Sunway Berhad – Part 2: Above the Rising Cloud

Neoh Jia En

Publish date: Thu, 28 Jul 2022, 09:55 AM

- Sunway’s consolidation of wholesale funds and reclassification of perps are technically separate events.

- Yinson’s external auditor has unfortunately provided a vague rationale for the company’s non-exclusion of profits distributed to equity-classified perps from EPS.

- An anticipated reply from YNH Property on two issues related to the company’s profit-allocation practices could be informative.

As noted in my previous post, the rationale for Sunway Berhad (Sunway) to reclassify its perpetual sukuks/bonds (perps) from equities to liabilities was unclear. I had speculated that the reclassification was due to supplementary agreements with managers of wholesale funds that obliged Sunway to pay distributions on or to redeem its perps under certain conditions. However, I was proven wrong.

During Sunway’s 12th Annual General Meeting (AGM) on 23rd June 2022, I posted the following question to the management:

“Referring to p.243 of FY21 annual report and p.8 of 4Q20 quarterly report released on 31st March 2021, may I know how did the consolidation of wholesale funds lead to Sunway's having obligations to repay its perpetual sukuk (i.e. reclassifying those sukuk from equities to liabilities)?”

Sunway’s reply on my question was clear and to the point, as seen below:

“Sunway Perpetual Sukuk fulfilled all the criteria in MFRS 132 except 19.b. Sunway Berhad does not have unconditional right to avoid delivering cash or financial asset to the Sukuk holders. Since the Sukuk holder is our major shareholder is viewed to have significant influence over the decision on when to redeem the sukuk. In addition, the consolidation of wholesale funds did not result in the obligations to repay the perpetual sukuk.”

In other words, Sunway’s consolidation of wholesale funds and reclassification of perps were driven by different causes: the former was due to Sunway’s de facto control over those funds, while the latter was due to the controlling shareholder’s investment in perps. Both events, however, occurred at the same time likely due to the company’s reassessment exercises.

Besides clearing the air, Sunway’s rationale for perps reclassification also serves as a precaution for controlling shareholders of other companies who are considering to fund their company’s issuance of equity-classified perps. Despite having good intention – note that Sunway managed to issue its perps at relatively low distribution rates – these shareholders may see their help backfire.

Yinson – The Puzzle Remains

If the clarity of the answer given by Sunway could be ranked at one end of a spectrum, then what Yinson Holdings Berhad (Yinson) has provided would likely be at the other end.

While I was impressed by Yinson’s shareholder-engagement initiatives, the company’s 29th AGM held on 14th July 2022 did not yield satisfactory explanations regarding the potential issue in earnings-per-share (EPS) computation as highlighted in my January’s writeup.

In particular, I have raised the following questions to Yinson:

“Referring to p.273 of annual report 2022, may I know why are Yinson's earnings per share calculated based on "net profit attributable to the owners of the Company" rather than "profit attributable to ordinary equity holders" as per MFRS 133? In the presence of distributions to holders of equity-classified perpetual securities, won't those two profit allocation figures be different?”

The management has wisely passed my questions to their external audit partner, who replied that:

“Just to clarify, profit attributable to the owners of the company is actually the same as the profit attributable to the ordinary equity holders, if you check. The other thing to highlight [is] that, MFRS133 basically calculates the earnings pertaining to ordinary shareholders. Therefore, perpetual securities, even though they are classified as equity, they do not meet the definition of ordinary shareholders. That’s the reason why the distribution to such perp holders are not taken into account for MFRS133.”

The key issue with this explanation lies in the first sentence. Paragraph 10 and 70(a) of IAS 33/MFRS 133 make it evident that the profit attributable to owners of the company is not necessarily the same as the profit attributable to ordinary equity holders; the exact wordings, including those in brackets, are provided below:

Paragraph 10 of IAS 33/MFRS 133: “Basic earnings per share shall be calculated by dividing profit or loss attributable to ordinary equity holders of the parent entity (the numerator) by the weighted average number of ordinary shares outstanding (the denominator) during the period.”

Paragraph 70 of IAS 33/MFRS 133: “An entity shall disclose the following: (a) the amounts used as the numerators in calculating basic and diluted earnings per share, and a reconciliation of those amounts to profit or loss attributable to the parent entity for the period…”

The auditor has correctly stated that IAS 33/MFRS 133 revolves around ‘earnings pertaining to ordinary shareholders’ – there is no requirement to compute EPS for non-ordinary equity instruments. However, the standard does require preparers of financial statements to ‘take into account’ the impact, on EPS, of distributions to non-ordinary equity holders via reconciliation adjustments, as implied in paragraph 70(a) and explicitly spelled out in Appendix A14 of IAS 33/MFRS 133 (which I have mentioned before).

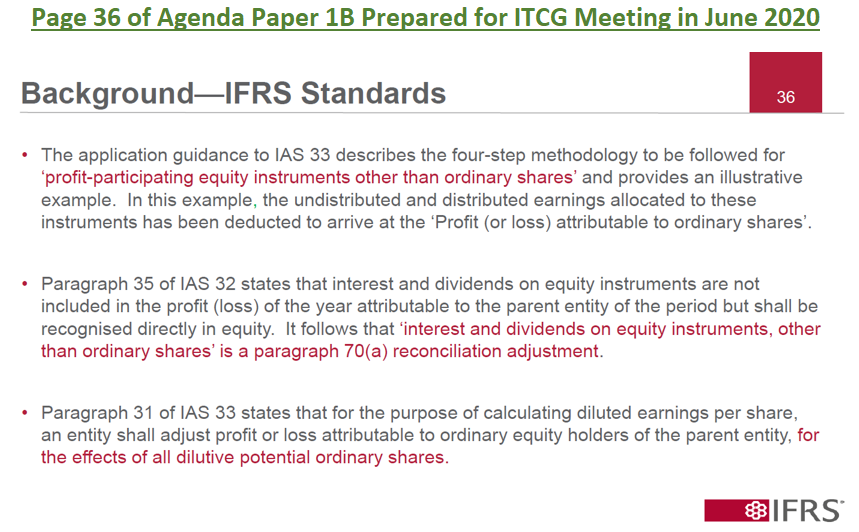

Agenda Paper 1B prepared by technical staff of the International Accounting Standards Board (IASB) for IFRS Taxonomy Consultative Group (ITCG) meeting in June 2020 has perhaps given the most explicit interpretation, thus far, of the requirement in paragraph 70(a) of IAS 33; the relevant slide is as follows:

Next Up

Unfortunately, after a six-month wait, both AGMs of Yinson and Malakoff Corporation Berhad could not resolve my doubt about their unusual EPS computation method. Two more relevant AGMs, namely that of PESTECH International Berhad and Dialog Group Berhad, are left for this year, although they will likely be held only in November.

While waiting for IASB’s updates on its “Financial Instruments with Characteristics of Equity” project, I have come across at least one more avenue for understanding the EPS-computation requirement.

Following my discovery of the covert amendments by YNH Property Berhad (YNH) to its EPS and referencing the previous experience of other investors, I have, on 30th May 2022, lodged a complaint to Bursa Malaysia with regard to YNH’s (1) discrepancy between the amount of “Profit/(loss) attributable to ordinary equity holders” stated on the ‘cover page’ of the company’s fourth quarter 2021 report and that in the company’s 2021 annual report; and (2) discrepancy between the 2020’s EPS figure stated in the company’s fourth quarter 2020 report and that which was used as prior year’s comparative amount in the fourth quarter 2021 report.

Since IFRS/MFRS does not require the allocation of profit or loss to ordinary shareholders in the income statement itself (only needed in notes to financial statements), my first complaint is related to Bursa Malaysia’s guidance on the presentation format for quarterly reports, which asks for the figure to be reported on the ‘cover page’ of quarterly reports. For its part, YNH has filled in its profit or loss figure attributable to owners of the company (which is the bottom line of income statements as required by IFRS/MFR), rather than that attributable to ordinary shareholders. Hopefully, a reply by YNH or clarification by Bursa Malaysia would make clear the difference between those two profit allocation figures.

My second complaint strikes at the core of the EPS-computation issue discussed: whether distributions to perps should be deducted from the profit or loss to arrive at the numerator used in computing EPS. YNH would likely need to explain why it has chosen to deduct those distributions for all earnings reported since the release of its audited financial statement for 2020, but not before, especially when the covert adjustment was large enough to result in EPS’ turning into loss per share.

Another potential source of clarification would be the Malaysian Institute of Accountants (MIA), although it would involve filling official complaints assuming that there were ‘gross carelessness’ or ‘neglect’ in the performance of professional duties by related members of MIA. Respondents to my questions during both AGMs are indeed members of MIA, but there are still few more prerequisites that I must fulfil to file an admissible complaint. Likely, this will be one of my summer holiday projects.

*This post is a follow-up to my previous posts titled "Has Yinson Found the Yellow Brick Road?", "Malakoff Corporation Berhad – Part 2: A Gap in Understanding the Gap," "YNH Property Berhad – Looking Beyond the 99.998%," and "Sunway Berhad – Not Just a Good Civil Engineer."

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2025-01-31

SUNWAY2025-01-31

SUNWAY2025-01-31

SUNWAY2025-01-28

SUNWAY2025-01-28

SUNWAY2025-01-27

SUNWAY2025-01-27

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-24

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-23

SUNWAY2025-01-22

SUNWAY2025-01-22

SUNWAY2025-01-22

SUNWAY2025-01-22

SUNWAYMore articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022