Hengyuan Refining Company Berhad – Part 2: Still One Short

Neoh Jia En

Publish date: Wed, 11 Jan 2023, 12:08 PM

- Since Hengyuan designates only the spot element of refining margin swaps as its hedging instrument, gains or losses arising from any difference between the spot price and the forward price do not affect hedge ineffectiveness reported by the company.

- Investors should also exercise care in interpreting any line item of other comprehensive income that is presented net of reclassification adjustment.

- Despite the requirements in IAS 1/MFRS 101, Hengyuan has likely not disclosed the amount of reclassification adjustment for the cost of hedging reserve.

- Regardless, Hengyuan’s hedging activity has stabilised the company’s annual profits.

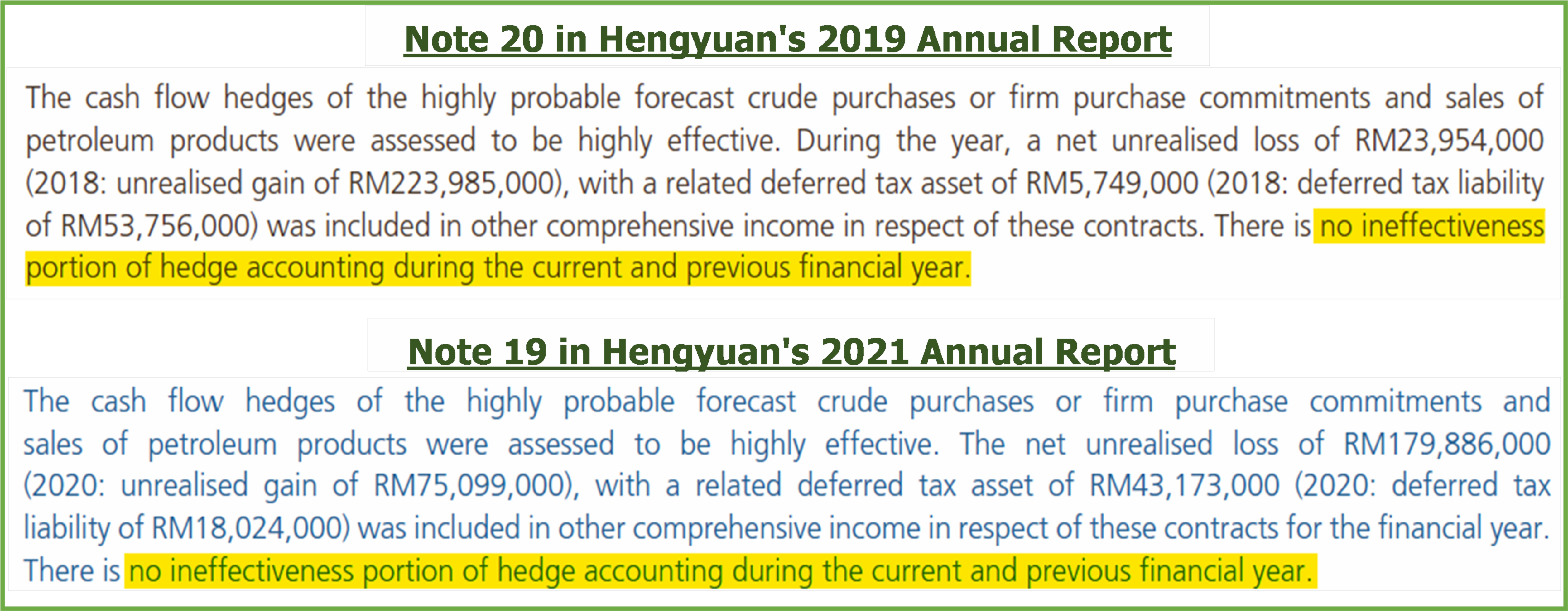

Blamed for the company’s dismal result for the third quarter of 2022, the hedging strategy of Hengyuan Refining Company Berhad (Hengyuan) is being scrutinised by investors. Complicating the matter is that Hengyuan has been reporting no hedge ineffectiveness since adopting MFRS 9 in 2018. Has the company finally lost its “perfect” record in hedging?

Following on from my previous write-up, I will first discuss how Hengyuan’s designation of hedging instruments affects the company’s measurement of hedge ineffectiveness, before zooming in on Hengyuan’s cost of hedging and the impact of hedging to the company’s profits.

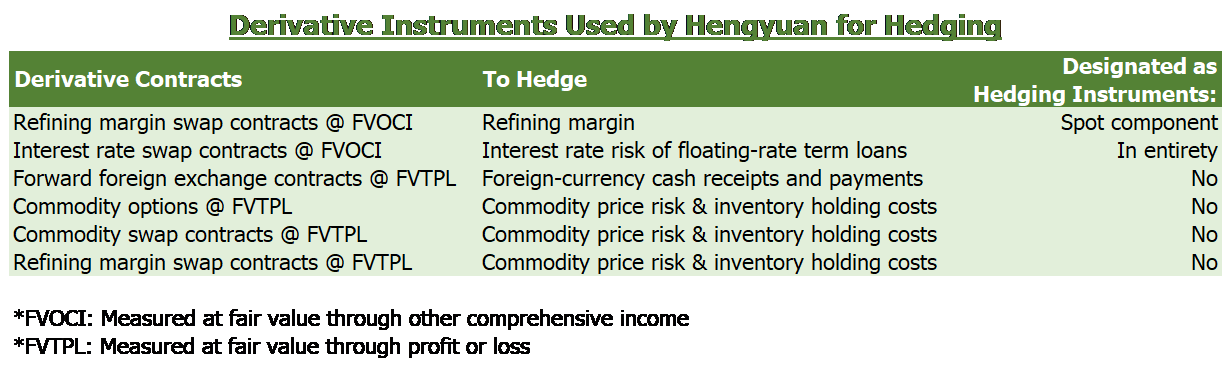

Derivative instruments used for hedging

While Hengyuan utilises a fair array of derivative contracts to manage its commodity price risk, the company has only designated two derivatives as its hedging instruments: the spot element of refining margin swap contracts that are measured at fair value through other comprehensive income (FVOCI), and interest rate swap contracts. I would focus my discussion on refining margin swap contracts designated as hedging instruments due to its disproportionate financial impact to Hengyuan, although investors should note that the company does have a small portion of refining margin swap contracts that are not designated as hedging instruments, of which any change in fair value (FV) is recognised as profit or loss immediately.

Hedge effectiveness vs. hedge ineffectiveness

Although my previous write-up made use of assumption about “hedge effectiveness,” the meaning of which is intuitively clear, companies that practise hedge accounting are not mandated to disclose such figures. IFRS 9/MFRS 9 defines hedge effectiveness as “the extent to which changes in the fair value or the cash flows of the hedging instrument offset changes in the fair value or the cash flows of the hedged item,” but does not prescribe a specific method for assessing the effectiveness; companies could opt to use qualitative methods so long as they meet requirements set out in paragraph 6.4.1(c) of the standard.

On the other hand, IFRS 9/MFRS 9 does require the measurement, and recognition in profit or loss, of retrospective hedge ineffectiveness, defined in paragraph B6.4.1 as “the extent to which the changes in the fair value or the cash flows of the hedging instrument are greater or less than those on the hedged item.” Furthermore, unlike my assumption on hedge effectiveness, hedge ineffectiveness is almost always reported in dollar value only, partly owed to requirements set out in paragraph 24C of IFRS 7/MFRS 7 which guides on disclosures about financial instruments.

To complicates the matter further, the method prescribed in paragraph 6.5.11 of IFRS 9/MFRS 9 restricts ineffectiveness measured for cash flow hedges to those of over-hedging. So long as changes in the fair value of the hedging instrument has been fully offset by opposing changes in the present value of the hedged cash flows, there is no retrospective hedge ineffectiveness. While IFRS 9/MFRS 9 has not explained why under-hedging, which results in excess changes in the present value of hedged cash flows, is not considered as hedge ineffectiveness, the staff paper prepared for IASB Meeting in October 2009 might shed a light: doing so would involve recognising profit or loss from the hedged item – usually a future transaction – which does not yet exist and hence is “conceptually incorrect and counter-intuitive.”

10/10 or 10/100?

Notwithstanding its asymmetrical properties, hedge ineffectiveness is still a relevant measure of the performance of a company’s cash flow hedges. At the very least, a lack of ineffectiveness would indicate that the company’s choice of hedging instrument has not exacerbated risk exposure. And for companies that have designated the entirety of derivative as the hedging instrument in cash flow hedges, smaller recognised losses from hedge ineffectiveness also imply that they are less likely to have overpaid for the derivative, for example, shorting futures at a price that is too much lower than the spot price or purchasing options at too high a premium.

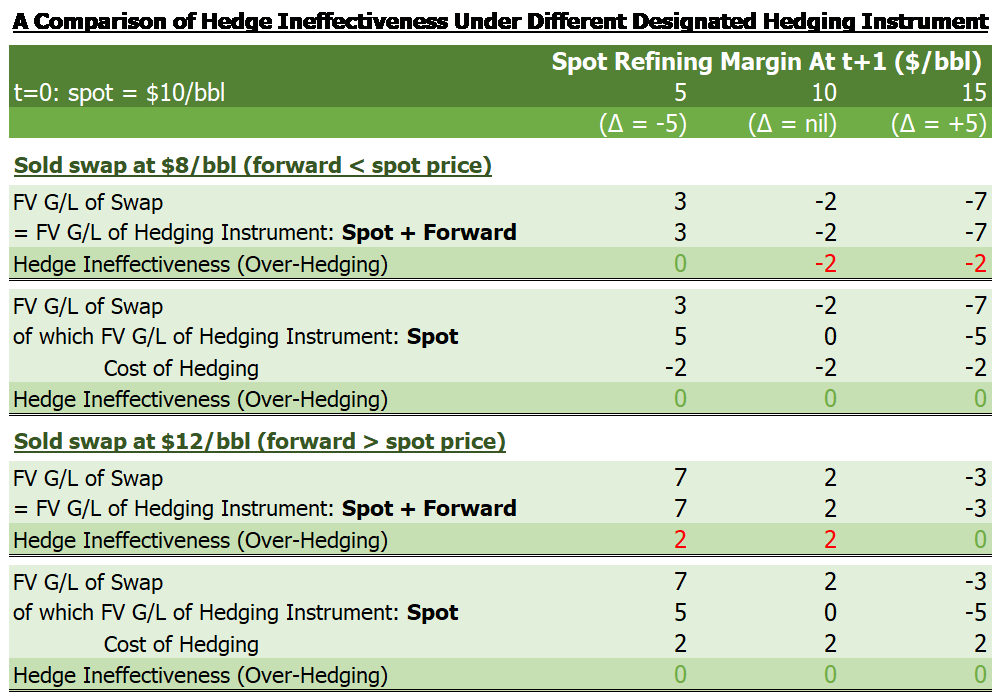

The second interpretation, however, does not apply to Hengyuan’s refining margin hedges in which only the spot element of swaps is designated as the hedging instrument. Regardless of how much Hengyuan priced the forward element of swaps sold, it is excluded when measuring hedge ineffectiveness. In other words, Hengyuan’s “cost of hedging” does not affect hedge ineffectiveness reported by the company. The following table illustrates this difference in impact to hedge ineffectiveness, for a one-period hedge on one barrel of refined products via selling refining-margin swap with maturity at t = 1.

It is hence clear that investors who look into Hengyuan’s hedge ineffectiveness for explanation of the company’s earnings disappointment would be disappointed, since it would at most reveal only an extremely limited aspect of potential failures in the company’s hedging strategy. An alternative approach is warranted.

Seeking the true cost

Logically speaking, burning down a house is indeed an effective way of exterminating any spider inside, but greedy houseowners are likely concerned with the monetary aspect of everything. Much like how houseowners would question about the cost of pest extermination, shareholders of Hengyuan might be interested in the company’s cost of hedging. Fortunately, such a figure should be available in the company’s financial statements, or is it?

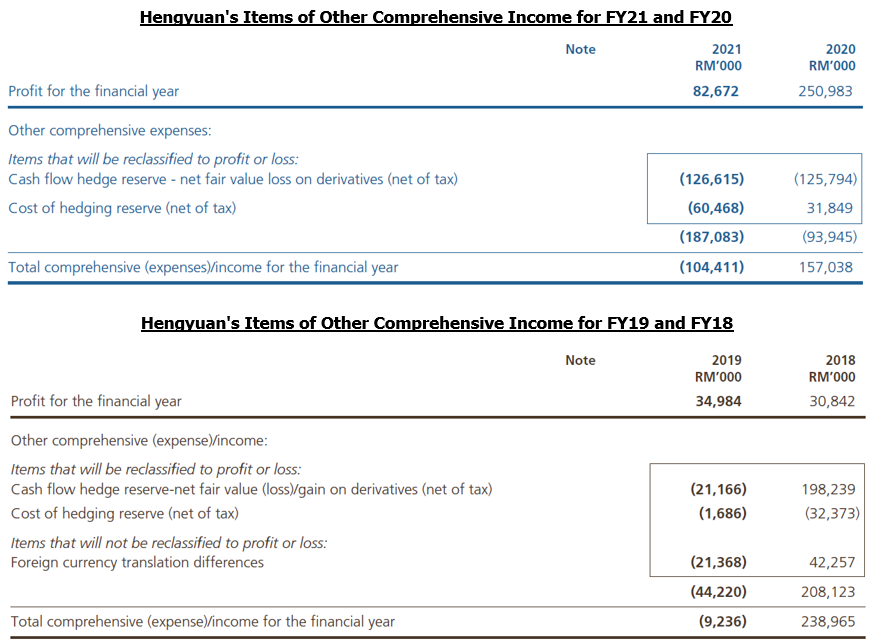

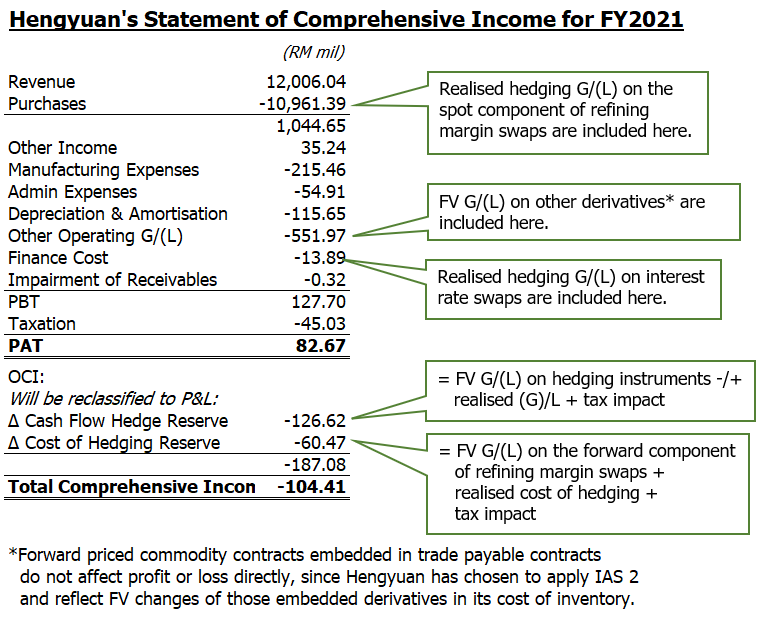

Although my previous write-up indicated that both the “incurred” (arose due to changes in the forward/time value during the current period) and realised (recognised as profit or loss) cost of hedging could be inferred easily from the statement of other comprehensive income, Hengyuan’s presentation of items in its other comprehensive income (OCI) complicates the matter slightly.

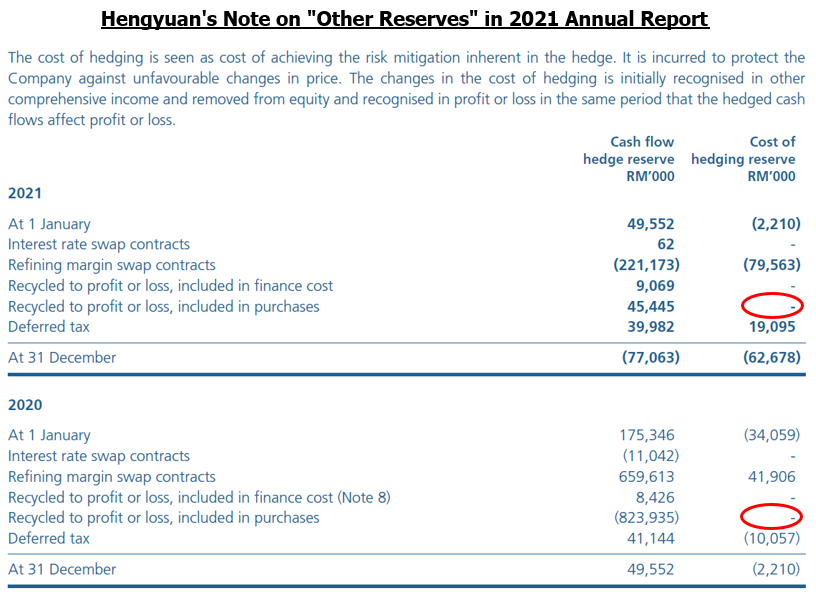

Ideally, the “incurred” cost of hedging in an accounting period would equal the gross change in cost of hedging reserve, and the realised cost of hedging would equal the negative amount of reclassification adjustment for cost of hedging reserve. However, Hengyuan has never presented the figure of reclassification adjustment for cost of hedging reserve among its items of other comprehensive income, as shown below:

One possible explanation is that Hengyuan is presenting changes in cost of hedging reserve net of reclassification adjustments, much like how it does for reporting changes in cash flow hedge reserve; the figure hence reflects the net increase in yet-to-be-realised cost of hedging, rather than the “incurred” cost of hedging as interpreted by some investors. This is a common style which is allowed by paragraph 94 of IAS 1/MFRS 1, which states that:

“An entity may present reclassification adjustments in the statement(s) of profit or loss and other comprehensive income or in the notes. An entity presenting reclassification adjustments in the notes presents the items of other comprehensive income after any related reclassification adjustments.”

To disaggregate the amount for “incurred” and for realised cost of hedging, investors just need to dig into Hengyuan’s notes to financial statements for the figure of reclassification adjustment. The most relevant note is that on “Other Reserves,” in which Hengyuan has also presented its reclassification adjustments for cash flow hedge reserve (i.e., the negative amount of realised hedging gains/losses) under items labelled “Recycled to profit or loss, included in …” as seen below.

Surprisingly, the note shows that there has been no reclassification adjustment for the cost of hedging reserve since 2018, which would most likely be included in “purchases” if it exists. This is nearly impossible given that there have been changes in Hengyuan’s cost of hedging reserve, meaning that the forward price could indeed differ from the spot price – or more accurately, basis spread is not necessarily zero – in the swap market that Hengyuan deals in. Unless Hengyuan timed its entry into every swap so coincidentally that each position started with zero basis spread, or exited all its swaps at exactly the same basis spread that each position started with, the company’s accountants might want to relook at IAS 1/MFRS 101 which contains guidance as follows:

Paragraph 7: “… The components of other comprehensive income include: … (h) changes in the value of the forward elements of forward contracts when separating the forward element and spot element of a forward contract and designating as the hedging instrument only the changes in the spot element, and changes in the value of the foreign currency basis spread of a financial instrument when excluding it from the designation of that financial instrument as the hedging instrument (see Chapter 6 of IFRS 9); …”

Paragraph 92: “An entity shall disclose reclassification adjustments relating to components of other comprehensive income.”

Paragraph 93: “… A reclassification adjustment is included with the related component of other comprehensive income in the period that the adjustment is reclassified to profit or loss…”

Beggars can't be choosers

Although Hengyuan’s cost of hedging is not available, there is enough information to determine the company’s realised gains/losses from both designated hedging instruments and undesignated derivatives used. And for simplicity, assuming that Hengyuan has indeed realised zero cost of hedging in every year, the impact of hedging to the company’s profit figures could be computed to check whether it helped to stabilise performance.

Besides the aforementioned note on “Other Reserves” which provides much of the information needed for designated hedging instruments, Hengyuan has also disclosed information about FV gains or losses on undesignated derivatives in its note on “Profit Before Taxation,” likely to fulfil the requirement in paragraph 20(a)(i) of IFRS 7/MFRS 7 which guides disclosures on financial instruments. Using these information, each of the line item impacted by the company’s hedging activity could be determined as follows:

And after plugging in figures disclosed, it is clear that Hengyuan’s hedging activity since 2018 has helped to stabilise the company profit before tax, for example by reducing losses in 2018 and 2020, and curbing excess profit in 2021. At the very least, Hengyuan’s hedges have likely fulfilled their main purpose up until 2021, disregarding any realised cost of hedging.

For short-termists

Of course, speculators are likely more interested in the impact of hedging to Hengyuan’s quarterly profits, especially after the third quarter of 2022. However, quarterly financial statements usually contain less information than annual financial statements do, as allowed by IAS 34/MFRS 134 which guides on interim financial reporting. Sometimes, workaround and the use of estimates are necessary to overcome the lack of disclosures in quarterly reports.

In the case of Hengyuan, the company omits the figure of reclassification adjustments and does not segregate FV gains/losses on undesignated derivatives from realised hedging gains/losses in its notes to quarterly financial statements. The method employed to derive hedging gains/losses from annual financial statements is hence not applicable to quarterly financial statements.

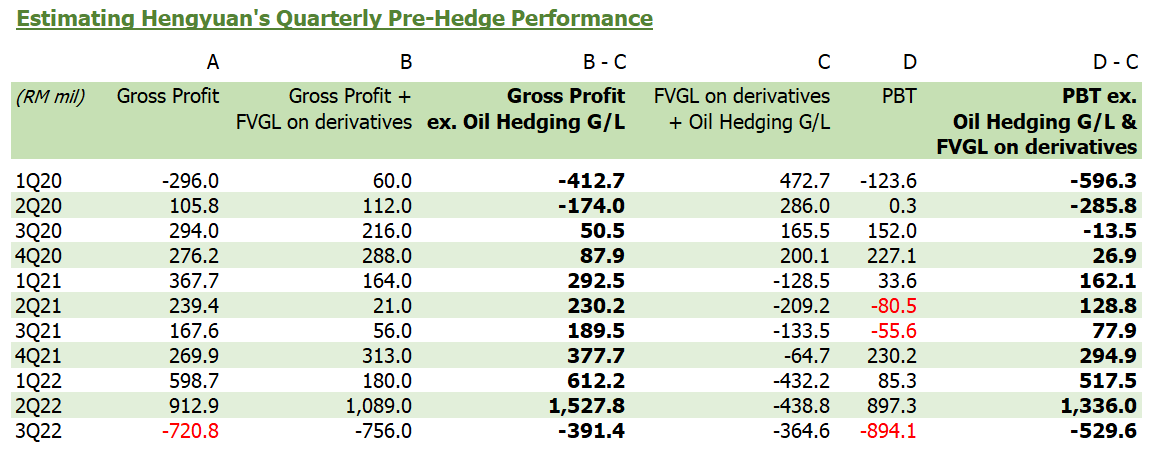

Fortunately, Hengyuan has voluntarily disclosed a figure named “Gross profit plus fair value changes in oil hedges recognised within other operating gains/(losses)” in its notes to quarterly financial statements. This gross profit figure, which has been further adjusted for FV gains/losses on undesignated derivatives, could be used in conjunction with the figure named “Fair value loss/(gain) on derivative financial instruments” (only consistent and reliable since 2020) in another note to derive realised hedging gains/losses from refining margin swaps. Ignoring realised hedging gains/losses from interest rate swaps which are not available, the impact of Hengyuan’s hedging activity to the company’s quarterly profit before tax could be seen below:

At the gross profit level, Hengyuan has recorded stabilisation effect from hedging up until the second quarter of 2022. While for profit before tax, the benefit from hedging is less obvious, but this is expected since Hengyuan does not apply hedge accounting to all derivatives used and hence fluctuations in FV of undesignated derivatives could impact the bottom line.

Still, the negative impact of refining margin hedge on gross profit in the third quarter of 2022 is surprising since the “pre-hedged” gross profit was already negative – does this mean that Hengyuan had purposely sold swaps to fix its margin at a negative level? Unfortunately, I do not have any lead to a definite answer.

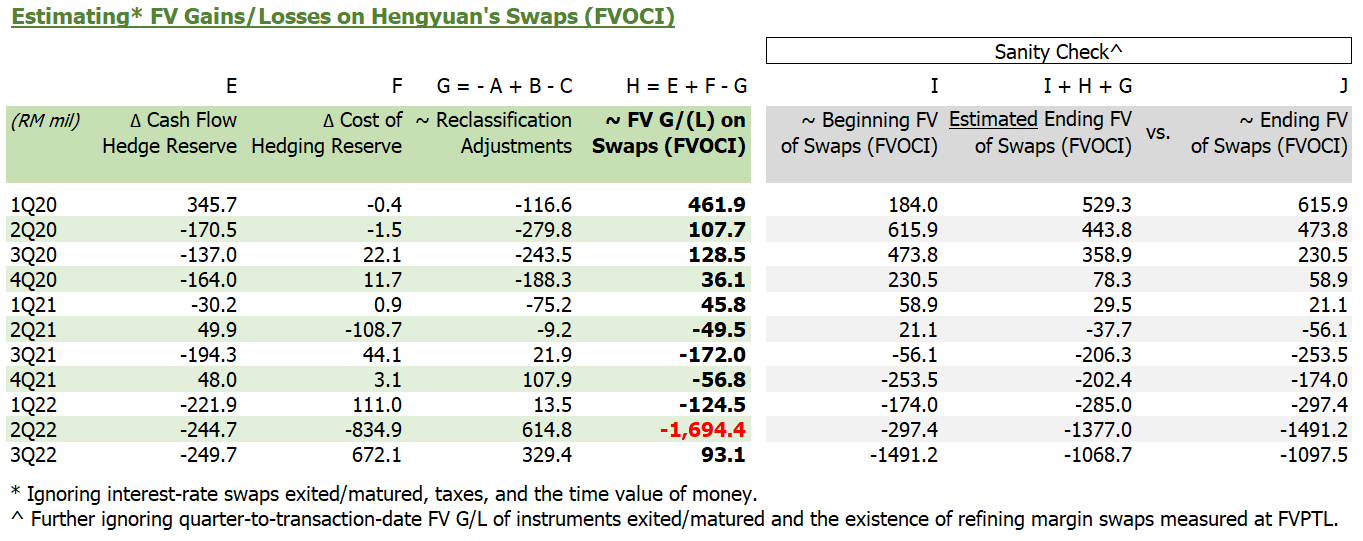

To make the matter worse, swaps sold by Hengyuan did not seem to have reversed much of its FV losses recorded in the second quarter even with the crash in refining margin during the third quarter. Utilising the realised hedging gains/losses from refining margin swaps computed earlier, and ignoring the impact of interest rate swaps exited/matured, taxation, and time value of money, the quarterly gains/losses on FV of swaps could be approximated. While it is not too surprising that the company had a huge FV losses on swaps in the second quarter (which was likely closer to RM1.7 billion rather than RM1.1 billion as mentioned by some investors), reversal in the third quarter was unexpectedly paltry.

Final words

Despite the limited information, two speculations could be made about the lack of rebound in FV of swaps in the third quarter. For one, it could mean that refining margins “traded” in the swap market for periods beyond the quarter, that Hengyuan had also sold swaps to lock in margin, might not have crashed, and hence the company will report strong “pre-hedged” margin to offset hedging losses in quarters to come. Alternatively, it could imply that Hengyuan has locked in extremely low (or even negative) margins using those swaps, in which case investors should prepare to see the manifestation of remaining unrealised FV losses of around RM1 billion in the company’s bottom line. For long-term investors, however, there is an easy way to determine which is the case: just wait for the result. After all, time will tell.

*This is a follow-up to my previous write-up titled “Hengyuan Refining Company Berhad - Designated Hedges, Undesignated Hedges, and A Foisted Hedge.”

*I have edited wordings in my previous article to better differentiate between hedge effectiveness and hedge ineffectiveness, and to amend an earlier error on the measurement classification of “forward priced commodity contracts,” which is in fact recorded by Hengyuan as FVTPL despite not recognising subsequent FV gains/losses in the income statement (although this does call into question compliance with paragraph 5.7.1 of IFRS 9/MFRS 9).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022