Resintech Berhad – Floating on the Great Awokening

Neoh Jia En

Publish date: Tue, 12 Mar 2024, 12:05 PM

-

Precluding potential investees from further consideration solely because their sectors are associated with higher ESG risks contradicts the goal of ESG investing in maximising long-term risk-adjusted returns.

- Fund managers who adopt this sector-based exclusionary strategy might miss out on mispricing opportunities, forgo the full benefits of diversification, be misled by any overgeneralisation in sector classification, and miss potential returns from company-led improvements to their ESG profiles.

- Resintech Berhad could be a good showcase of the latter scenario, as its existing business in plastic pipes might be shunned by some ESG investors, even as it explores opportunities in algae fuel and solar power.

When I recommended YTL Power International Berhad to two institutional public equity investors four years ago, they dismissed my idea almost immediately on the ground that the company’s involvement in coal-fired power generation poses environmental, social, and governance (ESG) concerns. That was a letdown for me, since I had believed that the projected slump in Singapore’s electricity reserve margin, as alerted by one of my colleagues who covered the company’s bonds, coupled with the scheduled commissioning of a power plant in Jordan (which was subsequently delayed), could help turn around the company’s declining profits. Similar episodes have also occurred with a few of my suggestions of oil & gas and palm oil plantation names to other institutional investors.

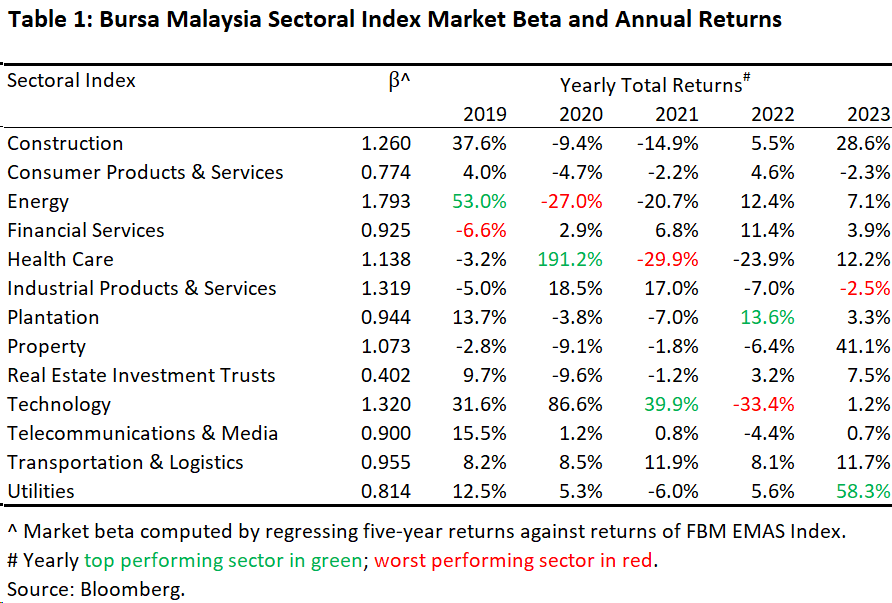

Given that the objective of ESG investing is to maximise long-term risk-adjusted returns, the sector[1] exclusions made by these institutional investors are bewildering. Such an approach is only reasonable for managers of responsible investment funds mandated with non-financial goals[2], but this was not the case for most of the institutional investors in question. Precluding a stock from further consideration solely because its sector is relatively more exposed to ESG risk factors theoretically reduces the long-term risk-adjusted return of investment portfolios. The intuition is that risk-adjusted returns are not maximised simply by minimising the denominator; otherwise, investors would have avoided sectors with high market beta, such as energy, technology, and industrial products (see Table 1), since the market risk factor is a common concern for all equity investors.

More specifically, a sector-based exclusionary strategy could worsen long-term portfolio performance due to at least four reasons: (1) missing out on undervalued securities in excluded sectors; (2) less diversified portfolios; (3) potential mismatches between sector classification and individual companies’ ESG profiles, and the (4) inability to benefit from ESG momentum in excluded sectors, as elaborated below.

Mispricing opportunities may exist in sectors excluded from investment consideration

First and forecast, a smaller investment universe means that investors will not be able to exploit any undervalued securities – after accounting for ESG risks – that are classified in excluded sectors. This limitation is especially detrimental to the return potential of public equity portfolios. Unlike private equity investors or corporates, public equity investors can easily recycle their capital, thus arguably competing on short-term returns to achieve the best compounded long-term returns. By not taking advantage of opportunities that arise in high ESG-risk sectors, these investors risk falling behind their peers in long-term portfolio returns.

A simplified comparison to support the argument above could be derived using figures from Table 1: investors with perfect insight who unrestrictedly invest 100% of their capital in the best performing sector of Bursa Malaysia could achieve a compounded total return of 1,020.0% over 2018-2023. However, if they had to invest in the second-best performing sector due to ESG concerns over the energy sector in 2019 and the plantation sector in 2022, they could only manage 896.9%.

Fortunately or unfortunately, the trend of divesting from high ESG-risk sectors solely to meet non-financial goals may have even led to a systematic undervaluation of public equities in some of these sectors. One notable piece of evidence is the rise in privatisation of oil and gas companies, as private equity investors, who are less burdened with non-financial goals, take advantage of the discount on public equities of these companies.

While one might argue that persistent undervaluation would lead to lower price returns and therefore lower total returns from high ESG-risk sectors, this is not necessarily the case when those sectors have high dividend payout ratios, which can boost total returns. This is evident in the case of Asian coal miners, well-known for their high yields, at least since China implemented its “Blue Sky Policy” in June 2018.

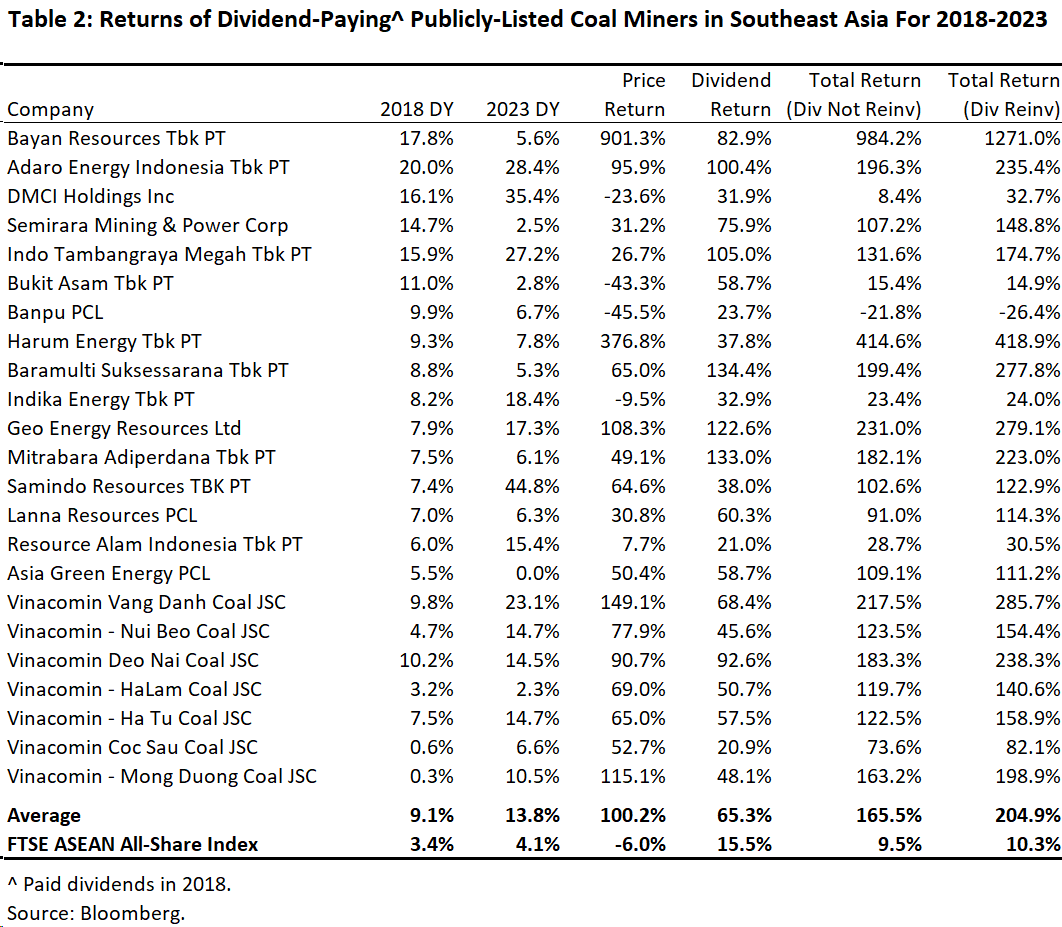

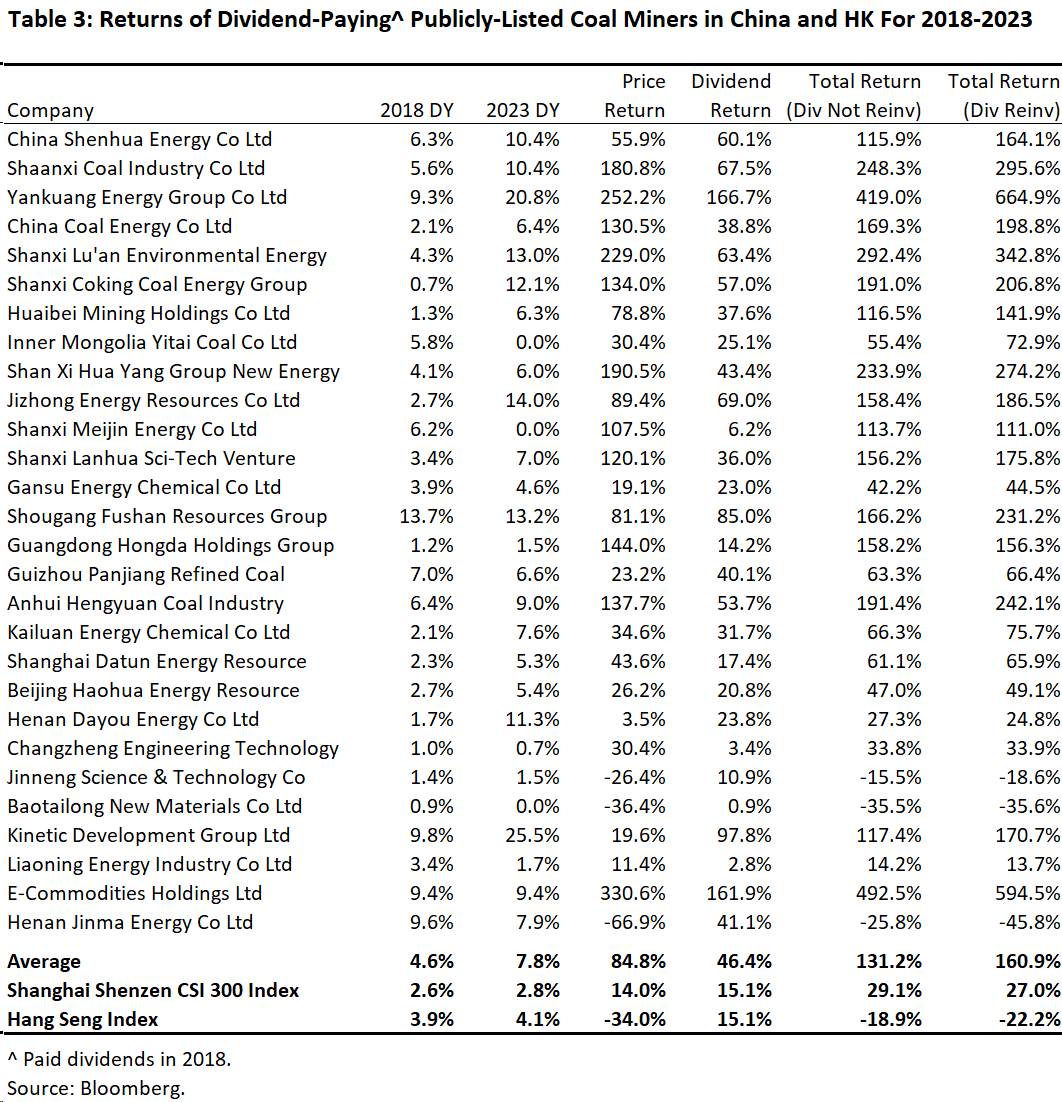

As illustrated in Table 2, the average dividend from investing in dividend-yielding coal miners in Southeast Asia between 2018 and 2023 amounted to 65.3% of the original capital, helping to improve the average total return to 165.5% amidst a bust-boom-bust cycle of coal prices. With their end-2023 average yield expanding further to 13.8%, these coal miners are now priced to doom in seven years, assuming constant dividends and ignoring the time value of money and liquidation values. The returns from Chinese coal miners, directly affected by the “Blue Sky Policy,” were also stunning, as illustrated in Table 3. Investors who exclude coal miners from their portfolios would therefore have missed, and might miss, an outperforming sector.

Portfolios are less diversified with investments in fewer sectors

Even if all securities are fairly priced, portfolios’ risk-adjusted returns could be improved by investing across more securities that are less correlated in returns. This concept of reducing unsystematic risks through portfolio diversification has been central to the fund management industry since the birth of modern portfolio theory in the 1950s.

Given the difference in sector dynamics and therefore weaker correlations of returns among stocks in different sectors, permanently excluding high ESG-risk sectors from investment portfolios will harm long-term risk-adjusted returns. This is especially true when some of those sectors have earnings cycles that differ from the general business cycle that drives profitability in most other sectors. For example, plastic packaging manufacturers benefitted [3] from the crash in crude oil prices between 2014 and 2016, which was a headwind for the local bourse, while oil palm planters also have a unique earnings cycle driven by the weather.

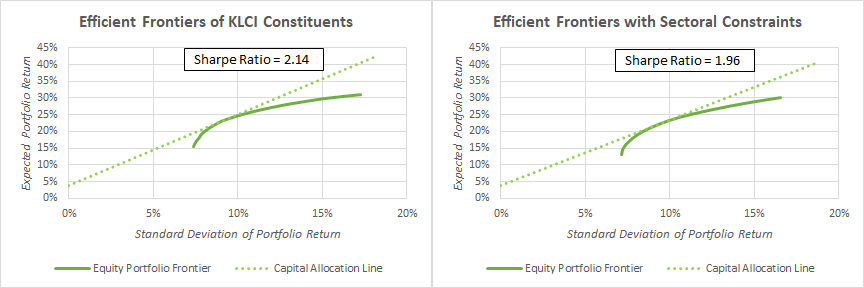

In any case, the unfavourable impact of sector exclusions on risk-adjusted returns could be clearly seen in the lower Sharpe Ratio of a constrained portfolio. Using constituents of the FTSE Bursa Malaysia KLCI index as the sample stock universe and the 10-year government bond as the risk-free asset, the capital allocation line computed based on sell-side consensus target prices compiled by Bloomberg as of 31st December 2023 implies that investors could expect to earn an additional 214 basis points in portfolio returns for each 100 basis points of risk – measured by the standard deviation of portfolio returns – borne.

Excluding oil & gas, plantation, and gaming stocks, the capital allocation line flattens to yield only 196 basis points in additional portfolio returns for each 100 basis points of risk, even though the 10 excluded stocks have an average expected return of 8.1%, considerably lower than the average of 13.8% for the remaining 20 stocks.

Sector classification might overgeneralise ESG risk profiles

Considering the diversity in product offerings, client base, and corporate strategies of each company, sector classification might not accurately reflect the ESG risk of individual companies or even sub-sectors. Therefore, exclusions based on such classification could sometimes lead to unfavourable outcomes.

Although sector-wide ESG risks should theoretically be captured by sector classification, this is not always the case when the classification mixes sub-sectors with disparate ESG risks. One such example is the coal-mining sector, where both thermal coal producers and coking/metallurgical coal producers are often lumped together [4] by investors. However, thermal coals and coking coals have vastly different demand risks amidst the global drive for greener energy. While cleaner, cost-competitive substitutes have emerged for thermal coals, no commercially-viable alternative[5] exists for coking coals, the raw material for coke that serves as both an energy source and a reducing agent for primary steelmaking. Therefore, a sector-based exclusionary strategy risks omitting coking-coal miners with arguably lower ESG risks from the investment portfolio.

Barry Tudor, Chairman and CEO of Pembroke Resources: “There's often no distinction between thermal and coking coal, but the only thing they have in common is they're both black.”

Sector classification does not capture ESG momentum

Finally, sector exclusions also ironically prevent investors from taking advantage of ESG opportunities in excluded sectors. This pertains to the financial returns from improving ESG profiles (ESG momentum), which have found wide empirical support. To align themselves with the capital market, corporates are exerting greater efforts towards transparency in ESG reporting and managing ESG risks, and these efforts should help lower their costs of capital and improve returns for existing shareholders. As corporates in high ESG-risk sectors are arguably more incentivised to improve their ESG profiles, investors who exclude those sectors from their portfolios will likely miss out on one of the key value drivers of ESG investing.

In extreme cases of ESG profile enhancement, corporates may shift their business out of high ESG-risk sectors, but they will usually be reclassified only when they derive most of their revenue from the new sector, thereby hindering investors who adopt an exclusionary strategy from exploiting the ESG momentum. One notable case is Mah Sing Group Berhad (Mah Sing), a plastic trading company that ventured into the property sector in 1994 but was reclassified only in 2000, though ESG investors were not “around.” The potential sector shift by Resintech Berhad (Resintech) might hence be a more relevant showcase.

Resintech – illustrating a pitfall of sector exclusions in ESG investing

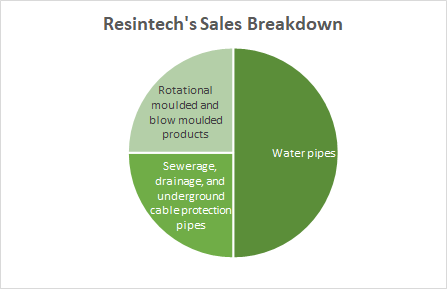

Considering its ventures into low ESG-risk businesses, Resintech is worth mentioning as a case where sector exclusions might lead to deviations from ESG investing. As the largest high-density polyethylene pipe manufacturer in Malaysia, Resintech is likely shunned by some ESG investors; the company’s annual report for 2023 does not list any institutional investor among its top 30 largest shareholders, and Bloomberg data also indicates the absence of sell-side coverage on the stock.

While ESG investors might dislike Resintech’s existing plastic pipe business, they would likely have a different view of the company’s ventures. One potential breakthrough relates to PETRONAS-SEDC algae fuel project, of which a one-acre nursery farm has been hosted at Resintech’s factory in Demak Laut Industrial Park. As the provider of RM5 million worth of algae tanks designed to vary sunlight penetration at different water depths, the company has signed a memorandum of understanding with SEDC to explore establishing a joint venture to supply the necessary infrastructure for subsequent phases of the algae fuel project. Given that Resintech’s annual revenue has stagnated at around RM80 million – no thanks to the long delay in water-sector restructuring – the contribution from the venture could be significant, especially as PETRONAS-SEDC plan to scale up their algae nursery to 1,000 acres.

Aside from the algae tank venture, Resintech is also poised to benefit from the expansion of floating solar power capacity in Malaysia, a field that has attracted immense attention from ESG investors. The company’s existing business in rotational moulded and blow moulded plastic products positions it well to provide floaters to these solar plants, which have just been introduced as a new category under Malaysia’s fifth large-scale solar scheme (LSS 5). Based on the average sale price of floaters of around RM0.50 per watt in China, the 500 MW quota under LSS 5 implies a medium-term market size of RM250 million for solar panel floaters in Malaysia. This market size is decent for Resintech to venture into when considering the long-term potential of 16.6 GW in floating solar power capacity in the country.

Given the ESG opportunities presented by its ventures, Resintech is therefore a good example of how a sector-based exclusionary strategy might hinder ESG investing. It would be ironic if ESG investors excluded themselves from this up-and-coming player in renewable energy due to the company’s existing business. Nonetheless, this is contingent upon the realisation of the joint venture with SEDC and PETRONAS-SEDC’s willingness to scale up the algae fuel project.

In any case, it should now be clear that a sector-based exclusionary strategy is detrimental to the long-term risk-adjusted return of investment portfolios, much against the objective of ESG investing. This can be inferred from the strategy’s exclusion of mispricing opportunities, higher correlation among portfolio holdings, potential overgeneralisation of sectors, and inability to capture ESG momentum. Resintech serves as a potentially good showcase of the latter scenario, as the plastic pipe manufacturer’s new ventures related to algae fuel and solar energy should gradually improve the company’s ESG profile and returns, yet these opportunities might not be accessible to some ESG investors who practise sector exclusions.

[1] For ease of discussion, the term “sectors” also refers to any sub-sector levels such as “industry groups,” “industries,” and “sub-industries” in this write-up.

[2] As defined in the official training manual for the Certificate in ESG Investing by CFA Institute, ESG investing is solely concerned with the financial impact of ESG risks and opportunities, while other responsible investment methodologies may have non-financial goals such as being ethical, socially-responsible, and environmentally sustainable (although these methodologies may also employ ESG metrics). Additional constraints mean that these other methodologies seek to optimise, but not maximise, risk-adjusted returns. Unless mandated by clients or regulators, fund managers who take non-financial goals into their investment consideration – which ultimately result in lower fund returns – are committing a breach of fiduciary duties.

[3] This was evident in the sector’s low market beta of 0.292, computed using the returns of BP Plastics Holding Berhad, CYL Corporation Berhad, Greater Bay Holdings Berhad, SCGM Bhd, Scientex Berhad, Scientex Packaging (Ayer Keroh) Berhad, SLP Resources Berhad, Thong Guan Industries Berhad, and Tomypak Holdings Berhad from the same period. In the extreme case of SCGM Berhad, which did not need to pass cost savings to its fragmented customer base, the stock even had a negative market beta of -0.008.

[4] As could be seen in Table 3, the Bloomberg Industry Classification Standard lists two coking coal-miners, namely Shanxi Coking Coal Energy Group and Shougang Fushan Resources Group, among thermal coal-miners.

[5] The cost of green hydrogen would need to decline substantially, from the current level of USD 4.50-12.00/kg to USD 1.60-1.70/kg, before green hydrogen could compete with coking coals.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022