Hengyuan Refining Company Berhad – Designated Hedges, Undesignated Hedges, and A Foisted Hedge

Neoh Jia En

Publish date: Fri, 30 Dec 2022, 09:59 AM

- Hedge accounting is optional – companies that do hedging do not necessarily record those transactions using hedge accounting.

- Investors should carefully interpret and differentiate accounting entries between those that are made under hedge accounting and those that are not.

- Further care is required in analysing Hengyuan’s embedded derivative position, which is accounted for differently from other derivatives used in hedging.

Amidst the extreme movements in refining margins, Hengyuan Refining Company Berhad (Hengyuan) was one of the most traded stocks on Bursa Malaysia this year. Fund flows provided by DIBots showed that retail investors dominated trades in the stock, while institutional investors have generally shunned the stock due to a lack of analyst coverage and difficulties in forecasting earnings, among other reasons.

In their endeavour to predict Hengyuan’s profits, retail investors have engaged in extended discussions on the company’s derivatives positions used to manage fluctuations in crude oil and product prices, but most have failed to discern the difference between accounting treatments for derivatives that are designated as hedges and for those that are not. Hostility emerged when the company reported less-than-satisfactory results, leading to some risky public comments about the company that may amount to defamation.

In this write-up, I would touch on the basics of hedge accounting used by Hengyuan in managing its market risk exposure, before moving on to explain the company’s embedded derivative position. My next write-up would elaborate on concerns that I have regarding the company’s financial reports. (Un)fortunately, I could not spot any evidence of fraud, as alleged by some investors, based on the company’s financial statements and my limited accounting knowledge.

Designated Cash Flow Hedges

Although hedge accounting could also be applied to hedges of fair value (FV) and of investment in foreign operation, Hengyuan is only involved in cash flow hedge and hence that is what I would elaborate. To further simplify my discussion, I would focus on the case of non-financial companies’ utilising cash-settled derivatives to hedge cash flows from future transactions, which is in line with the case of Hengyuan’s refining-margin hedges. Paragraph 6.5.2(b) of IFRS 9/MFRS 9, which guides the reporting of financial assets and liabilities, defines a cash flow hedge as follows:

“a hedge of the exposure to variability in cash flows that is attributable to a particular risk associated with all, or a component of, a recognised asset or liability (such as all or some future interest payments on variable-rate debt) or a highly probable forecast transaction, and could affect profit or loss.”

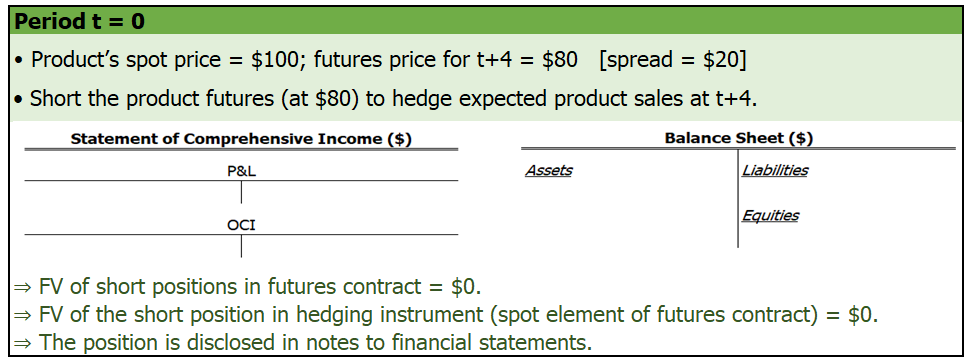

The purpose of cash flow hedge is to offset the variability in cash flows from a future transaction, by using hedging instruments to create cash flows that are expected to move in the opposite direction due to the common risk factor that affects both cash flows. In the best case where the hedge is 100% effective, the present value of the hedged cash flows moves in the same quantum but in the opposite direction as the fair value of the hedging instrument does.

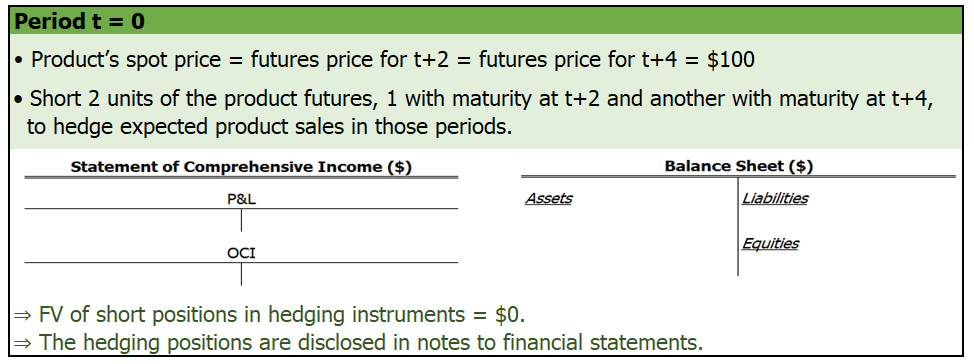

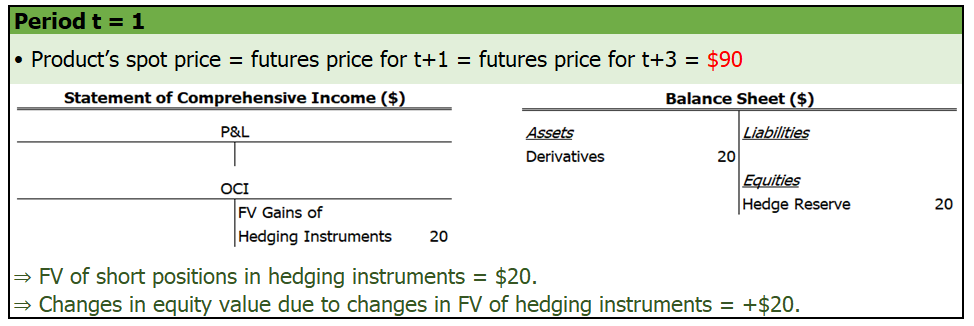

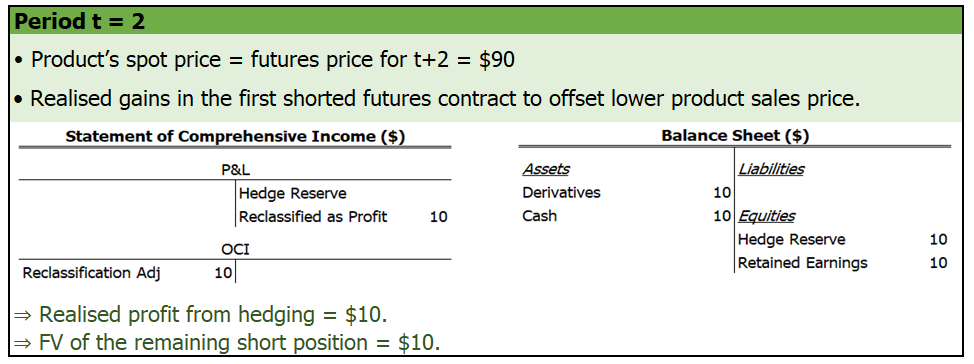

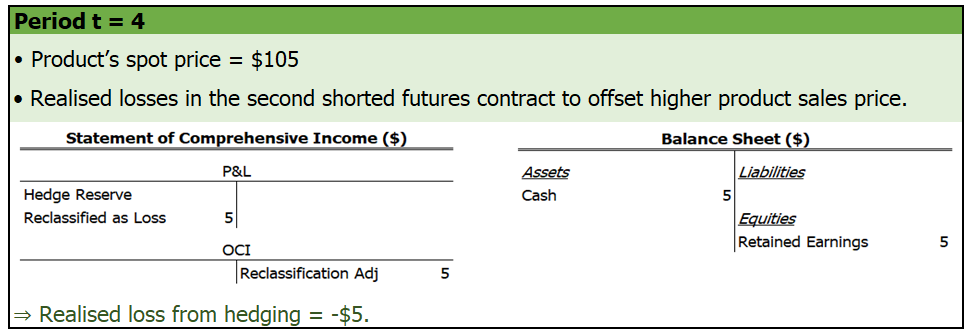

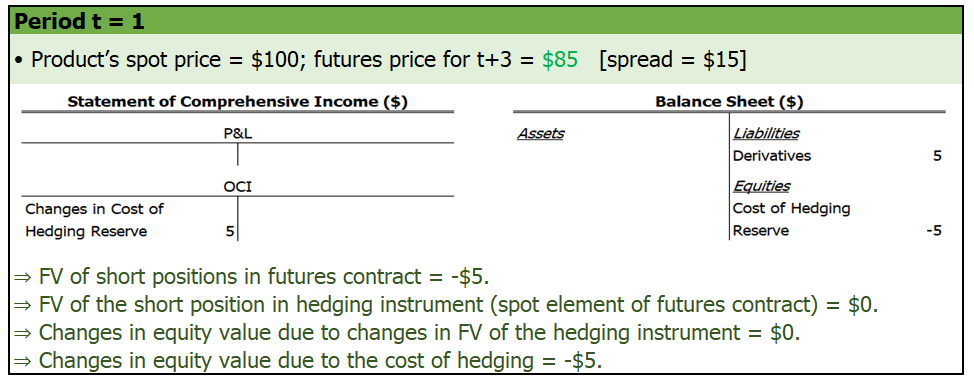

Meanwhile, the objective of cash flow hedge accounting is to match the timing of profit or loss recognition of the hedging instrument to that of the hedged transaction. To achieve this purpose, FV gains/losses of the hedging instrument that occur before the hedged transaction materialises are recorded as other comprehensive income (OCI) which affects the equity but not profit or loss during those periods. These accumulated OCI are then ‘recycled’ to be recognised as profit or loss when the hedged transaction finally takes place.

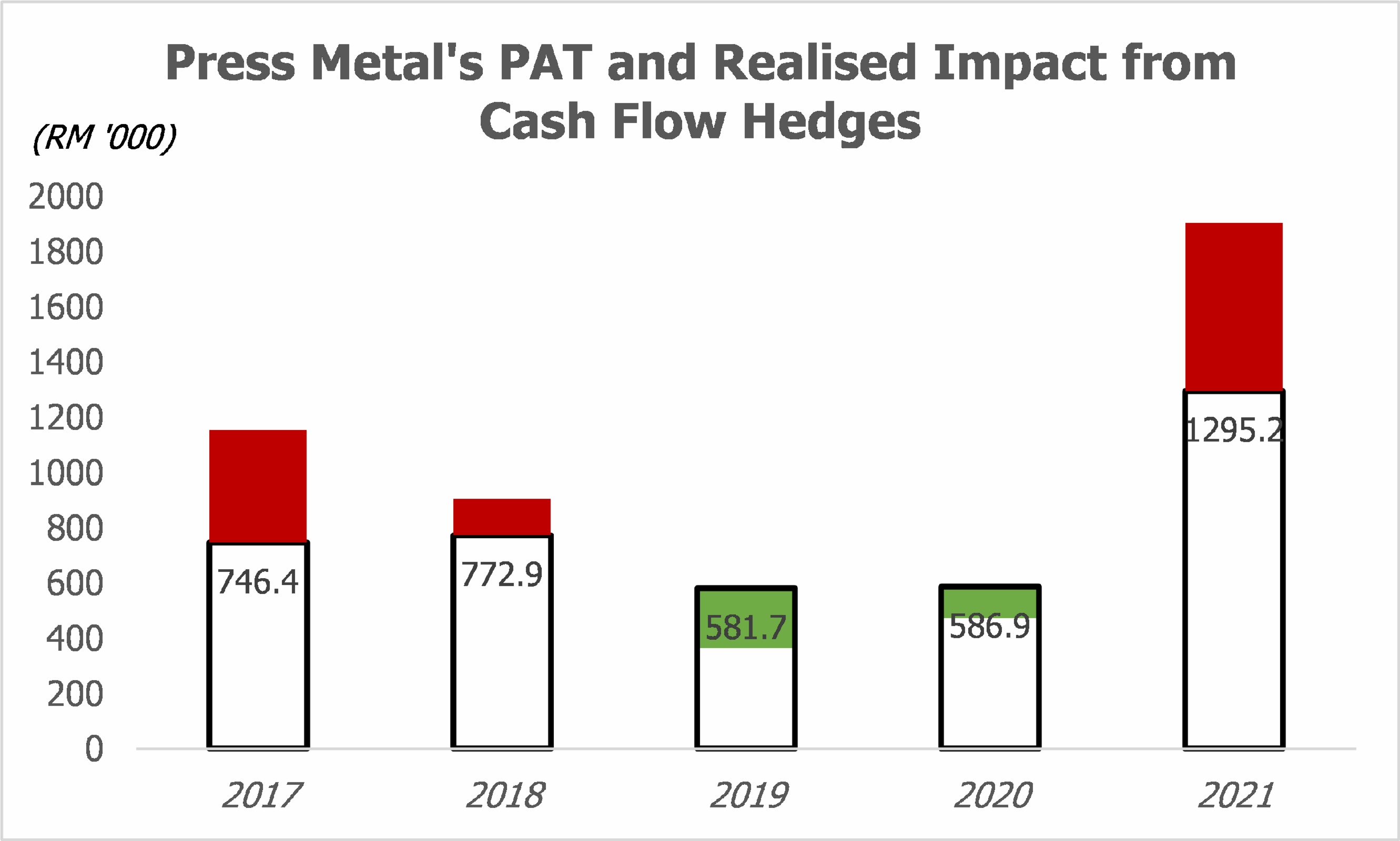

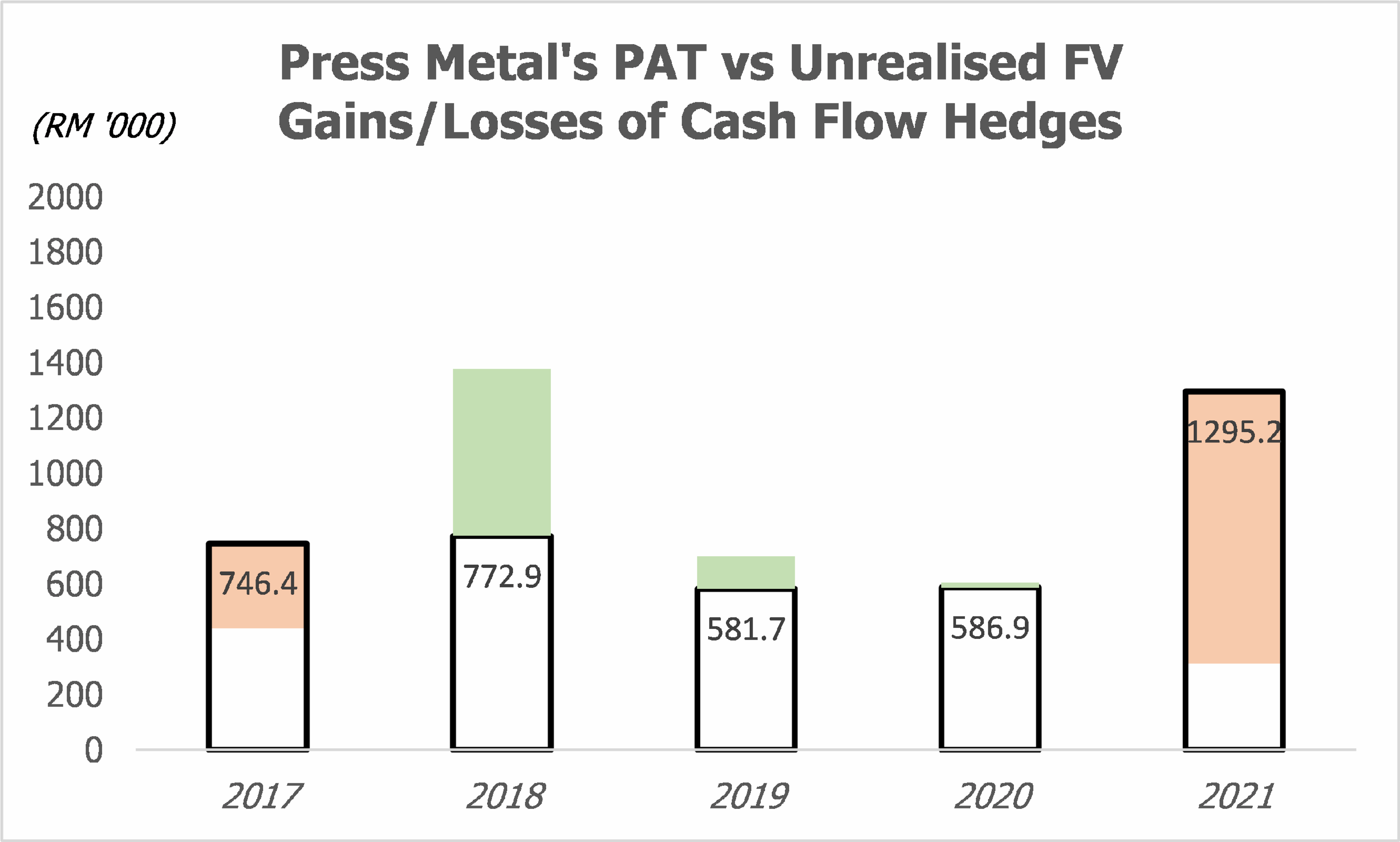

When executed properly, cash flow hedges would smooth out earnings; this should be reflected in the income statement of companies that practise hedge accounting. Press Metal Aluminium Holdings Berhad (Press Metal) is a good example: its hedges on aluminium prices and foreign currency risk have stabilised profit during its ‘bad’ years of 2019 and 2020.

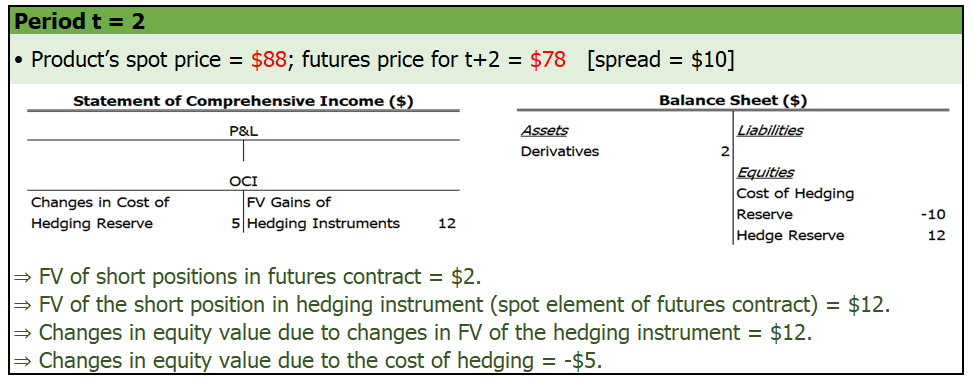

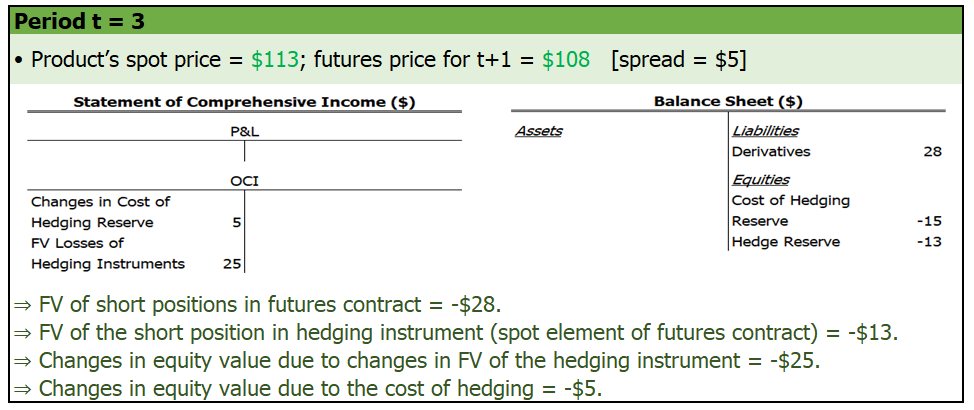

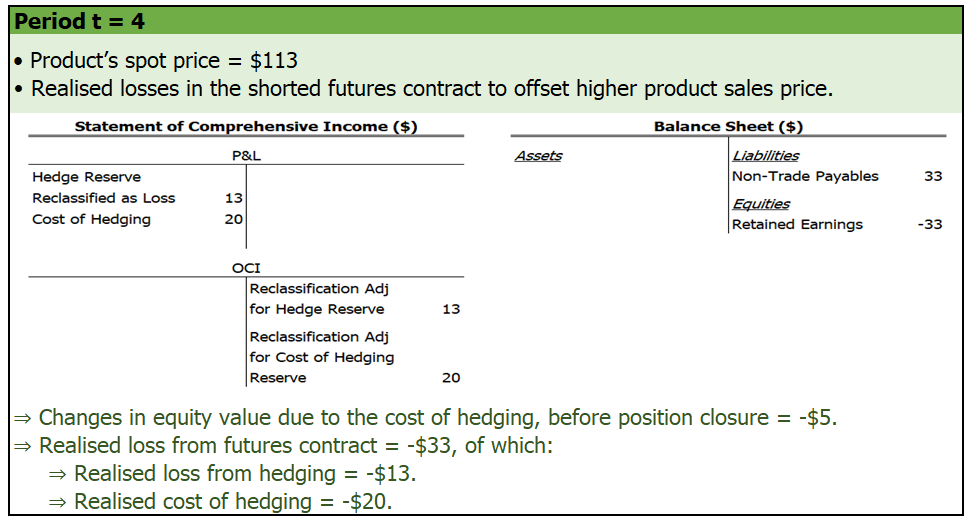

Noteworthily, some retail investors are unfamiliar with the accounting for OCI recycling, which actually is applicable not only to hedge accounting, and an elaboration is warranted. When an accumulated OCI is recycled as profit or loss, an offsetting entry is recorded in the OCI so that equity value is not affected by the recycling, since the impact to equity has already been recorded in previous periods. IAS 1/MFRS 101, which guides the presentation of financial statements, sets out requirements for these offsetting entries which are referred to as “reclassification adjustments” in paragraph 92 to 96. For illustration, with no time value of money, the periodic impact to the statement of comprehensive income, and cumulative impact to the balance sheet, of the hedging instrument in a cash flow hedge with 100% effectiveness are provided as follows.

In reality, hedge accounting is more complicated than the illustrated example above especially due to the fact that futures prices are usually different from spot prices driven by market expectations on changes in supply-demand situation, costs of carry (e.g. storage and insurance costs), and convenience yields. Options also trade at a premium, that is their market price is higher than intrinsic value, due to the asymmetry in payoff, while derivatives involving foreign currencies also often price in basis spreads – the difference in interest rates between currency pairs.

Due to these other factors, hedging may result in gains or losses even when the spot price of the hedging instrument and the present value of the hedged item do not move. Hence, some companies might want to designate as hedge instrument only the spot/instrinsic-value element of derivatives used, and account the forward/time value element as a cost of the risk management (hedging) activity much like paying insurance premium. Hengyuan has chosen to do so, for its refining margin swaps, as allowed by paragraph 6.2.4 of IFRS 9/MFRS 9.

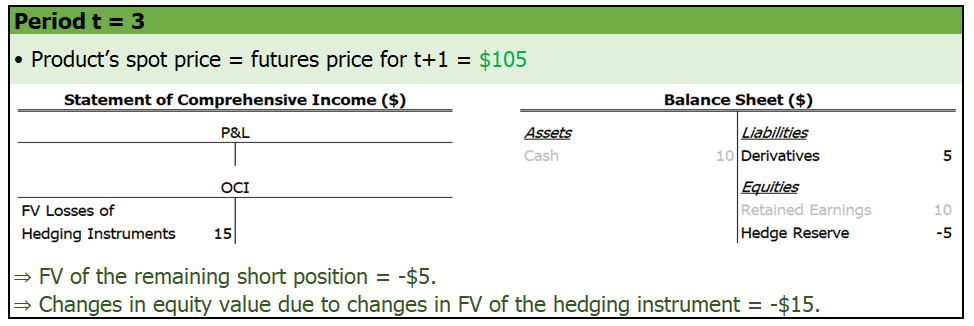

Fortunately for transaction-related hedges involving non-option derivatives, companies could further choose to account for the forward element/cost of hedging not through profit or loss immediately, but through OCI similar to how they do for the spot element (that is designated as the hedge instrument) – and this is also the case for Hengyuan’s refining margin swaps. Accordingly, FV gains or losses for the forward/time value element are also parked as OCI before being recycled as profit or loss when the forecast transaction takes place, although they are recorded in the line of OCI and component of equity that are different from those for the spot/instrinsic-value element; Hengyuan has labelled them as “cost of hedging reserve.” A simplified example with no time value of money, of a 100%-effective hedge on an underlying asset that is in backwardation (futures price is lower than the spot price), is provided below.

Undesignated Hedges

Although hedging against risk exposures is well-adopted among corporates, hedge accounting may not be as common as the practice of hedging itself. Two factors could be in play: (1) strict IFRS requirements to prevent abuse might lead to difficulties in designating as hedging instruments some contracts or derivatives genuinely used for hedging; (2) some corporates might not want to spend extra resources on hedge accounting, which remains an option under IFRS.

A few of the meticulous qualifying criteria for hedge accounting could be seen in paragraph 6.4 and Appendix B of IFRS 9/MFRS 9. Requirements for formal designation and documentation at the inception of a hedging relationship are set out in paragraph 6.4.1(b), and the assessment for economic relationship between the hedging instrument and hedged item is required to be supported not only by “mere existence of a statistical correlation” (paragraph B6.4.6). Paragraph 6.4.1(c)(ii) further requires that counterparty’s credit risk be taken into account before designating a hedging relationship.

Due to these requirements, some companies may find it difficult to formally designate their hedging activities. Guan Chong Berhad (Guan Chong) might be a good example: the company longs cocoa bean futures contracts to hedge the risk of raw material price fluctuations for its committed cocoa butter sales, yet it does not designate those contracts as hedging instruments. A likely reason for Guan Chong to not do so, despite utilising hedge accounting for its cross-currency swap contracts, is that the company’s actual cost of cocoa bean purchased from crop sellers may differ from the ending spot price in the cash-settled futures market due to factors such as difference in delivery locations and quality – the latter is a well-known issue for hedgers in the cocoa market. Although Guan Chong theoretically may designate as hedged item only the component of its forecasted cocoa bean purchase price that is attributable to movements in the futures market, such component must be “separately identifiable and reliably measurable”, as per paragraph 6.3.7(a) of IFRS 9/MFRS 9, and fulfilling this requirement may be impossible.

And even if a transaction could qualify for hedge accounting, the company may choose not to designate it as a hedge due to concerns on cost and risk assumed. IFRS 9 is known to be a difficult standard, and its section on hedge accounting is even more so. Thus, companies that practise hedge accounting assume a higher risk of financial restatements, not to mention the cost of documentation and monitoring. PricewaterhouseCoopers sums up the resource-draining aspect of implementing hedge accounting well, as follows:

“IFRS 9’s hedge accounting requirements are far-reaching and go beyond financial reporting. Their application may require changes to systems, processes and documentation and, in some cases, to the way companies view and manage risk. As ever, the devil is in the detail, and IFRS 9 certainly has a lot of detail. As companies have started to work through some of the new calculations, they have found it more challenging and complex than they initially expected.”

It is hence fair to speculate that consideration about resource consumption is one of the reasons why Hengyuan’s closest peer on Bursa Malaysia, Petron Malaysia Refining & Marketing Berhad (Petron Malaysia), does not adopt hedge accounting. While some investors have incorrectly concluded that Petron Malaysia does not engage in hedging, the company in fact does utilise commodity swaps to “mitigate crude and petroleum products price risks arising from volatile market prices” and forward exchange contracts to manage its foreign currency exposure.

When hedge accounting is not utilised, companies have to recognise the periodic FV changes of financial instrument used in a hedge as profit or loss in each period, even for unrealised FV gains or losses in periods before the forecast transaction takes place. This method of measurement, so called fair value through profit or loss (FVTPL or FVPL) is also required for the ineffective portion of designated hedging instruments in hedge accounting, although Hengyuan has recorded no ineffectiveness for all its designated hedges so far other than a small amount in 2017.

In any case, companies that do not adopt hedge accounting for their hedges would record profit or loss that is more volatile than if they do. The impact to Press Metal’s profit, had the company measured instruments used for its cash flow hedges at FVTPL, is illustrated below.

An artificial derivative forced upon by IFRS

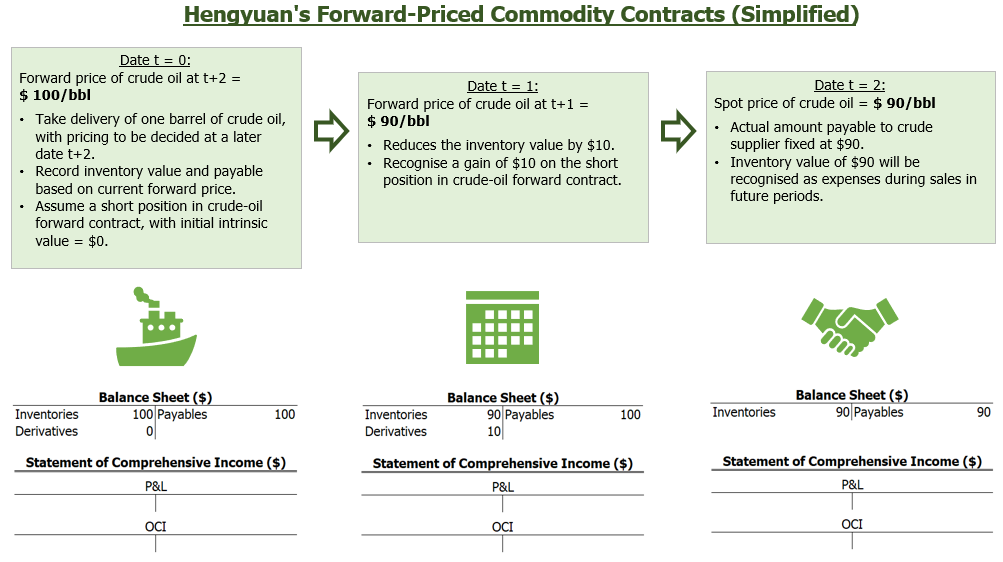

Finally, Hengyuan also has a derivative position of which changes in FV are not recognised immediately as profit or loss despite not being a designated hedging instrument. These “forward priced commodity contracts” help to offset the market price fluctuations of parts of Hengyuan’s crude oil inventory.

The reason why Hengyuan has the option for not reflecting FV fluctuations of its “forward priced commodity contracts” in the income statement ought to be explained from how these derivative contracts came into existence. Hengyuan actually takes delivery of its crude oil supply before knowing the actual price to be paid. To peg a value to these inventories and payables in its financial statements, the company utilises the forward price, available e.g. from the futures market, of crude oil to be delivered at the time when its payable amount will be fixed.

Owing to this arrangement, Hengyuan’s payable amount will fluctuate along with the market price of crude oil before the date when it is finally fixed, hence shielding the company from the risk of a crude oil price crash during the period. This is akin to hedging the market risk of crude oil inventory with a short position in crude oil futures contract.

Due to requirements stated in paragraph 4.3.3 of IFRS 9/MFRS 9 – details of which are ignored here – Hengyuan has to separately recognise the variability in payable as if it is a separate derivative contract, named as “forward priced commodity contracts” in the company’s book. This is considered an embedded derivative, defined in paragraph 4.3.1 of IFRS 9/MFRS 9 as follows:

“An embedded derivative is a component of a hybrid contract that also includes a non-derivative host—with the effect that some of the cash flows of the combined instrument vary in a way similar to a stand-alone derivative. An embedded derivative causes some or all of the cash flows that otherwise would be required by the contract to be modified according to a specified interest rate, financial instrument price, commodity price, foreign exchange rate, index of prices or rates, credit rating or credit index, or other variable, provided in the case of a non-financial variable that the variable is not specific to a party to the contract…”

Yet, when crude oil price and hence the actual amount of payable move in subsequent periods before the price-fixing date, Hengyuan claims that it has two options to record the price movement: the company could (1) attribute the movement to a change in the FV of embedded “forward priced commodity contracts” and reflect it as a profit or loss, as per IFRS 9/MFRS 9, or (2) attribute the movement as a change in the cost of inventory, as per IAS 2/MFRS 102 which prescribes the accounting treatment for inventories. Hengyuan has ultimately opted to record the price change as a change in the cost of inventory, as illustrated below:

Since changes in the FV of Hengyuan’s “forward priced commodity contracts” do not affect the company’s profit or loss or even OCI, this embedded derivative could be largely ignored when analysing the company’s operating and hedging performance.

Having explained the basic accounting rules used by Hengyuan in recording its hedging activities, I plan to describe a few of their implications, including one missing disclosure, in my next write-up.

*Edited to differentiate between the definition of hedge effectiveness and IFRS-/MFRS-prescribed measurement method of retrospective hedge ineffectiveness.

*Edited to amend an earlier error on the measurement classification of “forward priced commodity contracts,” which is in fact recorded by Hengyuan as FVTPL despite not recognising subsequent FV gains/losses in the income statement (although this does call into question compliance with paragraph 5.7.1 of IFRS 9/MFRS 9).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Discussions

From Petron Corp quarterly report on crack spread

https://www.petron.com/investor-relations/our-financial-reports/

Q1 2022

Prices of Dubai crude USD 95.6/barrel

Gasoline cracks USD 17.8. Price USD (95.6 + 17.8) = USD 113.4 /barrel

Diesel cracks USD 21.6. Price USD (95.6 + 21.6) = USD 117.2/barrel

Kero-jet cracks USD 16.2. Price USD (95.6 + 16.2) = USD 111.8/barrel

Q2 2022

Prices of Dubai crude USD (101.8X2- 95.6) = 108/barrel

Gasoline cracks USD (26.4X2-17.8) = 35. Price USD (108 + 35) = USD 143/barrel

Diesel cracks USD (36.6X2-21.6) = 51.6. Price USD (108 + 51.6) = USD 159.6/barrel

Kero-jet cracks USD (27.7X2-16.2) = 39.2. Price USD (108 + 39.2) =USD 147.2/barrel

Q3 2022

Prices of Dubai crude USD (101.2X3- 95.6-108) = USD 100.3/barrel

Gasoline cracks $ (22X3-17.8-35) = 13.2. Price USD (100.3 + 13.2) = USD 113.5/barrel

Diesel cracks $ (38.1X3-21.6-51.6) = 41.1. Price USD (100.3 + 41.1) = USD 141.4/barrel

Kero-jet cracks $(29.3X3-16.2-39.2) = 32.5. Price USD (100.3 + 32.5) = USD 132.8/barrel

2022-12-30 13:03

Hi Sslee, your first question can be partly answered using contents in this first write-up. Since PETRONM does not use hedge accounting, what it recorded as FV G/L of derivatives in P&L is intuitive: refining margin spiked in 2Q and crashed in 3Q, hence its derivatives used for hedging had a FV loss in 2Q and gain in 3Q, including those that were unrealised and intended for hedging of future sales.

For Hengyuan which has adopted hedge accounting, its FV loss of derivatives in 2Q was not fully reflected in P&L, with unrealised FV losses recorded in OCI. In 3Q when the matching hedged sales occurred, these FV losses were recycled to be recognised in P&L. As to why didn’t those derivatives turned profitable when the refining margin crashed in 3Q, it’s also a question that I have.

For your second and third question, my next write-up may provide the explanation. The hints are Hengyuan presents its OCI net of reclassification adjustments; and realised hedging losses for refining margin swaps are recognised in “Purchases.”

Anyway, thanks for sharing your complaint to Bursa on JAKS few years ago. I did refer to your case before filing my complaint on YNH Property.

2022-12-30 15:27

definitely this is public service and a work of love....but so complex so wonder IB analysts also dare not touch.

2022-12-30 16:03

It is illogical to record Q3 the OCI is gain of RM 422,463,000 when the fair values of outstanding financial instruments were net liabilities of RM 1,113,870,000.

2022-12-30 16:06

Sslee

It is illogical to record Q3 the OCI is gain of RM 422,463,000 when the fair values of outstanding financial instruments were net liabilities of RM 1,113,870,000.

================

I bet u, all the so called illogical stuffs will disappear once u have a chance to sit down with the accountant. logical illogical depends on the questioner.

2022-12-30 16:16

It's because much of these negative FV/outstanding liabilities was accumulated from 2Q...

2022-12-30 16:17

The fair values of outstanding financial instruments were as on 30/09/2022 with net liabilities of RM 1,113,870,000

2022-12-30 17:20

qqq3,

I remember asking too many question on derivatives during TA AGM and TA management arranged/forced the Auditors to stay back and explain to me Tony Tiah betting on USA OTC level 3 derivative financial assets after the AGM in private.

The auditors were very kocky and imply should they charge by hour? I gave them a "are you kiddy me look" and demand them to advise Tony Tiah not to gamble on these so called Level 3 OTC derivatives financial assets.

2022-12-30 17:50

Sslee

Dear Neoh Jia En,

Can you please kindly explain the below:

HRC Quarter 3: Fair value loss on derivatives financial instruments: RM 364,570,000. Cumulative 9 months RM 1,235,534,000?

Whereas Petron Malaysia managed to turn Q2: Derivatives Realized loss: RM 207,862,000. Unrealized loss: RM 166,799,000 to Quarter 3: Derivatives Realized gain: RM 139,957,000 and Unrealized gain RM 7,588,000

Outstanding refining margin swap contracts as at 30/09/22 Liabilities: RM (1,257,369,000) far exceeded Assets RM 169,473,000? Then how under P&L reporting other comprehensive (expense)/income: Q3 is RM 422,463,000 when the fair values of outstanding financial instruments were net liabilities of RM 1,113,870,000?

Quarter 2 revenue of USD 151 per barrel

Quarter 3 revenue of USD 124 per barrel

What are the reasons per my calculation crude purchase in Q3 USD 136.453/barrel even higher than Q2 of USD 126.71/barrel when average Dated Brent dropped to USD 101/barrel in Q3 from the USD 114/barrel in Q2?

2022-12-30 13:00