Hengyuan Refining Company Berhad – Part 3: Domino Effect from Power Outage in 2022

Neoh Jia En

Publish date: Mon, 29 May 2023, 08:40 AM

- The power outage in July 2022 led to lost output and hence inability to meet committed sales to offset hedging losses realised in the second half of the year. Still, this does not explain the lack of reversal in unrealised fair-value losses recorded for swaps amidst the normalising industry’s crack spread.

- Management confirmed that Hengyuan did recognise cost of hedging as profit or loss, at least in 2021 and 2022. However, disclosures on the corresponding reclassification adjustments to cost of hedging reserve are missing.

- On the other hand, management managed to clarify that cash flow hedge reserve that was recycled to finance costs in 2021 and 2022 has been capitalised.

With a few questions regarding the hedge accounting policy of Hengyuan Refining Company Berhad (Hengyuan), I attended the company’s 64th annual general meeting (AGM) held on 24th May 2023. Given the substantial hedging losses incurred by Hengyuan in 2022, it was unsurprising that the company’s hedging practice and hedge accounting policy was the centrepiece during the meeting. While the external auditor has treated the valuation of Hengyuan’s derivatives as a key audit matter as disclosed in the company’s 2022 annual report, the Minority Shareholders Watch Group (MSWG) has also submitted quite a few questions related to the company’s hedging practice, which were answered during the meeting alongside similar questions from shareholders. I identified four takeaways which are elaborated in this write-up.

Firstly, the chairman explained that the purpose of Hengyuan’s hedging practice is to manage the market risk of crude oil inventory after its price “becomes fixed.” The quantity of ICE Brent Crude futures sold for hedging matches that of crude inventory, hence any hedging gain/loss would be offset by loss/gain from selling the inventory, with the only difference being basis spread. Although the chairman’s explanation differs slightly from what have been provided in Hengyuan’s notes to financial statements as shown below, it is in line with accounting standards and attempts to reassure that the company does not hedge for speculative purposes.

Page 117 of annual report 2022: “Refining margins are hedged based on the Company’s physical exposures to prices of crude oil and its 3 main products namely mogas, gasoil and jet fuel… The purpose of executing these hedges is to stabilise refining margins exposure towards achieving a sustainable profit over the short and medium term.”

Page 133 of annual report 2022: “The [refining margin swap] contracts are intended to hedge the volatility of the refining margin (differences between purchase price of crude oil and sales price of petroleum products) for a period between 1 to 21 months (2021: 1 to 33 months).”

Secondly, Hengyuan’s Chief Financial Officer (CFO) attributed the company’s losses recorded for 2022 to lost output from a power outage and spike in crude premium. The national power outage on 27th July 2022 has disrupted the operation of Hengyuan’s refining plant, leading to unplanned shutdown and corrective maintenance. Incorrect instrument reading caused by the shutdown further catalysed a fire event later in the year. Altogether, the power outage led to quarter-on-quarter (qoq) decline in Hengyuan’s production volume of 14% in the third quarter and 6% in the fourth quarter, and the consequential change in production mix reduced the available sales volume of higher-margin gasoil and mogas by 22% and 18% respectively. The operational disruption forced Hengyuan to divert some crude-oil purchases and buy refined products from third parties to fulfil sales commitment, while the loss of profitable sales hindered Hengyuan’s ability to cover losses from hedges on those sales.

Giving the management the benefit of the doubt, the power outage is a good argument for not only the absence of profits from hedged sales that should have offset losses realised on swap contracts, but also for the loss at gross-profit level, before the impact of hedging, recorded in the third quarter of 2022. Additional costs from diverting crude inventory and from buying refined products from third parties might have led to the “pre-hedged” gross loss. These explained one of the questions raised in my previous write-up, although some investors might question why the power outage has seemingly not brought similar impacts to other refineries and industries to which undisrupted production is critical (such as those utilising blast furnaces).

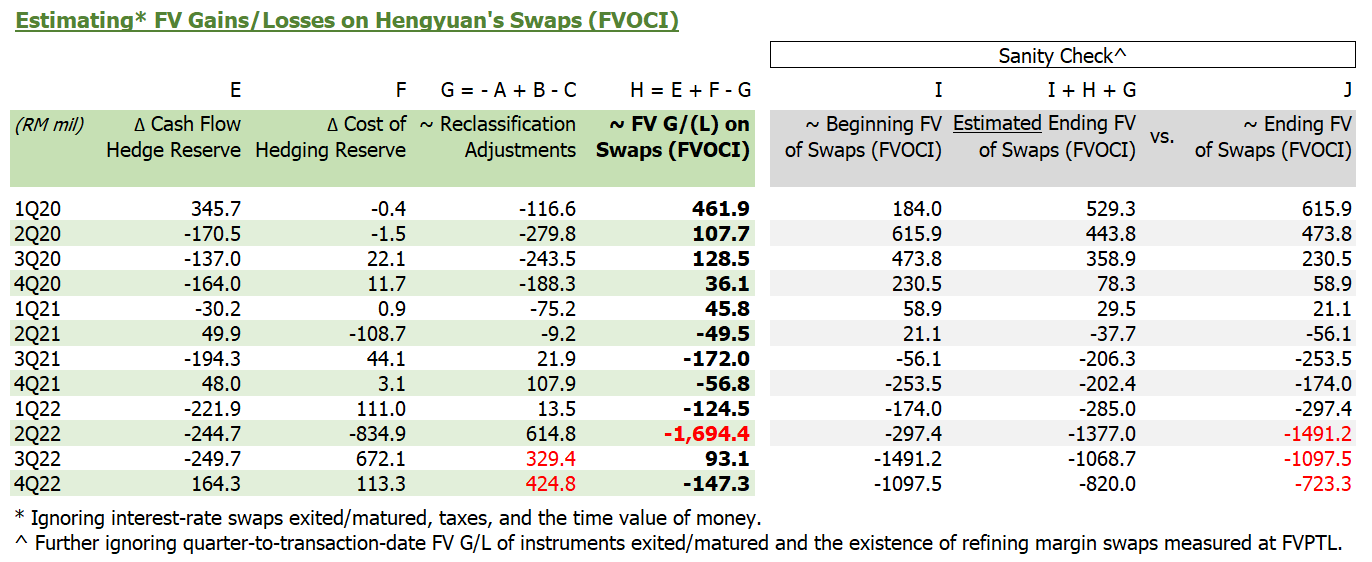

Nonetheless, the clarification regarding impacts of power outage did not solve my question on the lack of reversal in unrealised fair-value losses of hedging instruments. As at end-December 2022, Hengyuan has RM830.6m in net liabilities that arose from refining margin swap contracts designated as hedging instruments (or RM723.3m including refining margin swap contracts not officially designated as hedging instruments, which is the gross figure obtainable quarterly). Most of these fair-value losses were incurred in the second quarter of 2022 when the industry’s crack spread spiked and led to an estimated RM1.7b hit to Hengyuan’s hedging positions, but surprisingly they did not reverse when the crack spread sharply contracted in the second half of the year. Swap basis spread might be a plausible explanation, but I could not confirm. While Hengyuan continued to realise estimated hedging losses of RM300-400m per quarter, the ending liability was still large enough to attract the auditor’s attention. I have forwarded this question to the management before and again during the AGM, but it was not picked up.

Thirdly, management confirmed that they did recognise cost of hedging as profit or loss. In response to my question on whether Hengyuan has recognised any change in swap basis spread of cash flow hedges as profit or loss in 2021 or 2022, the CFO replied that “such cost has been charged out in both year[s], in accordance to the prevailing accounting standards that [are] disclosed in our 2022 annual report.” This, however, implies that disclosures on the corresponding reclassification adjustments to cost of hedging reserve are missing despite the requirements set out in paragraph 92-94 of IAS 1/MFRS 101. Unfortunately, I missed my opportunity to question the management on these non-disclosures. Such missing disclosures would obscure the source of Hengyuan’s hedging gains or losses, that is, we could not identify whether the company’s hedging gains or losses arose from the spot component or forward component of hedging instruments.

Fourth and lastly, Hengyuan managed to prove me wrong on my suspicion that RM8.6m and RM3.3m of the company’s cash flow hedge reserve that was recycled to finance costs in 2021 and 2022 respectively was misplaced (see the footnote in the third last table titled “Deriving Hengyuan’s Pre-Hedge Performance” in my previous write-up). The CFO clarified that those amounts, unlike in previous years, have been capitalised as costs of qualifying plant and equipment as provided in MFRS 123 and as according to Hengyuan’s accounting policy on borrowing costs stated in page 110 of annual report 2022. This explanation is indeed in line with paragraph 8 of IAS 23/MFRS 123, which states that “An entity shall capitalise borrowing costs that are directly attributable to the acquisition, construction or production of a qualifying asset as part of the cost of that asset…” My own failure in noticing the existence of qualifying assets on Hengyuan’s book has unfortunately led to the pointless question that could have been avoided. Updated for the latest information, my estimates of the impact of hedging on Hengyuan’s annual profits are given in the table below.

All in all, the AGM was a fruitful one. Hengyuan’s operational disruption serves as a good case study on how hedging losses might not be offset by profit from hedged sales, while I was reminded to exercise greater care in interpretating reclassification adjustments in the future. Investors could also take comfort in the management’s remark, when replying to MSWG’s query on inventory write-down, that product prices have stabilised after December 2022, which implies that there will likely be less inventory write-down compared to RM83.0m recorded in 2022. This should help to cushion Hengyuan’s first quarter profit growth against any further realisation of hedging losses, since the company has a low base from writing down RM131.6m worth of inventory in the corresponding quarter last year.

*This is a follow-up to my previous write-up titled “Hengyuan Refining Company Berhad – Part 2: Still One Short.”

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Lorem ipsum

Created by Neoh Jia En | Feb 02, 2024

Created by Neoh Jia En | Feb 10, 2023

Created by Neoh Jia En | Dec 30, 2022