, please visit MQ Trader Strategy – EMA 5 Crossover and MQ Trader Strategy – ADX Crossover respectively.

HENGYUAN Ema 5 Crossover Daily Chart

Source: MQ Trader Stock Analysis System

Source: MQ Trader Stock Analysis System

The daily charts above shows the share price movement of HENGYUAN throughout a year since August 2017. There are several red and green arrows observed indicating the presence of numerous trading signals over the time. However, not all trading signals are able to help traders in earning high profit.

What is low quality signal?

Figure 1: Example of low quality signals in HENGYUAN technical chart

Figure above shows the example of trading signals with low quality in HENGYUAN’s technical chart. Negligible profit can be earned when we trade according to signals with low quality.

How does low quality signal appear?

In fact, MQ Trading Strategies are using a series of calculation to provide traders a good indication of current price trend based on quantitative data of stocks. Trading signals are generated by following a set of rules to determine whether the particular stock is in bullish or bearish trend.

For example, the share price movement is considered as bullish if EMA 5 crosses EMA 20 from bottom. However, the buy signal produced cannot guarantee a sharp increase in share price, as there are much more uncertainties and unknown factors that can affect the share price significantly not taken into account of the trading strategies’ calculation.

Generally, poor quality trading signals are produced because it is impossible for a single trading strategy to be suitable for all types of technical charts, despite of the high accuracy of the trading strategies. Thus, it is important filter the trading signals that can fit into the technical charts of the particular stock to maximize our capital gain with high success rate.

Source: MQ Trader Stock Analysis System

MQ Backtesting

In our next blog post, we will be discussing on how MQ Backtesting can identify the good quality signals from the stocks. Please visit MQ Trader – How to quntify signal quality with MQ Backtesting (Part 2).

To understand more about MQ Backtesting, please read MQ Trader – Introduction to Backtesting.

MQ Trader Workshop

For those who are interested in MQ backtesting, you can visit MQ Trader Workshop - Budget 2019 Outlook & Backtesting With MQ Trader [Free Registration!] to know more about our coming workshop on 14 November 2018.

*Note: 300 MQ Points will be given away in the workshop!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedbacks coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on MQTrader Education Series

Created by MQTrader Jesse | Apr 13, 2023

Created by MQTrader Jesse | Aug 06, 2021

Created by MQTrader Jesse | Nov 01, 2019