Barakah Offshore Petroleum Berhad – Counting A Chick Outside the Hatch

Neoh Jia En

Publish date: Fri, 02 Feb 2024, 12:37 PM

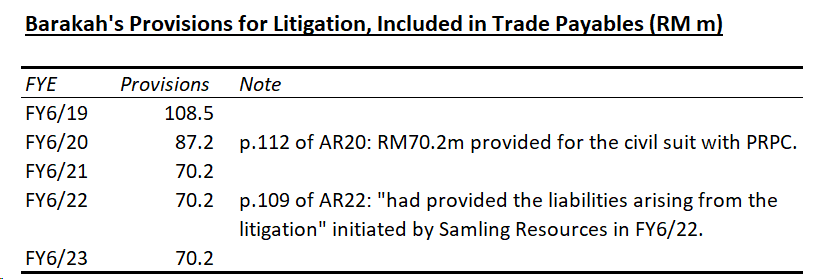

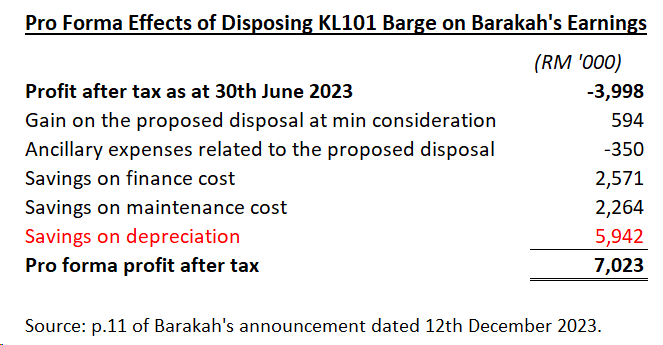

- To illustrate the impact of its proposed disposal of KL101 Barge, which has been classified as held for sale since the end of FY6/22, Barakah added savings on depreciation to its pro forma profit after tax for FY6/23.

- However, the illustrated amount of savings exceeds the amount of depreciation incurred by Barakah in FY6/23. To begin with, non-current assets held for sale are not depreciated, as per IFRS 5/MFRS 5.

- As the savings on depreciation inflated Barakah’s pro forma profit by 549.7%, the company might want to reconsider the “not misleading” principle contained in the Guidance Note For Issuers of Pro Forma Financial Information issued by the Council of the Malaysian Institute of Accountants.

Just a few years after being listed on Bursa Malaysia via a reverse takeover in November 2013, Barakah Offshore Petroleum Berhad (Barakah) was hit hard by the downturn in the oil and gas industry. The company fell into PN17 status in May 2019 due to its failure to make instalment payments on loans taken for its Kota Laksamana 101 (KL101) Barge. Its misfortune piled up when Petroliam Nasional Berhad (Petronas) suspended the license of its major subsidiary, PBJV Group Sdn Bhd (PBJV), two months later. Consequently, Barakah has been trading as a penny stock for the majority of its listing history, with its share price having plummeted by 98.2% from the peak of RM1.90 achieved in February 2014.

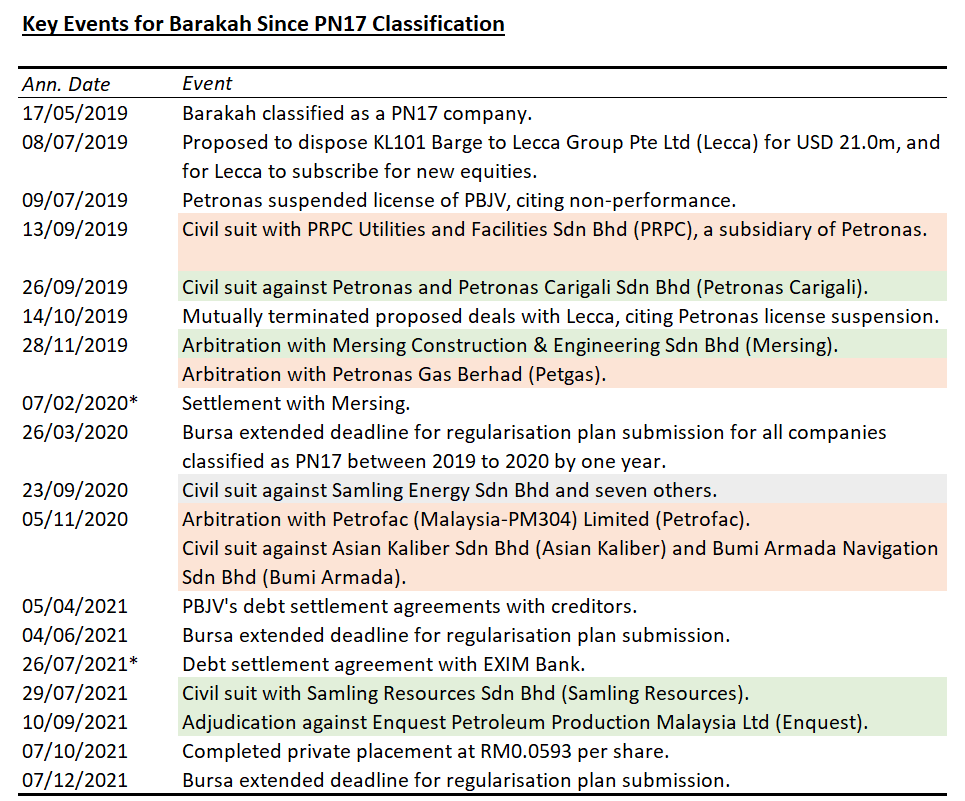

However, loyal shareholders of Barakah may finally see their patience come to fruition. The first turning point occurred in April 2021 when PBJV’s proposed debt settlement was accepted by creditors. Subsequently, Barakah also reached a similar settlement with the financier of KL101 Barge, Export-Import Bank of Malaysia Berhad (EXIM Bank). The positive momentum continued with Petronas lifting the license suspension imposed against PBJV in April 2023, PBJV receiving an extension for its Pan Malaysia Maintenance, Construction and Modification (PM-MCM) contract in July 2023, and, lastly, Brunei Shell Petroleum Co Sdn Bhd awarding the “SPM2 Replacement Project” to the same subsidiary in August 2023.

Against the backdrop of these positive developments, Barakah’s proposed fire sale of its KL101 Barge in December 2023 came as a surprise. Despite KL101 Barge’s appraised fair value of USD15.3 million (RM71.4 million), Barakah set a minimum auction sale value of USD11.4 million (RM53.3 million) for the pipelay barge. Importantly, Barakah will be left with minimal fixed assets post-disposal, as KL101 Barge accounts for 93.3% of the book value of the company’s non-current assets as at the financial year ending June 2023 (FY6/23). This proposed disposal might not be deemed necessary by investors who assess Barakah’s liquidity position solely on its balance sheet and cash flow statement: the company recorded a positive free cash flow of RM19.1 million in FY6/23 and a net cash position amounting to RM13.1 million as at the first quarter of FY6/24.

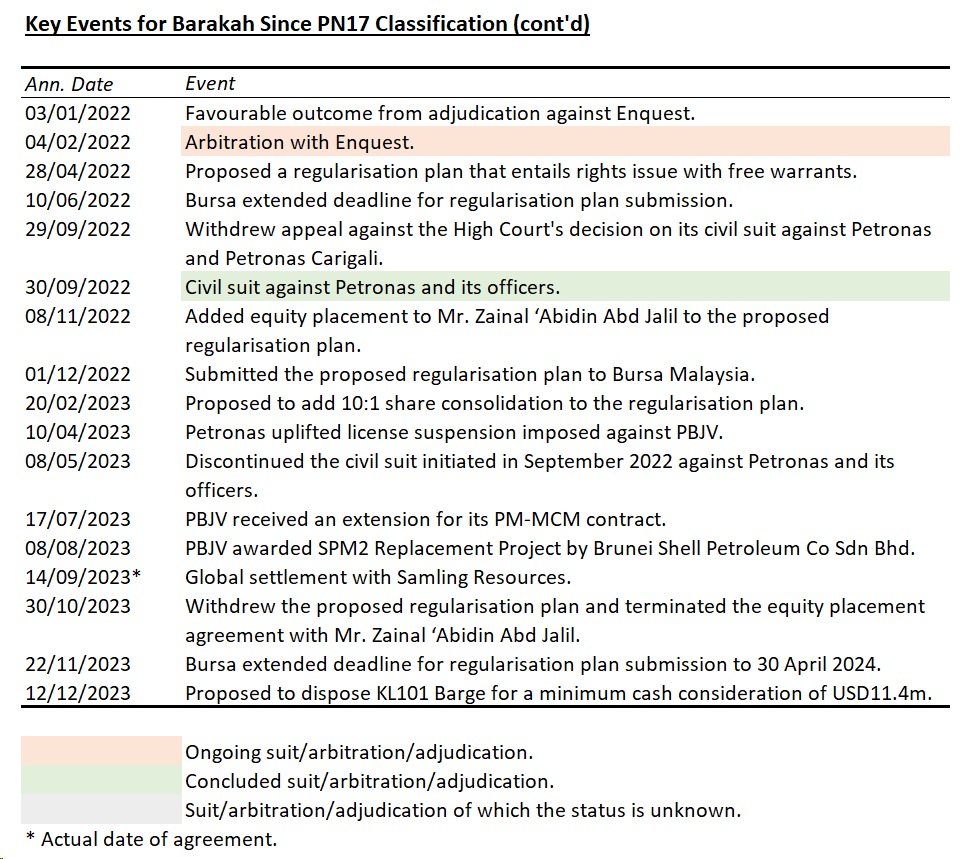

Reading further into Barakah’s proposal, it becomes apparent that the fire sale aims to meet Barakah’s upcoming cash need for its final payment of USD11.1 million (RM52.1 million) to EXIM Bank in April 2024. Understandably, the debt settlement that led to this substantial payment might have been overlooked by some investors. While the settlement was agreed upon on 26th July 2021, Barakah only disclosed the agreement in its Annual Report 2021, released on 29th October 2021, notwithstanding paragraph 9.03(3)(a) of Bursa Malaysia’s Main Market Listing Requirements. With its cash position recently eroded by an RM18 million settlement with Samling Resources (agreed upon on 14th September 2023, and disclosed in Annual Report 2023 released on 30th October 2023), coupled with contingent liabilities from ongoing litigations, Barakah does have a strong rationale for the fire sale.

Desperate for a blessing?

Amidst the adversity, Barakah’s proposal to dispose of KL101 Barge came with a captivating impact on profits.

As illustrated in its announcement, Barakah expects the disposal to result in savings on maintenance and depreciation expenses. If the barge had been disposed of at the beginning of FY6/23, the pro forma financial information prepared by Barakah shows that the company would have recorded a profit of RM7.0 million instead of a loss of RM4.0 million in FY6/23. Considering that its market capitalisation was only RM35.1 million as at the day of the announcement, Barakah seems to have submitted a compelling proposal.

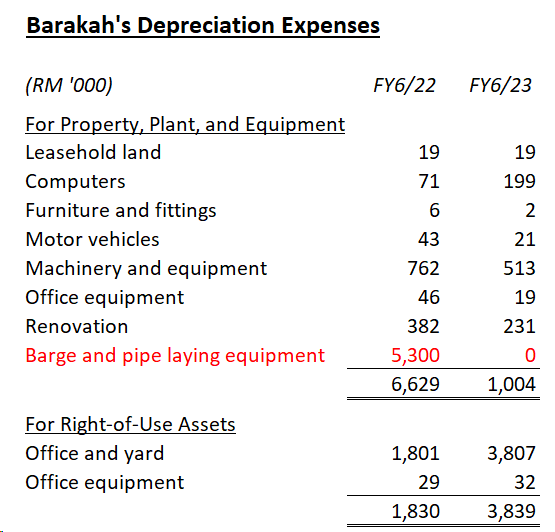

A careful evaluation of the pro forma profit presented, however, reveals an intriguing fact: the illustrated savings on depreciation exceed Barakah’s total depreciation expenses recorded for FY6/23. At RM5.9 million, the pro forma figure is larger than the sum of RM4.8 million in depreciation expenses incurred for all asset classes. Breaking down the actual depreciation by line, expenses for “barge and pipe laying equipment,” which KL101 Barge should be classified as, amounted to RM5.3 million in FY6/22 but were absent in FY6/23. Since it is impossible for Barakah to save more than what is being incurred, this discrepancy raises questions about the company’s audited financial statements.

Turning to Barakah’s balance sheet, the reason for the absence of depreciation expenses for barge and pipe laying equipment becomes apparent. As KL101 Barge was classified as a non-current asset held for sale at the end of FY6/22, the barge ceased to be depreciated since then. This is provided in paragraph 1(a) of IFRS 5/MFRS 5, which clearly states that “assets that meet the criteria to be classified as held for sale to be measured at the lower of carrying amount and fair value less costs to sell, and depreciation on such assets to cease…” Depreciating assets held for sale that are supposed to be carried at their fair value (less costs to sell) would only reduce their carrying amount below the said fair value (see paragraph BC30 of the Basis for Conclusions on IFRS 5/MFRS 5). Therefore, there should indeed be no depreciation expenses for KL101 Barge in FY6/23. This holds true even if Barakah has utilised the barge during the financial year, since any erosion in fair value before disposal would be captured by revaluation exercises that are supposed to conducted in every reporting period.

In this case, it is intriguing why Barakah added the savings on depreciation to its pro forma profit for FY6/23. This is concerning since the company has effectively inflated the profit figure by 549.7%. Considering that the preparation and presentation of pro forma financial information are governed by the Guidance Note For Issuers of Pro Forma Financial Information issued by the Council of the Malaysian Institute of Accountants, Barakah ought to reconsider the “not misleading” principle contained in the said guidance note. Otherwise, shareholders should prepare to be enlightened by the management during any extraordinary general meeting held to approve the company’s proposal to dispose of KL101 Barge.

Preamble of the Guidance Note For Issuers of Pro Forma Financial Information:

“As stated in Paragraph R113.1(b) MY of Part A of the MIA By-Laws1, a Guidance Note approved and issued by the Council is considered as one of the applicable technical and professional standards that members are expected to adhere. A breach of the MIA By-Laws will prima facie give rise to a complaint of unprofessional conduct against the member concerned. As such, members who fail to observe proper standards of ethics and professional conduct as set out in these by-laws may be required to answer a complaint before the Investigation and the Disciplinary Committees of the MIA pursuant to the Malaysian Institute of Accountants (Disciplinary) Rules 2002 [P.U.(A) 229/2002].”

P/S: During the EGM held on 25th March 2024, Barakah’s president-cum-CEO replied that the illustrated savings on depreciation is “the saving that we will incur after we sell [KL101 Barge] where we don’t cause any future depreciation because [of] holding the asset. In other words, if we are not selling the asset, we are going to incur future depreciation of 5.93 [million ringgit]. So, the figure that we put in page 12 [of the circular to shareholders] is showing the cost saving on depreciation, the same figure, after considering selling the asset.” However, this explanation seemingly goes against the definition/purpose of pro forma financial information, which should “represent a hypothetical illustration of the impact of an event or a transaction on an issuer’s unadjusted financial information … as if the event had occurred or the transaction had been undertaken at an earlier date selected for purposes of the illustration” (paragraph 1.1.1 of the Guidance Note For Issuers of Pro Forma Financial Information). While I would like to bring this question to the Malaysian Institute of Accountants (MIA), the sole member of MIA among Barakah’s directors (who are responsible for preparing the circular to shareholders) has unfortunately resigned on 28th February 2024.

More articles on Lorem ipsum

Created by Neoh Jia En | May 29, 2023

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022